COR 2018 IN

Corrosion-Resistant Steel Sheet

Statement of Reasons

Ottawa, February 6, 2019

Concerning the final determination with respect to the dumping of certain corrosion-resistant steel sheet from China, the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei), India and South Korea.

Decision

On January 22, 2019, pursuant to paragraph 41(1)(b) of the Special Import Measures Act, the Canada Border Services Agency made a final determination respecting the dumping of certain corrosion-resistant steel sheet from China, the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei), India and South Korea.

This document is also available in PDF (1,783 KB) [help with PDF files]

Summary of Events

[1] On June 5, 2018, the Canada Border Services Agency (CBSA) received a written complaint from ArcelorMittal Dofasco G.P., of Hamilton, Ontario, (hereinafter, “the complainant”), which was supported by Stelco Inc.Footnote 1 of Hamilton, Ontario, alleging that imports of certain corrosion-resistant steel sheet (COR) from the People’s Republic of China (China), the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei), the Republic of India (India) and the Republic of Korea (South Korea) (hereinafter “the subject goods”) are being dumped. The complainant alleged that the dumping has caused injury and is threatening to cause injury to the Canadian industry producing like goods.

[2] On June 26, 2018, pursuant to paragraph 32(1)(a) of the Special Import Measures Act (SIMA), the CBSA informed the complainant that the complaint was properly documented. The CBSA also notified the governments of China, the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei), India and South Korea that a properly documented complaint had been received.

[3] The complainant provided evidence to support the allegations that imports of the subject goods have been dumped. The evidence also disclosed a reasonable indication that the dumping has caused injury and/or is threatening to cause injury to the Canadian industry producing like goods.

[4] On July 26, 2018, pursuant to subsection 31(1) of SIMA, the CBSA initiated an investigation respecting the dumping of the subject goods.

[5] Upon receiving notice of the initiation of the investigation, the Canadian International Trade Tribunal (CITT) commenced a preliminary injury inquiry, pursuant to subsection 34(2) of SIMA, into whether the evidence discloses a reasonable indication that the alleged dumping of the goods has caused injury or retardation or is threatening to cause injury to the domestic industry producing the like goods.

[6] On September 24, 2018, pursuant to subsection 37.1(1) of SIMA, the CITT made a preliminary determination that there is evidence that discloses a reasonable indication that the dumping of COR from China, the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei), India and South Korea has caused injury or is threatening to cause injury to the domestic industry.

[7] On October 24, 2018, as a result of the CBSA’s preliminary investigation and pursuant to subsection 38(1) of SIMA, the CBSA made a preliminary determination of dumping of the subject goods.

[8] On the same date, pursuant to subsection 8(1) of SIMA, provisional duty was imposed on imports of dumped goods that are of the same description as any goods to which the preliminary determination applies, and that are released during the period commencing on the day the preliminary determination was made and ending on the earlier of the day on which the CBSA causes the investigation in respect of any goods to be terminated pursuant to subsection 41(1) of SIMA or the day the CITT makes an order or finding pursuant to subsection 43(1) of SIMA.

[9] On October 25, 2018, the CITT initiated an inquiry pursuant to section 42 of SIMA to determine whether the dumping of the goods has caused injury or retardation or is threatening to cause injury to the domestic industry.

[10] Based on the available evidence, the CBSA is satisfied that COR originating in or exported from China, the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei), India and South Korea has been dumped. Therefore, on January 22, 2019, the CBSA made a final determination of dumping pursuant to paragraph 41(1)(b) of SIMA in respect of those goods.

[11] The CITT’s inquiry into the question of injury to the domestic industry is continuing, and it will issue its decision by February 21, 2019. Provisional duty will continue to be imposed on the subject goods until the CITT renders its decision.

Period of Investigation

[12] The Period of Investigation (POI) for the dumping investigation is April 1, 2017 to March 31, 2018.

Profitability Analysis Period

[13] The Profitability Analysis Period (PAP) for the dumping investigation is April 1, 2017 to March 31, 2018.

Interested Parties

Complainant

[14] ArcelorMittal Dofasco G.P. was founded as the Dominion Steel Casting Company in 1912 in Hamilton, Ontario. In 2006, Dofasco was acquired by Arcelor S.A. Later that year, Arcelor S.A. merged with Mittal Steel.

[15] ArcelorMittal Dofasco G.P. produces COR at its facility in Hamilton, Ontario. The company is the largest of the three known producers of COR in Canada and accounts for a major proportion of the total domestic production of like goods.

[16] The contact information of the complainant is as follows:

ArcelorMittal Dofasco G.P.

1330 Burlington Street East,

Hamilton, ON L8N 3J5

Other Producers

[17] The other two known producers of like goods in Canada are:

Stelco Inc.

386 Wilcox Street

Hamilton, ON L8L 8J6

Material Science Corp.

1430 Martin Grove Road

Rexdale, ON M9W 4Y1

Trade Unions

[18] The complaint identified two trade unions that represent persons employed in the production of COR in Canada:

United Steel Workers Local 8782

P.O. Box 220

Jarvis, ON N0J 1J0

United Steel Workers Local 1005

350 Kenilworth Avenue North

Hamilton, ON L8H 4T3

The trade unions did not make any submissions during the investigation.

Importers

[19] At the initiation of the investigation, the CBSA identified 82 potential importers of the subject goods from CBSA import documentation and from information submitted in the complaint. All of the potential importers were asked to respond to the CBSA’s Importer Request for Information (RFI)Footnote 2 to obtain information on their imports of the subject goods. In addition, importers were requested to provide information respecting re-sales in Canada of like goods imported from a third country. Five importers provided a response to the Importer RFI.

Exporters

[20] At the initiation of the investigation, the CBSA identified 278 potential exporters of the subject goods based on CBSA import documentation and information submitted in the complaint. All of the potential exporters were sent the CBSA’s Dumping RFI.Footnote 3 The CBSA conducted, as part of its dumping investigation, a Section 20 inquiry to determine whether the conditions set forth in paragraph 20(1)(a) of SIMA exist in the flat-rolled steel industry sector in China. As such, exporters and producers located in China were also sent a separate Section 20 RFI.Footnote 4

[21] Twenty-six companies provided a response to the Dumping RFI.Footnote 5 Respondents included producers and exporters as well as intermediary companies (agents, trading companies, vendors, etc.). In addition, four companies in China provided responses to the Section 20 RFI.

[22] Information on the results of the investigation pertaining to the companies who provided a response to the Dumping RFI and were considered to be exporters of the subject goods for SIMA purposes are summarized under the Results of the Dumping Investigation of this document.

[23] CBSA officers conducted on-site verifications at the premises of Prosperity Tieh Enterprise Co., Ltd. (PT), Sheng Yu Steel Co., Ltd. (SYSCO) and Yieh Phui Enterprise Co., Ltd. (YPE) in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) and of Dongbu Steel Co., Ltd. (Dongbu), POSCO and POSCO Coated & Color Steel Co., Ltd. (POSCO C&C) in South Korea. Furthermore, two trading companies, POSCO Daewoo Corporation and Soon Hong Trading Co., Ltd. were also verified by CBSA officers in South Korea.Footnote 6

Government

[24] For the purposes of this investigation, Government of China (GOC) refers to all levels of government, i.e., federal, central, provincial/state, regional, municipal, city, township, village, local, legislative, administrative or judicial, singular, collective, elected or appointed. It also includes any person, agency, enterprise, or institution acting for, on behalf of, or under the authority of, or under the authority of any law passed by, the government of that country or that provincial, state or municipal or other local or regional government.

[25] At the initiation of the investigation, the CBSA sent a Government Section 20 RFI to the GOC.Footnote 7 The GOC did not respond to the CBSA’s Section 20 RFI.

Product Information

Definition

[26] For the purposes of this investigation, the subject goods are defined as:

Corrosion-resistant flat-rolled steel sheet products of carbon steel including products alloyed with the following elements:

- Boron (B) not more than 0.01%,

- Niobium (Nb) not more than 0.100%,

- Titanium (Ti) not more than 0.08%, or

- Vanadium (V) not more than 0.300%

in coils or cut lengths, in thicknesses up to 0.168 in. (4.267 mm) and widths up to 72 inch (1,828.8 mm) with all dimensions being plus or minus allowable tolerances contained in the applicable standards, chemically passivated, originating in or exported from the People’s Republic of China, the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei), the Republic of India, and the Republic of Korea and excluding:

- unpassivated corrosion-resistant steel sheet products;

- corrosion-resistant steel sheet products for use in the manufacture of passenger automobiles, buses, trucks, ambulances or hearses or chassis therefor, or parts thereof, or accessories or parts thereof;

- steel products for use in the manufacture of aeronautic products;

- steel sheet that is coated or plated with tin, lead, nickel, copper, chromium, chromium oxides, both tin and lead (“terne plate”), or both chromium and chromium oxides (“tin free steel");

- stainless flat-rolled steel products;

- corrosion-resistant steel sheet products that have been pre-painted or coated with organic (non-metallic) coatings, including lacquers or varnishes;

- galvanized armouring tape, which is narrow flat steel tape of 3 in. or less, that has been coated by a final operation with zinc by either the hot-dip galvanizing or the electrogalvanizing process so that all surfaces, including the edges, are coated;

- and tool steel.

Additional Product InformationFootnote 8

[27] The product definition includes corrosion-resistant steel sheet where the substrate is coated or plated with a corrosion-resistant material such as zinc, aluminum, and other alloys. The coating may be applied by a variety of processes including hot-dip galvanizing or electro-galvanizing.

[28] The product definition includes corrosion-resistant steel sheet which has been chemically passivated by coating with standard or acrylic chromate and non-chromate solutions.

[29] Passivation refers to a material becoming “passive”, that is, less affected or corroded by the environment of future use. Passivation involves creation of an outer layer of shield material that is applied as a micro-coating, created by chemical reaction with the base material, or allowed to build from spontaneous oxidation in the air. As a technique, passivation is the use of a light coat of a protective material, to create a shell against corrosion. The most common method of passivation for steel products is the application of a standard chromate based or acrylic chromate and non-chromate coatings. Passivation treatments provide protection against oxidation during handling, transportation, and storage, and they also add lubricity during the forming or stamping of the part.

[30] Corrosion-resistant steel sheet is usually produced from cold-rolled carbon steel sheet (“CRS”) and sometimes from hot-rolled carbon steel sheet (“HRS”). However, additions of certain elements, such as titanium, vanadium, niobium or boron, during the steel-making process enable the steel to be classified as alloy steel. Therefore, corrosion-resistant steel produced from either carbon steel or alloy steel is included in the definition of the subject goods.

[31] The subject goods (and like goods produced by the domestic industry) are manufactured to meet certain American Society for Testing and Materials (ASTM), Society of Automotive Engineering (SAE) or equivalent specifications, including, but not limited to:

- ASTM A653/653M

- ASTM A792/A792M

- SAE J403

- SAE J1392

- SAE J2329

- SAE J1562

[32] The product definition excludes corrosion-resistant steel for use in automobiles and automobile parts, hereafter referred to as “automotive”. Automotive end users include original equipment manufacturers (“OEMs”) and auto part producers. Such excluded goods normally fall under Customs Tariff item 9959.00.00.

[33] The product definition excludes corrosion-resistant steel sheet products that have been pre-painted or coated with organic (non-metallic) coatings. In Canada, the commonly used term for steel that has been coated with paint at the mill is “pre-painted” or “pre-coated” steel. Outside Canada, it is common for the term “organic coated” to be used to describe pre-painted steel. “Organic coated” may also refer to permanently applied plastic coatings or films. Common paint types for pre-painted and other organic coating products are silicon modified polyester, polyester, polyurethane, acrylic, epoxy, epoxy phenolic, polyvinylchloride and polyvinylidene difluoride.

[34] The product definition includes “seconds”. Seconds are goods that do not meet some aspect of the original specification. This could include dimensions, grade, or coating. It could also include a coil that has been damaged. Seconds are sold at a discount. Seconds may meet ASTM, SAE or other specifications or may be re-certified to meet a standard. For example, a coil that is damaged along the edge may be a “second”. However, if the damaged edge is slit and the damage is removed, the coil could be classified as a primary coil produced to the new width. Seconds are graded and sold on a scale of five.

Production ProcessFootnote 9

[35] COR is usually produced from CRS and sometimes from HRS. The steel sheet to be coated is commonly referred to as steel substrate. Hot-dip galvanizing and electrogalvanizing are the two processes that can be used to coat the substrate steel sheet with zinc, aluminum, or other alloys. The complainant uses hot-dip galvanizing.

[36] In the hot-dip galvanizing process, the first step is to clean the surfaces to improve the adhesion of the coating. After cleaning, the substrate enters a continuous annealing furnace. The furnace heats the substrate to the temperature necessary to develop the desired metallurgical properties of the final product. The substrate is then placed in a molten coating bath and, as it emerges from the bath, an air, nitrogen or steam wipe is used to control the thickness of the coating. The galvanized steel sheet is then cooled in a cooling tower.

[37] In some cases, the galvanized steel is further processed into galvannealed steel sheet. The first step in galvannealing is to reduce the thickness of the coating. This can be done either by “wipe-coat galvannealing”, in which thick pads are used to wipe the sheet as it emerges from the molten coating bath, or by an air/nitrogen wiping process. The galvanized sheet then passes through a galvannealing furnace, with the heat from the furnace causing the iron from the substrate to combine with the zinc coating to produce a thin zinc-iron alloy. Because of its thinner coating, galvannealed steel sheet is easier to weld and paint than galvanized steel sheet.

[38] In the electro-galvanizing process, charged steel passes through a plating bath and opposite electrical charges cause the zinc solution to coat the steel. Cold-rolled steel coils are batch annealed in multi-stack furnaces or in off-line continuous annealing process, often skin passed on a temper mill, before being electro-galvanized with a thin coating of zinc on a continuous processing line.

Product UseFootnote 10

[39] Common applications for COR falling within the product definition include, but are not limited to, production of farm buildings, grain bins, culverts, garden sheds, roofing material, siding, floor decks, roof decks, wall studs, drywall corner beads, doors, door frames, ducting (and other heating and cooling applications), flashing, hardware products and appliance components.

Classification of Imports

[40] The subject goods are normally classified under the following tariff classification numbers (tariff numbers):

- 7210.30.00.00

- 7210.49.00.10

- 7210.49.00.20

- 7210.49.00.30

- 7210.61.00.00

- 7210.69.00.10

- 7210.69.00.20

- 7212.20.00.00

- 7212.30.00.00

- 7212.50.00.00

- 7225.91.00.00

- 7225.92.00.00

- 7226.99.00.10

[41] The listing of tariff numbers is for convenience of reference only. The tariff numbers may include non-subject goods. Also, the subject goods may fall under tariff numbers that are not listed. Refer to the product definition for authoritative details regarding the subject goods.

Like Goods and Class of Goods

[42] Subsection 2(1) of SIMA defines “like goods” in relation to any other goods as goods that are identical in all respects to the other goods, or in the absence of any identical goods, goods the uses and other characteristics of which closely resemble those of the other goods.

[43] In considering the issue of like goods, the CITT typically looks at a number of factors, including the physical characteristics of the goods, their market characteristics and whether the domestic goods fulfill the same customer needs as the subject goods.

[44] After considering questions of use, physical characteristics and all other relevant factors, the CBSA initiated its investigation under the premise that domestically produced COR are like goods to the subject goods. Further, the CBSA was of the opinion that the subject goods and like goods constitute only one class of goods.

[45] In its preliminary injury inquiry for this investigation, the CITT reviewed the matter of like goods and classes of goods. On October 9, 2018, it issued its preliminary inquiry Statement of Reasons for this investigation, indicating that “the Tribunal will conduct its analysis on the basis that domestically produced COR of the same description as the subject goods are “like goods” in relation to the subject goods and that there is one class of goods.”Footnote 11

The Canadian Industry

[46] The complainant and the supporting producer, Stelco Inc., account for nearly all of the domestic production of like goods.

Imports into Canada

[47] During the final phase of the investigation, the CBSA refined the volume and value of imports based on information from CBSA import entry documentation and other information received from exporters and importers.

[48] The following table presents the CBSA’s analysis of imports of COR for the purposes of the final determination:

| Source | % of Total Import Volume |

|---|---|

| China | 55.5% |

| The Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) | 4.6% |

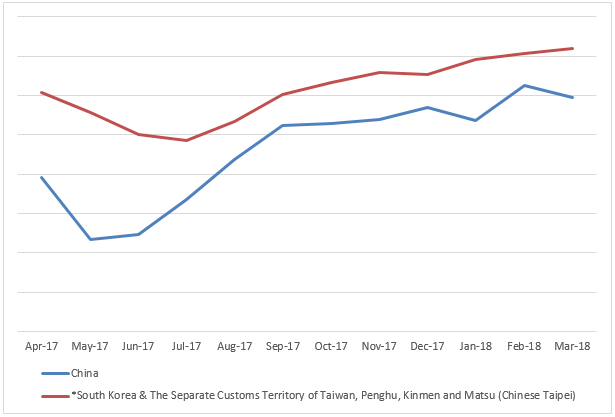

| India | 3.1% |

| South Korea | 5.3% |

| All Other Countries | 31.4% |

| Total Imports | 100.0%* |

*The total may not add to 100% due to rounding to one decimal point.

Investigation Process

[49] Regarding the dumping investigation, information was requested from all known and potential exporters, producers, vendors and importers, concerning shipments of COR released into Canada during the POI.

[50] Regarding the section 20 inquiry, information was requested from all known and potential exporters and producers of COR in China and from the GOC. As the investigation already included appropriate “surrogate producers”, no additional producers not named in this investigation were requested to provide information for the purposes of determining normal values under paragraph 20(1)(c) of SIMA. These producers were considered appropriate as they operate in well-developed COR industries and under competitive conditions. Furthermore, importers were requested to provide information respecting re-sales in Canada of like goods imported from a third country in order to gather information to determine normal values under paragraph 20(1)(d) of SIMA.

[51] The GOC and the exporters/producers were notified that failure to submit all required information and documentation, including non-confidential versions, failure to comply with all instructions contained in the RFI, failure to permit verification of any information or failure to provide documentation requested during the verification visits may result in the margin of dumping and the assessment of anti-dumping duty on the subject goods being based on facts available to the CBSA. Further, they were notified that a determination on the basis of facts available could be less favorable to them than if complete, verifiable information was made available.

[52] Under Article 15 of the World Trade Organization (WTO) Anti-dumping Agreement, developed countries are to give regard to the special situation of developing country members when considering the application of anti-dumping measures under the Agreement. Possible constructive remedies provided for under the Agreement are to be explored before applying anti-dumping duty where they would affect the essential interests of developing country members. As India is listed as a least developed country, other low income country or lower middle income country or territory on the Development Assistance Committee List of Official Development Assistance RecipientsFootnote 12, the CBSA recognizes this country as a developing country for purposes of actions taken pursuant to SIMA.

[53] Accordingly, the obligation under Article 15 of the WTO Anti-dumping Agreement was met by providing the opportunity for exporters to submit price undertakings. In this particular investigation, the CBSA did not receive any undertaking proposals from exporters in India.

[54] Several parties requested an extension to respond to their respective RFIs. The CBSA reviewed each request and granted extensions in instances where the reasons for making the requests constituted unforeseen circumstances or unusual burdens. Where an extension request was denied, the CBSA informed the parties that it could not guarantee that submissions received after the RFI response deadline would be taken into consideration for the purposes of the preliminary phase of the investigation.

[55] After reviewing the RFI responses, supplemental RFIs (SRFIs) were sent to several responding parties to clarify information provided in the responses and request any additional information considered necessary for the investigation.

[56] On-site verifications were conducted at the premises of three exporters in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) and three exporters in South Korea. CBSA officers also conducted on-site verifications at the premises of two trading companies in South Korea. Desk audits were conducted for the remaining responding exporters.

[57] Details pertaining to the information submitted by the exporters in response to the Dumping RFI as well as the results of the CBSA’s dumping investigation, including the section 20 inquiry, are provided in the Dumping Investigation section of this document.

[58] As part of the final phase of the investigation, case briefs and reply submissions were provided by counsels representing the complainant, seven exporters and one trading company. Details of the representations are provided in Appendix 2.

Dumping Investigation

[59] The following presents the results of the investigation into the dumping of the subject goods.

Normal Value

[60] Normal values are generally determined based on the domestic selling prices of like goods in the country of export, in accordance with section 15 of SIMA, or on the aggregate of the cost of production of the goods, a reasonable amount for administrative, selling and all other costs, plus a reasonable amount for profits, in accordance with paragraph 19(b) of SIMA.

[61] In the case of a prescribed country such as China, if, in the opinion of the President of the CBSA, the government of that country substantially determines domestic prices and there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market, the normal values are generally determined on the basis of section 20 of SIMA using either the selling prices or the full costs of like goods in a “surrogate” country, or using re-sales in Canada of goods imported from a “surrogate” country.

[62] Where, in the opinion of the CBSA, sufficient information has not been furnished or is not available, normal values are determined pursuant to a ministerial specification in accordance with subsection 29(1) of SIMA.

Export Price

[63] The export price of goods sold to importers in Canada is generally determined in accordance with section 24 of SIMA based on the lesser of the adjusted exporter’s sale price for the goods or the adjusted importer’s purchase price. These prices are adjusted where necessary by deducting the costs, charges, expenses, duties and taxes resulting from the exportation of the goods as provided for in subparagraphs 24(a)(i) to 24(a)(iii) of SIMA.

[64] Where, in the opinion of the CBSA, sufficient information has not been furnished or is not available, export prices are determined pursuant to a ministerial specification under subsection 29(1) of SIMA.

Margin of Dumping

[65] The margin of dumping by exporter is equal to the amount by which the total normal value exceeds the total export price of the goods, expressed as a percentage of the total export price. All the subject goods shipped to Canada during the POI are included in the margins of dumping of the goods. Where the total normal value of the goods does not exceed the total export price of the goods, the margin of dumping is zero.

Section 20 Inquiry

[66] Section 20 is a provision of SIMA that may be applied to determine the normal value of goods in a dumping investigation where certain conditions prevail in the domestic market of the exporting country. In the case of a prescribed country under paragraph 20(1)(a) of SIMA, it is applied where, in the opinion of the CBSA, the government of that country substantially determines domestic prices and there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market.

[67] The provisions of section 20 are applied on a sector basis rather than on the country as a whole. The sector reviewed will normally only include the industry producing and exporting the goods under investigation. The CBSA proceeds on the presumption that section 20 of SIMA is not applicable to the sector under investigation absent sufficient information to the contrary. The CBSA may form an opinion where there is sufficient information that the conditions set forth in paragraph 20(1)(a) of SIMA exist in the sector under investigation.Footnote 13

[68] A section 20 inquiry refers to the process whereby the CBSA collects information from various sources in order to form an opinion as to whether the conditions described under subsection 20(1) of SIMA exist with respect to the sector under investigation.

[69] The CBSA is required to examine whether the government of that country substantially determines domestic prices. The CBSA is also required to examine the price effect resulting from substantial government determination of domestic prices and whether there is sufficient information on the record for the CBSA to have reason to believe that the resulting domestic prices are not substantially the same as they would be in a competitive market.

[70] The complainant alleged that the conditions described in section 20 prevail in the flat-rolled steel industry sector, which includes COR, in China. That is, the complainant alleged that this industry sector in China does not operate under competitive market conditions and consequently, prices established in the Chinese domestic market for COR are not reliable for determining normal values.

[71] The complainant provided evidence supporting the claim that the GOC substantially determines prices of COR sold in China, including a pricing analysis. The complainant also provided evidence of state-ownership in the steel industry, involving both producers and purchasers, including those in the flat-rolled steel industry sector.

[72] The complainant also cited specific GOC policies such as China’s 2015 Steel Adjustment Policy and China’s 13th Five-Year PlanFootnote 14 as evidence of continued influence on market forces in China, including the flat-rolled steel industry sector, which includes COR.

[73] At the initiation of the investigation, the CBSA had sufficient evidence, supplied by the complainant and from its own research and past investigation findings, to support the initiation of a section 20 inquiry to examine the extent of GOC involvement in pricing in the flat-rolled steel industry sector, which includes COR. The information indicated that prices in China in this sector have been influenced by various GOC industrial policies. Consequently, the CBSA sent Section 20 RFIs to producers and exporters of COR in China, as well as to the GOC, to obtain information on the extent to which the GOC is involved with the determination of domestic prices in the flat-rolled steel industry sector, which includes COR.

Responses to Section 20 Inquiry

[74] The CBSA received responses to the Section 20 RFIs from four exporters/producers.Footnote 15

[75] An RFI was sent to the GOC requesting information for the purposes of the section 20 inquiry. However, the GOC did not provide a response to the Government Section 20 RFI or any other information with respect to the investigation.

[76] As the investigation already included appropriate potential “surrogate producers”, surrogate RFIs were not sent to COR producers in any other countries. These producers were considered appropriate as they operate in well-developed COR industries and under competitive conditions. The CBSA received substantially complete and reliable responses to the Dumping RFI from three companies in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) and one company in South Korea.

[77] As part of the section 20 inquiry, the RFIs sent to importers requested information on re-sales in Canada of COR imported from sources other than China, the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei), India and South Korea. The CBSA received five responses to the Importer RFI. However, only one importer provided information on re-sales in Canada of like goods from non-subject countries.

CBSA’s Analysis with Respect to Section 20 Inquiry

[78] The following is the CBSA’s analysis of the relevant factors that are present in the flat-rolled steel industry sector in China, which includes COR.

GOC Industrial Policies

[79] The following GOC industrial policies were examined by the CBSA:

- 13th Five-Year National Plan on National Economic and Social Development;

- Steel Capacity Replacement Policy;

- Iron and Steel Industry Adjustment and Upgrade Plan (2016-2020);

- Iron and Steel Industrial Restructuring Policy (2015);

- The National Steel Policy and the Steel Revitalization/Rescue Plan; and

- 12th Five-Year Development Plans for the steel industry.

13th Five-Year Plan on National Economic and Social Development

[80] The GOC adopted its 13th Five-Year Plan for Economic and Social Development (13th Five-Year Plan)Footnote 16 on March 15, 2016. The 13th Five-Year Plan outlines China’s goals, principles and targets for its development for the period of 2016-2020, which covers the POI for this investigation. The objectives outlined in the 13th Five-Year Plan continue the themes expressed in the 12th Five-Year Plan, which is discussed in a later section. This includes the strengthening of state owned enterprises (SOEs) and control over the economy within the steel industry.

[81] The 13th Five-Year Plan calls for greater involvement of SOEs in the development of the Chinese economy. Specifically, Chapter 11 of the plan states:

We will ensure that public ownership is dominant and that economic entities under diverse forms of ownership develop side by side ... We will exercise oversight over economic entities under all forms of ownership in accordance with the law … We will remain firmly committed to ensuring that SOEs grow stronger, better, and bigger and work to see that a number of such enterprises develop their capacity for innovation and become internationally competitive, thereby injecting greater life into the state-owned sector, helping it exercise a greater level of influence and control over the economy, increasing its resilience against risk, and enabling it to contribute more effectively to accomplishing national strategic objectives.Footnote 17

[82] Given the overcapacity in the steel industry causing excess supply, the above statement supports GOC intentions to further consolidate the steel industry through mergers and restructuring and that the GOC views SOEs as having an important role to play in the economy.

Steel Capacity Replacement Policy

[83] On January 8, 2018, the Ministry of Industry and Information Technology of China issued the Steel Capacity Replacement PolicyFootnote 18 to cut existing steel production capacity and strictly ban the launch of any new steelmaking facilities in 2018. The new policy is to ensure zero growth of production capacity in steel, cement and plate glass industries and to continue capacity replacement measures this year.

[84] According to a reportFootnote 19 by South China Morning Post, China fulfilled its target of cutting back steel capacity by 50 million metric tonnes in 2017, as well as phasing out another 120 million tonnes of low-tech illicit steel product capacity. China also plans to meet the 2016 to 2020 capacity cutback target of eliminating up to 150 million tonnes ahead of schedule in 2018.

[85] The analysis on the 13th Five-Year Plan together with the other similar administrative policies of the steel industry discussed below, indicate that the GOC plays a key role in the control and administration of the steel industry, which includes the flat-rolled steel industry sector.

Iron and Steel Industry Adjustment and Upgrade Plan (2016-2020)

[86] On November 14, 2016, the Ministry of Industry and Information Technology of China issued the Iron and Steel Industry Adjustment and Upgrade Plan (2016 - 2020)Footnote 20, to support the Chinese steel industry’s development in the next five years. The plan aims to raise the average annual growth rate of industrial added value from 5.4% in 2015 to 6.0% by 2020, raise the capacity utilization rate from 70% in 2015 to 80% by 2020 and raise the industrial concentration in top ten producers from 34.2% in 2015 to 60% by 2020. As supporting measures, the plan calls on local governments to utilize existing funds, explore multiple kinds of support measures and guide financial institutions and social funds to support key tasks of the plan.

[87] Comments from a report by the American Iron and Steel Institute (AISI) on an earlier draft of the Adjustment and Upgrade Plan included the following:

The measures described in the Policy reflect ongoing government intervention in the management and operation of steel companies and the allocation of resources in the industry. As a result, the Policy is largely inconsistent with the goal of subjecting the industry to market discipline… The absence of concrete steps towards fundamental market-driven reforms and significant capacity reductions will render the Policy ineffective in addressing this fundamental problem.Footnote 21

The specific measures contained in the Policy indicate that market forces will not be permitted to play a “decisive” role in the development of China's steel industry, and that the role of the market will remain secondary to the role of the government.Footnote 22

[88] Other observations made by the AISI on the draft policy included:

- The Policy envisions ultra-large steel groups to be formed through mergers and acquisitions and to dominate the market, with the government “supporting the unification of strong and dominant enterprises” and encouraging them to “implement strategic reorganizations” throughout the production chain;Footnote 23

- The Policy does not remove the primary barrier to market reforms in the Chinese steel industry – state ownership;Footnote 24

- While the Adjustment Policy acknowledges objectives related to China’s excess capacity crisis, it fails to provide for any effective means to significantly reduce it;Footnote 25 and

- The Policy aims to concentrate 60% of production capacity into three to five ultra-large, globally competitive enterprises, along with several leading enterprises in regional or specialty markets by 2025.Footnote 26

[89] In analyzing the Iron and Steel Industry Adjustment and Upgrade Plan (2016-2020) together with the discussion on the draft Iron and Steel Industrial Restructuring Policy (2015 Revision) below, indications are that the GOC continued its level of control in the administration of the flat-rolled steel industry sector.

Iron and Steel Industrial Restructuring Policy (2015)

[90] On March 20, 2015, the Ministry of Industry and Information Technology released a draft document entitled, Iron and Steel Industrial Restructuring Policy (Steel Restructuring Revision).Footnote 27 The Steel Restructuring Revision is intended to replace the National Steel Policy previously issued in 2005.

[91] Currently, no information is available to the CBSA regarding whether a formal version of the policy exists. However, given the information available on the draft Steel Restructuring Revision, the major objectives of the Steel Restructuring Revision can be summarized into four main categories as follows: re-structuring of the steel industry, capacity requirements, profitability targets and productivity targets.Footnote 28

[92] Additionally, Article 4 in the Steel Restructuring Revision provides further support of the GOC’s strengthening of control and oversight over the Chinese steel industry:

There should be continuous innovation in the means of governmental administration; ongoing and retrospective oversight and services should be continuously strengthened; and the role of the government should be more effectively realized. Relevant laws and regulations should be better implemented in the industry in order to basically build a fair and competitive market environment. A sound investment project information disclosure system and corporate credit record system should be established in order to form an open, honest community oversight system.Footnote 29

[93] This extract also indicates that the GOC has realized that the current steel industry is not in a fair and competitive market environment.

[94] According to Xinhua Net, an official press agency of China, as a result of the Steel Restructuring Revision, by 2020 the GOC has pledged to reduce steel production capacity by 100-150 million metric tonnes (MT).Footnote 30 Furthermore, according to a report by Change Partnership, it is estimated that China would need to close down 112.5 million MT of capacity per year to 2020 in order to remove its surplus.Footnote 31 By the end of May 2017, capacity reductions totaled 42 million tonnes, or 80% of the target for 2017.Footnote 32

[95] Based on the above objectives, tasks and measures outlined in the Steel Restructuring Revision, indications are that the GOC intends to continue the restructuring of the steel industry; set capacity requirements and profitability and productivity targets. The CBSA views the role of the GOC in the management and supervision over the Chinese steel industry as indicative of its continued control of the steel industry.

National Steel Policy and Steel Revitalization/Rescue Plan

[96] As cited in previous section 20 inquiries on steel products, the Development Policies for the Iron and Steel Industry – Order of the National Development and Reform Commission [No. 35], (National Steel Policy)Footnote 33 was promulgated on July 8, 2005 and outlines the GOC’s future plans for the Chinese domestic steel industry. The major objectives of the National Steel Policy are:

- The structural adjustment of the Chinese domestic steel industry;

- Industry consolidations through mergers and acquisitions;

- The regulation of technological upgrading with new standards for the steel industry;

- Measures to reduce material and energy consumption and enhance environmental protection; and

- Government supervision and management in the steel industry.

[97] On March 20, 2009, the GOC promulgated the Blueprint for the Adjustment and Revitalization of the Steel Industry issued by the General Office of the State Council (Steel Revitalization/Rescue Plan).Footnote 34 This macro-economic policy was the GOC’s response to the global financial crisis and is also the action plan for the steel industry for the 2009 through 2011 period. Although the period when the National Steel Policy was applied was prior to the period of this inquiry, there are no indications that the GOC has not maintained such policies in the administration of the steel industry. This plan includes the following major tasks:

- Maintain the stability of the domestic market and improve the export environment;

- Strictly control the total output of steel and accelerate the process of eliminating what is backward (obsolete);

- Enhance enterprise reorganization and improve the industrial concentration level;

- Spend more on technical transformation and promote technical progress;

- Optimize the layout of the steel industry and overall arrangements of its development;

- Adjust the steel product mix and improve the product quality;

- Maintain stable import of iron ore resources and rectify the market order; and

- Develop domestic and overseas resources and guarantee the safety of the industry.

[98] There are common measures between these two GOC policies, as the Steel Revitalization/Rescue Plan is an acceleration of the major objectives of the National Steel Policy. In the Steel Revitalization/Rescue Plan, the GOC asserts its strict control over new or additional steel production capacity and promotes new GOC directed mergers and acquisitions to reform the Chinese steel industry into larger conglomerates, with an increased emphasis on steel product quality. These measures and reforms affect the steel industry in China and, as a result, affect COR producers in the flat-rolled steel industry sector.

12th Five-Year Development Plans for the Steel Industry

[99] The 12th Five-Year Development Plans for the Steel Industry (12th Five-Year Development Plans) is a policy document that was released by the GOC’s Ministry of Industry and Information Technology on November 7, 2011.Footnote 35 The 12th Five-Year Development Plans served as the guiding document for the development of the Chinese steel industry for the 2011-2015 period and was followed by the 13th Five-Year Development Plans (2016-2020), which was discussed in detail previously in this document. The two plans together clearly indicate the GOC’s continuous involvement in the administration and control of the steel industry. The 12th Five-Year Development Plans directives include:

- Increased mergers and acquisitions to create larger, more efficient steel companies;

- GOC restrictions on steel capacity expansion;

- Upgrading of steel industry technology;

- Greater GOC emphasis on high-end steel products; and

- GOC directed relocation of iron and steel companies to coastal areas.

[100] Also included in this plan are minimum requirements for steel production in order to eliminate smaller players in the market. Through this plan, the GOC continued its reform and restructuring of the Chinese steel industry. The GOC’s target was that by 2015, China’s top 10 steel producers would represent 60% of the country’s total steel output. According to the National Steel Policy, the long-range GOC target for mergers and acquisitions is to have the top 10 Chinese steel producers account for 70% of total national steel production by 2020. This plan was to be part of the next development stage of GOC directives aimed at achieving this long-range 2020 target.

[101] The GOC’s direction of the steel industry includes enabling regional or provincial governments to combine enterprises across boundaries. Furthermore, as a result of the GOC’s administration of steel production capacity, the Chinese steel industry remains under the purview of the GOC. Together with the GOC’s legislation: Criterion for the Production and Operation of Steel IndustryFootnote 36 – GY [2010] No. 105 and Several Observations of the General Office of the State Council on Further Strengthening Energy-saving and Emission Reduction Efforts as well as Accelerating of Restructuring of Steel IndustryFootnote 37 – GBF (2010) No. 34, these plans set out requirements for existing production and operations of steel enterprises in China at the time.

[102] The intent of the latter legislation is to further support and carry out the Steel Revitalization/Rescue Plan to achieve the energy-saving and emission targets, in addition to the restructuring of the steel industry in China, as approved by the State Council. One main objective of the State Council is to “resolutely suppress the excessive growth of steel production capacity” and “strictly implement the approval and review process of steel projects.”

[103] Should steel enterprises not follow the GOC’s requirements, laws, and industrial policies, there are repercussions which include the withdrawal of steel production licenses and credit support.

GOC Ownership and Control of Suppliers of Raw Material Inputs

[104] The CBSA is of the view that state-owned and state-controlled enterprises in the steel industry in China are under the direction of GOC industrial policies and objectives, and this entails that these steel producers do not necessarily operate under market conditions.

[105] The CBSA reviewed the most recent data available on steel production as reported by the World Steel Association (WSA). Based on this information, the top 10 steel producers by volume in ChinaFootnote 38 accounted for 37.3% of all steel production in China in 2017.Footnote 39 Of these 10 producers, eight are state-owned, and the combined production of steel by these top eight state-owned enterprises in China represents 30.3% of all steel production in China in 2017.

[106] As a result of GOC steel policies aimed at supply side structural reform, on September 22, 2016, Baosteel Group and Wuhan Steel Group consolidated by merging into BaoWu Steel Group, the second largest by production volume of crude steel, among global iron and steel companies. The result of the merger has led to a stronger and more influential state-owned entity and greater concentration in the steel industry.

[107] The GOC’s extensive ownership and control of the majority of large Chinese steel producers means that these companies likely produce and market steel according to GOC objectives and policies instead of market conditions.

[108] Given that the state-owned steel companies produce raw material inputs for cold-rolled and hot rolled steel sheet, which are also a direct input material in the production of COR, there is a strong likelihood that prices of COR are also distorted.

GOC Ownership and Control of COR Producers

[109] The complaint provided evidence of state-owned enterprises which produce COR in China. The complaint identified 15 enterprises which are known to be state-owned or controlled.Footnote 40

[110] The presence of state-owned and state-controlled enterprises that produce COR in the flat-rolled steel industry sector would necessitate that private companies supplying COR would have to compete with these state-owned and stated-controlled enterprises operating under non-market conditions.

Government Influence over Inputs

[111] The complainant submits that the Chinese domestic price of COR is influenced by the GOC because the GOC influences the price of cold-rolled and hot-rolled steel, the primary input material of COR. The information submitted shows that the Chinese domestic price for hot-rolled steel was an average of 18% below the US Midwest hot-rolled steel price and an average of 19% below the India hot-rolled steel price during the period from Q2 2017 to Q1 2018Footnote 41, and that the Chinese domestic price for cold-rolled steel was an average of 27% below the US Midwest cold-rolled steel price and an average of 18% below the India cold-rolled steel price during the same period.Footnote 42

| US Midwest | China | Difference | India | China | Difference | |

|---|---|---|---|---|---|---|

| 2017Q2 | 681 | 471 | 31% | 613 | 471 | 23% |

| 2017Q3 | 683 | 608 | 11% | 734 | 608 | 17% |

| 2017Q4 | 671 | 624 | 7% | 745 | 624 | 16% |

| 2018Q1 | 820 | 652 | 21% | 826 | 652 | 21% |

| Average | 714 | 589 | 18% | 730 | 589 | 19% |

| US Midwest | China | Difference | India | China | Difference | |

|---|---|---|---|---|---|---|

| 2017Q2 | 911 | 539 | 41% | 677 | 539 | 20% |

| 2017Q3 | 897 | 672 | 25% | 815 | 672 | 18% |

| 2017Q4 | 881 | 716 | 19% | 826 | 716 | 13% |

| 2018Q1 | 980 | 734 | 25% | 912 | 734 | 19% |

| Average | 914 | 665 | 27% | 808 | 665 | 18% |

[112] The CBSA concurs with the complainant’s analysis, which demonstrates the GOC’s influence over the price of material inputs in producing COR.

GOC Export Controls

[113] There is evidence that the GOC maintains export controls on raw materials used in the production of steel. These GOC measures limit or prevent the export of the raw materials resulting in increasing supply in the Chinese domestic market causing downward pressure on domestic prices.

[114] On January 1, 2017, the GOC imposed an export tax of 15% on pig iron, steel billets, and steel slab.Footnote 45 The extra burden imposed on the export of such steel products is likely to increase their supply in the Chinese domestic market and cause downward pressure on domestic prices on such products and products made therefrom, such as cold-rolled and hot-rolled steel sheet, which are the main raw material input in the production of COR. Similarly, steel slab is a major input for steel plate, which in turn is a major input for flat-rolled steel.

[115] The export controls of the GOC detailed above on steel products, including raw materials used in the production of COR, create an excess supply and therefore lower prices of raw materials for COR producers below what would exist in a competitive market, without such government controls.

Subsidization of the Steel Industry

[116] Although the CBSA is not conducting a subsidy investigation, the complainant provided information on subsidization of the Chinese steel industry and argues that this subsidization influences the price of steel products, including COR.Footnote 46 Previous CBSA positive findings of subsidized steel products in China is in itself evidence of the GOC’s indirect influence in the steel industry, including the flat-rolled steel industry sector. These subsidies provided to the producers of steel products in China have an indirect effect on domestic pricing of steel goods, including COR.

[117] As submitted in the complaint, Reuters reported, in 2014, that 88% of Chinese firms have received subsidies with a value worth USD 5.24 billion.Footnote 47 These subsidies reduce the domestic price of material inputs purchased by COR producers. This in turn incentivizes and allows COR producers to sell lower priced goods to customers.

[118] In conclusion, these subsidies allow Chinese steel enterprises, including cold-rolled and hot-rolled steel producers, to market steel and provide downstream COR producers lower priced input materials, which in turn allows the COR producers to sell COR at prices determined by factors other than the market conditions, resulting in prices lower than they would be without government subsidization.

[119] The support, through subsidies, of the steel industry and the flat-rolled steel industry sector by the GOC, is evidence that the GOC intended to assert control and influence the selling price of COR in the domestic market.

Summary of Government Control Analysis

[120] The GOC’s measures, notices and observations detailed above illustrate that the GOC is closely administering the steel industry in China. Based on the information on the record as of the date of the final determination, the scope of the GOC’s macro-economic policies and measures provide a compelling factual basis that the GOC is influencing the Chinese steel industry, which encompasses the flat-rolled steel industry sector, including COR, the goods under investigation. The use of such policies and measures can dramatically change the demand and supply balance in the domestic market thereby materially altering the domestic prices of steel products such as steel slab, plate, hot-rolled steel sheet, cold-rolled steel sheet, as well as downstream products like COR.

[121] The major macro-economic policies and measures of the GOC include the 12th and 13th Five-Year Development Plans for the Steel Industry; the Steel Capacity Replacement Policy; the Iron and Steel Industry Adjustment and Upgrade Plan (2016 – 2020); the Steel Industry Adjustment Policy (2015 Revision); the National Steel Policy and the Steel Revitalization/Rescue Plan. These policies and measures have resulted in an environment where the commercial objectives of steel enterprises conflict with those of the GOC, affecting the type of products produced, production volumes and ultimately prices.

[122] In addition to the industrial policies and plans, the GOC closely administers the steel industry, including the flat-rolled steel industry sector, through state-ownership and state-control of upstream enterprises involved in the manufacture and supply of steel inputs, as well as COR producers. Furthermore, export controls and subsidization of the steel industry, including the flat-rolled steel industry sector, further demonstrates the GOC’s intent to exert control.

[123] In conclusion, the cumulative impact of these GOC actions, measures and control indicate that prices in the flat-rolled steel industry sector, which includes COR, are being indirectly determined by the GOC.

Chinese Domestic Price Analysis

[124] The complainant submitted MEPS data, a publisher of steel market prices around the world, to compare hot-dipped galvanized steel prices (which includes COR) in China, to those in other markets. The table below demonstrates that prices of hot-dipped galvanized steel products in China are significantly lower than in other countries, suggesting the GOC’s involvement in the hot-dipped galvanized steel sector is affecting prices: hot-dipped galvanized steel prices in China were lower than domestic pricing in other markets by C$203/MT-C$557/MT in the past three years.

| Canada | USA | China | Japan | South Korea | Difference between China vs. Others | |

|---|---|---|---|---|---|---|

| 2015 | 951 | 977 | 570 | 854 | 886 | 284-407 |

| 2016 | 1,103 | 1,155 | 632 | 924 | 884 | 252-523 |

| 2017 | 1,302 | 1,328 | 771 | 974 | 1,026 | 203-557 |

[125] The data shows that prices of hot-dipped galvanized steel (which includes COR) are significantly lower in China in comparison to prices in the United States, Canada, Japan and South Korea.

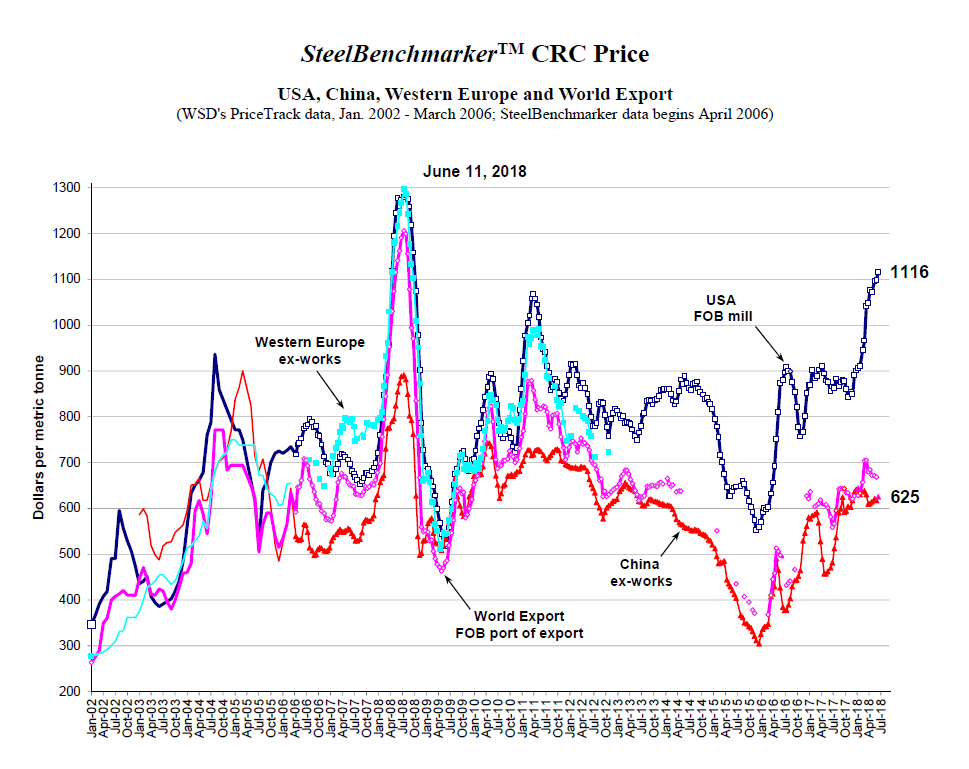

[126] The CBSA was able to obtain information from SteelBenchmarker which collects and analyzes ex-mill prices of plate, scrap, hot-rolled band and cold-rolled coil in China, the United States and other regions, including prices during the review period from April 2017 to March 2018.Footnote 49 The SteelBenchmarker semi-monthly report also includes a summary chart of a domestic price comparison of cold-rolled coils (see chart below).Footnote 50 Based on the following chart depicting the prices of cold-rolled coil, the main material input in the production of COR, the CBSA reasonably concluded that FOB mill prices of COR in China in 2016 and 2017 were consistently lower than those in the United States by between 190-490 USD per MT, and also consistently lower than the world average prices to a lesser degree.

[127] As previously stated, the domestic price for cold-rolled and hot-rolled steel in China was also below the prices in the US Midwest and Indian markets. Given that cold-rolled and hot-rolled steel are commodity products freely traded on the world market, these disparities further support the assertion that domestic prices of COR in China are impacted by the distorted prices of steel inputs.

[128] The CBSA also compared the weighted average domestic selling prices of COR from companies who provided complete responses to the Dumping RFI, whose information was verified via on-site verification or via desk audit, and whose information was considered for the final determination in determining normal values.

Weighted Average Domestic Selling Prices of COR in USD per MTFootnote 51

*For reasons of confidentiality, the data for South Korea and the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) were combined, and actual selling prices not shown.

[129] From the graph above, a similar pattern emerges, whereby prices of COR in China are not the same as in other markets during the POI. The domestic selling prices of COR in China during the POI are consistently lower than in South Korea and the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei), and ranging in difference from $38 USD per metric tonne to $162 USD per metric tonne.

Summary of the Results of the Section 20 Inquiry

[130] The information discussed above supports the conclusion that the domestic prices of COR in China are not substantially the same as they would be if they were determined in a competitive market.

[131] Based on the above analysis of the flat-rolled steel industry sector for the purposes of the final determination, the CBSA is of the opinion that:

- domestic prices in the flat-rolled steel industry sector in China, which includes COR, are substantially determined by the GOC; and

- there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market.

[132] Based on the above analysis, for the purposes of the final determination, the CBSA affirmed the opinion rendered at the preliminary determination that the conditions of paragraph 20(1)(a) of SIMA exist in the flat-rolled steel industry sector in China, which includes COR.

Normal Values – Section 20

[133] Normal values could not be determined on the basis of the domestic selling prices in China or on the full cost of goods plus profit, because the CBSA formed the opinion that the conditions of paragraph 20(1)(a) of SIMA exist in the flat-rolled steel industry sector in China, which includes COR.

[134] Where section 20 conditions exist, the CBSA may determine normal values pursuant to paragraph 20(1)(c) or 20(1)(d) of SIMA which are normally based on the domestic selling prices of the like goods sold by surrogate producers designated by the President of the CBSA and adjusted for price comparability; or the cost of production of the like goods plus a reasonable amount for administrative, selling and all other costs, plus a reasonable amount for profits; or on the basis of the selling price in Canada of like goods imported from any source designated by the President of the CBSA and adjusted for price comparability.

[135] The CBSA designated the producers from the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) as the appropriate surrogates. The Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) also has a significant flat-rolled steel industry, which includes COR. The CBSA received substantially complete responses to the Dumping RFI from producers/exporters in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) which were verified on-site during the course of this investigation.

[136] For the purposes of the final determination, normal values for the subject goods shipped by the exporters in China, who provided a substantially complete and reliable response to the Dumping RFI, were determined pursuant to paragraph 20(1)(c) of SIMA, using the information provided by the three producers/exporters in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei).

[137] Where normal values could not be determined under paragraph 20(1)(c) of SIMA, the normal values were determined pursuant to ministerial specification in accordance with subsection 29(1) of SIMA using the domestic selling prices of the closest matching products, based on the consideration of the relevant characteristics, in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei).

Results of the Dumping Investigation

[138] The following summarizes the results of the dumping investigation for the exporters in China, the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei), India and South Korea, which provided a response to the RFIs:

China

Angang Steel Company Limited (Ansteel) / Angang Group International Trade Corporation (Angang International)

[139] Ansteel is a producer of the subject goods in China and Angang International is the export trading arm of Ansteel. During the POI, all the subject goods produced by Ansteel were shipped to Canada by Angang International.

[140] Ansteel and Angang International provided a joint response to the Dumping RFI.Footnote 52 Four Supplemental RFIs were sent to Ansteel and Angang International to gather additional information and seek clarification. Ansteel and Angang International provided joint responses to all Supplemental RFIs.Footnote 53 A desk audit was completed to review and verify the submissions provided by Ansteel and Angang International.

[141] Ansteel and Angang International’s response to the Dumping RFI was used to estimate the normal values and export prices for the purposes of the preliminary determination. However, during the final phase of the investigation, the CBSA’s review and verification of Ansteel and Angang International’s submissions uncovered inconsistencies and discrepancies in their submitted export sales information. As a result, Ansteel and Angang International’s submissions were considered to be unreliable and were not taken into account for the purposes of the final determination.

[142] For the final determination, the margin of dumping for Ansteel/Angang International is based on the “China - All Other Exporters” normal value and export price methodologies which are described later in this document.

Beijing Shougang Cold Rolling Co., Ltd. (BSCR) / Shougang Holding Trade (Hong Kong) (SHHK)

[143] BSCR is a producer of like and subject goods located in China. Shougang International Trade & Engineering Corporation (SITE) is a related company located in China with whom BSCR has a vending agreement for all sales to SHHK. SHHK is a related company located in Hong Kong who is the vendor on all export sales from BSCR. Due to the relationship between BSCR and SHHK and their roles and responsibilities during the exportation process, the companies have collectively been determined to be the exporter for SIMA purposes. Where appropriate, the companies are referred to collectively as BSCR/SHHK.

[144] The three companies filed a joint response to the Dumping RFI by submitting only the relevant sections of the RFI as they apply to their specific role in the manufacturing and selling of like and subject goods.Footnote 54 A Deficiency Letter was sent to SITE as the CBSA did not initially receive a response from this entity.Footnote 55 In addition, Supplemental RFIs were sent to the three companies to gather additional information and seek clarification.Footnote 56 A desk audit was completed to review and verify the submissions provided by the three companies.

[145] As per the CBSA’s review and verification of the information, all of the issues raised in the deficiency letter and Supplemental RFIs were addressed. As a result, the three companies’ submissions, as a whole, were found to be substantially complete and reliable for the purposes of the final determination.

[146] As explained above, for exporters in China who were found to have provided substantially complete and reliable information in this investigation, normal values were determined pursuant to paragraph 20(1)(c) of SIMA, using the information provided by the three producers/exporters in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) during the PAP, or pursuant to subsection 29(1) of SIMA, using the domestic selling prices of the closest matching products, based on the consideration of the relevant characteristics, in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei).

[147] For the subject goods shipped to Canada produced by BSCR during the POI, the export price was determined pursuant to section 24 of SIMA based on the SHHK’s selling price less all costs, charges and expenses resulting from the exportation of the good.

[148] For the purposes of the final determination, the total normal value compared to the total export price results in a margin of dumping of 3.6% for the BSCR/SHHK, expressed as a percentage of the total export price.

Bengang Steel Plates Co., Ltd. (Bengang Plates) / Benxi Iron & Steel (Group) International Economic and Trading Co., Ltd. (Bengang Trading)

[149] Bengang Plates and Bengang Trading are related companies. Both companies are located in Benxi, Liaoning, China. Bengang Plates is a producer of the subject goods and Bengang Trading is the export trading arm of Bengang Plates. During the POI, all the subject goods produced by Bengang Plates were shipped to Canada by Bengang Trading. The subject goods were exported directly from China to Canada. Due to the relationship between Bengang Plates and Bengang Trading and their roles and responsibilities during the exportation process, the companies have collectively been determined to be the exporter for SIMA purposes. Where appropriate, the companies are referred to collectively as Bengang Plates/Bengang Trading.

[150] Bengang Trading and Bengang Plates responded to the Dumping RFI.Footnote 57 One Supplemental RFI was sent to Bengang Trading and four Supplemental RFIs were sent to Bengang Plates to gather additional information and seek clarification.Footnote 58 A desk audit was completed to review and verify the submissions provided by the companies. For the final determination, the submissions from Bengang Trading and Bengang Plates were considered to be substantially complete and reliable.

[151] As explained above, for exporters in China who were found to have provided substantially complete and reliable information in this investigation, normal values were determined pursuant to paragraph 20(1)(c) of SIMA, using the information provided by the three producers/exporters in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) during the PAP, or pursuant to subsection 29(1) of SIMA, using the domestic selling prices of the closest matching products, based on the consideration of the relevant characteristics, in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei).

[152] For the subject goods shipped to Canada by Bengang Plates/Bengang Trading during the POI, the export price was determined pursuant to section 24 of SIMA based on the exporter’s selling price less all costs, charges and expenses resulting from the exportation of the goods.

[153] For the purposes of the final determination, the total normal value compared to the total export price results in a margin of dumping of 18.4% for Bengang Plates/Bengang Trading, expressed as a percentage of the total export price.

BX Steel POSCO Cold Rolled Sheet Co., Ltd. (BX Posco) / Benxi Iron & Steel (Group) International Economic and Trading Co., Ltd. (Bengang Trading)

[154] BX Posco and Bengang Trading are related companies. Both companies are located in Benxi, Liaoning, China. BX Posco is a producer of the subject goods and Bengang Trading is the export trading arm of BX Posco. During the POI, all the subject goods produced by BX Posco were shipped to Canada by Bengang Trading. The subject goods were exported directly from China to Canada. Due to the relationship between BX Posco and Bengang Trading and their roles and responsibilities during the exportation process, the companies have collectively been determined to be the exporter for SIMA purposes. Where appropriate, the companies are referred to collectively as BX Posco/Bengang Trading.

[155] Bengang Trading and BX Posco responded to the Dumping RFI.Footnote 59 One Supplemental RFI was sent to Bengang Trading and four Supplemental RFIs were sent to BX Posco to gather additional information and seek clarification.Footnote 60 A desk audit was completed to review and verify the submissions provided by the companies. For the final determination, the submissions from Bengang Trading and BX Posco were considered to be substantially complete and reliable.

[156] As explained above, for exporters in China who were found to have provided substantially complete and reliable information in this investigation, normal values were determined pursuant to paragraph 20(1)(c) of SIMA, using the information provided by the three producers/exporters in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) during the PAP, or pursuant to subsection 29(1) of SIMA, using the domestic selling prices of the closest matching products, based on the consideration of the relevant characteristics, in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei).

[157] For the subject goods shipped to Canada by BX Posco/Bengang Trading during the POI, the export price was determined pursuant to section 24 of SIMA based on the exporter’s selling price less all costs, charges and expenses resulting from the exportation of the goods.

[158] For the purposes of the final determination, the total normal value compared to the total export price results in a margin of dumping of 14.2% for BX Posco/Bengang Trading, expressed as a percentage of the total export price.

Inner Mongolia Baotou Steel Union Co., Ltd. (Baotou Steel)

[159] Baotou Steel provided a response to the Dumping RFI.Footnote 61 However, Baotou Steel did not export any subject goods to Canada during the POI. As a result, the information provided by Baotou Steel was not used for the purposes of the final determination.

Jiangyin ZongCheng Steel Co., Ltd. (JYZC)

[160] JYZC, a foreign-owned company, is a producer and exporter of the subject goods located in Jiangyin, China.

[161] JYZC provided a response to the Dumping RFI.Footnote 62 Supplemental RFIs were sent to JYZC to gather additional information and seek clarification.Footnote 63 A desk audit was completed to review and verify the submission provided by the company. For the final determination, JYZC’s submission was considered to be substantially complete and reliable.

[162] As explained above, for exporters in China who were found to have provided substantially complete and reliable information in this investigation, normal values were determined pursuant to paragraph 20(1)(c) of SIMA, using the information provided by the three producers/exporters in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) during the PAP, or pursuant to subsection 29(1) of SIMA, using the domestic selling prices of the closest matching products, based on the consideration of the relevant characteristics, in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei).

[163] For the subject goods shipped to Canada by JYZC during the POI, the export price was determined pursuant to section 24 of SIMA based on the exporter’s selling price less all costs, charges and expenses resulting from the exportation of the good.

[164] For the purposes of the final determination, the total normal value compared to the total export price results in a margin of dumping of 21.1% for JYZC, expressed as a percentage of the total export price.

Jingtang United Iron & Steel Co., Ltd. (JUIS) / Shougang Holding Trade (Hong Kong) (SHHK)

[165] JUIS is a producer of like and subject goods located in China. Shougang International Trade & Engineering Corporation (SITE) is a related company located in China with whom JUIS has a vending agreement for all sales to SHHK. SHHK is a related company located in Hong Kong who is the vendor on all export sales from JUIS. Due to the relationship between JUIS and SHHK and their roles and responsibilities during the exportation process, the companies have collectively been determined to be the exporter for SIMA purposes. Where appropriate, the companies are referred to collectively as JUIS/SHHK.

[166] The three companies filed a joint response to the Dumping RFI by submitting only the relevant sections of the RFI as they apply to their specific role in the manufacturing and selling of like and subject goods.Footnote 64 A Deficiency Letter was sent to SITE as the CBSA did not initially receive a response from this entity.Footnote 65 In addition, Supplemental RFIs were sent to the three companies to gather additional information and seek clarification.Footnote 66 A desk audit was completed to review and verify the submission provided by the three companies.

[167] As per the CBSA’s review and verification of the information, all of the issues raised in the deficiency letter and Supplemental RFIs were addressed. As a result, the three companies’ submissions, as a whole, were found to be substantially complete and reliable for the purposes of the final determination.

[168] As explained above, for exporters in China who were found to have provided substantially complete and reliable information in this investigation, normal values were determined pursuant to paragraph 20(1)(c) of SIMA, using the information provided by the three producers/exporters in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) during the PAP, or pursuant to subsection 29(1) of SIMA, using the domestic selling prices of the closest matching products, based on the consideration of the relevant characteristics, in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei).

[169] For the subject goods shipped to Canada produced by JUIS during the POI, the export price was determined pursuant to section 24 of SIMA based on the SHHK’s selling price less all costs, charges and expenses resulting from the exportation of the good.

[170] For the purposes of the final determination, the total normal value compared to the total export price results in a margin of dumping of 8.5% for JUIS/SHHK, expressed as a percentage of the total export price.

Yieh Phui (China) Technomaterial Co., Ltd. (YPC)

[171] YPC, a company incorporated in China, is a producer and exporter of the subject goods located in Changshu, China. During the POI, YPC sold the subject goods to Canada through a trading company. The subject goods were shipped directly from China to Canada.

[172] YPC provided a response to the Dumping RFI.Footnote 67 Supplemental RFIs were sent to YPC to gather additional information and seek clarification.Footnote 68 A desk audit was completed to review and verify the submission provided by the company. For the final determination, YPC’s submission was considered to be substantially complete and reliable.

[173] As explained above, for exporters in China who were found to have provided substantially complete and reliable information in this investigation, normal values were determined pursuant to paragraph 20(1)(c) of SIMA, using the information provided by the three producers/exporters in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) during the PAP, or pursuant to subsection 29(1) of SIMA, using the domestic selling prices of the closest matching products, based on the consideration of the relevant characteristics, in the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei).

[174] For the subject goods shipped to Canada by YPC during the POI, the export price was determined pursuant to section 24 of SIMA based on the exporter’s selling price less all costs, charges and expenses resulting from the exportation of the good.

[175] For the purposes of the final determination, the total normal value compared to the total export price results in a margin of dumping of 15.6% for YPC, expressed as a percentage of the total export price.

All Other Exporters - China