CRS 2018 IN

Cold-Rolled Steel

Statement of Reasons

Ottawa, September 7, 2018

Concerning the preliminary determinations with respect to the dumping and subsidizing of cold-rolled steel from China, South Korea and Vietnam.

Decision

Pursuant to subsection 38(1) of the Special Import Measures Act (SIMA), the Canada Border Services Agency (CBSA) made preliminary determinations on August 23, 2018 respecting the dumping and subsidizing of certain cold-rolled steel in coils or cut lengths from China, South Korea and Vietnam.

This document is also available in PDF (2,707 KB) [help with PDF files]

Summary of Events

[1] On April 5, 2018, the Canada Border Services Agency (CBSA) received a written complaint from ArcelorMittal Dofasco G.P., of Hamilton, Ontario, (hereinafter, “the complainant”), alleging that imports of certain cold-rolled steel in coils or cut lengths (CRS) from the People’s Republic of China (China), the Republic of Korea (South Korea) and the Socialist Republic of Vietnam (Vietnam) (hereafter “the named countries”) are being dumped and subsidized. The complainant alleged that the dumping and subsidizing have caused injury and are threatening to cause injury to the Canadian industry producing like goods.

[2] On April 26, 2018, pursuant to paragraph 32(1)(a) of the Special Import Measures Act (SIMA), the CBSA informed the complainant that the complaint was properly documented. The CBSA also notified the governments of China, South Korea and Vietnam that a properly documented complaint had been received. The governments of China, South Korea and Vietnam were also provided with the non-confidential version of the subsidy complaint and were invited for consultations pursuant to Article 13.1 of the Agreement on Subsidies and Countervailing Measures, prior to the initiation of the subsidy investigation.

[3] On May 15, 2018, consultations were held between the Government of Canada and the Government of China via video conference. During the consultations, the Government of China made representations with respect to its views on the evidence presented in the non-confidential version of the subsidy complaint. On May 17, 2018, the Government of China provided written representations related to the consultations. The CBSA considered the representations made by the Government of China in its analysis.

[4] On May 23, 2018 consultations were held between the Government of Canada and the Government of Vietnam. During the consultations, the Government of Vietnam made representations with respect to the evidence presented in the non-confidential version of the subsidy complaint and provided them in writing. The CBSA considered the representations made by the Government of Vietnam in its analysis.

[5] Also on May 23, 2018, consultations were held between the Government of Canada and the Government of South Korea.

[6] The complainant provided evidence to support the allegations that CRS from the named countries have been dumped and subsidized. The evidence also discloses a reasonable indication that the dumping and subsidizing have caused injury and are threatening to cause injury to the Canadian industry producing like goods.

[7] On May 25, 2018, pursuant to subsection 31(1) of SIMA, the CBSA initiated investigations respecting the dumping and subsidizing of CRS from China, South Korea and Vietnam.

[8] Upon receiving notice of the initiation of the investigations, the Canadian International Trade Tribunal (CITT) commenced a preliminary injury inquiry, pursuant to subsection 34(2) of SIMA, into whether the evidence discloses a reasonable indication that the alleged dumping and subsidizing of the above-mentioned goods have caused injury or retardation or are threatening to cause injury to the Canadian industry producing the like goods.

[9] On July 24, 2018, pursuant to subsection 37.1(1) of SIMA, the CITT made a preliminary determination that there is evidence that discloses a reasonable indication that the alleged dumping and subsidizing of CRS from China, South Korea and Vietnam have caused injury to the domestic industry.

[10] On August 23, 2018, as a result of the CBSA’s preliminary investigations and pursuant to subsection 38(1) of SIMA, the CBSA made preliminary determinations of dumping and subsidizing of CRS from China, South Korea and Vietnam. On the same date, the CBSA notified interested parties of a change to the investigations schedule.

[11] On August 23, 2018, pursuant to subsection 8(1) of SIMA, provisional duty was imposed on imports of dumped and subsidized goods that are of the same description as any goods to which the preliminary determinations apply, and that are released during the period commencing on the day the preliminary determinations were made and ending on the earlier of the day on which the CBSA causes the investigation in respect of any goods to be terminated pursuant to subsection 41(1) of SIMA or the day the CITT makes an order or finding pursuant to subsection 43(1) of SIMA.

Period of Investigation

[12] The Period of Investigation (POI) for these investigations is April 1, 2017, to March 31, 2018.

Profitability Analysis Period

[13] The Profitability Analysis Period (PAP) for the dumping investigation is April 1, 2017, to March 31, 2018.

Interested Parties

Complainant

[14] The complainant is ArcelorMittal Dofasco G.P, which was founded as the Dominion Steel Casting Company in 1912 in Hamilton, ON. In 2006 Dofasco was acquired by Arcelor S.A. Later that year, Arcelor S.A merged with Mittal Steel.

[15] ArcelorMittal Dofasco G.P produces CRS at its facility in Hamilton, ON. The company is the largest of three producers of CRS in Canada.

[16] The contact information of the complainant is as follows:

ArcelorMittal Dofasco G.P.

1330 Burlington St E,

Hamilton, ON L8N 3J5

[17] The other manufacturers of like goods in Canada are:

Essar Steel Algoma Inc.

105 West Street

Sault Ste. Marie, Ontario

Stelco Inc.

386 Wilcox Street

Hamilton, Ontario

Importers

[18] At the initiation of the investigations, the CBSA identified 62 potential importers of the subject goods based on both information provided by the complainant and CBSA import entry documentation. The CBSA sent an Importer Request for Information (RFI) to all potential importers of the goods. The CBSA received four responses to the Importer RFI.

Exporters

[19] At the initiation of the investigations, the CBSA identified 284 potential exporters/producers of the subject goods from information provided by the complainant and CBSA import entry documentation. All of the potential exporters were sent the CBSA’s Dumping and Subsidy RFIs. Exporters located in China and Vietnam were also sent the Section 20 RFI.

[20] One company that was involved in the sale of subject goods to Canada during the POI provided a response to the Dumping RFI.Footnote 1 However, the CBSA did not receive responses to the Dumping RFI from the Chinese producers of these goods. One producer of subject goods from Vietnam provided a response to the CBSA’s Dumping RFI; however, this company did not export subject goods to Canada during the POI.Footnote 2

[21] No companies in China and Vietnam responded to the Section 20 RFI.

[22] No companies provided a response to the Subsidy RFI.

Governments

[23] For the purposes of these investigations, “Government of China (GOC)”, “Government of South Korea (GOK)”, and “Government of Vietnam (GOV)” refer to all levels of government, i.e., federal, central, provincial/state, regional, municipal, city, township, village, local, legislative, administrative or judicial, singular, collective, elected or appointed. It also includes any person, agency, enterprise, or institution acting for, on behalf of, or under the authority of, or under the authority of any law passed by, the government of that country or that provincial, state or municipal or other local or regional government.

[24] At the initiation of the investigation, the CBSA sent a Government Subsidy RFI to the GOC, GOK and GOV. In addition, the GOC and GOV were sent the CBSA’s Government Section 20 RFI.

[25] None of the governments of the named countries provided a response to the Government Subsidy RFI or the Government Section 20 RFI.

Product Information

Definition

[26] For the purpose of these investigations, the subject goods are defined as:

Cold-reduced flat-rolled sheet products of carbon steel (alloy and non-alloy), in coils or cut lengths, in thicknesses up to 0.142 inches (3.61 mm) and widths up to 73 inches (1854 mm) inclusive, originating in or exported from the People’s Republic of China, the Republic of Korea, and the Socialist Republic of Vietnam, and excluding:

- organic coated (including pre-paint and laminate) and metallic coated steel;

- steel products for use in the manufacture of passenger automobiles, buses, trucks,

- ambulances or hearses or chassis therefor, or parts thereof, or accessories or parts thereof;

- steel products for use in the manufacture of aeronautic products;

- perforated steel;

- stainless steel;

- silicon-electrical steel; and

- tool steel.

Additional Product InformationFootnote 3

[27] For greater certainty, where the nominal and actual measurements vary, a product is considered to be subject goods if either the actual or nominal measurement (being plus or minus allowable tolerances in the applicable standards), meets the definition set forth above.

[28] The product definition covers both annealed and “full-hard” (unannealed) CRS as well as rectangular and non-rectangular cross-section products.

[29] The maximum widths and thicknesses that apply to non-rectangular CRS are the same as those that apply to rectangular CRS, i.e., thicknesses up to 0.142 inches (3.61 mm) and widths up to 73 inches (1854 mm) inclusive.

[30] The product definition includes carbon steel, whether alloyed or non-alloyed. Alloying elements may include boron, titanium, manganese, silicon, copper, aluminum chromium, cobalt, lead, nickel, tungsten, molybdenum, niobium, vanadium, and zirconium.

[31] The product definition includes cold-rolled steels generally described as interstitial free (IF) steels, high-strength-low-alloy (HSLA) steels, motor lamination steels and advanced high-strength steels (AHSS). IF steel is a common term for a low carbon steel with low levels of elements like titanium or niobium. HSLA steels contain low levels of elements like copper, titanium, chromium, niobium, vanadium and/or molybdenum. Motor lamination steels contain low levels of elements like silicon and aluminium, but are commercially and metallurgically distinct from silicon-electrical steel. AHSS is a term used to describe steel with high tensile strength.

[32] CRS includes “black plate”, which is an industry term used to describe light gauge, low carbon, cold-reduced steel intended for use in the production of tin mill products or for use in its untinned state. It is supplied either dry or oiled. CRS for use in the production of tin mill products is included in the product definition (as it is black plate), but the finished product, tin plate, is excluded from the product definition.

[33] CRS is manufactured to meet certain Canadian Standards Association (CSA) and/or ASTM specifications, or equivalent specifications. ASTM specifications for cold-rolled steel meeting the product definition include, but are not limited to A568/A568A, A606/A606M, A424, A1008/A1008M, A726, A625/A625M, and A650/A650M. CRS that does not meet a specification is generally referred to as “non-prime” or “seconds”. Both prime and non-prime CRS for non-automotive uses are included in the product definition.

[34] The product definition excludes CRS with organic and metallic coatings. Coating methods include spraying, laminating, plating and hot-dip treatments. [35] The product definition excludes cold-rolled steel for use in automobiles and automobile parts, hereafter referred to as “automotive”. Automotive producers include Original Equipment Manufacturers (OEMs) and part producers.

[36] The product definition excludes perforated cold-rolled steel. Perforated steel is steel sheet that has a pattern of punched or stamped holes throughout the length and width of the steel sheet.

[37] The product definition excludes stainless cold-rolled steel. The Customs Tariff currently defines stainless steel as steel containing no more than 1.2% carbon and 10.5% or more of chromium by weight. This is the same definition that will apply to the subject goods definition. Stainless steel may also include other alloying elements. Stainless steel is commercially and metallurgically distinct from carbon steel, including alloyed carbon steel. Alloyed carbon steel (or alloy carbon steel) is included in the product definition.

[38] The product definition excludes silicon-electrical steel. Silicon-electrical steels include both grain-oriented electrical steel (commonly known as GOES) and non-oriented electrical steel (NOES). At present, the notes to Chapter 72 of Canada’s Customs Tariff schedule defines silicon-electrical steel as:

Alloy steels containing by weight at least 0.6% but not more than 6% of silicon and not more than 0.08% of carbon. They may also contain by weight not more than 1% of aluminum but no other element in a proportion that would give the steel the characteristics of another alloy steel.

[39] The above definition of silicon-electrical steel will apply to the subject goods definition.

[40] The product definition excludes tool steel. Tool steel is a variety of steel with distinct characteristics, such as hardness, that make it suitable for hand tools and dies. Tool steel will meet CSA or ATSM standards, such as ASTM 681 or ASTM 686. The Custom Tariff has specific tariff classification numbers for cold-rolled tool steel, such as such as 7225.50.00.11 and 7225.50.00.21.

[41] More specifically, tool steel is defined as steel which contains the following combinations of elements in the quantity by weight respectively indicated: (i) more than 1.2 percent carbon and more than 10.5 percent chromium; or (ii) not less than 0.3 percent carbon and 1.25 percent or more but less than 10.5 percent chromium; or (iii) not less than 0.85 percent carbon and 1 percent to 1.8 percent, inclusive, manganese; or (iv) 0.9 percent to 1.2 percent, inclusive, chromium and 0.9 percent to 1.4 percent, inclusive, molybdenum; or (v) not less than 0.5 percent carbon and not less than 3.5 percent molybdenum; or (vi) not less than 0.5 percent carbon and not less than 5.5 percent tungsten.

[42] CRS falling within the product definition is commonly used in the production and manufacture of other goods, including household appliances, drums, tubing, furniture and strapping.

Production ProcessFootnote 4

[43] The primary input for CRS is hot-rolled steel sheet (HRS). While details may vary from mill to mill, the process by which HRS is produced is essentially the same for all domestic producers.

[44] HRS is rolled on a continuous strip mill at temperatures above 1600°F (870°C) from an incoming hot slab up to 9" (229 mm) thick. The slab is made of steel produced in a basic oxygen furnace or an electric arc furnace. The slab is progressively reduced to a sheet of the required thickness, 0.625" (15.875 mm) or less. Processing in the mill may include slitting or shearing to remove tongues and tails from the sheet. During hot-rolling, surface oxide (scale) forms, which is not acceptable for cold-rolling. This scale may be removed at a separate pickle line mill or at a continuous pickling cold-rolling mill. After pickling, rinsing and drying, oil may be applied as a temporary protection against rust.

[45] HRS is transformed into CRS through a cold-rolling process. The HRS is reduced in thickness by a cold reduction rolling process on a continuous or reversing cold-rolling mill. The process produces a steel that is referred to as “full-hard”. Full-hard steel has minimal ductility (i.e., it is not pliable) and it can be sold in the merchant market or further processed as an annealed product. “Full hard” sheet may go through further internal processing into non-like goods, such as conversion to corrosion-resistant steel sheet or tin-plate.

[46] Annealing is the process of heating and cooling the steel to recover ductility. After annealing, a sheet may go through a temper rolling process that results in improved sheet shape, surface and performance during steel fabrication.

Product UseFootnote 5

[47] The subject goods are typically used in the production and manufacture of other goods, including household appliances, drums, tubing, furniture and strapping.

Classification of Imports

[48] Beginning January 1, 2017, under the revised customs tariff schedule, subject goods are normally classified under the following tariff classification numbers:

- 7209.15.00.00

- 7209.16.00.00

- 7209.17.00.00

- 7209.18.00.00

- 7209.25.00.00

- 7209.26.00.00

- 7209.27.00.00

- 7209.28.00.00

- 7209.90.00.00

- 7211.23.00.00

- 7211.29.00.00

- 7211.90.00.00

- 7225.50.00.00

[49] The listing of tariff classification numbers is for convenience of reference only. The tariff classification numbers include non-subject goods. Also, subject goods may fall under tariff classification numbers that are not listed. Refer to the product definition for authoritative details regarding the subject goods.

Like Goods and Class of Goods

[50] Subsection 2(1) of SIMA defines “like goods” in relation to any other goods as goods that are identical in all respects to the other goods, or in the absence of any identical goods, goods the uses and other characteristics of which closely resemble those of the other goods.

[51] In considering the issue of like goods, the CITT typically looks at a number of factors, including the physical characteristics of the goods, their market characteristics and whether the domestic goods fulfill the same customer needs as the subject goods.

[52] After considering questions of use, physical characteristics and all other relevant factors, the CBSA initiated its investigations under the premise that domestically produced CRS are like goods to the subject goods. Further, the CBSA was of the opinion that subject goods and like goods constitute only one class of goods.

[53] In its preliminary injury inquiry for this investigation, the CITT further reviewed the matter of like goods and classes of goods. On August 8, 2018, it issued its preliminary injury inquiry determination and reasons indicating that “the Tribunal, will analyze the allegations of injury and threat of injury on the basis that domestically produced CRS, as described in the product definition, is “like goods” in relation to the subject goods and that there is a single class of goods”.Footnote 6

The Canadian Industry

[54] The complainant, combined with the two supporting producers, account for all known domestic production of like goods.

Imports into Canada

[55] During the preliminary phase of the investigations, the CBSA refined the estimated volume and value of imports based on information from CBSA import entry documentation and other information received from exporters and importers.

[56] The following table presents the CBSA’s analysis of imports of CRS for the purposes of the preliminary determinations:

| Country | POI (April 1, 2017 to March 31, 2018) |

|---|---|

| China | 57.9% |

| South Korea | 6.9% |

| Vietnam | 6.2% |

| All Other Countries | 29.0% |

| Total Imports | 100.0% |

Representations

[57] On July 4, 2018, the CBSA received written representations from POSCO concerning the CRS investigations. These representations followed a meeting held on June 22, 2018 with the CBSA, representatives from POSCO, and a representative from the Embassy of the Republic of Korea.Footnote 7

[58] During the meeting, and in their written representations, POSCO alleged that the volume of imports from South Korea were de minimis. During the meeting POSCO also noted that they would be providing additional information to support their claims. The CBSA received no further information from POSCO in this regard.

[59] On August 8, 2018, further meetings were held with representatives from the South Korean Ministry of Trade, Industry and Energy (MOTIE) and the CBSA. In addition to re-iterating POSCO’s allegations that the volume of imports from South Korea were de minimis, MOTIE expressed reservations concerning potential negative impacts of any participation by South Korean exporters/producers or the GOK, as well as the undertaking of time and effort that is required to complete the Subsidy RFIs in particular.

[60] On August 13, 2018, the CBSA received further written representations from POSCO requesting that the CRS Subsidy investigation be terminated by the CBSA.Footnote 8

[61] The CBSA has noted the arguments and evidence submitted in these representations and has taken take them into consideration.

[62] As part of the preliminary investigations, the CBSA reviewed import documentation for goods which were produced by POSCO, as well as a number of other producers from both subject and non-subject countries. Where the import documentation indicated that the goods are non-subject, the CBSA has excluded those goods from the calculation of import volumes.

Investigation Process

[63] Regarding the dumping investigation, information was requested from all known and potential exporters, producers, vendors and importers, concerning shipments of CRS released into Canada during the POI.

[64] Regarding the Section 20 inquiry, information was requested from all known and potential exporters and producers of CRS in China and Vietnam and from the GOC and GOV. The CBSA also sent surrogate RFIs to all known producers of CRS in Italy, South Korea and Sweden to gather information to determine normal values under paragraph 20(1)(c) of SIMA.Footnote 9 Furthermore, importers were requested to provide information respecting re-sales in Canada of like goods imported from a third country in order to gather information to determine normal values under paragraph 20(1)(d) of SIMA.

[65] Regarding the subsidy investigation, information related to potential actionable subsidies was requested from all known and potential exporters and producers in the named countries. The exporters/producers were requested to forward a portion of the RFI to their input suppliers, who were asked to respond to questions pertaining to their legal characterization as state-owned enterprises (SOEs). Information was requested in order to establish whether there had been financial contributions made by any level of government, including SOEs possessing, exercising or vested with government authority and, if so, to establish if a benefit has been conferred on persons engaged in the production, manufacture, growth, processing, purchase, distribution, transportation, sale, export or import of CRS; and whether any resulting subsidy was specific in nature. Information was also requested from the governments of those countries, concerning financial contributions made to exporters or producers of CRS released into Canada during the subsidy POI. The respective governments were also requested to forward the RFIs to all subordinate levels of government that had jurisdiction over the exporters.

[66] The governments and the exporters/producers were notified that failure to submit all required information and documentation, including non-confidential versions, failure to comply with all instructions contained in the RFI, failure to permit verification of any information or failure to provide documentation requested during the verification visits may result in the margins of dumping, the amounts of subsidy and the assessment of anti-dumping and/or countervailing duties on subject goods being based on facts available to the CBSA. Further, they were notified that a determination on the basis of facts available could be less favorable to their firm than if complete, verifiable information was made available.

[67] Preliminary determinations are based on the information available to the CBSA at the time of the preliminary determinations. During the final phase of the investigations, additional information may be obtained, which may be incorporated into the CBSA’s final decisions. Given the lack of participation from parties, the CBSA has revised its expected final decision date from November 21, 2018 to October 31, 2018. However, the CBSA may still elect to take the full length of time to make its final decisions.

Dumping Investigation

[68] The following presents the preliminary results of the investigation into the dumping of CRS originating in or exported from China, South Korea and Vietnam.

Normal Value

[69] Normal values are generally estimated based on the domestic selling prices of like goods in the country of export, in accordance with the methodology of section 15 of SIMA, or on the aggregate of the cost of production of the goods, a reasonable amount for administrative, selling and all other costs, plus a reasonable amount for profits, in accordance with the methodology of paragraph 19(b) of SIMA.

[70] In the case of prescribed countries such as China and Vietnam, if, in the opinion of the CBSA, the government of that country substantially determines domestic prices and there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market, the normal values are generally estimated on the basis of section 20 of SIMA using either the selling prices or costs of like goods in a “surrogate” country.

Export Price

[71] The export price of goods sold to importers in Canada is generally estimated in accordance with the methodology of section 24 of SIMA based on the lesser of the adjusted exporter’s sale price for the goods or the adjusted importer’s purchase price. These prices are adjusted where necessary by deducting the costs, charges, expenses, duties and taxes resulting from the exportation of the goods as provided for in subparagraphs 24(a)(i) to 24(a)(iii) of SIMA.

Margin of Dumping

[72] The estimated margin of dumping by exporter is equal to the amount by which the total estimated normal value exceeds the total estimated export price of the goods, expressed as a percentage of the total estimated export price. All subject goods imported into Canada during the POI are included in the estimation of the margins of dumping of the goods. Where the total estimated normal value of the goods does not exceed the total estimated export price of the goods, the margin of dumping is zero.

Preliminary Results of the Dumping Investigation

Section 20 Inquiry

[73] Section 20 is a provision of SIMA that may be applied to determine the normal value of goods in a dumping investigation where certain conditions prevail in the domestic market of the exporting country. In the case of a prescribed country under paragraph 20(1)(a) of SIMA, it is applied where, in the opinion of the CBSA, the government of that country substantially determines domestic prices and there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market.

[74] The provisions of section 20 are applied on a sector basis rather than on the country as a whole. The sector reviewed will normally only include the industry producing and exporting the goods under investigation.

[75] A section 20 inquiry refers to the process whereby the CBSA collects information from various sources in order to form an opinion as to whether the conditions described under subsection 20(1) of SIMA exist with respect to the sector under investigation.

[76] The CBSA is required to examine whether the government of that country substantially determines domestic prices. The CBSA is also required to examine the price effect resulting from substantial government determination of domestic prices and whether there is sufficient information on the record for the CBSA to have reason to believe that the resulting domestic prices are not substantially the same as they would be in a competitive market.

[77] The complainant alleged that the conditions described in section 20 prevail in the flat-rolled steel sector, which includes CRS, in China and Vietnam. That is, the complainant alleges that these industry sectors in China and in Vietnam do not operate under competitive market conditions and consequently, prices of CRS established in the Chinese and Vietnamese domestic markets are not reliable for determining normal values.Footnote 10

[78] The complainant provided a variety of evidence supporting the claim that the GOC and GOV substantially determines prices of CRS, respectively, sold in China and Vietnam, including a pricing analysis. The complainant provided evidence of state-ownership in the steel industry, involving principally the CRS input producers and CRS producers. The complainant also provided evidence of subsidization in the steel industry, which includes the flat-rolled steel sector.

[79] Finally, the complainant cited specific GOC policies such as China’s 13th Five Year Plan, the 2016 Iron and Steel Industry Adjustment and Upgrade Plan and the State Council Decision on Accelerating the Development of Strategic Emerging Industries as evidence of continued influence on market forces in China, including the flat-rolled steel sector, which includes cold-rolled steel. Also, the complainant referred to specific GOV policies such as the Steel Master Plan 2007-2015 and 2015-2025, the Strategy on exports and imports for 2011-2020, with visions to 2030 and the Industrial Development Strategy through 2025, that continued influence on market forces in the flat-rolled sector, including CRS.

[80] At the initiation of the investigation, the CBSA had sufficient evidence, supplied by the complainant, from its own research and from past investigations, to support the initiation of a section 20 inquiry to examine the extent of GOC and GOV involvement in pricing in the flat-rolled sector, which includes cold-rolled steel. The information indicated that Chinese and Vietnamese prices in this sector have been influenced by various government industrial policies. Consequently, the CBSA sent Section 20 RFIs to the GOC and GOV and all known producers and exporters of cold-rolled steel in China and Vietnam to obtain information on the matter.

Responses to Section 20 Inquiry – China

[81] The CBSA only received one incomplete response to the Chinese Section 20 RFI from Salzgitter Mannesmann International (HK) Ltd., a trading company of subject goods located in Hong Kong.Footnote 11

[82] The response from Salzgitter Mannesmann HK is considered to be incomplete because most questions in the RFI were left unanswered and questions related to the GOC’s involvement in pricing in their domestic flat-rolled steel sectors are generally not applicable in the Chinese special administrative region (Hong Kong special administrative region). No other producers or exporters in China provided the CBSA with a response to the exporter Section 20 RFI or any significant information with respect to GOC influence on the flat-rolled steel sector.

[83] As part of the Section 20 inquiry, surrogate RFIs were sent to all known producers of CRS in Italy and Sweden. These countries were selected as they are major exporters of CRS to Canada. No vendors located in surrogate countries responded to the RFI.

[84] Also, as part of the section 20 inquiry, the RFIs sent to importers requested information on re-sales in Canada of CRS imported from countries other than China and Vietnam. The CBSA received responses from four importers. One importer provided information on re-sales in Canada of like goods from non-subject countries; however; the information provided by this importer represented a very small volume of imports. As such, the CBSA determined that this information could not be used for the purposes of estimating normal values pursuant to section 20 of SIMA.

Preliminary Results of the Section 20 Inquiry - China

Government Industrial Policies Analysis

[85] As part of its section 20 analysis, the CBSA examined:

- The 13th Five-Year National Economic and Social Development Plan;

- The Steel Capacity Replacement Policy

- The Iron and Steel Industrial Adjustment and Upgrade Plan

- The Iron and Steel Industrial Restructuring Policy

- The National Steel Policy and the Steel Revitalization/Rescue Plan;

- The 12th Five-Year Development Plan for the Steel Industry

13th Five-Year Plan for National Economic and Social Development

[86] The GOC adopted its 13th Five-Year Plan for National Economic and Social Development of the People’s Republic of China (2016-2020) (13th Five-Year Plan)Footnote 12, on March 15, 2016. The 13th Five-Year Plan outlines China’s goals, principles and targets for its development for the period of 2016-2020.

[87] The objectives outlined in the 13th Five-Year Plan continue the themes expressed in the 12th Five-Year Steel Plan, including the strengthening of state owned enterprises (SOE) and control over the economy within the steel industry.

[88] The 13th Five-Year Plan calls for greater involvement of SOEs in the development of the Chinese economy. Specifically, Chapter 11 of the plan states:

“We will ensure that public ownership is dominant and that economic entities under diverse forms of ownership develop side by side ... We will exercise oversight over economic entities under all forms of ownership in accordance with the law ... We will remain firmly committed to ensuring that state-owned enterprises grow stronger, better and bigger and work to see that a member of such enterprises develop the capacity for innovation and become internationally competitive, thereby injecting a greater life into the state-owned sector, helping it exercise a greater level of influence and control over the economy, increasing its resilience against risk, and enabling it to contribute more effectively to accomplishing national strategic objectives.”Footnote 13

[89] Given the overcapacity in the steel industry causing excess supply, the above statement supports GOC intentions to further consolidate the steel industry through mergers and restructuring and that the GOC views SOEs as having an important role to play in the economy.

Steel Capacity Replacement Policy

[90] On January 8, 2018, the Ministry of Industry and Information Technology of China issued the Steel Capacity Replacement Policy to cut existing steel production capacity and strictly ban the launch of any new steelmaking facilities in 2018. The new policy is to ensure zero growth of production capacity in steel, cement and plate glass industries and to continue capacity replacement measures this year.

[91] According to a reportFootnote 14 by South China Morning Post, China fulfilled its target of cutting back steel capacity by 50 million tonnes in 2017, as well as phasing out another 120 million tonnes of low-tech illicit steel product capacity. China also plans to meet the 2016 to 2020 capacity cutback target of eliminating up to 150 million tonnes ahead of schedule in 2018.

[92] Although there is no English version or translation of the policy that could be found in the public domain, the discussion on 13th Five-Year Plan together with the other similar administrative policies of the steel industry discussed above, indicate that the GOC plays a key role in the administration of the steel industry, which includes the flat-rolled steel sector.

Iron and Steel Industry Adjustment and Upgrade Plan

[93] On November 14, 2016, the Ministry of Industry and Information Technology of China issued the Iron and Steel Industry Adjustment and Upgrade Plan (2016 - 2020)Footnote 15, to support the Chinese steel industry’s development in the next five years. The Plan aims to raise the average annual growth rate of industrial added value from 5.4% in 2015 to 6.0% by 2020, raise the capacity utilization rate from 70% in 2015 to 80% by 2020, and raise the industrial concentration in top ten producers from 34.2% in 2015 to 60% by 2020. As supporting measures, the plan calls on local governments to utilize existing funds, explore multiple kinds of support measures, and guide financial institutions and social funds to support key tasks of the plan.

[94] Comments on the adjustment and upgrade plan from a report by the American Iron and Steel Institute included the following:

The measures described in the Policy reflect ongoing government intervention in the management and operation of steel companies and the allocation of resources in the industry. As a result, the Policy is largely inconsistent with the goal of subjecting the industry to market discipline… The absence of concrete steps towards fundamental market-driven reforms and significant capacity reductions will render the Policy ineffective in addressing this fundamental problem.Footnote 16

The specific measures contained in the Policy indicate that market forces will not be permitted to play a “decisive” role in the development of China's steel industry, and that the role of the market will remain secondary to the role of the government.Footnote 17

[95] An article from the South China Morning Post outlines the objectives of the Ministry of Industry and Information Technology of China regarding the steel industry which align with the Policy:

- The Policy does not remove the primary barrier to market reforms in the Chinese steel industry – state ownership;Footnote 18

- While the Adjustment Policy acknowledges objectives related to China’s excess capacity crisis, it fails to provide for any effective means to significantly reduce it;Footnote 19

- The Policy aims to concentrate 60 percent of production capacity into three to five ultra-large, globally competitive enterprises, along with several leading enterprises in regional or specialty markets by 2025;Footnote 20

[96] Other observations were made on a draft Policy issued in 2015 which included that the Chinese government intends to continue “its top-down management” of all aspects of the steel industry including the number and location of enterprises, of products that they produce and the technologies as they should use to produce them.Footnote 21 Also, the Policy envisions “ultra-large steel groups” to be formed through mergers and acquisitions and to dominate the market, with the government “supporting the unification of strong and dominant enterprises” and encouraging them to “implement strategic reorganizations” throughout the production chain.Footnote 22

[97] The CBSA was only able to obtain a Chinese version of the Iron and Steel Industry Adjustment and Upgrade Plan (2016-2020). Still, the CBSA found an article, Comments on China’s Steel Industry Adjustment Policy (2015 Revision), from the American and Iron Steel Institute. Although there are limited documents in English that could be found in the public domain regarding the plan for the flat-rolled steel sector, the discussion on the draft 2015 Revision together with the Chinese version of the Plan, these measures and reforms affect all of the steel industry in China, including the flat-rolled steel, which includes cold-rolled steel.

Iron and Steel Industrial Restructuring Policy

[98] On March 20, 2015, the Ministry of Industry and Information Technology released a draft document entitled, Iron and Steel Industrial Restructuring Policy (Steel Restructuring Revision).Footnote 23 The Steel Restructuring Revision is intended to replace the National Steel Policy previously issued in 2005.

[99] Currently, no information is available to the CBSA regarding whether a formal version of the policy exists. However, given the information available on the draft Steel Restructuring Revision, the major objectives of the Steel Restructuring Revision can be summarized into four main categories as follows: re-structuring of the steel industry, capacity requirements, profitability targets, and productivity targets.Footnote 24

[100] Additionally, Article 4 in the Steel Restructuring Revision provides further support of the GOC strengthening of the control and oversight over the Chinese steel industry:

“There should be continuous innovation in the means of governmental administration; ongoing and retrospective oversight and services should be continuously strengthened; and the role of the government should be more effectively realized. Relevant laws and regulations should be better implemented in the industry in order to basically build a fair and competitive market environment. A sound investment project information disclosure system and corporate credit record system should be established in order to form an open, honest community oversight system.”Footnote 25

[101] This extract also indicates that the GOC has realized that the current steel industry is not in a fair and competitive market environment.

The National Steel Policy and the Steel Revitalization/Rescue Plan

[102] The Development Policies for the Iron and Steel Industry – Order of the National Development and Reform Commission [No. 35], (National Steel Policy)Footnote 26 was promulgated on July 8, 2005 and outlines the GOC’s future plans for the Chinese domestic steel industry. The major objectives of the National Steel Policy are:

- The structural adjustment of the Chinese domestic steel industry;

- Industry consolidations through mergers and acquisitions;

- The regulation of technological upgrading with new standards for the steel industry;

- Measures to reduce material and energy consumption and enhance environmental protection; and

- Government supervision and management in the steel industry.

[103] On March 20, 2009, the GOC promulgated the Blueprint for the Adjustment and Revitalization of the Steel Industry issued by the General Office of the State Council (Steel Revitalization/Rescue Plan).Footnote 27 This macro-economic policy was the GOC’s response to the global financial crisis and is also the action plan for the steel industry for the 2009-2011 period. This plan included the following major tasks:

- Maintain the stability of the domestic market and improve the export environment;

- Strictly control the total output of steel and accelerate the process of eliminating what is backward (obsolete);

- Enhance enterprise reorganization and improve the industrial concentration level;

- Spend more on technical transformation and promote technical progress;

- Optimize the layout of the steel industry and overall arrangements of its development;

- Adjust the steel product mix and improve the product quality;

- Maintain stable import of iron ore resources and rectify the market order; and

- Develop domestic and overseas resources and guarantee the safety of the industry.

[104] There are common measures between these two GOC policies, as the Steel Revitalization/Rescue Plan is an acceleration of the major objectives of the National Steel Policy. These measures and reforms affect all of the steel industry in China, and as a result affect CRS producers in the flat-rolled steel sector.

12th Five-Year Development Plan for the Steel Industry

[105] The 12th Five-Year Development Plans for the Steel Industry (12th Five-Year Development Plans) is a policy document that was released by the GOC’s Ministry of Industry and Information Technology on November 7, 2011.Footnote 28 The 12th Five-Year Development Plan served as the guiding document for the development of the Chinese steel industry for the 2011-2015 period and was followed by the 13th Five-Year National Economic and Social Development Plan (2016-2020), which was discussed in detail in a previous section. Some of the key objectives in the plan included:

- Increased mergers and acquisitions to create larger, more efficient steel companies;

- GOC restrictions on steel capacity expansion;

- Upgrading of steel industry technology;

- Greater GOC emphasis on high-end steel products; and

- GOC directed relocation of iron and steel companies to coastal areas.

[106] Also included in this plan were minimum requirements for steel production in order to eliminate smaller players in the market. Through this plan, the GOC continued its reform and restructuring of the Chinese steel industry. The GOC’s target was that by 2015, China’s top 10 steel producers would represent 60% of the country’s total steel output. According to the National Steel Policy, the long-range GOC target for mergers and acquisitions is to have the top 10 Chinese steel producers account for 70% of total national steel production by 2020.Footnote 29 This plan was the next development stage of the GOC directives aimed at achieving this long-range 2020 target.

[107] The GOC’s direction of the steel industry includes enabling regional or provincial governments to combine enterprises across boundaries. Furthermore, as a result of the GOC’s administration of steel production capacity, the Chinese steel industry is very much under the purview of the GOC.

[108] Together with the GOC’s: Criterion for the Production and Operation of Steel IndustryFootnote 30 – GY [2010] No. 105 and Several Observations of the General Office of the State Council on Further Strengthening Energy-saving and Emission Reduction Efforts as well as Accelerating of Restructuring of Steel IndustryFootnote 31 – GBF (2010) No. 34, these policies set out the detailed requirements for existing production and operations of steel enterprises in China.

[109] Should steel enterprises not acquiesce to the GOC’s requirements, laws and industrial policies, there are repercussions which include the withdrawal of steel production licenses and credit support.

Government Ownership of Suppliers/Producers

[110] As part of its section 20 analysis, the CBSA examined:

- State Ownership of the Cold-Rolled Steel Producers; and

- GOC Ownership of Suppliers of Raw Materials.

State Ownership of Cold-Rolled Steel Producers

[111] The complaint provided evidence of state-owned enterprises which produce CRS in China. The complaint identified 27 enterprises which are known to be state-owned or controlled.Footnote 32 In the same manner as state-owned and state-controlled steel producers, state-owned and state-controlled CRS producers are driven by GOC mandates and do not necessarily operate under market forces.

[112] The presence of state-owned and state-controlled enterprises that produce CRS in the flat-rolled steel sector would necessitate that private companies supplying CRS would have to compete with these state-owned and stated-controlled enterprises operating under non-market conditions.

State Ownership of Raw Material Suppliers

[113] As mentioned previously, according to the Iron and Steel Industry Adjustment and Upgrade Plan (2016-2020) and Steel Industry Adjustment Policy (2015 Revision), the top ten steel producers in China were expected to reach 60% of total steel production in China by 2025.Footnote 33

[114] The CBSA conducted its own research on the most recent data available on steel production as reported by the World Steel Association (WSA). Based on the CBSA’s research, the top ten steel producers by volume in ChinaFootnote 34 accounted for 37.3% of all steel production in China during 2017.Footnote 35 Of these ten producers, eight are state-owned, and the combined production of steel by these eight state-owned enterprises in China represents 30.3% of all steel production in China during 2017.

[115] According to the complaint, the GOC’s extensive ownership and control of the majority of large Chinese steel producers means that these companies produce and market steel according to GOC objectives and policies instead of market conditions.Footnote 36

[116] The information provided by the complainant and available from the World Steel Association supports the assertion that there is substantial state ownership and control of suppliers of raw materials. Given that the state-owned steel companies produce raw material inputs for CRS, there is a strong likelihood that prices of CRS are also distorted in the flat-rolled steel sector as a result of distorted raw material input prices.

Chinese Domestic Price Analysis

[117] In order to determine normal values pursuant to section 20 of SIMA, in addition to the requirement in paragraph 20(1)(a) of SIMA that the CBSA be of the opinion that the government of a prescribed country substantially determines domestic prices, the CBSA must be of the opinion that there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market.

[118] At the initiation, in the complaint, the complainant used information from MEPS, a publisher of steel market prices around the world, to compare CRS prices in China to those in other competitive markets.

[119] At the preliminary stage, the complainant provided a more recent MEPS report that covered the POI in its entirety.Footnote 37 The CBSA used the recent MEPS report to calculate the differences between the domestic prices of CRS in China and in the other countries.Footnote 38 The table below demonstrates that prices of CRS in China are significantly lower than in other countries, suggesting that the GOC’s involvement in the CRS sector is affecting prices. CRS prices in China were lower than domestic pricing in other markets by $164/MT to $471/MT in various periods.

[120] Detailed information regarding domestic prices cannot be divulged for confidentiality reasons. Certain details provided in submissions were qualified as confidential information by the complainant. Therefore, based on the MEPS report submitted by the complainant, the CBSA has prepared the following table to show CRS’s domestic price differences between China and other countries.

| Difference between China vs. Others* | |

|---|---|

| 2015 | 196-344 |

| 2016 | 212-471 |

| 2017 | 164-459 |

| POIFootnote 40 | 185-451 |

* “Others” refers to the United States, Japan and the European Union

[121] The analysis shows that prices of cold-rolled steel are significantly lower in China in comparison to prices in the United States, Canada, Japan and the European Union.

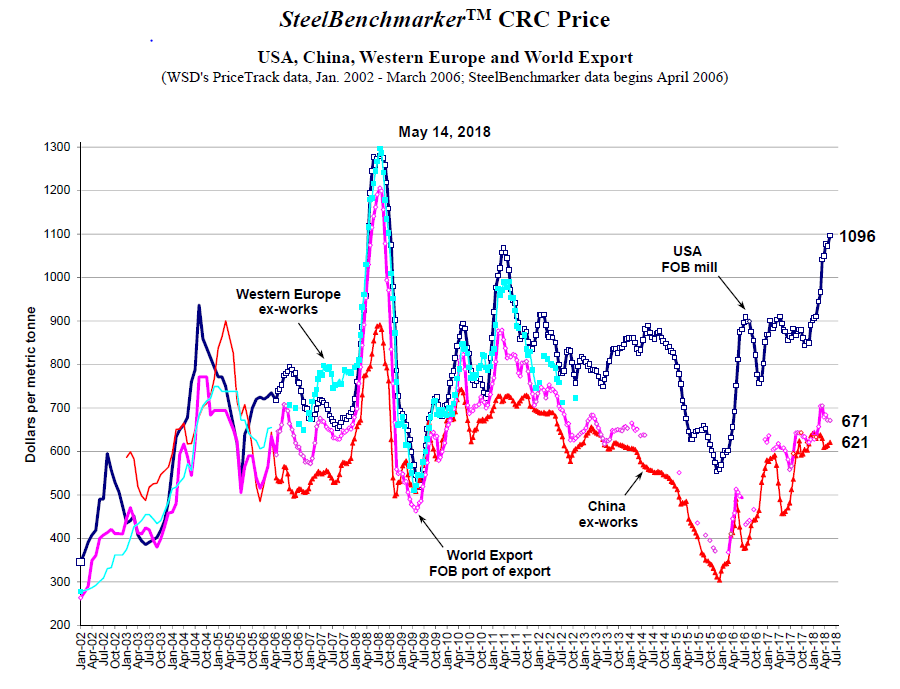

[122] The CBSA did not receive any responses to the Dumping RFI and therefore no domestic sales information of CRS from China was available. However, the CBSA was able to obtain information from Steel Benchmarker, which collects and analyzes ex-mill prices of plate, scrap, hot-rolled band and cold-rolled coil in China, the United States and other regions during the review period from January 2017 to December 2017.Footnote 41 Steel Benchmarker also includes a summary chart of a domestic price comparison of cold-rolled coils, which has been reproduced below.Footnote 42 Based on this information, the CBSA concluded that FOB mill prices of CRS in China were consistently lower than those in the United States or world average prices.

[123] In addition, based on a MEPS report, the domestic selling prices of CRS in China were 28.2 % lower than the reported domestic selling prices of CRS in other countries during the POI. This is strong evidence that prices in China are lower than they would be in a competitive market.

[124] The information discussed above, supports the conclusion that the domestic prices of CRS in China are not substantially the same as they would be if they were determined in a competitive market.

Summary of the Preliminary Results of the Section 20 Inquiry

[125] The wide range and material nature of the GOC measures have resulted in significant influence on the flat-rolled steel sector in China, which includes cold-rolled steel. Based on the preceding, the President is of the opinion that:

- domestic prices are substantially determined by the GOC; and

- there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market.

[126] During the final stage of the dumping investigation, the CBSA will continue the Section 20 inquiry and further verify and analyze relevant information. The CBSA may reaffirm its opinion that the conditions of section 20 of SIMA exist in the flat-rolled steel sector in China, which includes cold-rolled steel, as part of the final phase of the investigation, or conclude that the determination of normal values may be made using domestic selling prices and costs in China if such information is available.

Responses to section 20 Inquiry – Vietnam

[127] The CBSA only received one response from a Vietnamese producer of the subject goods, VNSteel – Phu My Flat Steel Co., Ltd. (PFS) which provided limited information in its Section 20 RFI response.Footnote 43 PFS is a subsidiary solely owned by Vietnam Steel Corporation (VNSteel).

[128] PFS is a producer of CRS that did not export any subject goods to Canada during the POI. No other producer or exporter in Vietnam provided the CBSA with a response to the Section 20 RFI or any significant information with respect to GOV influence on the flat-rolled steel sector.

[129] As part of the Section 20 inquiry, surrogate RFIs were sent to all known producers of CRS in Italy and Sweden. These countries were selected as they were both major exporters of CRS to Canada. No producers/vendors located in surrogate countries responded to the RFI.

[130] Also, as part of the Section 20 inquiry, the RFIs sent to importers requested information regarding re-sales in Canada of CRS imported from countries other than China and Vietnam. The CBSA received responses from four importers; however, only one of the importers provided information on re-sales in Canada of like goods from non-subject countries.

Preliminary Results of the Section 20 Inquiry - Vietnam

Government Industrial Policies

[131] As part of its section 20 analysis, the CBSA examined:

- The Master Plan on the Development of Vietnam’s Steel Industry (2007-2015); and

- The New Master Plan (2015-2025).

The Steel Master Plan 2007-2015

[132] The Master Plan on the Development of Vietnam’s Steel Industry (2007-2015) (Steel Master Plan) (Decree No. 145/2007/QD-TTg)Footnote 44 was presented to the Organization for Economic Co-operation and Development Steel Committee on July 1, 2013. It outlines the GOV’s objectives in respect to the Steel Industry.

[133] The principal objectives of the Steel Master Plan, as set out in Article 1 of the plan, are as follows:

- To develop Vietnam’s steel industry in compliance with the national master plan on socio-economic and industrial development, local socio-economic development planning and Vietnam’s integration roadmap.

- To build and develop Vietnam’s steel industry into an important industry, ensuring stable and sustainable development, minimizing imbalance between the manufacture of pig iron and ingot steel and the manufacture of finished steel products, between long steel products and flat steel products.

- To build Vietnam’s steel industry with advanced and rational technologies, using domestic resources in a thrifty and efficient manner, ensuring harmony with eco-environmental protection in localities where the industry is developed.

- To attach importance to, and encourage domestic economic sectors and branches to cooperate with foreign parties to invest in the construction of a number of mining-metallurgy complexes, combine mills and large factories which manufacture flat steel products.

[134] In addition to the broader goals outlined above, the Steel Master Plan also sets out specific development objectives with respect to the manufacture of pig iron, ingot steel (raw steel), finished steel products, and the export of pig iron and other steel types.Footnote 45 With respect to the manufacture of finished steel products, the Steel Master Plan provides targeted production levels for specified time periods. The document states, as follows:

By 2010, 6.3-6.5 million tonnes of finished steel products (1.8-2.0 million tonnes of flat steel products); by 2015, 11-12 million tonnes (6.5-7.0 million tonnes of flat steel products); by 2020, 15-18 million tonnes (8-10 million tonnes of flat steel products); and by 2025, around 19-22 million tonnes (11-13 million tonnes of flat steel products and 0.2 million tonnes of special steel) will be manufactured.Footnote 46

[135] The Steel Master Plan provides direction concerning how to increase the production of pig iron, spongy iron, steel billet and finished steel products to reach the targets specified in the plan. This includes, among other things, direct investments to manufacturing facilities, as well as direction to diversify domestic steel manufacturing in order to produce hot-rolled steel, cold-rolled steel and metallic coated steel. By promoting investments to produce high quality steel and alloy steel, the GOV aims to reduce their dependency on imported goods.Footnote 47

[136] The complainant argues that based on the solutions revealed in the Steel Master Plan, the GOV is imposing technical barriers that may have the effect of distorting market prices. For example, the GOV issued direction “To protect the domestic market through lawful technical barriers and quality environmental standard […]”.Footnote 48

[137] The Steel Master Plan includes specific tasks for the GOV’s Ministry of Finance and Ministry of Natural Resources and Environment. The presence of these directives suggest that the GOV has the power to impose mechanisms that control or impact the prices in the steel industry, which would encompass the flat-rolled steel sector and CRS market.Footnote 49

The Steel Master Plan 2015-2025

[138] Based on publicly available media information, at the end of 2016, the GOV was in the process of preparing a new Steel Master Plan. This plan was supposed to be approved by the Prime Minister by the end of 2017. At that time, the ministry was collecting input from experts in various areas to evaluate its draft master plan. This new Steel Master Plan would provide direction for the Vietnamese steel sector for 2015 to 2025, and a vision of the sector through 2035.Footnote 50 However, limited information was found in this regard as the Steel Master Plan 2015-2025 does not appear to have been published and/or may not be available to the public.

[139] Although the CBSA does not have access to a final version of the new Steel Master Plan, the CBSA has found publicly available news reports and articles, which provide some information as to what is included in the plan. For example, Decision No. 879/QD-TTg approved by the Prime Minister the Industrial Development Strategy through 2025, vision toward 2035. The strategy aims to raise the average annual growth rate of industrial added value from 6.5% in 2015 to 7.0% by 2020, raise the rate of industrial exports to the total exports from 85% to 88% by 2025 and over 90% after 2025, and raise the industrial sector’s ICOR (Incremental Capital Output Ratio) from 3.5% to 4.0% by 2025.Footnote 51

[140] The Vietnamese Steel Association (VSA) has recently declared to the Ministry of Industry and Trade “that the State would no longer manage the steel industry with any master plan” in the event that a certain “planning law” is put in place in 2018.Footnote 52 This assertion from the VSA shows that the GOV currently manages the steel industry, and that the master plan is the mechanism employed to do so. Moreover, in a recent article, they indicate that the Government will enhance disbursement for many projects with public investment to finish the projects, leading to higher demand for steel products.Footnote 53 Again, this information leads to believe that the GOV has a certain leverage on the steel productions.

[141] As discussed above, the new Steel Master Plan established control of construction and investment projects in the steel industry. As evidence of this fact, the GOV has intervened to start and stop multiple projects. This allows the government to manage the supply of steel products and, in turn, influence domestic prices in the steel sector.

[142] The CBSA finds that the existence of the new Steel Master Plan demonstrates the GOV’s intention to remain active in managing the domestic steel sector. Such influence would alter the natural forces of supply and demand and would substantially influence the price of goods in this sector.

Government Ownership of Suppliers/Producers

[143] As part of its section 20 analysis, the CBSA examined:

- State Ownership of the Cold-Rolled Steel Producers.

State ownership in the flat-rolled steel sector

[144] The Law on Investment (No. 59-2005-QH11), adopted by the National Assembly of Vietnam on November 29, 2005 (Current LOI)Footnote 54, regulates investment activities for business purposes; the rights and obligations of investors; the guarantee of lawful rights and interests of investors; encouragement of investment and investment incentives; State administration of investment activities in Vietnam and offshore investment from Vietnam.Footnote 55

[145] Although the Current LOI provides for a common legal framework regardless of ownership types, foreign direct investment was still subject to conditions in many sectors in 2010.Footnote 56 More recently, the GOV adopted a SOE restructuring scheme aligned with the equitization (i.e. partial privatization) of SOEs. However, even though the number of SOEs has decreased from 12,000 in 1990 to 3,048 in 2014, this number remains substantial.Footnote 57 This demonstrates that the GOV still has a considerable influence on the investment activities of companies in their country.

[146] While there is not a significant amount of information in the public domain to indicate the extent of state ownership in Vietnam’s steel sector, there is sufficient information to indicate the market is dominated by state-owned VNSteel, the country’s biggest steel producer and employer of approximately 14,000 workers.Footnote 58

[147] In a discussion paper prepared by The Research Institute of Economy, Trade & Industry, it is noted that there are worrying signs about the quality of equitization in Vietnam:

The state continues to hold very high proportions of capital in equitized enterprises, which casts doubts on the effectiveness of equitization in transforming SOEs. While the state held 46.1% of the total shares of equitized enterprises as of the end of 2004, this share is reported to have increased to 92% by 2017. This has happened as the state continues to hold large stakes, particularly in large SOEs in strategic sectors, even after equitization.Footnote 59

[148] In a public document jointly written by the World Bank Group and the Ministry of Planning and Investment of Vietnam, “Vietnam 2035 - Toward Prosperity, Creativity, Equity, and Democracy, they addressed a section specific to the Economic Modernization and Private Sector Development”. An excerpt from this section, shows that Vietnam has maintained a virtual monopoly in several major segments of the economy. Also, by holding such control in key sectors, for instance, gas, electricity, coal, water, and mining and quarrying, the Government of Vietnam has control of the cost of major inputs involved in the production of flat-rolled steel products and cold-rolled steel. In other words, the GOV can indirectly determine domestic prices through a variety of mechanisms which can involve the supply and price of inputs (goods and services) used in the production of the subject goods.

[149] Given that the state-owned steel companies produce raw material inputs for CRS, there is a strong likelihood that prices of CRS are also distorted in the flat-rolled steel sector as a result of distorted raw material input prices.

Vietnamese Domestic Price Analysis

[150] In order to determine normal values pursuant to section 20 of SIMA, in addition to the requirement in paragraph 20(1)(a) of SIMA that the CBSA be of the opinion that the government of a prescribed country substantially determines domestic prices, the CBSA must be of the opinion that there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market.

[151] At the initiation stage of the investigations, although information on world market prices for CRS was provided by the complaint with a MEPS report, the same could not be said with respect to domestic market prices for CRS in Vietnam. Despite this difficulty, the complainants used Vietnam customs declaration data to calculate a weighted average import price of CRS into Vietnam as a proxy for domestic Vietnamese pricing.Footnote 60 At the same time, the CBSA did its own research and experienced the same difficulties obtaining information in the public domain regarding CRS pricing. It was reasoned that these import prices into Vietnam would reflect the general market price of CRS in that country and was the best available information.

[152] During the preliminary phase of the investigation, the CBSA received one response from a Vietnamese producer, VNSteel – Phu My Flat Steel Co., Ltd. (PFS), which did not export into Canada during the POI. The CBSA was able to use the limited information provided by PFS in their Section 20 RFI response and compare the domestic prices of CRS in Vietnam to domestic prices of CRS in other countries for purposes of the preliminary determination.

[153] Detailed information regarding the Vietnamese producer domestic price and, also, the domestic prices in other countries cannot be divulged for confidentiality reasons. This has restricted the ability of the CBSA to disclose the CRS domestic price difference between Vietnam and other countries (United States, Japan and European Union).

[154] Based on information obtained, the CBSA was able to confirm that prices of CRS in Vietnam are significantly lower than they are in other countries. This is strong evidence that prices in Vietnam are lower than they would be in a competitive market.

Summary of the Preliminary Results of the Section 20 Inquiry

[155] Based on the information on the record, the GOV’s government macro-economic policies and actions have influenced the Vietnamese steel industry, which encompasses the flat-rolled steel sector. Based on the preceding, the President is of the opinion that:

- domestic prices are substantially determined by the GOV; and

- there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market.

[156] During the final stage of the dumping investigation, the CBSA will continue the Section 20 inquiry and further verify and analyze relevant information. The CBSA may reaffirm its opinion that the conditions of section 20 of SIMA exist in the flat-rolled steel sector in Vietnam, which includes cold-rolled steel, as part of the final phase of the investigation, or conclude that the determination of normal values may be made using domestic selling prices and costs in Vietnam if such information is available.

China

[157] The CBSA received a response to the Dumping RFI from Salzgitter Mannesmann International GmbH (Salzgitter). Salzgitter is located in Germany but has subsidiaries in various countries including China. Salzgitter was involved in the sale of subject goods to Canada that were produced in China. The companies that produced the goods sold to Canada by Salzgitter did not respond to the CBSA’s Dumping RFI.

[158] As discussed above, for the purposes of the preliminary determination the CBSA has formed the opinion that the conditions described in section 20 of SIMA exist in the flat-rolled steel sector in China.

[159] Normal values pursuant to paragraph 20(1)(c) or 20(1)(d) of SIMA are normally based on the domestic selling price or cost of production of the goods plus a reasonable amount for administrative, selling and all other costs, plus a reasonable amount for profits of the like goods sold by producers in any country designated by the President and adjusted for price comparability; or on the basis of the selling price in Canada of like goods imported from any country designated by the President and adjusted for price comparability. However, at this time no such information is available to the CBSA.

[160] As there is no surrogate information available and no exporters of subject goods from China provided a complete response to the CBSA’s Dumping RFI, the normal values and export prices were estimated on the basis of facts available.

[161] In establishing the methodology for estimating normal values and export prices, the CBSA analyzed all the information on the administrative record, including the complaint filed by the domestic industry, the CBSA’s estimates at the initiation of the investigation, and customs import documentation.

[162] The CBSA decided that the information submitted on the CBSA customs entry documentation was the best information on which to estimate the export price of the goods as it reflects actual import data.

[163] The CBSA decided that the normal value it estimated at initiation, based on the methodology of subparagraph 20(1)(c)(ii) of SIMA, using surrogate information from South Korea, would be used to establish the methodology for estimating normal values for goods from China as it reflects the best information available to the CBSA. This methodology is explained in greater detail in the South Korea section below.

[164] The CBSA examined the difference between the normal value it estimated at initiation and the estimated export prices for each individual transaction in order to obtain an appropriate amount for the normal value methodology. The transactions were also examined to ensure that no anomalies were considered, such as very low volume and value, effects of seasonality or other business factors. Based on this analysis the CBSA excluded certain transactions from consideration.

[165] The CBSA considered that the highest amount by which the normal value estimated at initiation exceeded the estimated export price on an individual transaction of exporters of goods from China, excluding anomalies (expressed as a percentage of the export price), was an appropriate basis for estimating normal values for the preliminary determination. This methodology limits the advantage that an exporter may gain from not providing necessary information requested in a dumping investigation.

[166] Therefore, the normal values were estimated based on the estimated export price, plus an amount equal to 91.9% of that estimated export price.

[167] Based on the above methodologies, the estimated margins of dumping for all exporters of subject goods from China is 91.9%, expressed as a percentage of the export price.

South Korea

[168] No exporters of subject goods from South Korea provided a response to the CBSA’s Dumping RFI. As such, normal values and export prices for subject goods from Korea were estimated on the basis of facts available.

[169] In establishing the methodology for estimating normal values and export prices, the CBSA considered all the information on the administrative record, including the complaint filed by the domestic industry, the CBSA’s estimates at the initiation of the investigation and customs import documentation.

[170] The CBSA decided that the information submitted on the CBSA customs entry documentation was the best information on which to estimate the export price of the goods as it reflects actual import data.

[171] The CBSA decided that the normal value it estimated at initiation, using a constructed cost approach to reflect the methodology under paragraph 19(b) of SIMA, would be used to establish the methodology for estimating normal values for goods from South Korea as it reflects the best information available to the CBSA.

[172] As described in the Cold-rolled Steel - Initiation Statement of Reasons, one normal value was estimated for South Korea by aggregating the estimated costs of producing the goods (materials, direct labour and overhead), a reasonable amount for selling, general and administrative (SG&A) costs and other costs, and a reasonable amount for profits.

[173] This estimate was based on the complainant’s own costs of production for all domestically produced CRS that falls within the product definition, during the period of Q4 2016 through Q3 2017, as well as public information from South Korea for the same period.

[174] This information was used to estimate the normal value for goods imported into Canada during the period of January 1, 2017 to December 31, 2017. The complainant submitted that it was appropriate to use cost information for this period due to the lag time between the production and shipment of the goods. For the purposes of the preliminary determination, the CBSA has used this information as the basis for estimating the normal value for goods imported into Canada during the POI.

[175] Material costs were estimated based on the complainant’s own data and adjusted based on HRS pricing in South Korea. HRS is the primary material used in the production of CRS. For South Korea, the complainant used the cost of HRS as reported by MEPS.

[176] Labour costs were estimated based on the complainant’s labour costs and adjusted to reflect labour cost differences between Canada and South Korea. A downward adjustment of 37.6% was applied to these costs based on productivity adjusted cost of labour comparisons reported by the Boston Consulting Group.Footnote 61

[177] Overhead costs were based on the complainant’s unadjusted factory overhead costs. According to the complainant they are an efficient and technologically advanced producer of CRS and as such, no downward adjustment to overhead costs is required.

[178] The complainant estimated the amounts for SG&A and financial expenses, as well as the amounts for profits, based on the publicly available financial statements of POSCO, a CRS producer located in South Korea. The amounts for SG&A and financial expenses, as well as the amounts for profits, are reported as a percent of the cost of goods manufactured.

[179] As noted in the Cold-rolled Steel - Initiation Statement of Reasons, for the purposes of the initation of the investigation the CBSA did make a correction to the normal value estimates provided by the complainant. This correction also applied to the normal value estimated for the purposes of the preliminary determination.

[180] The CBSA examined the difference between the normal value it estimated at initiation and the estimated export prices for each individual transaction in order to obtain an appropriate amount for the normal value methodology. The transactions were also examined to ensure that no anomalies were considered, such as very low volume and value, effects of seasonality or other business factors. Based on this analysis the CBSA excluded certain transactions from consideration.

[181] The CBSA considered that the highest amount by which the normal value estimated at initiation exceeded the estimated export price on an individual transaction of an exporter of goods from South Korea, excluding anomalies (expressed as a percentage of the export price), was an appropriate basis for estimating normal values. This methodology limits the advantage that an exporter may gain from not providing necessary information requested in a dumping investigation.

[182] Therefore, the normal values were estimated based on the estimated export price, plus an amount equal to 53.0% of that estimated export price.

[183] Based on the above methodologies, the estimated margins of dumping for all exporters of subject goods from South Korea is 53.0%, expressed as a percentage of the export price.

Vietnam

[184] One producer of subject goods from Vietnam that did not ship goods to Canada during the POI provided a response to the CBSA’s Dumping RFI. As the company did not ship goods to Canada during the POI this information could not be used for the purposes of estimating normal values or export prices. However, the CBSA did consider the domestic price information provided by this company as part of its Section 20 inquiry.

[185] As discussed above, for the purposes of the preliminary determination, the CBSA has formed the opinion that the conditions described in section 20 of SIMA exist in the flat-rolled steel sector in Vietnam.

[186] Normal values pursuant to paragraph 20(1)(c) or 20(1)(d) of SIMA are normally based on the domestic selling price or cost of production of the goods plus a reasonable amount for administrative, selling and all other costs, plus a reasonable amount for profits of the like goods sold by producers in any country designated by the President and adjusted for price comparability; or on the basis of the selling price in Canada of like goods imported from any country designated by the President and adjusted for price comparability. However, at this time no such information is available to the CBSA.

[187] As there is no surrogate information available and no exporters of subject goods from Vietnam provided a response to the CBSA’s Dumping RFI, the normal values and export prices for subject goods from Vietnam were estimated on the basis of facts available.

[188] In establishing the methodology for estimating normal values and export prices, the CBSA analyzed all the information on the administrative record, including the complaint filed by the domestic industry, the CBSA’s estimates at the initiation of the investigation, and customs import documentation.

[189] The CBSA decided that the information submitted on the CBSA customs entry documentation was the best information on which to estimate the export price of the goods as it reflects actual import data.

[190] The CBSA decided that the normal values it estimated at initiation, based on the methodology of subparagraph 20(1)(c)(ii) of SIMA, using surrogate information from South Korea, would be used to establish the methodology for estimating normal values for goods from Vietnam as it reflects the best information available to the CBSA.