Request under Section 60 of the Customs Act for a Re-determination, a further Re-determination or a Review by the President of the Canada Border Services Agency

Memorandum D11-6-7

This D-memo will be updated and will come into effect with the scheduled external implementation of CARM in October 2024. The pending version is available now in PDF format only for your reference. The D-memo currently in effect is available on this page

ISSN 2369-2391

Cat. No. Rv55-8E-PDF

Ottawa, February 16, 2023

This document is also available in PDF (1.1 MB) [help with PDF files]

In brief

This memorandum was revised to reflect the amendments to the Prescription Instrument identifying the prescribed form and manner and the prescribed information required to submit requests pursuant to section 60 of the Customs Act.

Procedures related to filing a request for re-determination or further re-determination have been streamlined to reflect the Prescription Instrument. All requests must follow the prescribed form and manner and contain the prescribed information as identified in Appendix A of this document.

The review process wording has been updated to reflect the elimination of the issuance of the preliminary position letter.

The policy guidance regarding decisions made on goods classified under Tariff Item no. 9899.00.00 of the Schedule to the Customs Tariff has been removed as the guidance is provided in D Memoranda D9-1-1 and D9-1-15.

This memorandum explains the process pursuant to section 60 of the Customs Act (the Act) for a request to the President of the Canada Border Services Agency (CBSA) for a re-determination or a further re-determination of the origin, the tariff classification, the value for duty or marking in respect of goods or a request to the President of the CBSA for a review of an advance ruling.

Legislation

- Customs Act

- Section 32.2 (Corrections to declarations in particular circumstances)

- Section 43.1 (Advance Rulings)

- Subsection 57.01(1) (Marking Determination)

- Section 58 (Determinations and deemed determinations)

- Section 59 (Re-determination or further re-determination)

- Section 60 (Re-determination and further re-determination by the President)

- Section 74 (Refund)

Regulations made under the Customs Act

Determination, Re-determination and Further Re-determination of Origin, Tariff Classification and Value for Duty Regulations (SOR/98-44)

Proof of Origin of Imported Goods Regulations (SOR/98-52)

Free Trade Agreement Advance Rulings Regulations (SOR/97-72)

Tariff Classification Advance Rulings Regulations (SOR/2005-256)

Schedule to the Customs Tariff

Tariff Items 9897.00.00 and 9898.00.00 of the Customs Tariff (the Tariff).

Guidelines and general information

Definition

1. In this memorandum, the term “a request” refers to a request to the President of the CBSA under section 60 of the Act. This includes requests for a re-determination or a further re-determination of origin, tariff classification (including prohibited or restricted goods), value for duty or marking in respect of goods. It also includes requests for a review of an advance ruling.

Types of decisions eligible for review

2. The following types of decisions are eligible for review under section 60 of the Act:

- Advance rulings issued pursuant to section 43.1 of the Act;

- Decisions where an officer has issued a notice of determination, re-determination, or further re-determination under subsection 59(2) of the Act (including a denial of a refund for non-commercial goods (casual goods)); and

- Decisions indicating that your goods are classified under tariff item no. 9898.00.00 (also known as prohibited goods). For more details, please refer to Appendix D, Requests Regarding Decisions Made on Goods Classified as Prohibited or Restricted Under Tariff Item No. 9898.00.00 of the Customs Tariff, Such as Prohibited or Restricted Weapons or Prohibited Devices and the CBSA website.

3. Reviews not covered by this memorandum include:

- Initial importer request arising from non-commercial importations (refer to Memorandum D6-2-6, Refund of Duties and Taxes on Non-Commercial Importations);

- The administration of “subsequent goods” related to appeals before the Canadian International Trade Tribunal (CITT) or the courts (refer to Memorandum D11-6-3, Administrative Policy Respecting Re-Determinations or Further Re-Determinations made Pursuant to Paragraph 61(1)(c) of the Customs Act);

- Reviews of National Customs Rulings (NCRs) when goods have not yet been imported (refer to Memorandum D11-11-1, National Customs Rulings (NCR));

- Importer appeals concerning anti-dumping and countervailing duties (refer to Memorandum D14-1-3, Re-determinations and Appeals Under the Special Import Measures Act);

- Applications made pursuant to section 60.1 of the Act to extend the time to file a request (refer to Memorandum D11-6-9, Applications to the President for an Extension of Time to File a Request under Section 60 of the Customs Act);

- Requests regarding decisions made on goods classified under tariff item 9899.00.00 of the Schedule to the Customs Tariff provided for in Memoranda D9-1-1, Canada Border Services Agency’s Policy on the Classification of Obscene Material, D9-1-15, Canada Border Services Agency’s Policy on the Classification of Hate Propaganda, Sedition and Treason & D9-1-17, Canada Border Services Agency’s Determination Procedures for Obscenity and Hate Propaganda.

Who can file a request under section 60 of the Act

4. A person, to whom an Officer has given a notice of decision under subsection 59(2) of the Act, may file a request. These persons include:

- The importer of the goods;

- The owner of the goods at the time of release;

- Any person liable for payment of duties on the goods at the time of release;

- The person who accounted for the goods under subsection 32(1),(3), or (5) of the Act; or

- Where preferential tariff treatment under a free trade agreement was claimed in respect of those goods, the person who completed and signed the certificate of origin for the goods (i.e. an exporter and/or producer).

5. A person, to whom an Officer has given an advance ruling under section 43.1 of the Act, may file a request. These persons include:

- The importer of the goods in Canada;

- A person who is authorized to account for goods under paragraph 32(6)(a) or subsection 32(7) of the Act; and

- Any exporter or producer of those goods outside of Canada.

6. In addition, requests may be submitted by a third party agent of an eligible person if accompanied by a written statement or general agency agreement authorizing the third party to act on behalf of the person for the purpose of the request.

Requirements to submit a valid request under section 60 of the Act

7. A request will only be accepted if the following conditions are met:

- The person making the request must be one of those identified in paragraphs 4 through 6 of this memorandum;

- The request must be made within 90 days of the notice given under subsection 59(2) of the Act or the advance ruling issued under section 43.1 of the Act. Please note that when the last day of the 90 day-time limit falls on a day the CBSA Recourse Directorate is not open for business, the final day for filing the request is the next business day. An application for an extension of time pursuant to section 60.1 of the Act is available under certain conditions. Refer to Memorandum D11-6-9, Applications to the President for an Extension of Time to File a request under Section 60 of the Customs Act.

Making a request under section 60 of the Act does not protect the time limit on other adjustments, and the Act does not provide the legislative authority to allow for the section 60 of the Act decision to apply to subsequent goods. Should you have additional adjustments concerning the same goods and/or the same issue, and you wish to request a review under section 60 of the Act, you must follow the legislation and submit all applicable requests within the legislated time frames.

- The request must be made in the prescribed form and manner with the prescribed information as set out in Appendix A Prescription of Form, Manner and Information to Make A Request for Re-Determination, Further Re-Determination or Review Under Section 60 of the Customs Act;

- Appendix A provides details on how and where to submit a request and what information to include;

- Appendix B Information That May Be Provided To Facilitate A Request (In Addition To What Is Prescribed In Appendix A) provides information that should be submitted with certain types of requests to facilitate the review and expedite a decision (not applicable to goods classified under tariff item 9898.00.00);

- The request for a re-determination or a further re-determination may be made only after all amounts owing to the CBSA in respect of the goods are paid or security satisfactory to the Minister is given in respect of the total amount owing (Refer to Appendix C, Requirements for Posting Security Requirement) (not applicable to goods classified under tariff item 9898.00.00);

8. Requests that are not submitted in the prescribed form and manner and which do not include the prescribed information may be rejected. A rejected request may be re-submitted once any deficiencies have been addressed, provided all requirements for a valid request are met.

9. If time limits are exceeded, an application for an extension of time under section 60.1 of the Act may be submitted. For more information, consult Memorandum D11-6-9, Applications to the President for an Extension of Time to File a Request under Section 60 of the Customs Act.

Procedures for electronic filing

10. Your electronic request must include the prescribed core information as defined in the prescription instrument (Appendix A) in order for the request to be identified and verified by the Recourse Directorate.

11. Once the Recourse Directorate has verified your electronic request, you will be contacted by the Recourse Directorate as applicable.

The review process

12. You will be provided with the name and contact details of the Appeals Officer responsible for your file. The Appeals Officer, who is delegated by the President of the CBSA to make the decision, will conduct a full and impartial review of your request.

13. The Appeals Officer will consider your position and the rationale for the decision that is the subject of the request. The Appeals Officer may contact you for additional information.

14. The Appeals Officer will consider the evidence, arguments provided, the relevant law and policy, and any other additional research that is conducted.

15. The Appeals Officer will notify you of the decision on behalf of the President, including a rationale, in accordance with subsection 60(5) of the Act.

16. In the event that you disagree with the decision, you may appeal the decision to the Canadian International Trade Tribunal (CITT) pursuant to section 67 of the Act, within 90 days following the notice of the decision.

Service standards for requests

17. The CBSA endeavours to meet the service standards under normal operational conditions. However, standards may not be met when, for example:

- The CBSA is waiting for a CITT or court decision on identical goods, or on an issue sufficiently similar which might affect the decision under review;

- The information or arguments submitted with the request are incomplete or require follow up (such as laboratory analysis; consultations; or requests to the importer, manufacturer, or vendor for additional information);

- The nature of the request is unusually complex or the amount of information that must be reviewed is exceptionally large; or

- The identification or engagement of suitable external authorities or experts is unusually time consuming.

18. For more details on service standards, please refer to the Service Standards page on the CBSA website.

Additional information

For more information, refer to CBSA Website or if within Canada contact the Border Information Service at 1-800-461-9999. From outside Canada contact (204) 983-3500 or (506) 636-5064. Long distance charges will apply. Agents are available Monday to Friday (08:00 – 16:00 local time / except holidays). TTY is also available within Canada: 1-866-335-3237.

Appendix A

Prescription of form, manner and information to make a request for re-determination, further re-determination or review under section 60 of the Customs Act

Authority

Pursuant to the Authorization signed by the President of the Canada Border Services Agency (CBSA) on , under subsection 2(4) of the Customs Act (the Act) and subsections 12(1) and 12(2) of the Canada Border Services Agency Act, as amended, and for the purpose of section 8 and subsection 60(3) of the Act, I hereby authorize the following form and manners for submitting the following requests under section 60 of the Act:

Interpretation

The purpose of this document is to prescribe the form, manner and information required for a person to make a request for a review pursuant to section 60 of the Act for the following three decisions made by the CBSA:

- A re-determination or further re-determination made pursuant to section 59 of the Act in origin, tariff classification, value for duty or marking of imported goods (including a denial of a refund for non-commercial goods (casual goods));

- An advance ruling issued, modified or revoked pursuant to section 43.1 of the Act; and

- A determination made pursuant to subsection 58(1) of the Act of goods classified under tariff item no. 9898.00.00 (also known as prohibited goods).

Any request that is not made in the prescribed form or in the prescribed manner or does not contain the prescribed information may be rejected for not meeting the requirement of subsection 60(3) of the Act. Any rejected request can be re-submitted once any deficiencies have been addressed provided all legal requirements are met. If time limits are exceeded, an application for an extension of time under section 60.1 of the Act may be submitted. For more information, consult Memorandum D11-6-9, Applications to the President for an Extension of Time to File a Request under Section 60 of the Customs Act.

Requesting a review

1. Prescribed form

1.1 Re-determination or further re-determination of origin, tariff classification, value for duty or marking of imported goods (commercial or non-commercial)

Application

Applies to requests for re-determination of further re-determination of origin, tariff classification (other than goods determined to be classified under tariff items 9897.00.00, 9898.00.00 or 9899.00.00 of the Tariff), value for duty or marking as per subsection 60(1) of the Act. Requests can concern goods imported for commercial purposes or for personal consumption or use.

Requests must be submitted using:

- A paper form:

-

A letter containing the prescribed information (all requests);

and

- Form B2 Canada Customs - Adjustment Request (commercial importer); or

- B2 Spreadsheet – Annex A (commercial importer); or

- B226 Request for Re-Determination of the Origin of Goods Imported From the Territory of a Trading Partner (producer/exporter); or

- Form B2G – CBSA Informal Adjustment Request (casual goods importer)

-

- An approved form of electronic filing including the prescribed information.

1.2 Review of an advance ruling

Application

Applies to requests for review of an advance ruling on the origin or tariff classification of goods as per subsection 60(2) of the Act.

Requests must be submitted using:

- A paper form: A letter containing the prescribed information; or

- An approved form of electronic filing identified below including the prescribed information.

1.3 Re-determination or further re-determination of goods classified under tariff item no. 9898.00.00 of the Schedule to the Customs Tariff

Application

Applies to requests for a re-determination or further re-determination of the tariff classification of goods classified under tariff item no. 9898.00.00 of the Schedule to the Customs Tariff, such as prohibited or restricted weapons or prohibited devices, as per subsection 60(1) of the Act.

Requests must be submitted using:

- A paper form: A letter containing the prescribed information; or

- An approved form of electronic filing identified below including the prescribed information.

2. Prescribed manner

All requests must be submitted in the following prescribed manner:

- By paper form or an approved form of electronic filing;

- If a representative is appointed to act on your behalf, the request must always be accompanied by an authorization that the representative is acting on your behalf.

Paper form

To ensure efficient processing, requests should be sent by regular or registered mail, or courier to:

Trade Triage Unit - Recourse Directorate

Canada Border Services Agency

333 North River Rd, 11th floor Tower A

Ottawa, ON K1L 8B9

By approved form of electronic filing

All electronic requests must be submitted using the approved online appeal form provided on the CBSA website.

Once the Recourse Directorate has verified your request, you may be contacted to submit the required prescribed information and supporting documentation.

Submitting the online appeal form is considered to be the first step in making a request. Should you fail to later provide the prescribed information when requested by the Recourse Directorate, your request via the online appeal form will not be considered valid nor will your legislated time limits to submit a section 60 of the Act request to the CBSA be protected. Only once all legislated requirements, including the provision of prescribed information are met will your request be considered to be filed with the CBSA. Please ensure that you keep a record of your submission.

If your request is not acknowledged within 2 weeks, please contact the Recourse Directorate.

All requests must include the prescribed information and adhere to the approved procedures for filing electronic requests found in D11-6-7.

3. Prescribed information

Core information

All requests must include the following prescribed information:

- Name and address of the person making the request:

- Business Number (BN) and Import – Export (RM) account number (if applicable);

- Contact name and title;

- Contact email;

- Contact phone number

- Representative Company Name (if applicable):

- Representative Contact: (Name and email of person working on your request);

- Representative Contact phone number;

- A copy of or the decision/advance ruling numbers under dispute (subsection 59(2) of the Act Notice and B2 adjustment number, Advance Ruling number, Case number, K26, K27, BSF241, etc.);

- The Trade program under dispute: Tariff Classification, Value for Duty, Origin, Marking;

- Accurately identify, in accordance with Appendix B, the goods at issue (product number, description, etc.) (not applicable to goods classified under tariff item 9898.00.00);

- A detailed rationale (your reasons for dispute, explain why your requested tariff classification, value for duty or origin applies);

- Documentation that supports your position and a detailed explanation of how it applies;

-

Any request pertaining to multiple transactions must be accompanied by a spreadsheet containing the prescribed information using the format outlined in Annex A: B2 Spreadsheet. (not applicable to goods classified under tariff item 9898.00.00);

The B2 Spreadsheet must list all the transactions and the related adjustment numbers where a notice of decision issued on a Detailed Adjustment Statement (DAS) under subsection 59(2) of the Act was issued and identify all of the goods and/or the issue under dispute.

A copy of at least one DAS (section 59 of the Act decision) and the supporting documentation (product literature, invoices, etc.) is required to be considered as representative of the good(s) and/or issue under dispute. Only one DAS is required if it represents all goods and/or issue in dispute.

Additional representative DASs and supporting documentation for each different good or issue in dispute are required.

If your request has 100 transactions for the imported good, and contains different models/styles of that good, a representative package may be required for each. All goods are to be identified on the B2 Spreadsheet.

- Any additional adjustments relating to an existing appeal file should quote the Appeal File number and must be accompanied by the prescribed information.

Original signed on , by Jonathan Moor, Vice-President, Finance and Corporate Management Branch, Canada Border Services Agency.

Annex A

B2 spreadsheet [prescribed information]

A list or a spreadsheet must be provided and include the following minimum data columns for each type of request filed under subsection 60(1) of the Customs Act for commercial goods.

The data to be included below each column heading is an example of the mandatory minimum information required. Please be sure to provide product descriptions and data elements that support your request. You may add additional columns that support your request or describe any additional qualifiers for the goods or issue.

| As accounted for | As determined by CBSA | As requested | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B3 Transaction Number | B3 Accounting Date | B3 Line No. | B3 Sub. Hdr. No. | Invoice Line No. | Quantity | Invoice Description | Item Model No. (on invoice) | B3 Tariff Treatment (TT) | B3 Tariff Classification (TC) | B3 Value for Currency Conversion (VCC) | B3 Value for Duty (VFD) | B3 Customs Duties | B3 GST | s. 59 DAS No. | s.59 Decision Date | s.59 Line No. | s.59 Sub. Hdr. No. | Quantity | s.59 TT | s.59 TC | s.59 VCC | s.59 VFD | s.59 Duties | s.59 GST | TT | TC | VCC | VFD | Duties | GST |

| As accounted for | As determined by CBSA | As requested | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B3 Transaction Number | B3 Accounting Date | B3 Line No. | B3 Sub. Hdr. No. | Invoice Line No. | Vendor | B3 Value for Currency Conversion (VCC) | B3 Value for Duty (VFD) | B3 Customs Duties | B3 GST | s. 59 DAS No. | s.59 Decision Date | s.59 VCC | s.59 VFD | s.59 Duties | s.59 GST | VCC | VFD | Duties | GST |

You may also be asked to provide additional data by an Appeals Officer in order to provide clarity and to facilitate your request. Depending on the request, the Appeals Officer may develop the spreadsheet further by including additional columns for completion as required.

Appendix B

Information that may be provided to facilitate a request (in addition to what is prescribed in Appendix A)

If your request is regarding the origin, tariff classification (other than goods classified under tariff item 9898.00.00), value for duty or marking of imported goods it is imperative that the CBSA be able to accurately identify the goods or the issue in order for a decision to be issued in a timely manner. Therefore, all requests must include sufficient and appropriate information to identify the goods or the issue such as but not limited to:

Tariff classification

1. To facilitate requests concerning the Tariff Classification of goods the request should be accompanied by the following information, (where applicable):

- The tariff classification the requester believes to be correct, a rationale explaining the requester’s position supported by documentary evidence.

- Identify the characteristics or attributes of the goods relevant to their tariff classification with respect to the aspects in point. Make appropriate references to accompanying supporting information, documentation or articles.

- Provide a clear and complete explanation of the arguments in support of the tariff classification requested. Indicate how the following are relevant to the tariff classification requested:

- the General Rules for the Interpretation of the Harmonized System and the Canadian Rules set out in the Schedule to the Customs Tariff;

- the wording of the heading, subheading, and tariff item requested;

- any relevant legal (section, chapter, subheading, and supplementary) notes;

- any relevant Harmonized Commodity Description and Coding System (HS) Explanatory Notes or Compendium of Classification Opinions;

- any “ordinary” or “trade” specific definitions related to the goods, the terms of the headings, subheadings, or tariff items which the requester relies upon or disputes;

- any relevant court or CITT decisions;

- any and all previously obtained CBSA advice concerning the tariff classification of like goods, such as NCRs, previous decisions on the same or related goods, CBSA opinion letters;

- any relevant references in Agency policy, such as Memoranda or Customs Notices.

- A detailed description of the good including the trade name, or its commercial, common or technical designation such as model number, where applicable;

- The composition of the good;

- A description of the process by which the good is manufactured, if applicable;

- The packaging information used to transport the good;

- The intended and/or actual use of the good;

- The producer’s or manufacturer’s product literature, drawings, photographs, and/or schematics for the good;

-

A copy of the relevant commercial invoice(s).

If the person making the request or their representative has difficulty obtaining proprietary information from the manufacturer or foreign supplier, they may request the manufacturer or foreign supplier to send the information directly to the CBSA. The disclosure of customs information is protected by the legislation and may only be shared with the proper consent pursuant to Section 107 of the Act, (Disclosure of information).

- A physical sample of the good may be submitted at the request of an Officer. Physical samples can be useful for those goods whose essential character is dependent on the good’s precise composition and/or constituent elements, or when examining a physical sample will facilitate or expedite the classification of the good. If a physical sample of the good has already been provided please submit a copy of any documentation that may have accompanied the sample.

Samples are not to be included with the request if the good is a perishable item, requires special handling, or is a hazardous product. These should only be provided at the request of the CBSA. In these instances, contact the Appeals Officer handling your case who will provide instructions on how to safely provide the CBSA your hazardous or perishable samples.

Value for duty (valuation)

2. To facilitate requests concerning the valuation of goods, the request should be accompanied by the following information, where applicable:

- The value for duty the requester believes to be correct, the calculation used to determine the value for duty, a rationale explaining the requester’s position supported by documentary evidence;

- Documentary evidence from the Books and Records for the period under dispute, supporting the value for duty of goods as requested;

- T2 income tax return including all schedules and Notice of Assessment for period(s) under review;

- GST/HST return(s);

- Financial Statements (audited if available), including Balance Sheet, Income Statement/Profit and Loss Statement, notes to the Financial Statements, etc;

- General ledger detailed postings;

- Commercial invoices;

- Credit notes;

- Purchase order confirmations;

- Sale agreements, contracts or bills of sale;

- Letters of credit;

- Proof of payment;

- Quota agreements;

- Warranty agreements;

- Conditions of sale, for example, information relating to trade-ins;

- Agreements or written contracts (for example, transfer price agreements or pricing studies);

- Agreements to provide assists and agreements between third parties with information supporting the value and/or apportionment of the assists;

- Royalty, trademark, copyright and licence fee agreements;

- Evidence of freight costs;

- Details of rebates;

- Lease/rental agreements;

- Information relating to the identification of the place of direct shipment;

- Information which substantiates the transaction value of identical or similar goods;

- Detailed calculations indicating the applicability of the transaction value of identical goods method, the transaction value of similar goods method, the deductive method, the computed method, or the residual value method, as appropriate; and,

- Any other relevant document that supports the use of the valuation method claimed.

Origin

3. To facilitate requests concerning the origin or preferential tariff treatment of goods, the request should be accompanied by the following information, where applicable:

- The tariff treatment the requester believes to be correct, a rationale explaining the requester’s position supported by documentary evidence;

- Any applicable Exporter Questionnaires;

- If originating from a beneficiary country, a list of non-originating materials entering in the production of the good and the criteria by which they meet the requirements of the tariff treatment being applied for (if applicable);

- Proof of origin of materials as required by the regulations for the preferential tariff treatment for the goods being claimed;

- The country where the good is finished in the form it is imported into Canada;

- The transportation mode(s) and route used to ship the goods to Canada;

- The identification of a consignee in Canada on a through bill of lading from the country of origin if claiming a regional value content or the net cost value for the goods, a list indicating the value of all costs included in the ex-factory price including materials, labour, factory overhead and reasonable profit, and a calculation of these costs expressed as a percentage of the ex-factory price;

- Whether the good was transhipped, and if so, through which country(ies), and what (if any) operations the good underwent during transhipment;

- Supporting documentation previously requested by the CBSA and not provided, that resulted in the denial of preferential tariff treatment or alternative supporting documentation.

4. The person who signed the Certificate of Origin may also make a request. However, proof should be provided that all duties and interest owing on the related imported goods has been paid or security satisfactory to the Minister has been given in respect of the total amount owing. The CBSA may reject any requests if such proof is not provided for the goods at issue and will notify the exporter that those requests have been rejected. To assist exporters or producers with their requests, Form B226 or a letter containing the same information should be completed and provided with the Request.

5. The required information mentioned above, such as the transaction, adjustment and line number of an importation, could be obtained in the following way:

The exporter may contact the person who imported the goods. The importer of the goods should have a copy of the documentation filed with the original importation and in addition will be informed by way of a Canada Customs Detailed Adjustment Statement (DAS) that the origin of goods in a particular importation has been re-determined or further re-determined. The importer will therefore know the line number, adjustment number, and the transaction number of the importation.

6. For information on additional requirements relating to specific tariff treatments and related origin issues please refer to the appropriate memorandum found in the Memoranda D11 – General Tariff Information series.

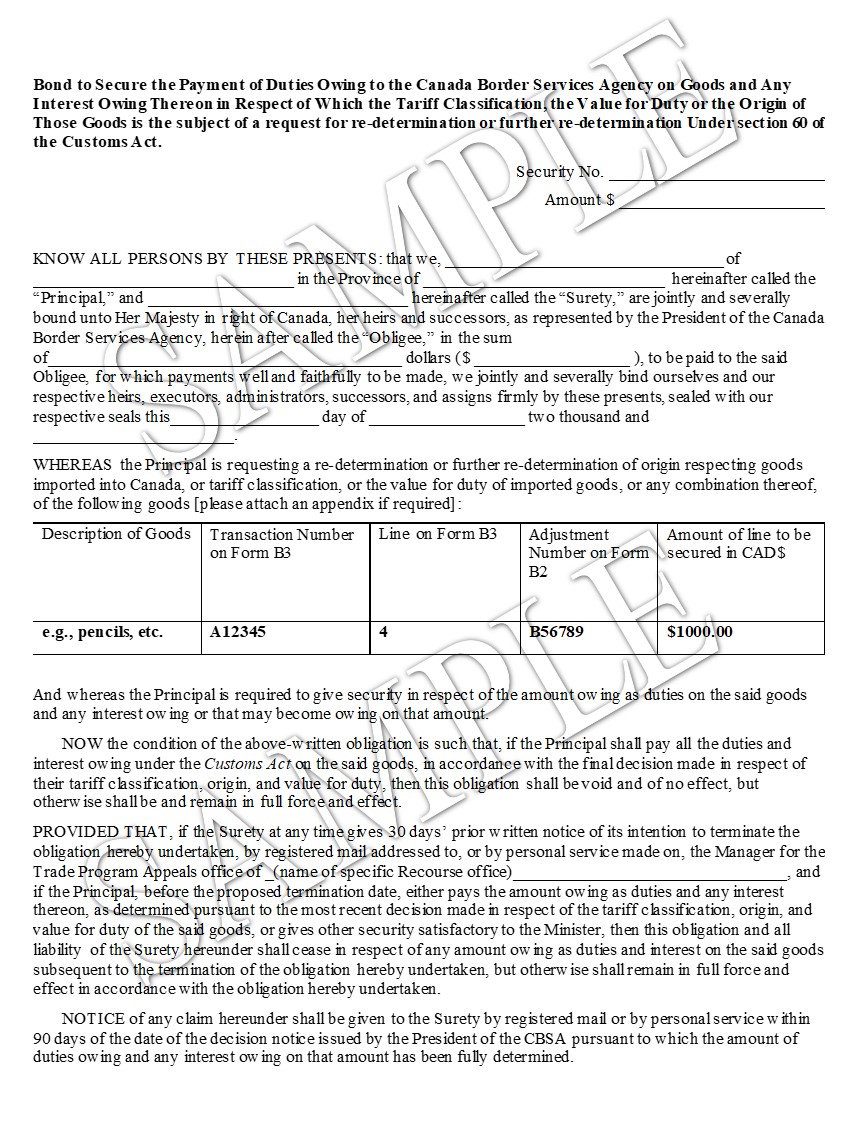

Appendix C

Requirements for posting security

1. For the purposes of sections 59 and 65 of the Act, an importer who gives security satisfactory to the Minister for all amounts owing to the CBSA as duties and accrued interest, including the Goods and Services Tax (GST), must present the security with Form B2, Canada Customs - Adjustment Request.

2. Security must be provided in the amount of duties owing plus interest on that amount, if any. Memorandum D11-6-5, Interest and Penalty Provisions: Determinations/Re-determinations, Appraisals/Re-appraisals, and Duty Relief, provides more information on calculating the interest on amounts owing when security is posted. Importers can also obtain details on the amounts owing and any accrued interest from the Canada Revenue Agency Collections Unit responsible for their account.

3. Examples of security include cash, certified cheques, transferable bonds issued by the Government of Canada or a bond from an acceptable financial institution as identified in the Treasury Board of Canada Secretariat's Guideline on Security for Debts, in Appendix B, Recommended Maximum Values Assigned to Assets Taken as Security and Other Forms of Acceptable Security, of those guidelines. Importers should note that the CBSA reserves the right to determine if other types of security such as letters of credit or promissory notes are satisfactory security.

4. An importer who chooses to post a bond as security should do so several days before the end of the 90-day time period for filing a request to allow the bond to be validated. Bonds must be formulated in accordance with the bond sample found in this Appendix. If they are not, the CBSA may refuse them.

5. The CBSA will reject any request for re-determination or further re-determination filed under section 60 of the Act if the payment of duties and interest in respect of the goods has not been made or if security satisfactory to the Minister has not been given. If security was posted with a previous request, the person making the request must write “on file” after the security number in Field 11, Security Number, on the Form B2, Canada Customs - Adjustment Request.

Although the legislation allows for 90 days to request an appeal, interest begins to accrue 30 days after the day the determination or re-determination under section 59 of the Act is rendered and posting security does not stop the interest from accruing (please see Memorandum D11-6-5, Interest and Penalty Provisions: Determinations/Re-determinations, Appraisals/Re-appraisals, and Duty Relief, for more details on interest regarding security).

Appendix C – continuation

Bond sample

Appendix D

Requests regarding decisions made on goods classified as prohibited or restricted under tariff No. 9898.00.00 of the Customs Tariff, such as prohibited or restricted weapons or prohibited devices

Requests must be made in the prescribed form and manner with the prescribed information as set out in Appendix A Prescription of Form, Manner and Information To Make A Request For Re-Determination, Further Re-Determination or Review Under Section 60 of The Customs Act;

Requests that are not submitted in the prescribed form and manner and which do not include the prescribed information may be rejected. A rejected request may be re-submitted once any deficiencies have been addressed, provided all requirements for a valid request are met.

Requesting a review

1. You may submit a request regarding a decision made on goods classified as prohibited goods (weapons or devices including firearms) under tariff item No. 9898.00.00 of the Tariff if the following applies:

- you received a decision from the CBSA, on a letter and/or a notice (Form K26 Notice of Detention or BSF241 Non-Monetary General Receipt), indicating that your goods are classified as prohibited weapons or devices; and

- you believe that the CBSA has misunderstood the facts or has applied the law incorrectly.

2. You must submit your request within 90 days after notice is given of the decision that is being contested. Please note that when the last day of the 90 day-time limit falls on a day the appropriate CBSA office is not open for business, the final day for filing the dispute notice is the next business day. In exceptional circumstances, the Act allows a person to make an application to the President for an extension of time within which to make a Request. For more information, consult Memorandum D11-6-9, Applications to the President for an Extension of Time to File a Request under Section 60 of the Customs Act.

3. Your request must include the prescribed core information as defined in the prescription instrument (Appendix A) and can be submitted using:

- A paper form: A letter containing the prescribed information; or

- An approved form of electronic filing identified below identified below including the prescribed information.

4. If a representative is appointed to act on your behalf, the request must always be accompanied by an authorization that the representative is acting on your behalf.

5. It is important that you clearly articulate your position as it relates to the legislation and the policy of the goods involved and that you provide documentation that supports your position. For more details, please refer to the CBSA website.

6. Further details can also be found in Memorandum D19-13-2, Importing and Exporting Firearms, Weapons, and Devices – Customs Tariff, Criminal Code, Firearms Act, Export and Import Permits Act and the Regulations Prescribing Certain Firearms and Other Weapons, Components and Parts of Weapons, Accessories, Cartridge Magazines, Ammunition and Projectiles as Prohibited or Restricted).

7. If submitting your request by paper form, to ensure efficient processing, you may send it to:

Trade Triage Unit - Recourse Directorate

Canada Border Services Agency

333 North River Rd, 11th floor Tower A

Ottawa, ON K1L 8B9

8. If you are submitting your request by an approved form of electronic filing, you must use the approved online appeal form indicated on the CBSA website. Once the Recourse Directorate has verified your request, you may be contacted to submit the required prescribed information and supporting documentation.

9. Submitting the online appeal form is considered to be the first step in making a request. Should you fail to later provide the prescribed information when requested by the Recourse Directorate, your request via the online appeal form will not be considered valid nor will your legislated time limits to submit a section 60 of the Act request to the CBSA be protected. Only once all legislated requirements, including the provision of prescribed information are met will your request be considered to be filed with the CBSA. Please ensure that you keep a record of your submission.

References

- Issuing office

- Recourse Policy Unit

Recourse Directorate

Finance and Corporate Management Branch

Canada Border Services Agency

Ottawa, ON K1A 0L8 - Headquarters file

- 4502-10-3

- Legislative references

- Canada Border Services Agency Act

Criminal Code

Customs Act

Customs Tariff

Export and Import Permits Act

Firearms Act

Proof of Origin of Imported Goods Regulations - Other references

- D6-2-6, D14-1-3, D11-11-1, D11-11-3, D11-4-16, D11-6-5, D11-6-9

- Superseded memorandum D

- D-11-6-7 dated

- Date modified: