Cannabis: Edibles, Extracts and Topicals Customs Excise Duty Procedures

Customs Notice 19-24

Ottawa,

1. The purpose of this notice is to inform importers on the calculation of the amounts of excise duty and any additional duty to be imposed on edible cannabis, cannabis extracts or cannabis topical products, as per legislative changes to the Excise Act, 2001, when importing these goods into Canada for medical or scientific purposes.

2. Information on the federal and provincial excise duty rates applicable on importations of cannabis edibles, extracts and topicals for medical or scientific purposes may be found on the Canada Revenue Agency website. All modifications will be active in the Customs Commercial System (CCS) beginning December 16, 2019.

3. The table below is a list of the province/territory HS Administrative Codes to be entered in Field 27 on Form B3-3, Canada Customs Coding Form.

| Province / territory | HS administrative code |

|---|---|

| Alberta | 0000.99.99.70 |

| British Columbia | 0000.99.99.71 |

| Manitoba | 0000.99.99.72 |

| New Brunswick | 0000.99.99.73 |

| Newfoundland & Labrador | 0000.99.99.74 |

| Northwest Territories | 0000.99.99.75 |

| Nova Scotia | 0000.99.99.76 |

| Nunavut | 0000.99.99.77 |

| Ontario | 0000.99.99.78 |

| Prince Edward Island | 0000.99.99.79 |

| Québec | 0000.99.99.80 |

| Saskatchewan | 0000.99.99.81 |

| Yukon | 0000.99.99.82 |

4. The table below is a list of the Proposed Excise Duty Rates for Cannabis Edibles, Cannabis Extracts (including Oil) and Cannabis Topicals

| Province/territory | Federal rate ($/mg of total THC) |

Additional rate in respect of province/territory $/mg of total THC) |

Current Ad Valorem sales tax adjustment (%) |

|---|---|---|---|

| Alberta | 0.0025 | 0.0075 | 16.8 |

| British Columbia | 0.0025 | 0.0075 | N/A |

| Manitoba | 0.0025 | N/A | N/A |

| New Brunswick | 0.0025 | 0.0075 | N/A |

| Newfoundland and Labrador | 0.0025 | 0.0075 | N/A |

| Northwest Territories | 0.0025 | 0.0075 | N/A |

| Nova Scotia | 0.0025 | 0.0075 | N/A |

| Nunavut | 0.0025 | 0.0075 | 19.3 |

| Ontario | 0.0025 | 0.0075 | 3.9 |

| Prince Edward Island | 0.0025 | 0.0075 | N/A |

| Quebec | 0.0025 | 0.0075 | N/A |

| Saskatchewan | 0.0025 | 0.0075 | 6.45 |

| Yukon | 0.0025 | 0.0075 | N/A |

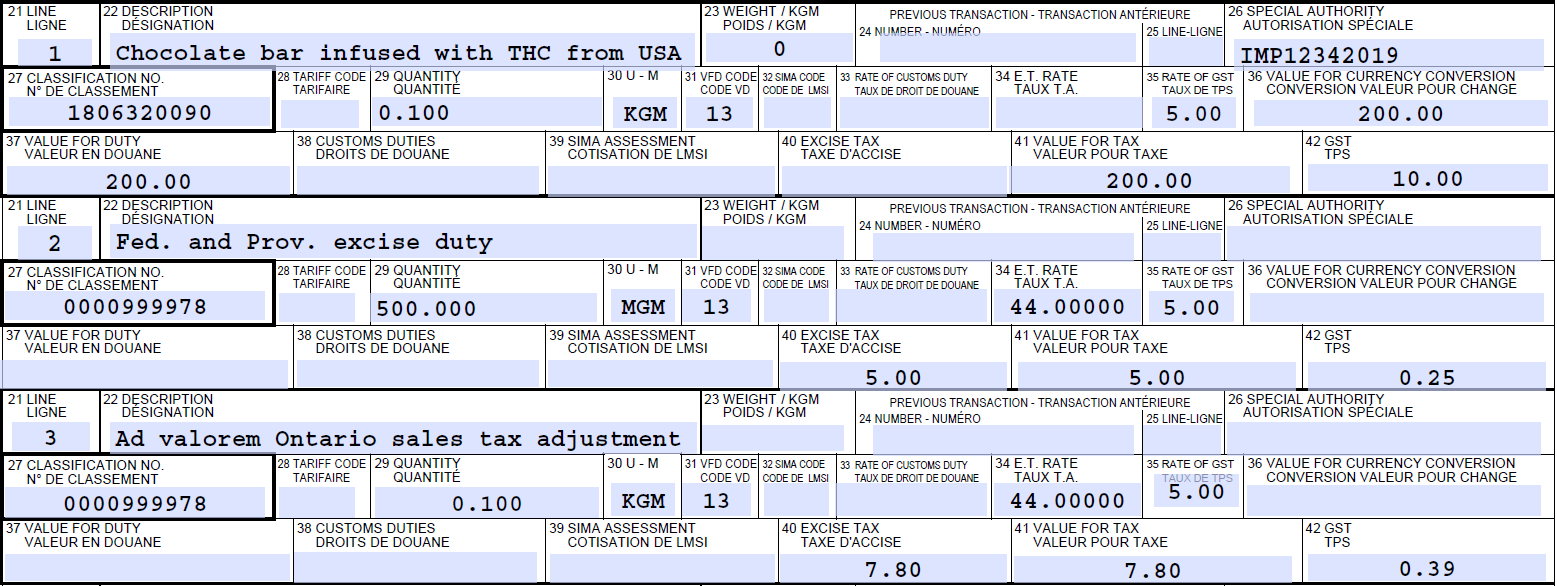

5. The following example illustrates how the customs duty, federal excise duty and provincial excise duty is to be calculated on Form B3-3, Canada Customs Coding Form.

Example:

Calculation of cannabis duty and additional cannabis duty on a chocolate bar (U.S. origin), 100 grams, infused with 500 milligrams of THC imported in Ontario. The value of the importation is $200.00 (CAD).

Classification: Line 1

Shows the actual classification line; the Health Canada Import permit number must be entered in Special Authority field (26). The GST (5%) is calculated on the value for duty and entered in Field 42.

Calculation of Combined Federal and Provincial Excise Duty: Line 2

Shows the amount of the combined federal and provincial excise duty; this amount is calculated at $0.01 per milligram of THC of the quantity imported (which includes the flat-rate federal cannabis duty of $0.0025 per milligram of the total THC of the cannabis product plus the flat-rate provincial additional cannabis duty of $0.0075). Refer to table: Proposed Excise Duty Rates for Cannabis Edibles, Cannabis Extracts (including Oil) and Cannabis Topicals.

- The importer is required to add the province/territory HS Administrative Code, for the province/territory of import in Field 27. Refer to table: List of the province/territory HS Administrative Codes.

- The importer is required to enter 44 on field 34: Excise Tax Rate to allow a manual calculation of Federal and Provincial excise duty to be entered in field 40 and THC quantity must be entered in field 29 of this line.

- The amount of the excise duty payable to be entered in field 40 is $5.00, this is calculated by multiplying 500 milligrams of THC by $0.01.

- This amount of $5.00 is also to be entered in field 41, value for tax.

Provincial Sales Tax Adjustment: Line 3

Shows the amount of sales tax adjustment for Ontario, calculated by multiplying the base amount by 3.9%. Refer to table: Proposed Excise Duty Rates for Cannabis Edibles, Cannabis Extracts (including Oil) and Cannabis Topicals.

- The importer is required to add the province/territory HS Administrative Code, for the province/territory of import in Field 27. Refer to table: List of the province/territory HS Administrative Codes.

- The importer is required to enter 44 on field 34: Excise Tax Rate and manually calculate the sales tax adjustment amount to be entered on field 40.

- The sales tax adjustment amount to be entered in on field 40 is $7.80. This amount is calculated by multiplying the value for duty from field 37 of Line 1 ($200.00) by the provincial sales tax adjustment rate for the province of Ontario, which is 3.9%

- This amount of $7.80 is also to be entered in field 41, value for tax.

Amount Payable

All of the individual line amounts will be totaled automatically in field number 51 when submitting the B3 for importation. This amount will be the amount payable by the importer.

In the above-referenced example, the total amount payable is $23.44, corresponding to the sum of the total amount of GST ($10.64) and excise duty ($12.80).

6. For additional information on how to complete Form B3-3, Canada Customs Coding please refer to D17-1-10, Coding of Customs Accounting Documents.

7. For more information, within Canada, call the Border Information Service at 1-800-461-9999. From outside Canada call 204-983-3500 or 506-636-5064. Long distance charges will apply. Agents are available Monday to Friday (08:00 to 16:00 local time/except statutory holidays). TTY is also available within Canada: 1-866-335-3237.

- Date modified: