General Import Permit No. 83 – Aluminum Products

Customs Notice 19-20

Ottawa,

Purpose and Coverage

1. The purpose of this Notice is to inform importers of the aluminum import monitoring program. Effective September 1, 2019, the Governor in Council has added certain aluminum products to the Import Control List (ICL) as item 83 and the Minister of Foreign Affairs has issued General Import Permit (GIP) No. 83 for importing certain aluminum products.

2. The purpose of this program is to enable Global Affairs Canada to monitor imports of certain aluminum products and facilitate the collection of import data. In addition, importers may be required, upon request, to provide to Global Affairs Canada documents and records for the purpose of identifying any errors in import data and determining the source of any inconsistencies in a targeted manner.

3. The aluminum import monitoring program does not limit the quantity of aluminum products that may be imported into Canada.

4. This Notice applies to all aluminum products included in item 83 of the ICL.

Import requirements and procedures

5. Customs brokers and importers utilizing this Permit must comply with the requirements of the GIP. They are requested to ensure that quantity (in kilograms), value (in Canadian dollars and excluding freight costs), product classification, country of origin, U.S. state of export (if applicable), supplier name and address and importer name are given correctly, if necessary by amending the import documentation. Customs brokers and importers utilizing this Permit are urged to cooperate fully with the Trade and Export Controls Bureau of Global Affairs Canada, as administrators of the monitoring program. Such cooperation and the provision of complete and accurate information in their customs declaration forms will enhance the reliability of the data and reduce the burden of post-clearance auditing.

6. To import shipments that include aluminum products listed in item 83 of the ICL, customs brokers and importers are required to cite “GIP83-OIC19-1224” in the commodity description field in the release document.

7. Failure to cite the required GIP or not complying with the terms and conditions of the Permit may lead to the levying of penalties by the Canada Border Services Agency (CBSA) under the Administrative Monetary Penalty System, which authorizes the CBSA to assess monetary penalties for non-compliance with customs legislative, regulatory and program requirements. Importers may also face prosecution under the EIPA for contravening a provision of the Act or its regulations (section 19). Compliance is monitored by the CBSA and Global Affairs Canada.

Application

The below aluminum products are subject to the aluminum import monitoring program. For a description of the commodity, please refer to the CBSA Customs Tariff website.

| Codes | Description | Unit of Measure |

|---|---|---|

Unwrought aluminum. |

||

-Aluminum. Not alloyed |

||

7601.10.00.20 |

Ingots |

KGM |

7601.10.00.90 |

Other |

KGM |

-Aluminum alloys |

||

7601.20.00.10 |

Aluminum vanadium alloys |

KGM |

7601.20.00.21 |

Ingots, of other aluminum alloys: Remelt scrap ingot |

KGM |

7601.20.00.29 |

Ingots, of other aluminum alloys: Other |

KGM |

7601.20.00.90 |

Other |

KGM |

Aluminum bars, rods and profiles. |

||

-Of aluminum, not alloyed |

||

7604.10.00.30 |

Profiles |

KGM |

7604.10.00.40 |

Bars and rods |

KGM |

-Of aluminum alloys: Hollow profiles |

||

7604.21.00.10 |

Unworked |

KGM |

7604.21.00.90 |

Other |

KGM |

-Of aluminum alloys: Other |

||

7604.29.00.11 |

Bars and rods, of a maximum cross-sectional dimension exceeding 12.7 mm: Having a round cross-section |

KGM |

7604.29.00.19 |

Bars and rods, of a maximum cross-sectional dimension exceeding 12.7 mm: Other |

KGM |

7604.29.00.21 |

Bars and rods, of a maximum cross-sectional dimension not exceeding 12.7 mm: Having a round cross-section |

KGM |

7604.29.00.29 |

Bars and rods, of a maximum cross-sectional dimension not exceeding 12.7 mm: Other |

KGM |

7604.29.00.30 |

Profiles |

KGM |

Aluminum wire. |

||

7605.11.00.00 |

-Of aluminum, not alloyed: Of which the maximum cross-sectional dimension exceeds 7 mm |

KGM |

7605.19.00.00 |

-Of aluminum, not alloyed: Other |

KGM |

7605.21.00.00 |

-Of aluminum alloys: Of which the maximum cross-sectional dimension exceeds 7 mm |

KGM |

7605.29.00.00 |

-Of aluminum alloys: Other |

KGM |

Aluminum plates, sheets and strip, of a thickness exceeding 0.2 mm. |

||

-Rectangular (including square): Of aluminum, not alloyed |

||

7606.11.00.10 |

Clad |

KGM |

7606.11.00.90 |

Other |

KGM |

-Rectangular (including square): Of aluminum alloys |

||

7606.12.00.11 |

Not clad: Of a thickness exceeding 0.2 mm but less than 7 mm |

KGM |

7606.12.00.12 |

Not clad: Of a thickness of 7 mm or more |

KGM |

7606.12.00.20 |

Clad |

KGM |

-Other: Of aluminum, not alloyed |

||

7606.91.00.10 |

Unworked circles or discs |

KGM |

7606.91.00.90 |

Other |

KGM |

7606.92.00.00 |

-Other: Of aluminum alloys |

KGM |

Aluminum foil (whether or not printed or backed with paper, paperboard, plastics or similar backing materials) of a thickness (excluding any backing) not exceeding 0.2 mm. |

||

-Not backed: Rolled but not further worked |

||

7607.11.00.10 |

Of a thickness of less than 0.005 mm |

KGM |

7607.11.00.20 |

Of a thickness of 0.005 mm or more but less than 0.127 mm |

KGM |

7607.11.00.30 |

Of a thickness of 0.127 mm or more |

KGM |

7607.19.00.00 |

-Not backed: Other |

KGM |

-Backed |

||

7607.20.00.10 |

Printed |

KGM |

7607.20.00.90 |

Other |

KGM |

Aluminum tubes and pipes. |

||

-Of aluminum, not alloyed |

||

7608.10.00.10 |

Seamless |

KGM |

7608.10.00.90 |

Other |

KGM |

7608.20.00.00 |

-Of aluminum alloys |

KGM |

7609.00.00.00 |

Aluminum tube or pipe fittings (for example, couplings, elbows, sleeves). |

KGM |

Other articles of aluminum. |

||

-Other |

||

7616.99.90.21 |

Castings: Die |

KGM |

7616.99.90.29 |

Castings: Other |

KGM |

7616.99.90.30 |

Forgings |

KGM |

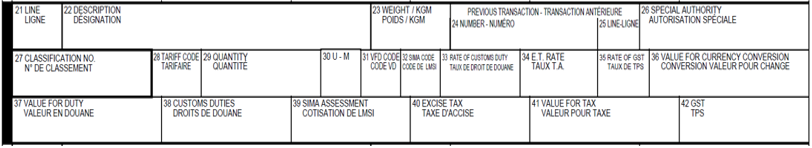

Completing the B3-3 Canada Customs Coding Form

8. The following instructions and examples demonstrate how the B3 should be completed for importations of goods described in item 83 of the ICL.

| Field | Instructions |

|---|---|

22 |

Provide as much detail as possible and state the specific product (ex. Alloy, Wire) and cite “GIP83-OIC19-1224”. |

23 |

Indicate the weight in kilograms. |

26 |

Leave blank. |

27 |

Provide the goods’ 10-digit classification number. |

29 |

For the quantity field, indicate the total weight of the goods in kilograms (KGM). |

30 |

Specify unit of measure in kilograms (KGM). |

35 |

GST rate is 5% |

37 |

Provide the value for duty (VFD) of the imported goods in Canadian dollars. |

41 |

Value for tax = VFD + SIMA duties (if applicable). |

42 |

The GST is value for tax times 5%. |

Example

9. Refer to Memorandum D17-1-10, Coding of Customs Accounting Documents for additional information on completing Form B3-3.

Additional Information

10. Memorandum D 19-10-2 Administration of the Export and Import Permits Act (Importations) will be updated to reflect the changes related to aluminum importation.

11. For information on the terms and conditions of GIP 83 and the administration of the aluminum import monitoring program, please refer to the Notice to Importers on Global Affairs Canada website, Serial No. 969, or contact the Trade and Export Controls Bureau of Global Affairs Canada via e-mail: aluminum.tin@international.gc.ca.

12. For any other information on the importation of aluminum products, within Canada call the Border Information Service at 1-800-461-9999. From outside Canada call 204-983-3500 or 506-636-5064. Long distance charges will apply. Agents are available Monday to Friday (08:00 – 16:00 local time / except holidays). TTY is also available within Canada: 1-866-335-3237.

- Date modified: