Final Safeguard Measures Imposed on the Importation of Certain Steel Goods

Customs Notice 19-08

Ottawa,

Revised

Revised

What’s New: Update on subject good exclusions and related refunds

This update provides information on the implementation of the Order Amending the Order Imposing a Surtax on the Importation of Certain Steel Goods (Exclusions), SOR/2019-313, as well as on the Surtax on the Importation of Certain Steel Goods Remission Order (Surtax Remission Order), SOR/2019-315, which came into effect on August 23, 2019.

The Exclusions Order amends the definition of heavy plate and stainless steel wire products subject to final safeguards, to incorporate the product exclusions that were recommended by the Canadian International Trade Tribunal in its exclusions inquiry report, published on July 15, 2019. The Surtax Remission Order relieves surtax paid on goods that are subject to these exclusions. Further guidance is provided below.

Order Amending the Order Imposing a Surtax on the Importation of Certain Steel Goods (Final Safeguards):

- Heavy plate

- Stainless steel wire

1. This notice provides information on the implementation of the Order Amending the Order Imposing a Surtax on the Importation of Certain Steel Goods (Final Safeguards), SOR/2019-127, imposing final safeguard measures on subject Heavy Plate and Stainless Steel Wire, effective May 13, 2019.

The Final Safeguards Order amends the Order Imposing a Surtax on the Importation of Certain Steel Goods, SOR/2018/206, which came into force October 25, 2018. The amendment replaces the provisonal safeguard measures on imports of certain Heavy Plate and Stainless Steel Wire with final safeguard measures, effective May 13, 2019.

2. The Final Safeguards Order applies to Heavy Plate and Stainless Steel Wire (goods) imported from all countries except for:

- a) goods originating in Canada;

- b) goods originating in Chile, Columbia, Mexico, Panama, Peru, the Republic of Korea, the United States or Israel or another CIFTA beneficiary; and

- c) goods originating in a World Trade Organization (WTO) Member country that is a beneficiary of the General Preferential Tariff (GPT), as long as the share of imports from such a country does not exceed 3% of total imports of each good, provided that imports from countries accounting for less than 3% of import share do not collectively account for more than 9% of total imports of each good.

A list of WTO member GPT beneficiary countries that qualify for this exception is provided in Appendix A.

3. The origin of the goods is determined in accordance with the rules of origin set out in the Determination of Country of Origin for the Purposes of Marking Goods (NAFTA Countries) Regulations or the Determination of Country of Origin for the Purpose of Marking Goods (Non-NAFTA Countries) Regulations, as the case may be.

Application

4. Importers should refer to the Schedule in the Final Safeguards Order (reproduced in the table below) to determine if the goods meet the product description of goods subject to the safeguard surtax.

| Goods | Description |

|---|---|

| 1. Heavy Plate | Hot-rolled carbon steel plate and high-strength low-alloy steel plate not further manufactured than hot rolled, heat-treated or not, in widths from 80 inches (± 2,030 mm) to 152 inches (± 3,860 mm, and thicknesses from 0.375 inches (± 9.525 mm) to 4.0 inches (101.6 mm), with all dimensions being plus or minus allowable tolerances contained in the applicable standards. For greater certainty, these dimensional restrictions apply to steel plate, which contains alloys greater than required by recognized industry standards provided that the steel does not meet recognized industry standards for an alloy-specification steel plate. The following goods are excluded:

HS Codes Heavy plate is commonly imported under the following 10-digit HS numbers: 7208.51.00.10; 7208.51.00.93; 7208.51.00.94; 7208.51.00.95; 7208.52.00.10; 7208.52.00.93; 7208.52.00.96 Please note that these HS numbers are illustrative. There may be goods under the listed HS number that do not fall within the product definition, or goods that are imported under a HS number that is not listed but that fall within the product definition. |

2. Stainless Steel Wire |

Cold drawn and cold drawn and annealed, stainless steel round wire, up to 0.256 inches (6.50 mm) in maximum solid cross-sectional dimension; and cold drawn, and cold drawn and annealed, stainless steel cold-rolled profile wire, up to 0.031 square inches (0.787 sq. mm) in maximum solid cross-sectional area. 439 copper-coated TiCu stainless steel wire in diameters of 0.030 inch to 0.187 inch is excluded. HS Codes Stainless steel wire is commonly imported under the following 10-digit HS numbers: 7223.00.00.10; 7223.00.00.20 Please note that these HS numbers are illustrative. There may be goods under the listed HS number that do not fall within the product definition, or goods that are imported under a HS number that is not listed but that fall within the product definition. |

5. As per the Schedule in the Final Safeguards Order, safeguard surtax at the rates outlined in Tables 2 and 3 below is applicable to imported goods absent a specific permit or once all subject importations exceed the Global Affairs Canada tariff rate quota (TRQ) for each class of goods.

| Period | Duration | Surtax Rate | TRQ (tonnes) |

|---|---|---|---|

| 1 | One-year period beginning on May 13, 2019 and ending after May 12, 2020. | 20% | 100,000 |

2 |

One-year period beginning on May 13, 2020 and ending after May 12, 2021. | 15% | 110,000 |

| 3 | 165 day period beginning on May 13, 2021 and ending after October 24, 2021. | 10% | 54,699 |

| Period | Duration | Surtax Rate | TRQ (tonnes) |

|---|---|---|---|

| 1 | One-year period beginning on May 13, 2019 and ending after May 12, 2020. | 25% | 2,800 |

2 |

One-year period beginning on May 13, 2020 and ending after May 12, 2021. | 15% | 3,080 |

| 3 | 165 day period beginning on May 13, 2021 and ending after October 24, 2021. | 5% | 1,532 |

6. The TRQ is administered by Global Affairs Canada by way of shipment-specific import permits (specific permit). Goods for which an importer obtained a specific permit from Global Affairs Canada, valid at the time of accounting, are exempt from the applicable safeguard surtax. Imports of goods that do not have a specific permit, or are in excess of the quantity of a specific permit at the time of accounting, are subject to the safeguard surtax.

7. For information on TRQ allocation applications and conditions to satisfy when requesting specific permits, please refer to the Notices to Importers on the Global Affairs Canada website. The Notices provide information about the permit application process, timelines and the information required from applicants.

8. The safeguard surtax is applied on the value for duty of goods determined in accordance with sections 47 to 55 of the Customs Act.

9. Absent a specific permit, safeguard surtax applies to all goods including those released from a Customs Bonded Warehouse or Sufferance Warehouse on or after May 13, 2019 when the Final Safeguards Order came into force.

10. Canada’s Duties Relief Program and Duty Drawback Program continue to be available to importers for duties relief, including safeguard surtax, paid or owed by businesses that meet the requirements of these programs.

Proof of Origin/ Required Documentation

11. The burden of proof that goods meet one of the exceptions as defined in the Final Safeguard Order and are thus not subject to safeguard surtax lies with the importer.

12. Proof of origin may be in the form of a commercial invoice, a Canada Customs Invoice, a Form A - Certificate of Origin, an Exporter's Statement of Origin, a Certificate of Origin pursuant to a Free Trade Agreement, or any other acceptable documentation that clearly indicates the country of origin of the goods.

13. To confirm whether imported goods are subject to the safeguard surtax, the CBSA may require importers to provide the following documentation:

- Specific permit

- Purchase invoice or order

- Bill of lading

- Mill certificate

- Product literature and technical specifications

- Any other document to substantiate whether the goods are subject to the safeguard surtax

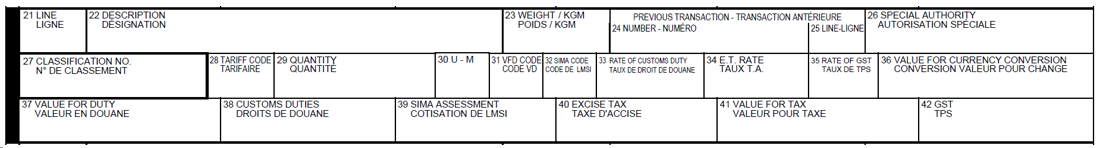

Completing the B3-3 Canada Customs Coding Form

14. The following instructions and examples demonstrate how the B3 should be completed for importations of goods subject to the final safeguard surtax.

| Field | Instructions |

|---|---|

| 22 | Provide as much detail as possible. Where the goods are subject to the safeguard surtax, state the specific product (Heavy Plate or Stainless Steel Wire). Where the goods are exempt, include information explaining why they are exempt. |

| 23 | Indicate the weight in kilograms. |

| 26 | Provide the specific permit number if applicable. If a specific permit has not been obtained leave blank. Note: Imported subject goods will not be exempt from the safeguard surtax unless the specific permit number is entered into this field at the time of accounting. |

| 27 | Provide the goods’ 10 digit classification number. |

| 29 | For the quantity field, indicate the total weight of the goods. Use field 30 to indicate whether this is in kilograms. |

| 30 | Specify unit of measure in kilograms (KGM). |

| 32 | SIMA code 51 is used if the safeguard surtax and/or SIMA duties are payable. Otherwise, leave this field blank. Note: If you entered a specific permit number in field 26, then field 32 should remain blank, as the safeguard surtax is not payable. |

| 35 | GST rate is 5%. |

| 37 | Provide the value for duty of the imported goods in Canadian dollars. |

| 39 | This field is used for both SIMA duties and the amount of final safeguard surtax. The safeguard surtax is calculated at the value for duty (Field 37) x applicable surtax rate %. Where SIMA duties are also applicable, the SIMA duties and amount of safeguard surtax will be added together and entered in this field. Leave field 39 blank if there is no safeguard surtax or SIMA duties payable. |

| 41 | Value for tax = VFD + Safeguard surtax + SIMA duties (if applicable). |

| 42 | The GST is value for tax times 5%. |

Note: Examples 1, 2 and 4 below are at a rate of 25% for stainless steel wire in period 1, while example 3 is at a rate of 20% for heavy plate in period 1. However, a different rate may apply depending on the product category or year as shown in Tables 2 and 3 above.

Example 1: Safeguard surtax not payable (specific permit obtained) – no other applicable duties

- The specific permit number is entered in field 26. (Note: Imported goods will not be exempt from the safeguard surtax unless the specific permit number is entered into this field at the time of accounting.)

- The SIMA Code (Field 32) is left blank, as the goods are exempt from the safeguard surtax.

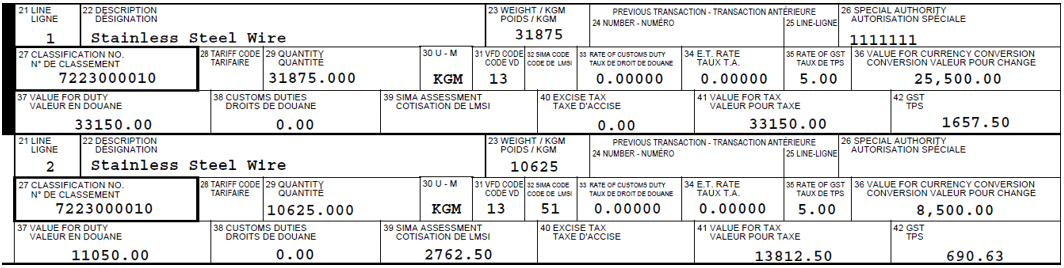

Example 2: Safeguard Surtax payable – No other applicable duties

- No specific permit was obtained so the import is subject to the safeguard surtax.

- The SIMA Code (Field 32) is entered as 51, as the safeguard surtax is payable.

- The amount of safeguard surtax is calculated as follows: $44,200.00 (VFD) x 0.25 (applicable safeguard surtax rate for stainless steel wire in period 1) = $11,050.00 (safeguard surtax payable).

- The value for tax is $44,200.00 (VFD) + $11,050.00 (safeguard surtax) = $55,250.00

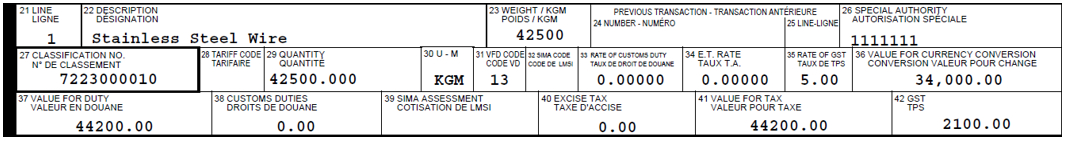

Example 3: Safeguard Surtax payable in addition to SIMA duties

Note: certain Heavy Plate is subject to anti-dumping duties under the Special Import Measures Act (SIMA). For further information on SIMA duties, please refer the CBSA Measures in Force website.

- The SIMA Code (Field 32) is entered as 51, as the safeguard surtax is payable.

- The amount of the safeguard surtax is: $44,200.00 (VFD) x 0.20 (applicable safeguard surtax for Heavy Plate in period 1) = $8,840.00 (safeguard surtax payable).

- For this example, there are $2000.00 in SIMA duties.

- Amount to enter in Field 39: $8,840.00 (safeguard surtax) + $2000.00 (SIMA duties) = $10,840.

- The value for tax is $44,200.00 (VFD) + $8,840.00 (amount of safeguard surtax) + 2000.00 (SIMA duties) = $55,040.00

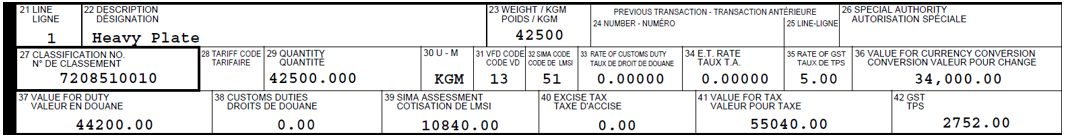

Example 4: Safeguard Surtax partially payable (specific permit obtained but part of importation exceeds TRQ)

- Where the quantity of imported goods exceeds the corresponding quantity of a specific permit, and the safeguard surtax is applicable to the exceeding quantity of goods, two lines need be completed: Line 1 where the goods are covered by a specific permit (Note: In this situation the SIMA Code (Field 32) is left blank as the goods are exempt from the safeguard surtax); Line 2 where the goods are not covered by a specific permit (Note: In this situation the SIMA Code (Field 32) is entered as 51 as the goods are not exempt from the safeguard surtax.

15. For further information on the applicability of SIMA (anti-dumping) duties see the SIMA website, Measures in Force section.

16. Refer to Memorandum D17-1-10, Coding of Customs Accounting Documents for additional information on completing Form B3-3.

Corrections, Re-Determinations, and Refunds

17. Corrections to original declarations and requests for re-determinations or further re-determinations, and applications for a refund are to be made in the prescribed form and manner under the relevant provisions of the Customs Act, in accordance with the procedures outlined in Memorandum D11-6-7, as well as Memorandum D11-6-6, “Reason to Believe” and Self-Adjustments to Declarations of Origin, Tariff Classification, and Value for Duty, and Memorandum D6-2-3, Refund of Duties.

18. Where an overpayment of safeguard surtax has been identified on a commercial importation, Form B2, Canada Customs – Adjustment Request may be filed in a regional CBSA office requesting a refund of the overpaid amount under paragraph 74(1)(g) of the Customs Act. If accounting information is being self-adjusted for a safeguard surtax refund or safeguard surtax payable to the CBSA, refer to Memorandum D17-2-1, The Coding, Submission and Processing of Form B2, Canada Customs Adjustment Request, for additional information on completing Form B2. Note that Customs Self Assessment (CSA) clients must use this process when seeking an adjustment of the safeguard surtax.

19. Refund requests for overpayments of SIMA duties must be filed on a separate B2 form. For more information on SIMA redeterminations, refer to Memorandum D14-1-3, Re-determinations and Appeals Under the Special Import Measures Act.

20. Accounting documents are reviewed by the CBSA to ensure that the correct amount of safeguard surtax was self-assessed by the importer. The CBSA may review the origin, tariff classification, value for duty and/or applicability of the safeguard surtax or SIMA duties on its own initiative or in response to a correction. In so doing, as with customs duties and taxes, the CBSA may assess any undeclared amount of safeguard surtax.

Surtax Remission for Exclusions

21. As per the Surtax Remission Order, SOR/2019-315, which came into effect on August 23, 2019, all safeguard surtaxes paid on heavy plate exclusions c) to i) and on the stainless steel wire exclusion identified in Table 1 (see above) released by the CBSA since October 25, 2018, may be refunded.

22. Remission is granted under the following conditions:

- no other claim for relief of the surtax, or the portion of the surtax, as applicable, has been granted under the Customs Tariff in respect of those goods; and

- a claim for remission is made by the importer to the Minister of Public Safety and Emergency Preparedness within two years after the date of the importation of those goods.

23. Where the Surtax Remission Order is applicable, and an overpayment of safeguard surtax has been identified on importations, Form B2, Canada Customs – Adjustment Request may be filed with the CBSA Trade Programs Office at the address below requesting a refund of the overpaid amount under section 74(1)(g)* of the Customs Act. Please refer to Memorandum D17-2-1, The Coding, Submission and Processing of Form B2 Canada Customs Adjustment Request for additional information on completing Form B2.

In addition to Form B2, importers must provide product literature and technical specifications and/or any other document to substantiate whether the goods correspond to the exclusions eligible for the Surtax Exclusions Remission Order.

SIMA Registry and Disclosure Unit

Trade and Anti-dumping Programs Directorate – Compliance Unit

Canada Border Services Agency

100 Metcalfe Street, 11th Floor

Ottawa, Ontario K1A 0L8

Canada

* Please note that the use of section 74(1)(g) of the Customs Act is for administrative purposes only. Remission Order SOR/2019-315 is the authority for the remission of duties and the conditions under which remission may be granted, including time limits. As per section 22 of this Customs Notice and section 2(b) of the Remission Order, the time limit to submit a claim for remission is two years.

24. Enquiries regarding the safeguard surtax remission process for exclusions can be directed to CBSA Trade Programs.

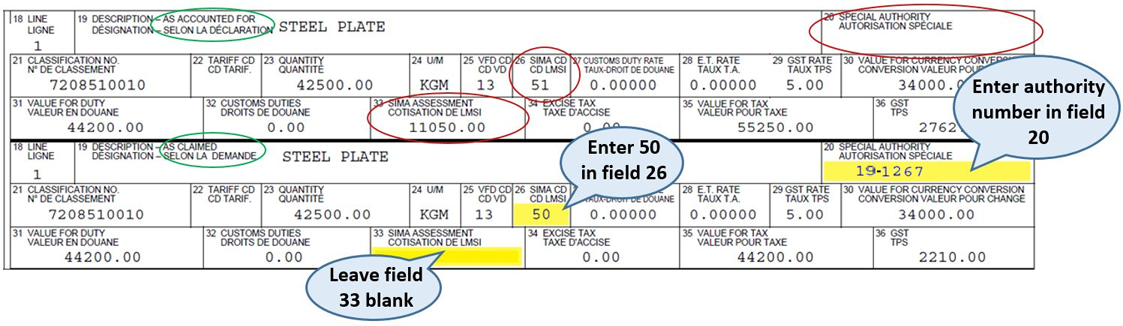

Example – How to apply for surtax remission

As accounted for:

- The “as accounted for” section of Form B2 (first three rows) shows the surtax assessed on Form B3-3.

As claimed:

- The “as claimed” portion of Form B2 (second three rows) shows the request for the surtax to be relieved by the Order.

- Enter 50 in field 26

- Enter the authority number 19-1267 in field 20

- Leave field 33 blank

Note: If the goods are subject to Special Import Measures Act (SIMA) duties, then, in the “as claimed” portion of Form B2, enter 51 in field 26 and enter only the SIMA duties in field 33.

In Transit Remission

25. For information on the remission of safeguard surtax paid on goods that were in transit to Canada before (i.e., began their physical journey to Canada), please see Customs Notice 18-24, Provisional Safeguards – In-transit Steel Goods Remission Order.

Recourse

26. Determinations, re-determinations or further re-determinations made by a CBSA officer may be reviewed under and in accordance with the Customs Act.

Examinations and Verifications

27. Importations may be subject to examination at the time of accounting and to post-release verification for compliance with the Tariff Classification, Valuation, Origin and Marking programs, and any other applicable provisions administered by the CBSA. If non-compliance is encountered by the CBSA, the safeguard surtax, SIMA duties and taxes, as well as penalties and interest will be assessed, where applicable.

Additional Information

28. Refer to Memorandum D16-1-1, Information pertaining to the application, collection, and adjustment of a surtax, for additional information concerning the administration and enforcement of safeguard surtax orders under sections 53(2), 55(1), 60, 63(1), 68(1), 77.1(2), or 77.6(2) or 78(1) of the Customs Tariff.

29. For more information on the administration of the safeguard surtax orders, within Canada call the Border Information Service at 1-800-461-9999. From outside Canada call 204-983-3500 or 506-636-5064. Long distance charges will apply. Agents are available Monday to Friday (08:00 – 16:00 local time / except holidays). TTY is also available within Canada: 1-866-335-3237.

Appendix A – WTO Member Countries Benefiting from the General Preferential Tariff

| 1 | Afghanistan | 25 | Guatemala | 49 | Pakistan |

| 2 | Angola | 26 | Guinea | 50 | Papua New Guinea |

| 3 | Armenia | 27 | Guinea-Bissau | 51 | Paraguay |

| 4 | Bangladesh | 28 | Guyana | 52 | Philippines |

| 5 | Belize | 29 | Haiti | 53 | Rwanda |

| 6 | Benin | 30 | Honduras | 54 | Samoa |

| 7 | Bolivia | 31 | Kenya | 55 | Senegal |

| 8 | Burkina Faso | 32 | Kyrgyzstan | 56 | Sierra Leone |

| 9 | Burundi | 33 | Laos | 57 | Solomon Islands |

| 10 | Cambodia | 34 | Lesotho | 58 | Sri Lanka |

| 11 | Cameroon | 35 | Liberia | 59 | Swaziland |

| 12 | Cape Verde | 36 | Madagascar | 60 | Tajikistan |

| 13 | Central African Republic | 37 | Malawi | 61 | Tanzania |

| 14 | Chad | 38 | Mali | 62 | Togo |

| 15 | Congo | 39 | Mauritania | 63 | Tonga |

| 16 | Côte d'Ivoire | 40 | Moldova | 64 | Uganda |

| 17 | Democratic Republic of the Congo | 41 | Mongolia | 65 | Ukraine |

| 18 | Djibouti | 42 | Morocco | 66 | Vanuatu |

| 19 | Egypt | 43 | Mozambique | 67 | Vietnam |

| 20 | El Salvador | 44 | Myanmar | 68 | Yemen |

| 21 | Fiji | 45 | Nepal | 69 | Zambia |

| 22 | Gambia | 46 | Nicaragua | 70 | Zimbabwe |

| 23 | Georgia | 47 | Niger | ||

| 24 | Ghana | 48 | Nigeria | ||

Sources: Notification to the WTO under Article 12.1 (B) of the Agreement on Safeguards Canada Border Services Agency, Customs Tariff 2019 – List of Countries and Applicable Tariff Treatments |

|||||

- Date modified: