Memorandum D18-3-2: Excise duty framework for vaping products

May 13, 2024: Change to import-export program (RM) administration

The Canada Revenue Agency continues to issue the required business number (BN9). The CBSA has taken over RM account-related services. Until October 2024:

- to register for a new import-export program account (RM), complete form BSF947: Request for a CBSA Import/Export Program Account

- to submit a maintenance request for existing RM accounts, complete form BSF948: Request for Change(s) to Existing CBSA Import/Export Program Account

Ottawa,

ISSN 2369-2391

This document is also available in PDF (1.04 MB) [help with PDF files]

This memorandum provides information concerning the administration and enforcement under the Excise Act, 2001 and under the Customs Act (The Act).

On this page

- Updates made to this D-memo

- Definitions

- Guidelines

- Date of effect

- Currencies

- Health Canada – Compliance

- Scope of the excise duty framework for vaping products

- Licensing requirements

- Vaping prescribed person

- Vaping prescribed person – exception

- Carriers

- Registration for the vaping stamping regime

- Registration for the vaping stamping regime – exceptions

- Vaping excise stamps – Order process

- Stamping of vaping products

- Stamping of vaping products – exceptions

- Importation of unstamped vaping products – Not destined for the Canadian duty-paid market

- Importation of unstamped vaping products – Destined for the Canadian duty-paid market

- Vaping duty – Relieved or not payable

- Vaping duty payable

- Other duties and taxes payable

- Rates of vaping duty

- Value for tax

- GST/HST and provincial sales tax

- Illustrative examples

- Tariff classification numbers

- Rulings

- Reporting and accounting for vaping products

- Accounting where the vaping duty is payable

- Accounting where the vaping duty is relieved or not payable

- Additional information on report and accounting

- Return and sale of vaping products

- Reporting and remitting the vaping duty to CRA

- Correction, refund, drawback, re-determination and further re-determination

- Review

- Keeping records

- Administration and enforcement

- Additional information

- Appendix

- References

- Contact us

- Related links

Updates made to this D-memo

This memorandum has been amended to:

- Provide additional definitions in paragraph 2;

- Inform that a vaping product licensee is allowed, effective , to import packaged vaping products for stamping;

- Inform the timelines and obligations when a vaping product licensee imports packaged vaping products for stamping; and

- Provide revised flow charts in annexes.

Definitions

The following terms, defined under the Excise Act, 2001 or related regulations, are used in this memorandum:

- Accredited representative

- Means a person who is entitled under the Foreign Missions and International Organizations Act to the tax exemptions specified in Article 34 of the Convention set out in Schedule I to that Act or in Article 49 of the Convention set out in Schedule II to that Act.

- Case

- Means a corrugated cardboard box in which packages or cartons of tobacco products, or packages of vaping products, are packed primarily for the purpose of transport and protection against damage.

- Container

- In respect of a vaping product, a wrapper, package, carton, box, crate, bottle, vial or other container that contains the vaping product.

- Immediate container

- In respect of a vaping substance, means the container that is in direct contact with the vaping substance. It does not include a vaping device.

- Manufacture

- Includes, in respect of a vaping product, any step in the production of the vaping product, including inserting a vaping substance into a vaping device or packaging the vaping product.

- Packaged

- Means, in respect of a vaping product, packaged in a prescribed package.

- Person

- Means an individual, a partnership, a corporation, a trust, the estate of a deceased individual, a government or a body that is a society, a union, a club, an association, a commission or another organization of any kind.

- Prescribed Package

- Means, in respect of a vaping product, packaged in the smallest package – including any outer wrapper, package, box or other container – in which it is sold to the consumer.

- Stamped

- Means, in respect of a vaping product, that a vaping excise stamp, and all prescribed information in a prescribed format in respect of the vaping product, are stamped, impressed, printed or marked on, indented into or affixed to the vaping product or its container in the prescribed manner to indicate that duty has been paid on the vaping product.

- Unit

- A unit of vaping products consists of 120 millilitres of vaping substance in liquid form, or 120 grams of vaping substance in solid form, within any combination of not more than 12 vaping devices and immediate containers, as per subsection 5.1(2) of the Stamping and Marking of Tobacco, Cannabis and Vaping Products Regulations.

- Vaping device

- Means property (other than prescribed property) that is

- a device that produces emissions in the form of an aerosol and is intended to be brought to the mouth for inhalation of the aerosol;

- a vaping pod or another part that may be used with a device referred to in paragraph (a); or

- a prescribed property.

- Vaping duty

- Means a duty imposed under section 158.57 of the Excise Act, 2001.

- Vaping excise stamp

- Means a stamp that is issued by the Minister of National Revenue under subsection 158.36(1) of the Excise Act, 2001, and that has not been cancelled under section 158.4 of that Act.

- Vaping product

-

Means

- a vaping substance that is not contained within a vaping device; or

- a vaping device that contains a vaping substance.

It does not include a cannabis product or a tobacco product.

- Vaping product drug

-

Means a vaping product (other than a prescribed vaping product) that is

- a drug that has been assigned a drug identification number under the Food and Drug Regulations; or

- a prescribed vaping product.

- Vaping product licensee

- Means a person that holds a vaping product licence issued under section 14 of the Excise Act, 2001.

- Vaping product marking

- Means prescribed information that is required under the Excise Act, 2001 to be printed on, or affixed to, a container of vaping products that are not required under this Act to be stamped.

- Vaping substance

-

Means

- a substance or mixture of substances, whether or not it contains nicotine, that is produced to be used, or sold for use, with a vaping device to produce emissions in the form of an aerosol; or

- a prescribed substance, material or thing.

It does not include a prescribed substance, material or thing.

Guidelines

Date of effect

1. The excise duty framework for vaping products came into effect on October 1, 2022.

2. For more definitions of the terms found in this memorandum, refer to section 2 of the Excise Act, 2001 and to subsection 2(1) of the Customs Act, at the links found in the "References" section of this memorandum.

Currencies

3. All amounts expressed in this memorandum are in Canadian dollars (CAD).

Health Canada - Compliance

4. Manufacturers, importers and sellers of vaping products must also comply with the Tobacco and Vaping Products Act and the Canada Consumer Product Safety Act. For more information, refer to Vaping compliance and enforcement, at the link found in the "References" section of this memorandum.

Scope of the excise duty framework for vaping products

5. The excise duty framework for vaping products applies on vaping products imported into or manufactured in Canada and intended for the Canadian duty-paid market, whether or not they contain nicotine.

6. Vaping products that do not meet the Excise Act, 2001 definition of a vaping product are not subject to the excise duty framework. For example, vaping substances that contain tobacco or any cannabis and, reusable vaping devices (e.g., ‘vaping pens’) that do not contain a vaping substance, do not meet the definition of a vaping product, and as such are not subject to the excise duty framework.

7. A person who manufactures vaping products in Canada or who imports packaged vaping products for stamping, with the exception of manufacturing for their personal use, must apply to the Canada Revenue Agency (CRA) for a vaping product licence. Such persons must meet specific eligibility criteria to obtain a vaping product licence under the Excise Act, 2001.

8. A person who only imports stamped packaged vaping products into the Canadian duty-paid market, must apply to the CRA to be a vaping prescribed person in order to obtain vaping excise stamps for their products.

9. Vaping product licensees and vaping prescribed persons are also required to register with the CRA for the vaping stamping regime. All vaping products entering the Canadian duty-paid market are required to be packaged and stamped with a vaping excise stamp.

10. A flow chart representing how the excise duty framework applies to the importation of vaping products is found in Annex 3 of this memorandum.

Licensing requirements

Vaping Product licence

11. A person must apply to the CRA for a vaping product licence under paragraph 14(1)(f) of the Excise Act, 2001 if they are manufacturing vaping products in Canada or importing packaged vaping products for stamping. This licence also allows a vaping product licensee to import non-duty-paid vaping products into Canada, for further manufacturing, re-work or destruction.

12. Upon meeting the eligibility criteria, the CRA will send a letter to the applicant to confirm their CRA vaping product licence approval and give them their new excise duty program account number.

13. For more information, refer to Excise Duty Notice EDN79, Obtaining and Renewing a Vaping Product Licence, at the link found in the "References" section of this memorandum.

Vaping product licence - exceptions

14. A person does not have to apply for a vaping product licence under the Excise Act, 2001 if they

- are not manufacturing vaping products in Canada

- are not importing packaged vaping products for stamping

- are importing vaping products only for their personal use in quantities that do not exceed the prescribed limit of 5 units, as per subsection 5.01 of the Stamping and Marking of Tobacco, Cannabis and Vaping Products Regulations

- are only importing stamped packaged vaping products into Canada (i.e., they do not manufacture vaping products in Canada). In such case, the person must apply to the CRA to be a vaping prescribed person in order to obtain vaping excise stamps (see below).

15. A vaping product licence is not required if a person is strictly handling or selling stamped products. Being a vaping prescribed person may be required.

16. A vaping product licence is not required if a person is strictly transporting vaping products on behalf of a vaping product licensee, an excise warehouse licensee or accredited representative, in accordance with the Excise Act, 2001.

Excise warehouse licence

17. A vaping product licensee who manufactures and imports vaping products in Canada for export or for sale to an accredited representative (i.e., vaping products not intended for the Canadian duty-paid market), also requires an excise warehouse licence. Under the Excise Act, 2001, vaping products destined for export or for sale to an accredited representative that are packaged but not stamped, must be marked with prescribed markings and entered into the licensee's excise warehouse. For more information, refer to Excise Duty Notice EDN79, Obtaining and Renewing a Vaping Product Licence, at the link found in the "References" section of this memorandum.

Vaping prescribed person

18. An importer who is only importing stamped packaged vaping products into Canada is required to become a vaping prescribed person with the CRA in order to obtain vaping excise stamps. Upon meeting the eligibility criteria, the CRA will send a letter to the person to confirm they meet the conditions to be a vaping prescribed person and give them their new excise duty program account number.

19. For more information, refer to Excise Duty Notice EDN81, Becoming a Vaping Prescribed Person, at the link found in the "References" section of this memorandum.

Vaping prescribed person – exception

20. Under paragraph 158.47(2)(c) of the Excise Act, 2001 and subsection 5.01 of the Stamping and Marking of Tobacco, Cannabis and Vaping Products Regulations, a person who imports vaping products for personal use in quantities that do not exceed the prescribed limit of 5 units, is not required to be a vaping prescribed person.

Carriers

21. As per section 1.4 of the Regulations Respecting the Possession of Tobacco, Cannabis or Vaping Products that are not stamped, a person may possess a vaping product that is not stamped if the person is authorized by an officer under section 19 of the Customs Act to transport vaping products that have been reported under section 12 of that Act and is acting in accordance with that authorization. The goods may have a First Port of Arrival (FPOA) release or move in bond to a sufferance warehouse that is authorized to accept vaping products. For more information, refer to the D Memoranda series: D3 – Transportation and to the Regulations Respecting the Possession of Tobacco, Cannabis or Vaping Products that are not stamped, at the links found in the "References" section of this memorandum.

Registration for the vaping stamping regime

22. Under the Excise Act, 2001, the following persons are required to register for the vaping stamping regime in order to purchase vaping excise stamps

- a vaping product licensee who manufactures vaping products in Canada or who imports vaping products for stamping in Canada ,

- a vaping prescribed person importing stamped, packaged vaping products into the Canadian duty-paid market.

23. A person can register for the vaping stamping regime at the same time as they apply for a vaping product license or as a vaping prescribed person under the Excise Act, 2001. The CRA will send the applicant a letter to confirm their registration and provide instructions on how to purchase stamps.

24. For more information, refer to Excise Duty Notice EDN80, Overview of Vaping Excise Stamps, at the link found in the "References" section of this memorandum.

Registration for the vaping stamping regime - exceptions

25. Under the Excise Act, 2001, the following persons are not required to register for the vaping stamping regime

- a vaping product licensee who packages only vaping products for export outside Canada

- a vaping product licensee who packages only vaping product drugs that have been assigned a drug identification number under the Food and Drug Regulations

- a vaping product licensee who packages only vaping products to be sold to an accredited representative for their official or personal use

- a vaping product licensee who does not package vaping products in the smallest package in which they are sold to the consumer

- a person who imports vaping products for personal use in quantities that do not exceed the prescribed limit of 5 units, as per subsection 5.01 of the Stamping and Marking of Tobacco, Cannabis and Vaping Products Regulations.

26. For more information, refer to Excise Duty Notice EDN80, Overview of Vaping Excise Stamps, at the link found in the "References" section of this memorandum.

Vaping excise stamps – Order process

27. An importer must be approved by the CRA to purchase vaping excise stamps. For more information, refer to Excise Duty Notice EDN80, Overview of Vaping Excise Stamps, at the link found in the "References" section of this memorandum.

Stamping of vaping products

28. All packaged vaping products entering the Canadian duty-paid market must bear a vaping excise stamp, unless one of the exceptions mentioned in the section "Stamping of vaping products – exceptions" of this memorandum applies.

29. As per section 158.47 of the Excise Act, 2001, vaping products that are being imported into Canada and entering the Canadian duty-paid market must be packaged and have a vaping excise stamp affixed to the products before they can be released under the Customs Act unless they are being imported by a vaping product licensee for further manufacturing or stamping by the licensee.

30. As per section 158.51 of the Excise Act, 2001, Non-Compliant Imports, if a vaping prescribed person imports a vaping product intended for the Canadian duty-paid market, that is packaged and not stamped, when it is being reported to the CBSA, it shall be placed in a sufferance warehouse for the purpose of being stamped by the importer or owner of the imported vaping product.

31. As per section 158.511 of the Excise Act, 2001, if a vaping product licensee imports a packaged vaping product for stamping, the vaping product licensee shall, immediately after the vaping product is released under the Customs Act, deliver the vaping product to its premises for stamping.

32. Section 4.2 of the Stamping and Marking of Tobacco, Cannabis and Vaping Products Regulations requires that the stamp be affixed:

- in a conspicuous place on the package

- in a manner that seals the package

- in a manner that the stamp remains affixed to the package after the package is opened

- in a manner that does not interfere with the stamp’s security features

- in a manner that does not obstruct any information required by or under an Act of Parliament to appear on that package

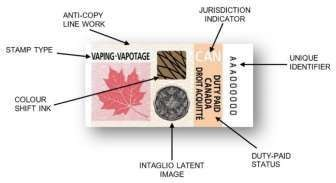

33. Vaping excise stamp - example

Image of the stamp wording - Text version

- Stamp type

- Anti-copy line work

- Jurisdiction Indicator

- Unique Identifier

- Duty-paid status

- Intaglio latent image

- Colour shift ink

34. For more information, refer to Excise Duty Notice EDN80, Overview of Vaping Excise Stamps, at the link found in the "References" section of this memorandum.

Stamping of vaping products - exceptions

35. The following vaping products are not required to bear a vaping excise stamp:

- unstamped vaping products that are imported by a vaping product licensee for further manufacturing or stamping by the licensee. In this situation, the vaping product would be required to be stamped by the licensee before entering the Canadian duty-paid market. Vaping products must be stamped before the end of the second calendar month following the month in which the licensee packages the vaping product or that the product has been released by the CBSA;

- vaping products entered into an excise warehouse to be exported or sold to an accredited representative for their official or personal use, not destined for the Canadian duty-paid market;

- vaping products that are vaping product drugs that are assigned a drug identification number under the Food and Drug Regulations;

- vaping products that are re-imported by a vaping product licensee for re-work or destruction in a manner approved by the CRA;

- vaping products that are imported by an individual for personal use within prescribed limits as per subsection 5.01 of the Stamping and Marking of Tobacco, Cannabis and Vaping Products Regulations (the limit is 5 units).

Importation of unstamped vaping products - Not destined for the Canadian duty-paid market

Excise warehouse

36. When imported packaged vaping products not destined for the Canadian duty-paid market are not stamped, (intended for export or for sale to an accredited representative) they must immediately be marked as per section 8 and section 9 of the Stamping and Marking of Tobacco, Cannabis, and Vaping Product Regulations, and entered into an excise warehouse.

37. Only imported packaged, unstamped and marked vaping products can enter an excise warehouse and, exclusively for export, for sale to accredited representatives, or to be delivered to another excise warehouse (not be destined for the Canadian duty-paid market).

38. An excise warehouse does not allow for the deferral of vaping duty and imported vaping products cannot be removed from an excise warehouse for re-work or destruction.

39. The excise warehouse licence number must be indicated on the customs reporting documentation at the time the imported goods are reported to the CBSA to obtain release under the Customs Act. These goods must be entered into the excise warehouse immediately after release from the CBSA.

40. The excise warehouse licence number must be input in field 26 of the B3-3 Canada Customs Coding Form. The required excise warehouse licence format that must be submitted is either 99-XXX-99999 or 99- XX-99999. All digits must be input in the special authority field 26 of the B3-3 Canada Customs Coding Form. For example, if the licence is 99-EWL-1 then the number to go in the special authority field is 99-EWL-00001.

Customs bonded warehouse

41. Only imported packaged, unstamped and marked vaping products can enter a customs bonded warehouse and, exclusively for export, or for sale to accredited representatives. For more information, refer to Memorandum D7-4- 4, Customs Bonded Warehouses, at the link found in the "References" section of this memorandum.

Importation of unstamped vaping products – Destined for the Canadian duty-paid market

42. When imported packaged vaping products destined for the Canadian duty-paid market are not stamped in accordance with the Excise Act, 2001 at the time of report to the CBSA, the products will either be:

- exported;

- abandoned to the Crown under section 36 of the Customs Act;

- entered into a customs sufferance warehouse where the vaping prescribed person will stamp the vaping products; or

- entered into the premises of a vaping product licensee where the licensee will stamp the vaping products.

43. If a vaping product licensee imports packaged vaping products for stamping but does not stamp the vaping products before the end of the particular calendar month that is the second calendar month following the calendar month in which the vaping products are released under by the CBSA, then the vaping product licensee must enter the vaping products into its excise warehouse before the end of the particular calendar month.

44. Importers can apply to the CBSA to obtain their own customs sufferance warehouse licence. Applicants must meet all regulatory requirements set out in the Customs Sufferance Warehouse Regulations in order to be issued a customs sufferance warehouse licence. However, a customs sufferance warehouse licence will not be issued to applicants seeking to only stamp vaping products in the warehouse facility.

45. Unstamped packaged vaping products can also be delivered to an existing customs sufferance warehouse in accordance with mode of transport. For more information, refer to Memorandum D4-1-4, Customs Sufferance Warehouses, at the link found in the "References" section of this memorandum.

46. To enter the sufferance warehouse where goods are stored, written authorization from the CBSA or the attendance of a CBSA officer is required for any person other than an employee of the sufferance warehouse or an employee of a carrier engaged in the delivery of goods to or the removal of goods from the sufferance warehouse. For more information, refer to Memorandum D4-1-4, Customs Sufferance Warehouses, at the link found in the "References" section of this memorandum.

47. Vaping products constitute a prescribed class of goods that are forfeited if they are not removed from a customs sufferance warehouse within 14 days after they were reported to the CBSA under section 12 of the Customs Act. For more information, refer to the Customs Sufferance Warehouses Regulations and to Memorandum D4-1-7, Extension of Time Limits for the Storage of Goods, at the links found in the "References" section of this memorandum.

48. Special services charges will be applied when an officer is asked to verify that packages in a customs sufferance warehouse have been stamped in accordance with the Stamping and Marking of Tobacco, Cannabis and Vaping Products Regulations. For more information, refer to Memorandum D1-2-1, Special Services, at the link found in the "References" section of this memorandum.

Vaping duty - Relieved or not payable

49. There are limited circumstances where the vaping duty is relieved or not payable with respect to vaping products. The Excise Act, 2001 provides exceptions where the vaping duty is relieved or not payable on importation of vaping products. Such exceptions are:

Vaping products imported by a vaping product licensee

Subsection 158.47(2) provides that an imported vaping product is exempted from stamping or packaging before release under the Customs Act for entry into the Canadian duty-paid market if the product is imported by a vaping product licensee for further manufacturing or for stamping by the licensee.

Vaping products imported for personal use

As per subsection 158.62 (2) of the Excise Act, 2001, vaping duty is relieved on the importation of vaping products by an individual for their personal use to the extent that the quantity of the products imported exceeds the quantity permitted under Chapter 98 of the List of Tariff Provisions set out in the schedule to the Customs Tariff to be imported without the payment of duties, as defined in Note 4 to that Chapter. The quantity permitted to be imported duty free is one unit.

Importation for re-working or destruction

As per subsection 158.64 of the Excise Act, 2001, the duties imposed under paragraphs 158.57(b) and 158.58(b) of that Act are relieved on a stamped vaping product that was manufactured in Canada by a vaping product licensee and that is imported for re-working or destruction in accordance with section 158.53 of that Act.Other circumstances

Section 158.66 of the Excise Act 2001 provides certain circumstances where the duty on vaping products is not payable, including vaping products that meet the definition of a vaping product drug.

Vaping duty payable

50. Vaping duty is imposed under section 158.57 of the Excise Act, 2001 on vaping products manufactured in Canada or imported into Canada in the amount determined under Schedule 8 to that Act.

51. As per subsection 158.59 of the Excise Act, 2001, the vaping duty in respect of an imported vaping product shall be paid and collected under the Customs Act. In addition, interest and penalties are to be imposed, calculated, paid and collected under the Customs Act, as if the tax was a customs duty levied on the vaping product under the Customs Tariff. The Customs Act applies with any modifications that the circumstances require.

52. In the case of imported vaping products, the importer, owner or other person who is liable under the Customs Act to pay duties levied under section 20 of the Customs Tariff is required to pay the duty imposed at the time of accounting to the CBSA. In the case of packaged vaping products that are imported by a vaping product licensee for stamping, the duty is payable by the vaping product licensee at the time they are stamped, and has to be paid to the CRA. For more information, refer to the "Reporting and accounting" section of this memorandum.

Other duties and taxes payable

53. All applicable duties and taxes related to customs (e.g. under the Customs Tariff, the Excise Tax Act, the Excise Act 2001, or the Special Import Measures Act, etc.), inclusive of the GST/HST and of the provincial sales tax (if applicable), are payable in respect of the importation of a vaping product.

Rates of vaping duty

54. The rates of vaping duty imposed on liquid vaping products under section 158.57 of the Excise Act, 2001 are:

- $1 per 2 mililitres (mL), or fraction thereof, for the first 10 mL of vaping substance in the vaping device or immediate container

- $1 per 10 mL, or fraction thereof, for amounts over the first 10 ml.

55. The rates of vaping duty imposed on solid vaping products under section 158.57 of the Excise Act, 2001 are:

- $1 per 2 grams (g), or fraction thereof, for the first 10 g of vaping substance in the vaping device or immediate container

- $1 per 10 g, or fraction thereof, for amounts over the first 10 g.

56. The vaping duty is calculated on the quantity of vaping substance contained in each individual device or immediate container, not on the total quantity contained in a package.

57. For more information, refer to Excise Duty Notice EDN82, Calculation of vaping duty, at the link found in the "References" section and to the Illustrative examples section of this memorandum.

Value for tax

58. The value for tax of the vaping product is the formula A + B where:

A is the value of the vaping product as it would be determined under sections 48 to 53 of the Customs Act

(i.e., value for duty)

+

B is any duties and taxes payable related to customs (e.g., under the Customs Tariff, the Excise Tax Act, the Excise Act, 2001 or the Special Import Measures Act, etc.), other than the GST/HST and provincial sales tax.

GST/HST and provincial sales tax

59. The GST/HST is applicable to the value for tax of the vaping product (as per the rules set out in the Excise Tax Act) as calculated above.

60. When a provincial sales tax is applicable, it applies also to the value for tax of the vaping product. For more information, refer to Memorandum D2-3-6, Non-commercial Provincial Tax Collection Programs, and Memorandum D17-1-22, Accounting for the Harmonized Sales Tax, Provincial Sales Tax, Provincial Tobacco Tax and Alcohol Markup/Fee on Casual Importations in the Courier and Commercial Streams, at the link found in the "References" section of this memorandum.

Illustrative examples

61. For examples on the calculation of the vaping duty and other duties and taxes, refer to Annex 2 of this memorandum.

Tariff classification numbers

62. A lists of goods that may be subject to the excise duty framework for vaping products at the time of issuance of this memorandum, accompanied with their respective tariff classification numbers, can be found in Annex 1 of this memorandum.

Rulings

63. The CBSA recommends that importers submit an application for a ruling if they have any doubt as to the origin, tariff classification or value for duty of goods. The procedures for obtaining a ruling are outlined in Memorandum D11-11-1, National Customs Rulings (NCR), Memorandum D11-11-3, Advance Rulings for Tariff Classification, and Memorandum D11-4-16, Advance Rulings Under Free Trade Agreements, at the links found in the "References" section of this memorandum.

Reporting and accounting for vaping products

Courier Low Value Shipment (CLVS) Program

64. Vaping products are regulated under the Tobacco and Vaping Products Act, Canada Consumer Product Safety Act and Food and Drugs Act and, therefore, are excluded from the CLVS Program. For more information, refer to Memorandum D17-4-0, Courier Low Value Shipment Program, at the link found in the "References" section of this memorandum.

Postal stream

65. Vaping products that are commercial goods or casual goods are eligible for importation in the postal stream. For more information, refer to Memorandum D5-1-1, International mail processing, at the link found in the "References" section of this memorandum.

Casual goods (non-commercial)

66. The accounting of vaping products which are casual goods follows the same process as any other casual goods. Casual goods means, for the purposes of this memorandum, 5 units or less of vaping products imported into Canada for personal use. Importers should be prepared to present on demand to the officer any relevant documentation, as would be the case for any other goods. Officers will determine if the vaping duty is applicable and proceed with the necessary calculations. For more information, refer to Memorandum D17-1-3, Casual Importations and to the relevant memorandum in the D Memoranda series: D2 – International Travel, at the links found in the "References" section and to the “Duties and taxes calculation” section of this memorandum.

Personal Exemptions

67. For more information on duty and tax free importation and limits on importation of vaping products accompanied by the traveller (whether taxed or not), refer to the relevant memorandum in the D2 series, D2 – International Travel, at the link found in the "References" section of this memorandum.

Commercial Goods

68. Reporting and accounting of vaping products that are commercial goods where the vaping duty is, or is not, payable on importation, is made in the same way and within the same prescribed time that customs duties and other taxes are, or are not, payable. Commercial goods means goods imported into Canada for sale or for any commercial, industrial, occupational, institutional or other like use.

69. Importers of vaping products must ensure that the appropriate and valid CRA vaping licence number or the letter of endorsement is available at the time of report when requested by the CBSA . When requested, the valid CRA vaping licence number or the letter of endorsement must be provided to the CBSA.

70. When the proof of the valid CRA vaping licence number or the letter of endorsement cannot be provided to the CBSA upon request, the vaping products may have to be exported, abandoned to the Crown or destroyed.

71. When accounting for vaping products, the importer should complete the B3 form, using the same method as it would normally. This includes correctly determining the proper tariff classification number and calculating the regular duties and taxes on the same B3 line. If provincial taxes are applicable, this will be calculated on a separate line, as per the normal procedures outlined in Memorandum D17-1-22, Accounting for the Harmonized Sales Tax, Provincial Sales Tax, Provincial Tobacco Tax and Alcohol Markup/Fee on Casual Importations in the Courier and Commercial Streams, at the link found in the "References" section of this memorandum.

72. An importer must pay all customs duties, GST/HST and vaping duty at the time of accounting (deferral of the amount equivalent to vaping duty is not allowed for vaping products). For more information, refer to the “Duties and taxes calculation” section of this memorandum.

73. The CBSA may require supporting documentation for the importation of a vaping product meeting conditions from one of the exceptions mentioned above that is claimed by the importer. If, at the time of accounting of the products (i.e., when the products have been released from the CBSA), the required supporting document is not valid or is not provided to the CBSA when required, in respect of the particular importation, and that the vaping duty would be payable in the absence of such proof, then the vaping duty would apply.

CSA Importers (Customs Self Assessment Program)

74. Vaping products are considered “eligible goods” for the purposes of CSA Importers. RSF code 49435 (EXCISE TAX/DUTIES VAPING PRODUCTS) should be used in E648 CSA Revenue Summary Form. For more information, refer to Memorandum D23-3-1, Customs Self-Assessment Program for Importers, at the link found in the "References" section of this memorandum

Accounting where the vaping duty is payable

75. To account for vaping products where the vaping duty is payable on importation, the importer must insert the correct tariff classification number on a single line for the goods and include the appropriate excise tax code in field 34. This code is based whether the goods are a liquid (ml) or solid vaping product (g) (see table below for a list of applicable excise tax codes when the vaping duty is payable). The vaping duty amount is manually calculated and entered in field 40.

| Vaping duty payable | Excise tax code |

|---|---|

| Liquid vaping products (ml) | 46 |

| Solid vaping products (g) | 47 |

Example 2

The B3 example below shows a commercial importation of a 30-gram bottle of solid vaping product that has a value for duty of $50.

In this example of the B3 - Text version

- In the field 21 we provided number 1

- In the field 22 we provided Vaping products/ Produits de vapotage

- In the field 27 we provided 2404190000

- In the field 29 we provided 0.030

- In the field 30 we provided KGM

- In the field 33 we provided 0.00000

- In the field 34 we provided 47.00000

- In the field 35 we provided 5.00

- In the field 36 we provided 50.00

- In the field 37 we provided 50.00

- In the field 38 we provided 0.00

- In the field 40 we provided 7.00

- In the field 41 we provided 57.00

- And in the field 42 we provided 2.85

Accounting where the vaping duty is relieved or not payable

76. To account for vaping products where the importer or goods meet the conditions of one of the exceptions mentioned in the “Vaping duty relieved or not payable on importation” section above, the importer must insert the correct tariff classification number on a single line for the goods and include the appropriate excise tax code in field 34. This code is based on the exception being claimed and indicates why the vaping duty is not payable (see table below for a list of applicable excise tax codes when an exception is being claimed). The vaping duty amount is entered as $0 in field 40.

| Vaping duty exceptions | Excise tax code |

|---|---|

| imported by a VPL | 80 |

| vaping product drug | 81 |

| personal importation within the prescribed limit | 82 |

Note: For the purposes of the table above, VPL means Vaping product licensee.

Example 3

The B3 example below is a commercial importation of a 30-gram bottle of vaping solid that has a value for duty of $50. In this example, the product is unstamped, unpackaged and imported by a vaping product licensee for further manufacturing. Excise tax code 80 is entered in field 34 to indicate this and relieves the vaping duty.

In this example of the B3 - Text version

- In the field 21 we provided number 1

- In the field 22 we provided Vaping products / Produits de vapotage

- In the field 27 we provided 2404190000

- In the field 29 we provided 0.030

- In the field 30 we provided KGM

- In the field 33 we provided 0.00000

- In the field 34 we provided 80.00000

- In the field 35 we provided 5.00

- In the field 36 we provided 50.00

- In the field 37 we provided 50.00

- In the field 38 we provided 0.00

- In the field 40 we provided 0.00

- In the field 41 we provided 50.00

- And in the field 42 we provided 2.50

Additional information on report and accounting

77. For more information regarding the report and the accounting for commercial goods and for casual goods (non-commercial), refer to D Memoranda series: D17 - Accounting and Release Procedures, at the link found in the "References" section of this memorandum.

Return and sale of vaping products

78. Section 117 of the Customs Act does not allow the return of vaping products unless the goods were seized in error.

79. Section 119.1 of the Customs Act allows the Minister to sell forfeited vaping products to a person with the appropriate license under the Excise Act, 2001.

Reporting and remitting the vaping duty to CRA

80. A vaping product licensee must file the Form B600, Vaping Duty and Information Return, monthly, to report their manufacturing activities (including inventories) and, if applicable, duty payable.

81. A vaping prescribed person who imports packaged vaping products is required to file the Form B601, Vaping Information Return - Prescribed Person, monthly, to report usage of vaping excise stamps.

82. For more information, refer to Reporting and remitting the vaping duty, at the link found in the "References" section of this memorandum.

Correction, refund, drawback, re-determination and further re-determination

83. The obligation to make a correction to the incorrect declaration starts when the importer has reason to believe that a declaration of origin, tariff classification or value for duty is incorrect. The prescribed 90 day period to make a correction pursuant to section 32.2 of the Customs Act starts on the date that the importer has, or was deemed to have had, specific information that a declaration is incorrect. Failure to correct incorrect declarations may result in the assessment of an Administrative Monetary Penalty (AMP) and interest. For more information, refer to the “Administration and enforcement” section of this memorandum.

84. Corrections to declarations and requests for refunds are to be made on Form B2, Canada Customs Adjustment Request, in the manner under the relevant provisions of the Customs Act, in accordance with the procedures outlined in Memorandum D11-6-6, “Reason to Believe” and Self-Adjustments to Declarations of Origin, Tariff Classification, and Value for Duty, Memorandum D6-2-3, Refund of Duties, Memorandum D6-2-6, Refund of Duties and Taxes on Non-commercial importations, and Memorandum D17-2-1, The Coding, Submission and Processing of Form B2 Canada Customs Adjustment Request, at the links found in the "References" section of this memorandum.

85. Where an amount of vaping duty on commercial goods is to be refunded to the importer or is to be paid to the CBSA, the CBSA will issue a Form B2‑1, Canada Customs – Detailed Adjustment Statement (DAS), which serves as a notice of refund or assessment, in response to an adjustment request, or in response to a review or re-determination initiated by the CBSA.

86. Drawback is available for customs duty and vaping duty when imported vaping products released from the CBSA are duty-paid and are exported, or are sold to accredited representatives. A drawback claim, accompanied by waivers (since either the importer or exporter can claim but not both), can be filed with the CBSA. There can be no drawback of the amount equivalent to excise levied under the Customs Tariff when this amount has been paid under the Excise Act, 2001 (e.g. entered into an excise warehouse immediately after release from CBSA). For more information, refer to Memorandum D7-4-2, Duty Drawback Program, at the link found in the "References" section of this memorandum.

87. Where there is overpayment of vaping duty on casual goods (non-commercial) that was paid to the CBSA, an importer may submit Form B2G, CBSA Informal Adjustment Request to the appropriate CBSA Casual Refund Centre to request refund of the amount overpaid. For more information, refer to Memorandum D6-2-6, Refund of Duties and Taxes on Non-commercial Importations, at the link found in the "References" section of this memorandum.

88. The CBSA may re-determine or further re-determine the origin, tariff classification or value for duty on its own initiative or in response to an adjustment request. In so doing, as with customs duties and taxes, the CBSA may assess any undeclared amount of vaping duty.

Review

89. Following a determination, Re-determination or further Re-determination of the origin, tariff classification or value for duty made by the CBSA, an importer may request a re-determination or further re-determination of origin, tariff classification, value for duty under the Customs Act. For more information, refer to Memorandum D11-6-7, Request under Section 60 of the Act for a Re-determination, a further Re-determination or a Review by the President of the Canada Border Services Agency, at the link found in the "References" section of this memorandum.

Keeping records

90. Every vaping product licensee and vaping prescribed person is required, under subsection 206(1) of the Excise Act, 2001, to maintain all records that are necessary to determine whether they are in compliance with that Act. This includes the amount of vaping products manufactured, received, used, packaged, sold and disposed of. Records must also support the information reported in respect of the possession and use of any vaping excise stamps issued.

91. Records must be kept for a period of at least six years from the end of the last year to which they relate.

92. For more information, refer to Excise Duty Memorandum EDM9-1-1, General Requirements for Books and Records, at the link found in the "References" section of this memorandum.

Administration and enforcement

93. The Customs Act legislative and administrative framework for importing and accounting including penalties, interest and enforcement action, will apply to vaping products until the time of release and to final accounting to the CBSA. After release from the CBSA, the provisions of the Excise Act, 2001 will apply as if the goods were domestic goods.

94. The Excise Act, 2001 provides penalties for different circumstances of non-compliance related to the vaping duty and the vaping stamping regime. For more information, refer to the Excise Act, 2001, at the link found in the "References" section of this memorandum.

95. Importations may be subject to examination at the time of importation and to post-release verification for compliance with the Origin, Tariff Classification, Value for duty, and Marking programs, and any other applicable programs or provisions administered by the CBSA. If non-compliance is encountered by the CBSA, in addition to assessments of any applicable duties and taxes, penalties may be imposed and interest will be assessed, where applicable.

96. For more information, refer to Memorandum D11-6-5, Interest and Penalty Provisions: Determinations/Re-determinations, Appraisals/Re-appraisals, and Duty Relief, Memorandum D22-1-1, Administrative Monetary Penalty System, and the Customs Act, at the links found in the "References" section of this memorandum.

Additional information

97. For more information, contact the CBSA Border Information Service (BIS):

Calls within Canada & the United States (toll free): 1-800-461-9999

Calls outside Canada && the United States (long distance charges apply):

1-204-983-3500 or 1-506-636-5064

TTY: 1-866-335-3237

Contact Us online (web form)

Contact Us at the CBSA website

98. For more information on how to register with CRA, refer to How to register for a business number or Canada Revenue Agency program accounts.

99. For more information on the vaping excise duty framework, refer to Excise duty for vaping products - Canada.ca

Appendix

Annex 1

HS Reference list: Goods that may be subject to the vaping duty and to the vaping excise stamp. For the most up to date classification numbers, refer to: Canadian Customs Tariff

| Vaping products | Tariff Classification |

|---|---|

| Vaping products that are vaping devices that contain vaping substances |

|

| Vaping products that are vaping substances in immediate containers |

|

| Vaping products that are vaping substances not in any vaping device or immediate container |

|

| Are not subject to the vaping excise duty framework | Tariff Classification |

| Vaping substance that contains tobacco | 2404.11.00.00 – containing tobacco |

| Vaping substance that includes any cannabis | 2404.19.00.00 – without tobacco or nicotine but containing any substances from cannabis |

| Vaping device without any vaping substance | 8543.40.00.90 – reusable, empty |

Annex 2

Examples of calculation of amounts of customs duty, vaping duty and GST

| A package containing 4 pods, with each pod containing 1.5 mL of vaping liquid | |

|---|---|

| Value for duty (VFD) | $40 |

| Customs duty (such products are duty-free) | $0 |

|

Vaping duty @ $1 per 2 millilitres (mL), or fraction thereof, for the first 10 mL of vaping substance ($1 X 4 pods of 1.5 mL each) |

$4 |

| Amounts payable—summary | |

| Customs duties | $0 |

| Vaping duty | $4 |

| Sub-total (value for tax) | $44 |

| GST | $2.20 |

| Total amount of duties and taxes | $6.20 |

Note: The vaping duty is calculated on the quantity of vaping liquid contained in each individual pod, not on the total volume contained in the package.

| A 30 grams bottle of vaping solid | |

|---|---|

| Value for duty (VFD) | $50 |

| Customs duty (such products are duty-free) | $0 |

|

Vaping duty @ $1 per 2 grams (g), or fraction thereof, for the first 10 g of vaping substance, and $1 per 10 g, or fraction thereof for amounts over the first 10 g ($5 for the first 10 g plus $2 for the next 20 g) |

$7 |

| Amounts payable—summary | |

| Customs duties | $0 |

| Vaping duty | $7 |

| Sub-total (value for tax) | $57 |

| GST | $2.85 |

| Total amount of duties and taxes | $9.85 |

Annex 3

Flow chart - Excise duty framework for the importation of vaping products

Annex 3 - Excise duty framework packaged vaping products: Text version

Licensing Requirements

If the importer only imports stamped packaged vaping products intended for the Canadian duty-paid market (not manufacturing or stamping in Canada):

- Vaping prescribed person is required

- Registration for the vaping stamping regime is required

If the importer is manufacturing or stamping vaping products in Canada:

- Vaping Product Licence (VPL) is required

- Registration for the vaping stamping regime may be required

- Excise warehouse licence is also required if vaping product licensee imports vaping products in Canada for export or for sale to an accredited representative

If the importer only imports vaping products for personal use in quantities that do not exceed the prescribed limit of 5 units:

- Vaping Product Licence and Vaping Prescribed Person registration are not required

- Registration for the vaping stamping regime is not required

Stamping Requirements

- Vaping stamp is required prior to CBSA release

- If unstamped: products have to be exported, abandoned or entered a customs sufferance warehouse stamped

Vaping stamp is affixed to packaged products

Vaping stamp is not required if:

- vaping products are packaged and will be stamped in Canada;

- vaping products are for export or for sale to an accredited representative or for transfer to an excise warehouse or customs bonded warehouse. Note: these products must also contain prescribed markings.

Vaping stamp is not required

Vaping Duty

Vaping duty is payable at the time of accounting

(see Report and accounting)

Vaping duty is relieved or not payable* (duty will be payable when the products are stamped in the VPL premises)

(see Report and accounting)

Vaping duty is relieved or not payable on only 1 unit under the personal exemption

(see Report and accounting)

Flow chart - Excise duty framework for the importation of vaping products

Annex 3 - Excise duty framework unpackaged vaping products: Text version

Licensing Requirements

- Vaping Product Licence is required

- Registration for the vaping stamping regime is required

Stamping Requirements

- Vaping stamp is not required on unpackaged products imported for further manufacturing (the vaping stamp will be applied after the product is packaged by the licensee)

- Unpackaged goods cannot enter an excise warehouse; they must be packaged and contain prescribed markings

Vaping Duty

Vaping duty is relieved on importation (it will be payable when stamped in Canada)

(see Report and accounting)

References

Consult these resources for further information.

Applicable legislation

- Canada Consumer Product Safety Act

- Customs Act

- Customs Sufferance Warehouses Regulations

- Customs Tariff

- Excise Act, 2001

- Excise Tax Act

- Food and Drugs Act

- Food and Drug Regulations

- Foreign Missions and International Organizations Act

- Non-residents’ Temporary Importation of Baggage and Conveyances Regulations

- Regulations Respecting the Possession of Tobacco, Cannabis or Vaping Products That Are Not Stamped

- Special Import Measures Act

- Stamping and Marking of Tobacco, Cannabis and Vaping Products Regulations

- Tobacco and Vaping Products Act

Superseded memoranda D

- D18-3-2 dated

Issuing office

Trade Policy Division

Trade Programs and Anti-dumping Directorate

Commercial and Trade Branch

Contact us

Contact border information services

Related links

- D1-2-1

- D2 series

- D3 series

- D4-1-4

- D4-1-7

- D5-1-1

- D6-2-3

- D6-2-6

- D7-4-2

- D7-4-4

- D11-4-16

- D11-6-5

- D11-6-6

- D11-6-7

- D11-1-1

- D11-11-3

- D17-1-3

- D17 series

- D17-2-1

- D17-1-22

- D17-4-0

- D22-1-1

- D23-3-1

- Form B2

- Form B2G

- Form B3-3

- Applying for a vaping product licence

- Excise Duty Notice EDN79, Obtaining and Renewing a Vaping Product Licence

- Excise Duty Notice EDN80, Overview of Vaping Excise Stamps

- Excise Duty Notice EDN81, Becoming a Vaping Prescribed Person

- Excise Duty Notice EDN82, Calculation of vaping duty

- Excise Duty Memorandum EDM9-1-1, General Requirements for Books and Records

- Form L601, Registration for Vaping Stamping Regime

- Reporting and remitting the vaping duty

- Vaping compliance and enforcement

- Date modified: