Memorandum D18-4-1: Select luxury items tax on importation

This D-memo will be updated and will come into effect with the scheduled external implementation of CARM in October 2024. The pending version is available now in PDF format only for your reference. The D-memo currently in effect is available on this page.

Pending D-memo in PDF - D18-4-1: Select luxury items tax on importation

Ottawa,

ISSN 2369-2391

This document is also available in PDF (681 KB) [help with PDF files]

In brief

This memorandum has been revised to

- Correct information found in paragraph 23 which now states that when a provincial sales tax is applicable, it applies to the value for tax of the subject item

- Include a B3-3, Canada Customs Coding Form example to demonstrate how the Harmonized Sales Tax (HST) is to be accounted for casual importations

- Inform that $0 or $0.01 can be entered in Line 2, field 37 of the B3-3, Canada Customs Coding Form when accounting for the goods when the luxury tax is payable or not payable.

This memorandum provides information concerning the administration and enforcement of the Select Luxury Items Tax under sections 2, 20, 22, 30, 34, 37, 38, 50, 77 and Division 5 of Part 1 of that Act, and sections 32.2, 42, 43, 59, 60, 61, 65, 67, 68, 70 and 74 of the Customs Act.

Legislation

- Customs Act

- Customs Tariff

- Select Luxury Items Tax Act

- Excise Tax Act

- Special Import Measures Act

- Value of Imported Goods (GST/HST) Regulations

- Vessel Duties Reduction or Removal Regulations

- Canadian Aviation Regulations

- Temporary Importation of Conveyances by Residents of Canada Regulations

- Motor Vehicle Safety Regulations

Guidelines and general information

Date of effect

1. The luxury tax will come into effect on .

Definitions

2. For a list of definitions of the words found in this memorandum, refer to subsection 2(1) of the Select Luxury Items Tax Act at the link found in the References section of this memorandum.

Currencies

3. All amounts expressed in this memorandum are in Canadian dollars (CAD).

Scope of the luxury tax

4. The luxury tax applies to importations into Canada of subject vehicles and subject aircraft that have a taxable amount above $100,000, and subject vessels that have a taxable amount above $250,000 (the price thresholds, respectively). For more information, refer to the Price thresholds, Taxable amount and Amount of luxury tax section of this memorandum.

5. A vehicle, aircraft or vessel falls within the scope of the luxury tax regime if it meets the definition of a subject vehicle, subject aircraft or a subject vessel, as set out in subsection 2(1) of the Select Luxury Items Tax Act. Such vehicles, aircraft and vessels are broadly referred to as subject items. Vehicles, aircraft or vessels that do not meet these definitions are not subject to the luxury tax. For more information, refer to the Subject items section of this memorandum.

6. Certain persons are required to register with the Canada Revenue Agency (CRA) as registered vendors under the Select Luxury Items Tax Act. Such persons include manufacturers, wholesalers, retailers and importers of subject vehicles, subject aircraft or subject vessels that are within the scope of the luxury tax regime and that are priced above the relevant price thresholds. For more information, refer to the Registration framework section of this memorandum.

Prohibited goods

7. The importation into Canada of certain subject items may be prohibited under tariff item No. 9897.00.00 of the schedule to the Customs Tariff. Exemption from the import restriction that relates to tariff item 9897.00.00 does not exempt a good from other import restrictions that may apply. For example, Transport Canada and Environment Canada have vehicle standards and emissions requirements that must also be met. The onus rests with the importer to determine the overall compliance status of the good prior to importing it. For more information about all aspects of vehicle admissibility, refer to Memorandum D9-1-11, Importation of Used or Second-hand Motor Vehicles and to Memorandum D19-12-1, Importation of Vehicles.

Subject items

Subject vehicle—definition

8. Subject vehicle means a motor vehicle that

- is designed or adapted primarily to carry individuals on highways and streets

- has a seating capacity of not more than 10 individuals

- has a gross vehicle weight rating, as that term is defined in subsection 2(1) of the Motor Vehicle Safety Regulations, that is less than or equal to 3,856 kg

- has a date of manufacture after 2018 and

- is designed to travel with four or more wheels in contact with the ground

9. Examples of subject vehicles include sedans, coupes, hatchbacks, convertibles, sport utility vehicles and light‑duty pickup trucks.

Subject vehicle—exclusions

10. Subject vehicle does not include

- an ambulance

- a hearse

- a motor vehicle that is clearly marked for policing activities

- a motor vehicle that is clearly marked and equipped for emergency medical response activities or emergency fire response activities

- a recreational vehicle that is designed or adapted to provide temporary residential accommodations, and is equipped with at least four of the following elements:

- cooking facilities

- a refrigerator or ice box

- a self-contained toilet

- a heating or air-conditioning system that can function independently of the vehicle engine

- a potable water supply system that includes a faucet and sink and

- a 110-V to 125-V electric power supply, or a liquefied petroleum gas supply, that can function independently of the vehicle engine

- a motor vehicle

- that is registered before September 2022 with a government1 and

- in respect of which possession was transferred to a user of the motor vehicle before September 2022

1refers to any Canadian or foreign government

Subject aircraft—definition

11. Subject aircraft means an aircraft that is

- an aeroplane, glider or helicopter, as those terms are defined in subsection 101.01(1) of the Canadian Aviation Regulations, that has a date of manufacture after 2018 if the aircraft

- is equipped only with one or more pilot seats and cannot have any other seating configuration

- is equipped only with one or more pilot seats, or is not equipped with any seats, and cannot have a seating configuration, excluding pilot seats, of 40 or greater or

- is equipped with one or more pilot seats and one or more passenger seats and has a seating configuration, excluding pilot seats, of 39 or fewer

Subject aircraft—exclusions

12. Subject aircraft does not include

- an aircraft that is designed and equipped for military activities

- an aircraft that is equipped for the carriage of goods only

- an aircraft

- that is registered with a government1 before September 2022 otherwise than solely for a purpose incidental to its manufacture, offering for sale or transportation and

- in respect of which a user of the aircraft has possession before September 2022

- a subject vehicle

1refers to any Canadian or foreign government

Vessel and subject vessel—definitions

13. Vessel means a boat, ship or craft that is designed, or is capable of being used, solely or partly for navigation in, on, through or immediately above water, without regard to the method or lack of propulsion.

14. Subject vessel means a vessel that

- is designed or adapted for leisure, recreation or sport activities and

- has a date of manufacture after 2018

Subject vessel—exclusions

15. Subject vessel does not include:

- a floating home, as defined in subsection 123(1) of the Excise Tax Act

- a vessel that is designed and equipped solely for

- commercially catching, harvesting or transporting fish or other living marine resources or

- ferrying passengers or vehicles on a fixed schedule between two or more points

- a vessel that has sleeping facilities for more than 100 individuals who are not crew members

- a vessel

- that is registered with a government1 before September 2022, otherwise than solely for a purpose incidental to its manufacture, offering for sale or transportation and

- in respect of which a user of the vessel has possession before September 2022

- a subject vehicle or a subject aircraft

1refers to any Canadian or foreign government

Tariff classification numbers

16. For tariff classification reference purposes only at time of issuance of this memorandum, a list of goods that may be subject to the luxury tax, accompanied with their respective tariff classification numbers, is found in Annex 1 of this memorandum.

Price Thresholds, Taxable amount and Amount of luxury tax

Price thresholds

17. As per Section 9 of the Select Luxury Items Tax Act, the price threshold in respect of a subject item is

- in the case of a subject vehicle, $100,000

- in the case of a subject aircraft, $100,000 and

- in the case of a subject vessel, $250,000

Taxable amount

18. For the purposes of calculating the taxable amount of a subject item at importation, the applicable GST/HST and provincial sales tax to the subject item are not to be taken into account. In addition, any deduction for a trade-in or down payment does not reduce the taxable amount of a subject item for the purposes of determining the applicable luxury tax.

19. The amounts of any duties and taxes (e.g., customs duty, excise tax, etc.), payable in respect of the importation of the subject item, other than the GST/HST and provincial sales tax, have to be included in the taxable amount for the purposes of determining the amount of luxury tax.

20. As per Section 20(2) of the Select Luxury Items Tax Act, the taxable amount is A in the formula + B in the formula:

A is the value of the subject item as it would be determined under sections 48 to 53 of the Customs Act (i.e., value for duty)

+

B is any duties and taxes payable related to customs (e.g., under the Customs Tariff, the Excise Tax Act or the Special Import Measures Act, etc.), other than the GST/HST and provincial sales tax.

Amount of luxury tax

21. As per section 34 of the Select Luxury Items Tax Act, the amount of luxury tax is calculated at the lesser of:

20 % of the taxable amount above the relevant price threshold of the subject item

or

10 % of the taxable amount of the subject item.

GST/HST and provincial sales tax

22. The GST/HST is applicable to the final value of the subject item (as per the rules set out in the Excise Tax Act), inclusive of the amount of luxury tax as calculated above. This final value amount is also referred to as the “Value for tax” for the Canada Border Services Agency’s (CBSA) accounting purposes.

Value for tax = taxable amount + amount of luxury tax

23. When a provincial sales tax is applicable, it applies to the value for tax of the subject item.

Duties and taxes payable

24. All applicable duties and taxes related to customs (e.g. under the Customs Tariff, the Excise Tax Act or the Special Import Measures Act, etc.), inclusive of the GST/HST and of the provincial sales tax (if applicable), are payable in respect of the importation of a subject item, in addition to the payable luxury tax.

Illustrative examples

25. For examples on the calculation of taxable amounts, amounts of luxury tax and amounts of other duties and taxes, refer to Annex 2 of this memorandum.

Application framework

Luxury tax payable on importation

26. As per subsection 20 (1) of the Select Luxury Items Tax Act, a person that is liable under the Customs Act to pay duty on an imported subject item, or that would be so liable if the subject item were subject to duty, must pay tax in respect of the subject item in the amount determined under section 34 (“Amount of luxury tax” section of this memorandum) if the taxable amount of the subject item exceeds the price threshold in respect of the subject item, unless one of the exceptions mentioned in the “Tax not payable on importation—Exceptions” section of this memorandum applies.

Application of Customs Act

27. As per subsection 20(4) of the Select Luxury Items Tax Act, the luxury tax in respect of a subject item is to be paid and collected under the Customs Act. In addition, interest and penalties are to be imposed, calculated, paid and collected under that Act, as if the tax were a customs duty levied on the subject item under the Customs Tariff.

Tax not payable on importation—exceptions

28. Section 21 of the Select Luxury Items Tax Act provides exceptions where the luxury tax is not payable on importation of subject items. Such exceptions are:

Registered vendor

29. The luxury tax in respect of a subject item that is imported is not payable if the subject item is imported by a registered vendor in respect of that type of subject item.

Written agreement for the sale prior to January 2022

30. The luxury tax will not apply to the importation of a subject item that has a taxable amount above the price threshold where a purchaser and a vendor have entered into a written agreement for the sale of the subject item before January 2022 in the course of the vendor’s business of selling that type of subject item.

1This provision is legislated by paragraph 135(4)(b) of the Budget Implementation Act, 2022, No. 1.

Previously registered vehicles

31. The luxury tax in respect of a subject vehicle that is imported is not payable if the subject vehicle has been registered with the Government of Canada or a province before the importation unless

- the registration was done in connection with the importation and

- the subject vehicle has never otherwise been registered with the Government of Canada or a province

Certain police and military vehicles

32. The luxury tax in respect of a subject vehicle that is imported is not payable if

- the subject vehicle is equipped for policing activities and imported by a police authority or a military authority or

- the subject vehicle is equipped for military activities and imported by a military authority

Tax certificate

33. The luxury tax in respect of a subject aircraft or subject vessel is not payable if a tax certificate issued by the CRA in respect of the subject aircraft or subject vessel is in effect in accordance with section 37 of the Select Luxury Items Tax Act at the time at which the tax would become payable in the absence of subsection 21(4) of the Select Luxury Items Tax Act.

Special import certificate

34. The luxury tax under section 20 of the Select Luxury Items Tax Act in respect of a subject aircraft or subject vessel (other than a select subject vessel1) that is imported is not payable if, at the time at which the tax would become payable in the absence of subsection 21(5), a special import certificate issued by the CRA in respect of the importation is in effect in accordance with section 38 of that Act.

1“select subject vessel” means a subject vessel that is equipped with a bed, bunk, berth or similar sleeping amenity.

35. For example, foreign businesses operating their corporate jet in Canada must obtain this special import certificate prior to importation if they don’t meet the conditions set out in heading 98.01 of the schedule to the Customs Tariff.

Special cases

36. The luxury tax in respect of a subject item that is imported is not payable if

- the subject item is classified under heading No. 98.01 or tariff item No. 9802.00.00 or 9803.00.00 of the schedule to the Customs Tariff, to the extent that the subject item is not subject to duty under that Act

- the subject item is imported for the sole purpose of maintenance, overhaul or repair of the subject item in Canada and

- neither title to, nor beneficial use of, the subject item is intended to pass, or passes, to a person in Canada while the subject item is in Canada and

- the subject item is exported as soon after the maintenance, overhaul or repair is completed as is reasonable having regard to the circumstances surrounding the importation and, where applicable, to the normal business practice of the importer

- it is the case that

- the subject item is a foreign-based conveyance

- the importation of the subject item was non-taxable by reason of the reference to heading No. 98.01 of the schedule to the Customs Tariff in paragraph (a) but the subject item is diverted solely for maintenance, overhaul or repair in Canada

- neither title to, nor beneficial use of, the subject item is intended to pass, or passes, to a person in Canada while the subject item is in Canada and

- the subject item is exported as soon after the maintenance, overhaul or repair is completed as is reasonable having regard to the circumstances surrounding the importation and, where applicable, to the normal business practice of the importer

- the subject item is a subject vessel imported in circumstances where customs duties have been removed under subsection 7(1) of the Vessel Duties Reduction or Removal Regulations

- the subject item is a subject vehicle that is imported temporarily by an individual resident in Canada and

- the subject item was last provided in the course of a vehicle rental business to the individual by way of lease, licence or similar arrangement under which continuous possession or use of the subject item is provided for a period of less than 180 days

- immediately before the importation, the individual was outside Canada for an uninterrupted period of at least 48 hours and

- the subject item is exported within 30 days after the importation

- the subject item would be classified under heading No. 98.02 of the schedule to the Customs Tariff to the extent that the subject item would not be subject to duty under that Act if the definition conveyance in section 2 of the Temporary Importation of Conveyances by Residents of Canada Regulations were read as follows:

“conveyance” means any vehicle, aircraft, water-borne craft or other contrivance that is used to move persons or goods.

Note: as subject vessels cannot be classified under heading No. 98.02 of the schedule to the Customs Tariff, in this specific situation, all other applicable duties and taxes remain payable in full. The only relief provided is from the luxury tax.

37. For more information on registered vendors, refer to “Registration Under the Select Luxury Items Tax Act” and for more information on the tax certificate and the special import certificate, refer to “Luxury tax—Services and information”, at the links provided in the References section of this memorandum.

Temporary importation under tariff item No. 9993.00.00

38. Subject vehicles and subject aircraft when imported temporarily under tariff Item No. 9993.00.00 of the schedule to the Customs Tariff may be relieved of the luxury tax under certain circumstances when they qualify as a special case in the section “Special cases” above.

39. A subject vessel imported for storage and/or repair under tariff Item No. 9993.00.00 of the schedule to the Customs Tariff for 12 months may be granted an additional 12 months under tariff item No. 9993.00.00 for the relief of the GST/HST at a rate of 1/120 under section 7(2) of the Vessel Duties Reduction or Removal Regulations and may also be subject to additional administrative requirements, including additional documentation. However, no extension of tax deferral is permitted regarding the luxury tax; this tax on the value of the vessel determined at the time of importation becomes payable immediately after 12 months. These vessels must be documented on a Form B3-3, Canada Customs Coding Form.

40. For more information, refer to Memorandum D8-1-1, Administration of Temporary Importation (Tariff Item No. 9993.00.00) Regulations.

Supporting documents—requirements

41. The CBSA may require supporting documentation for the importation of a subject item meeting conditions from one of the exceptions mentioned above. Such documents may be a proof of valid registration number under the luxury tax regime, a special import certificate, a tax certificate or a written agreement for the sale prior to January 2022. This shall be provided to the CBSA with the importation documents when the declaration is submitted in paper format. When the declaration is submitted electronically, the supporting documents must be available and must be submitted to CBSA upon the request by CBSA. For more information, refer to “Luxury tax notices” at the link found in the References section of this memorandum.

42. An importer must apply to the CRA in order to obtain a special import certificate or a tax certificate. For more information, refer to “Luxury tax—Services and information” at the link found in the References section of this memorandum.

43. If, at the time of accounting, the importer’s registration status with CRA, the special import certificate, the tax certificate, the written agreement for the sale prior to January 2022, and/or any other required supporting document is not in effect or is not presented to the CBSA when required, in respect of the particular importation, and that the luxury tax would be payable in the absence of such proof, then the luxury tax would apply.

Flow Chart—Application of the luxury tax on importation

Registration framework

44. Under section 50 of the Select Luxury Items Tax Act, there are certain circumstances where a person is required to register with the CRA under the luxury tax regime. If required to register, a person must register as a registered vendor of the type of subject item that they import. Accordingly, there are three types of registrations available:

- registered vendor of subject vehicles

- registered vendor of subject aircraft

- registered vendor of subject vessels

45. A registered vendor of a type of subject item will be able to import subject items of that type without the luxury tax applying at the time of accounting.

46. For more information, refer to “Registration Under the Select Luxury Items Tax Act” at the link found in the References section of this memorandum.

Declaration and accounting

Commercial Goods

47. Declaration and accounting of subject items that are commercial goods where the luxury tax is, or is not, payable on importation, is made in the same way and within the same prescribed time that customs duties and other taxes are, or are not, payable.

48. When accounting for subject vehicles, aircraft or vessels, the importer should complete the B3, using the same method as it would normally. This includes correctly determining the proper classification number and calculating the regular duties and taxes on the same B3 line. If provincial taxes are applicable, this will also be calculated on a separate line, as per the normal procedures outlined in Memorandum D17-1-22, Accounting for the Harmonized Sales Tax, Provincial Sales Tax, Provincial Tobacco Tax and Alcohol Markup/Fee on Casual Importations in the Courier and Commercial Streams.

Luxury tax payable on importation

49. To account for subject vehicles, aircraft or vessels where luxury tax is payable on the importation, the importer must insert the dummy classification number 0000.9999.69 on a separate line below the one for the goods and include the appropriate excise tax code in field 34. This code is based on the goods imported and the method used to calculate the luxury tax (see table below for a list of applicable excise tax codes when the luxury tax is payable). The luxury tax amount is manually calculated and entered in field 40, and GST is calculated on this amount and entered in field 42.

| Luxury tax payable | Excise tax code |

|---|---|

| 20% of the taxable amount above $100,000 of the vehicle | 60 |

| 10% of the taxable amount of the vehicle | 61 |

| 20% of the taxable amount above $100,000 of the aircraft | 62 |

| 10% of the taxable amount of the aircraft | 63 |

| 20% of the taxable amount above $250,000 of the vessel | 64 |

| 10% of the taxable amount of the vessel | 65 |

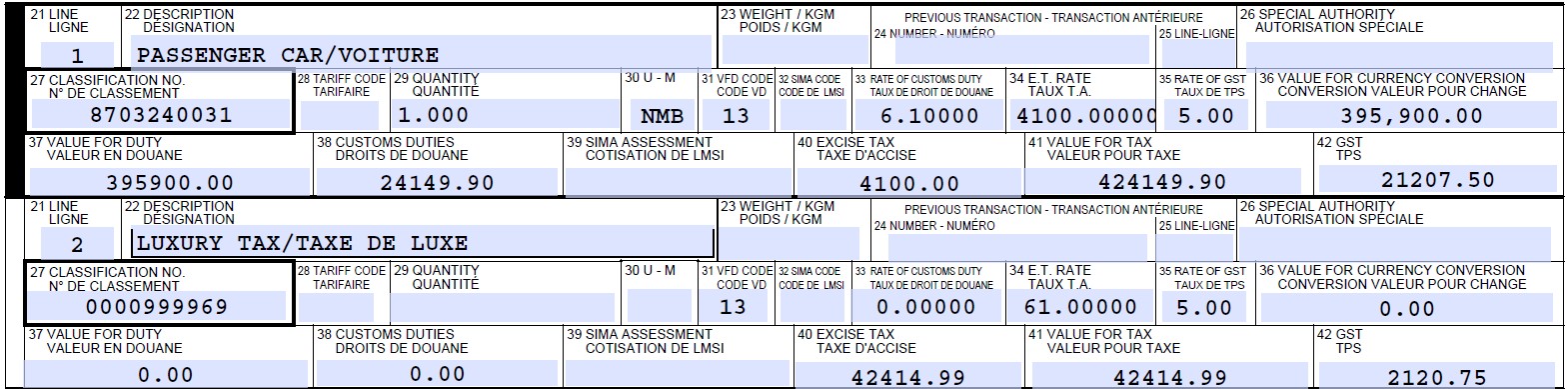

Example 1

This example corresponds to example 1 shown in Annex 2, with a subject vehicle that has a value for duty of $395,900 and attracts a 6.1% customs duty rate, a $4,000 green levy rate, and a $100 air conditioners excise tax.

Classification Line 1 shows the classification number of the vehicle (field 27), applicable customs duty rate (field 33), customs duty amount (field 38), excise tax rate for the green levy and air conditioner excise tax (field 34), excise tax amount for the green levy and air conditioners excise tax (field 40), GST rate (field 35) and GST amount (field 42).

Classification Line 2 shows the dummy classification number for the luxury tax (field 27), applicable excise tax code (field 34), luxury tax amount (field 40), GST rate (field 35) and GST amount on the luxury tax (field 42).The value for currency conversion (field 36) and value for duty (field 37) can be left blank or entered as “0.01”.

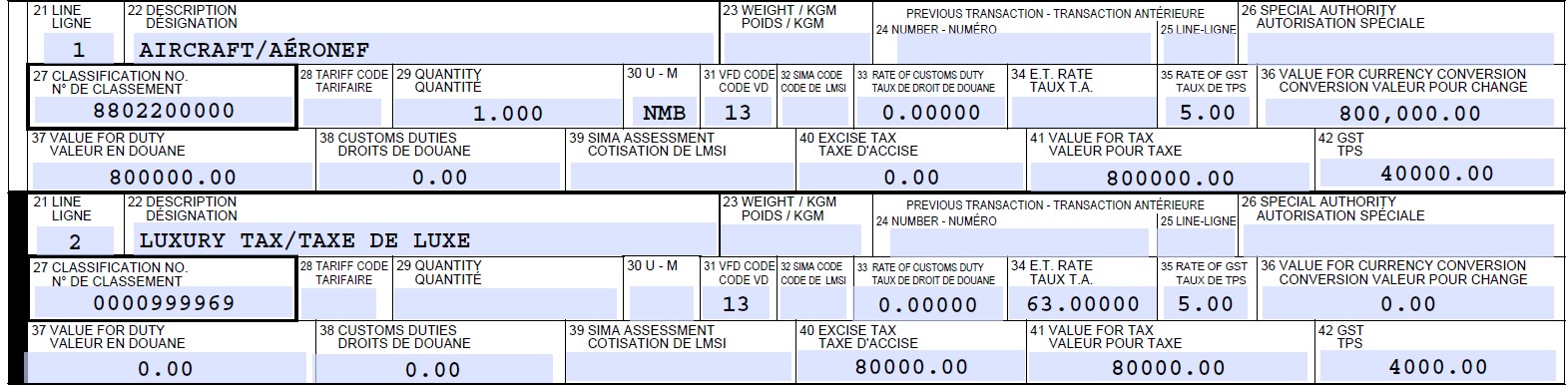

Example 2

This example corresponds to example 2 shown in Annex 2, with a subject aircraft that has a value for duty of $800,000. The aircraft is duty free (0%).

Classification Line 1 shows the classification number of the aircraft (field 27), GST rate (field 35), and GST amount (field 42).

Classification Line 2 shows the dummy classification number for the luxury tax (field 27), applicable excise code (field 34), luxury tax amount (field 40), GST rate (field 35) and GST amount on the luxury tax (field 42). The value for currency conversion (field 36) and value for duty (field 37) can be left blank or entered as “0.01”.

Example 3

This example is the same as Example 1 above, however the importation is casual and HST is applicable.

Classification Line 1 shows the classification number of the vehicle (field 27), applicable customs duty rate (field 33), customs duty amount (field 38), excise tax rate for the green levy and air conditioner excise tax (field 34), and excise tax amount for the green levy and air conditioners excise tax (field 40). Code 99 is entered in the Rate of GST field (field 35) to exempt the GST on this classification line.

Classification Line 2 shows the dummy classification number for the luxury tax (field 27), applicable excise tax code (field 34), and luxury tax amount (field 40). Code 99 is entered in the rate of GST field (field 35) to exempt the GST on this classification line. The value for currency conversion (field 36) and value for duty (field 37) can be left blank or entered as “0.01”

Classification Line 3 shows the dummy classification number for the designated province, code 39 which is entered in the Rate of GST field (field 35) to indicate HST is applicable, and the off entry calculated amount of HST which is entered in the GST field (field 42). This amount is calculated based on the value for tax, which is inclusive of the luxury tax amount. The value for currency conversion (field 36) and value for duty (field 37) can be left blank or entered as “0.01”.

Luxury tax not payable on importation

50. To account for subject vehicles, aircraft or vessels where the importer or goods meet one the exception conditions mentioned above and the luxury tax is not payable on the importation, the importer must insert dummy classification number 0000.9999.69 on a separate line below the one for the goods and include the appropriate excise tax code in field 34. This code is based on the exception being claimed and indicates why the luxury tax is not payable (see table below for a list of applicable excise tax codes when an exception is being claimed). The luxury tax amount is entered as $0 in field 40.

| Luxury tax exception | Excise tax code |

|---|---|

| Registered Vendor | 66 |

| Tax Certificate | 67 |

| Special Import Certificate | 68 |

| Other exceptions outlined in this memorandum that are not covered under codes 66-68 | 69 |

This example corresponds to the same scenario as Example 1, with a subject vehicle that has a value for duty of $395,900 and attracts a 6.1% customs duty rate, a $4,000 green levy rate, and a $100 air conditioners excise tax. In this case however, the importer is a registered vendor and is not subject to the luxury tax at the time of importation.

Classification Line 1 shows the classification number of the vehicle (field 27), applicable customs duty rate (field 33), customs duty amount (field 38), excise tax rate for the green levy and air conditioner excise tax (field 34), excise tax amount for the green levy and air conditioners excise tax (field 40), GST rate (field 35) and GST amount (field 42).

Classification Line 2 shows the dummy classification number for the luxury tax (field 27), applicable excise tax code (field 34), luxury tax amount (field 40), GST rate (field 35) and GST amount on the luxury tax (field 42). The value for currency conversion (field 36) and value for duty (field 37) can be left blank or entered as “0.01”

Casual goods (non-commercial)

51. Declaration and accounting of subject items that are casual goods where the luxury tax is, or is not, payable on importation, is made in the same way and within the same prescribed time that customs duties and other taxes are, or are not, payable. Importers should be prepared to present on demand to the officer, any relevant documentation, as would be the case for any other good. Officers will determine if the luxury tax is applicable to the subject item and proceed with the necessary calculations.

52. When the luxury tax has already been paid, importers are encouraged to keep with the subject item any documentation or copy of documentation, receipts and/or certificates, that demonstrates that the luxury tax has been paid.

Special cases

53. The luxury tax is payable in full when the subject item is classified under tariff item Nos. 9806.00.00 and 9807.00.00.

54. The Select Luxury Items Tax Act does not affect the establishment of the value for duty. This means that in cases where the subject item cannot be classified under heading Nos. 98.04, 98.05 and 98.16, because the value for duty exceeds the amount specified for these headings, the value for duty is to be reduced in accordance with sections 83, 84 and 85 of the Customs Tariff. It is that reduced value that will be used to establish the taxable amount and allow the officer to determine if the subject item is subject to the luxury tax, and if so, the amount of tax to be collected.

Additional information on declaration and accounting

55. For more information regarding the declaration and the accounting for subject items that are commercial goods and subject items that are casual goods (non-commercial), refer to D Memoranda series: D17—Accounting and Release Procedures.

Rulings

56. The CBSA recommends that importers submit an application for a ruling if they have any doubt as to the origin, tariff classification or value for duty of goods. The procedures for obtaining a ruling are outlined in Memorandum D11-11-1, National Customs Rulings (NCR), Memorandum D11-11-3, Advance Rulings for Tariff Classification, and Memorandum D11-4-16, Advance Rulings Under Free Trade Agreements.

Correction, refund, re-determination and further re-determination

Commercial goods

57. The obligation to make a correction to the incorrect declaration starts when the importer has reason to believe that a declaration of origin, tariff classification or value for duty is incorrect. The prescribed 90-day period to make a correction pursuant to section 32.2 of the Customs Act starts on the date that the importer has, or was deemed to have had, specific information that a declaration is incorrect.

58. Corrections to declarations and requests for refunds are to be made on Form B2, Canada Customs Adjustment Request in the manner under the relevant provisions of the Customs Act, in accordance with the procedures outlined in Memorandum D11-6-6, “Reason to Believe” and Self-Adjustments to Declarations of Origin, Tariff Classification, and Value for Duty, Memorandum D6-2-3, Refund of Duties, Memorandum D6-2-6, Refund of Duties and Taxes on Non-commercial Importations, and D17-2-1, The Coding, Submission and Processing of Form B2 Canada Customs Adjustment Request.

59. Where an amount of luxury tax is to be refunded to the importer or is to be paid to the CBSA, the CBSA will issue a Form B2‑1, Canada Customs—Detailed Adjustment Statement (DAS), which serves as a notice of refund or assessment, in response to an adjustment request, or in response to a review or re-determination initiated by the CBSA.

60. A drawback shall not be granted in respect of the luxury tax.

Casual goods (non-commercial)

61. Where there is overpayment of luxury tax, an importer may submit Form B2G, CBSA Informal Adjustment Request to the appropriate CBSA Casual Refund Centre to request refund of the amount overpaid as per Memorandum D6-2-6, Refund of Duties and Taxes on Non-commercial Importations.

Commercial goods and casual goods (non-commercial)

62. The CBSA may re-determine or further re-determine the origin, tariff classification or value for duty on its own initiative or in response to an adjustment request. In so doing, as with customs duties and taxes, the CBSA may assess any undeclared amount of luxury tax.

63. As per subsection 22(1) of the Select Luxury Items Tax Act, determination of the tax status of a subject item means a determination, re-determination or further re-determination that tax is, or is not, payable in respect of the subject item.

64. As per subsection 22(2) of the Select Luxury Items Tax Act, the determination of the tax status of a subject item is considered to be the determination, re-determination or further re-determination, as the case requires, of the tariff classification of the subject item (subject to subsections 22 (4) to (6) of the Select Luxury Items Tax Act, the Customs Act (other than subsections 67(2) and (3) and sections 68 and 70) and the regulations made under the Act apply, with any modifications that the circumstances require).

65. As per subsection 22(3) of the Select Luxury Items Tax Act, the appraisal, re-appraisal or further re-appraisal of the value of a subject item is considered to be the appraisal, re-appraisal or further re-appraisal, as the case requires, of the value for duty of the subject item (subject to the Customs Act and the regulations made under the Act that apply, with any modifications that the circumstances require).

Rebate

66. An importer seeking a rebate for luxury tax paid under sections 39, 40, 41, 42, and 43 of the Select Luxury Items Tax Act must submit an application for rebate to the CRA. For more information, refer to “Luxury tax—Services and information” at the link found in the References section of this memorandum.

Review

67. Following a determination, Re-determination or further Re-determination of the origin, tariff classification or value for duty made by the CBSA, an importer may request a re-determination or further re-determination of origin, tariff classification, value for duty under the Customs Act. For more information, refer to Memorandum D11-6-7, Request under Section 60 of the Act for a Re-determination, a further Re-determination or a Review by the President of the Canada Border Services Agency.

68. As per subsection 22(4) of the Select Luxury Items Tax Act, in applying the Customs Act to a determination of the tax status of a subject item, the references in that Act to the “Canadian International Trade Tribunal” are referred to the “Tax Court of Canada”.

Administration and enforcement

Examinations and verifications

69. The burden of proof lies with the importer to:

- demonstrate that the goods are not subject to the luxury tax

- demonstrate that the importation is not prohibited and

- provide supporting required documents when an exception applies and where such documents are required

70. Importations may be subject to examination at the time of importation and to post-release verification for compliance with the Origin, Tariff Classification, Value for duty, and Marking programs, and any other applicable programs or provisions administered by the CBSA. If non-compliance is encountered by the CBSA, in addition to assessments of any applicable duties and taxes, penalties may be imposed and interest will be assessed, where applicable.

71. For more information, refer to Memorandum D11-6-5, Interest and Penalty Provisions: Determinations/Re-determinations, Appraisals/Re-appraisals, and Duty Relief, Memorandum D22-1-1, Administrative Monetary Penalty System, and the Customs Act.

Penalties under the Select Luxury Items Tax Act

72. The Select Luxury Items Tax Act provides penalties for different circumstances of non-compliance. The list of such penalties is found under Subdivision H of that Act.

Additional information

73. For more information, contact the CBSA Border Information Service (BIS):

Calls within Canada & the United States (toll free): 1-800-461-9999

Calls outside Canada & the United States (long distance charges apply):

1-204-983-3550 or 1-506-636-5064

TTY: 1-866-335-3237

Contact Us online (webform)

Contact us at the CBSA website may also be accessed for information.

74. For more information on the use of the CARM Client Portal in terms of advance rulings, refer to the Onboarding documentation into the CARM Client Portal. If further assistance is required, contact the CARM Client Support Help Desk (CCSH) by completing the Web form.

75. How to register for a business number or Canada Revenue Agency program accounts.

76. For more information on the luxury tax program, go to Luxury tax.

Annex 1: HS Reference list

Goods that may be subject to the luxury tax. For the most up to date classification numbers, refer to Canadian customs tariff.

| Heading | Tariff class. number | Description |

|---|---|---|

| 87.02 | Motor vehicles for the transport of ten or more persons, including the driver. | |

| 8702.10.20.00 | With only compression-ignition internal combustion piston engine (diesel or semi-diesel) for the transport of ten to 15 persons, including the driver. | |

| 8702.20.20.00 | With both compression-ignition internal combustion piston engine (diesel or semi-diesel) and electric motor as motors for propulsion for the transport of ten to 15 persons, including the driver. | |

| 8702.30.20.00 | With both spark-ignition internal combustion piston engine and electric motor as motors for propulsion for the transport of ten to 15 persons, including the driver. | |

| 8702.40.20.00 | With only electric motor for propulsion for the transport of ten to 15 persons, including the driver. | |

| 8702.90.20.00 | With other means of propulsion, for the transport of ten to 15 persons, including the driver. | |

| 87.03 | Motor cars and other motor vehicles principally designed for the transport of persons (other than those of heading 87.02), including station wagons and racing cars. | |

| 8703.21.90.10 | Passenger cars, including racing cars and station wagons, with only spark-ignition internal combustion piston engine of a cylinder capacity not exceeding 1,000 cc. | |

| 8703.21.90.90 | Other vehicles with only spark-ignition internal combustion piston engine of a cylinder capacity not exceeding 1,000 cc | |

| 8703.22.00.11 | Used passenger cars, including racing cars and station wagons, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 1,000 cc but not exceeding 1,500 cc | |

| 8703.22.00.12 | New passenger cars, including racing cars and station wagons, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 1,000 cc but not exceeding 1,500 cc | |

| 8703.22.00.97 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), used, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 1,000 cc but not exceeding 1,500 cc | |

| 8703.22.00.98 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), new, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 1,000 cc but not exceeding 1,500 cc | |

| 8703.23.00.21 | Used passenger cars, including racing cars and station wagons, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 1,500 cc but not exceeding 3,000 cc | |

| 8703.23.00.22 | New passenger cars, including racing cars and station wagons, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 1,500 cc but not exceeding 3,000 cc | |

| 8703.23.00.91 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), used, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 1,500 cc but not exceeding 3,000 cc | |

| 8703.23.00.92 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), new, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 1,500 cc but not exceeding 3,000 cc | |

| 8703.24.00.31 | Used passenger cars, including racing cars and station wagons, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 3,000 cc | |

| 8703.24.00.32 | New passenger cars, including racing cars and station wagons, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 3,000 cc | |

| 8703.24.00.91 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), used, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 3,000 cc | |

| 8703.24.00.92 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), new, with only spark-ignition internal combustion piston engine of a cylinder capacity exceeding 3,000 cc | |

| 8703.31.00 00 | Vehicles with only compression-ignition internal combustion piston engine (diesel or semi-diesel) of a cylinder capacity not exceeding 1,500 cc | |

| 8703.32.00.21 | Used passenger cars, including racing cars and station wagons, with only compression-ignition internal combustion piston engine (diesel or semi-diesel) of a cylinder capacity exceeding 1,500 cc but not exceeding 2,500 cc | |

| 8703.32.00.22 | New passenger cars, including racing cars and station wagons, with only compression-ignition internal combustion piston engine (diesel or semi-diesel) of a cylinder capacity exceeding 1,500 cc but not exceeding 2,500 cc | |

| 8703.32.00.97 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), used, with only compression-ignition internal combustion piston engine (diesel or semi-diesel) of a cylinder capacity exceeding 1,500 cc but not exceeding 2,500 cc | |

| 8703.32.00.98 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), new, with only compression-ignition internal combustion piston engine (diesel or semi-diesel) of a cylinder capacity exceeding 1,500 cc but not exceeding 2,500 cc | |

| 8703.33.00.31 | Used passenger cars, including racing cars and station wagons, with only compression-ignition internal combustion piston engine (diesel or semi-diesel) of a cylinder capacity exceeding 2,500 cc | |

| 8703.33.00.32 | New passenger cars, including racing cars and station wagons, with only compression-ignition internal combustion piston engine (diesel or semi-diesel) of a cylinder capacity exceeding 2,500 cc | |

| 8703.33.00.97 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), used, with only compression-ignition internal combustion piston engine (diesel or semi-diesel) of a cylinder capacity exceeding 2,500 cc | |

| 8703.33.00.98 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), new, with only compression-ignition internal combustion piston engine (diesel or semi-diesel) of a cylinder capacity exceeding 2,500 cc | |

| 8703.40.10.00 | Vehicles with both spark-ignition internal combustion piston engine, of a cylinder capacity not exceeding 1,000 cc, and electric motor as motors for propulsion, other than those capable of being charged by plugging to external source of electric power | |

| 8703.40.90.10 | Passenger cars, including racing cars and station wagons, with both spark-ignition internal combustion piston engine and electric motor as motors for propulsion, other than those capable of being charged by plugging to external source of electric power | |

| 8703.40.90.90 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), with both spark-ignition internal combustion piston engine and electric motor as motors for propulsion, other than those capable of being charged by plugging to external source of electric power | |

| 8703.50.00.00 | Vehicles, with both compression-ignition internal combustion piston engine (diesel or semi-diesel) and electric motor as motors for propulsion, other than those capable of being charged by plugging to external source of electric power | |

| 8703.60.10.00 | Vehicles with both spark-ignition internal combustion piston engine, of a cylinder capacity not exceeding 1,000 cc, and electric motor as motors for propulsion, capable of being charged by plugging to external source of electric power | |

| 8703.60.90.10 | Passenger cars, including racing cars and station wagons, with both spark-ignition internal combustion piston engine and electric motor as motors for propulsion, capable of being charged by plugging to external source of electric power | |

| 8703.60.90.90 | Other vehicles (including crossovers, sport utility vehicles and passenger vans), with both spark-ignition internal combustion piston engine and electric motor as motors for propulsion, capable of being charged by plugging to external source of electric power | |

| 8703.70.00.00 | Other vehicles, with both compression-ignition internal combustion piston engine (diesel or semi-diesel) and electric motor as motors for propulsion, capable of being charged by plugging to external source of electric power | |

| 8703.80.00.10 | Passenger cars, including racing cars and station wagons, with only electric motor for propulsion | |

| 8703.80.00.90 | Other (including crossovers, sport utility vehicles and passenger vans) with only electric motor for propulsion | |

| 8703.90.00.00 | Other vehicles | |

| 87.04 | Motor vehicles for the transport of goods. | |

| 8704.21.90.10 | Vehicles with only compression-ignition internal combustion piston engine (diesel or semi-diesel), with a g.v.w. not exceeding 2 tonnes | |

| 8704.21.90.20 | Vehicles with only compression-ignition internal combustion piston engine (diesel or semi-diesel), with a g.v.w. exceeding 2 tonnes but not exceeding 3 tonnes | |

| 8704.21.90.30 | Vehicles with only compression-ignition internal combustion piston engine (diesel or semi-diesel), with a g.v.w. exceeding 3 tonnes but not exceeding 5 tonnes | |

| 8704.31.00.10 | Vehicles with only spark-ignition internal combustion piston engine, with a g.v.w. not exceeding 2.5 tonnes | |

| 8704.31.00.20 | Vehicles with only spark-ignition internal combustion piston engine, with a g.v.w. not exceeding 2.5 tonnes but not exceeding 5 tonnes | |

| 8704.41.90.10 | Vehicles with both compression-ignition internal combustion piston engine (diesel or semi-diesel) and electric motor as motors for propulsion, with a g.v.w. not exceeding 2 tonnes | |

| 8704.41.90.20 | Vehicles with both compression-ignition internal combustion piston engine (diesel or semi-diesel) and electric motor as motors for propulsion, with a g.v.w. exceeding 2 tonnes but not exceeding 3 tonnes | |

| 8704.41.90.30 | Vehicles with both compression-ignition internal combustion piston engine (diesel or semi-diesel) and electric motor as motors for propulsion, with a g.v.w. exceeding 3 tonnes but not exceeding 5 tonnes | |

| 8704.51.00.10 | Vehicles with both spark-ignition internal combustion piston engine and electric motor as motors for propulsion, with a g.v.w. not exceeding 2.5 tonnes | |

| 8704.51.00.20 | Vehicles with both spark-ignition internal combustion piston engine and electric motor as motors for propulsion, with a g.v.w. exceeding 2.5 tonnes but not exceeding 5 tonnes | |

| 8704.60.00.00 | Vehicles with only electric motor for propulsion | |

| 8704.90.00.00 | Other | |

| 88.01 | Balloons and dirigibles; gliders, hang gliders and other non-powered aircraft. | |

| 8801.00.90.00 | Other | |

| 88.02 | Other aircraft (for example, helicopters, aeroplanes), except unmanned aircraft of heading 88.06; spacecraft (including satellites) and suborbital and spacecraft launch vehicles. | |

| 8802.11.00.14 | New helicopters of an unladen weight not exceeding 998 kg | |

| 8802.11.00.15 | New helicopters of an unladen weight exceeding 998 kg but not exceeding 2,000 kg | |

| 8802.11.00.20 | Used or rebuilt helicopters of an unladen weight not exceeding 2,000 kg | |

| 8802.12.00.10 | New helicopters of an unladen weight exceeding 2,000 kg | |

| 8802.12.00.20 | Used or rebuilt helicopters of an unladen weight exceeding 2,000 kg | |

| 8802.20.00.00 | Airplanes and other aircraft, of an unladen weight not exceeding 2,000 kg | |

| 8802.30.00.16 | New multiple engine airplanes, of an unladen weight exceeding 2,000 kg but not exceeding 4,536 kg | |

| 8802.30.00.17 | New multiple engine airplanes, of an unladen weight exceeding 4,536 kg but not exceeding 15,000 kg, turbofan powered | |

| 8802.30.00.19 | Other multiple engine airplanes and other aircraft, new, of an unladen weight exceeding 2,000 kg but not exceeding 15,000 kg, new | |

| 8802.30.00.20 | Used or rebuilt airplanes and other aircraft, of an unladen weight exceeding 2,000 kg but not exceeding 15,000 kg | |

| 8802.40.00.16 | New passenger transports airplanes and other aircraft, of an unladen weight exceeding 15,000 kg | |

| 8802.40.00.19 | Other airplanes and other aircraft, new, of an unladen weight exceeding 15,000 kg | |

| 8802.40.00.20 | Used or rebuilt airplanes and other aircraft, of an unladen weight exceeding 15,000 kg | |

| 89.03 | Yachts and other vessels for pleasure or sports; rowing boats and canoes. | |

| 8903.19.00.00 | Other Inflatable (including rigid hull inflatable) boats | |

| 8903.21.00 00 | Sailboats, other than inflatable, with or without auxiliary motor of a length not exceeding 7.5 m | |

| 8903.22.00 00 | Sailboats, other than inflatable, with or without auxiliary motor of a length exceeding 7.5 m but not exceeding 24 m | |

| 8903.23.00 00 | Sailboats, other than inflatable, with or without auxiliary motor of a length exceeding 24 m | |

| 8903.31.00.11 | Personal watercraft, of an overall length not exceeding 4 m, inboard, water-jet driven, designed to be operated in a sitting, standing or kneeling position, other than inflatable, not including outboard motorboats | |

| 8903.31.00.19 | Other inboard motorboats other than inflatable, not including outboard motorboats, of a length not exceeding 7.5 m | |

| 8903.31.00.20 | Inboard/outboard motorboats (otherwise knows as stern drive) other than inflatable, not including outboard motorboats, of a length not exceeding 7.5 m | |

| 8903.31.00.90 | Other motorboats other than inflatable, not including outboard motorboats, of a length not exceeding 7.5 m | |

| 8903.32.00.11 | Cabin cruisers, with inboard motor, a length exceeding 7.5 m but not exceeding 24 m | |

| 8903.32.00.19 | Other inboard motorboats other than inflatable, not including outboard motorboats, of a length exceeding 7.5 m but not exceeding 24 m | |

| 8903.32.00.20 | Inboard/outboard motorboats (otherwise know as stern drive) other than inflatable, not including outboard motorboats, of a length exceeding 7.5 m but not exceeding 24 m | |

| 8903.32.00.90 | Other motorboats other than inflatable, not including outboard motorboats, of a length exceeding 7.5 m but not exceeding 24 m | |

| 8903.33.00.11 | Cabin cruisers, of inboard, a length exceeding 24 m | |

| 8903.33.00.19 | Other inboard motorboats other than inflatable, not including outboard motorboats, of a length exceeding 24 m | |

| 8903.33.00.20 | Inboard/outboard motorboats (otherwise know as stern drive) other than inflatable, not including outboard motorboats, of a length exceeding 24 m | |

| 8903.33.00.90 | Other motorboats other than inflatable, not including outboard motorboats, of a length exceeding 24 m | |

| 8903.93.10.00 | Racing shells of a length not exceeding 7.5 m | |

| 8903.93.90.00 | Other vessels for pleasure or sports, and rowing boats and canoes of a length not exceeding 7.5 m | |

| 8903.99.10.00 | Other Racing shells (of a length exceeding 7.5 m) | |

| 8903.99.90.21 | Outboard motorboats of metal | |

| 8903.99.90.22 | Outboard motorboats of reinforced plastics | |

| 8903.99.90.29 | Outboard motorboats of other materials | |

| 8903.99.90.90 | Other vessels for pleasure or sports, and rowing boats and canoes |

Annex 2: Examples of calculation of taxable amounts, amounts of luxury tax and GST

| Example 1: Imported car (commercial goods) | |

|---|---|

| Value for duty (VFD) | $395,900 |

| Customs duty (6.1% on VFD) | $24,150 |

| Green Levy | $4,000 |

| Air conditioners excise tax | $100 |

| Taxable amount (for luxury tax purposes) | $424,150 |

|

|

| Luxury tax amount (lesser of (a) and (b)) | $42,415 |

| Amounts payable—summary | |

| Customs duties | $24,150 |

| Green Levy | $4,000 |

| Air conditioners excise tax | $100 |

| Luxury tax amount | $42,415 |

| Sub-total (value for tax) | $466,565 |

| GST | $23,328 |

| Total amount of duties and taxes | $93,993 |

| Example 2: Imported aircraft (commercial goods) | |

|---|---|

| Value for duty | $800,000 |

| Customs duty (0% on VFD—aircraft are duty-free) | $0 |

| Taxable amount (for luxury tax purposes) | $800,000 |

|

|

| Luxury tax amount (lesser of (a) and (b)) | $80,000 |

| Amounts payable—summary | |

| Customs duties | $0 |

| Luxury tax amount | $80,000 |

| Sub-total (value for tax) | $880,000 |

| GST | $44,000 |

| Total amount of taxes and duties | $124,000 |

Casual goods

Note: While included in the casual goods examples for clarity sake, it is not necessary to calculate using both methods. If the taxable amount is less than twice the price threshold, just calculating Method A is sufficient. If the taxable amount is more than twice the price threshold amount, just calculating Method B is sufficient. If the taxable amount is exactly twice the price threshold amount, either method will return the same result.

Example 3: Subject vehicle (casual goods)

Subject vehicle’s value for duty is $100,500 The importer is a resident of Canada who is returning after an absence of 48 hours or more. As the only reason the vehicle cannot be classified under tariff item No. 9804.10.00 is that the value for duty exceeds the $800 exemption, by application of section 83 of the Customs Tariff, the value for duty is reduced by $800 and the vehicle is classified under its own tariff item in chapter 87.

The vehicle’s origin is Italy, tariff treatment is CEUT. For the purposes of this example, the tariff classification number is 8703.24.00.32 and the duty rate is 1.5% and the vehicle is equipped with an air conditioner unit.

In order to determine the value of item A for the purposes of establishing the taxable amount the calculation would be:

| Value for duty | $100,500 |

| Minus s. 83 reduction | $800 |

| Total A | $99,700 |

For item B the calculation would be:

| Customs duty | $99,700 X 1.5% = $1,495.50 |

| Excise Duty on air conditioner unit | $100 |

| Total B | $1,595.50 |

The taxable amount for this subject vehicle is:

| A $99,700 + B $1,595.50 | = $101,295.50 |

As the taxable amount $101,295.50 exceeds the price threshold of $100,000 for subject vehicles, this subject vehicle is subject to the luxury tax.

To determine the applicable luxury tax amount, calculate the luxury tax using Method A and B below:

| A $101,295.50 X B 10% | = $10,129.55 |

| (C $101,295.50—D $100,000) X E 20% | = $259.10 |

| C—D | = $1,295.50 |

The lesser amount of the two methods is method B at $259.10, this would be the amount of luxury tax to be collected.

Example 4: Subject vehicle—casual goods

A former resident returns to Canada to re-establish residence after an absence of more than a year. The importer imports a subject vehicle with a value for duty of $105,000. The vehicle’s origin is US and the tariff treatment is UST. The vehicle is equipped with an air conditioner unit.

As the only reason why the vehicle cannot be classified under tariff item No. 9805.00.00 is because the value exceeds $10,000, section 84 of the Customs Tariff requires that the value of the good be reduced by $10,000 and the vehicle be classified under its own tariff item in chapter 87.

In order to determine the value of item A for the purposes of establishing the taxable amount the calculation would be:

| Value for duty | $105,000 |

| Minus s. 84 reduction | $10,000 |

| Total A | $95,000 |

For item B the calculation would be:

| Customs duty | free |

| Excise duty on air conditioner unit | $100 |

| Total B | $100 |

The taxable amount for this subject vehicle is:

| A $95,000 + B $100 | = $95,100 |

As the taxable amount for the subject vehicle does not exceed the price threshold of $100,000 for subject vehicles, this vehicle is not subject to the luxury tax.

Example 5: Subject vessel—casual goods

A non-resident captains a motorboat from the US into Canada by water. The importer reports the boat and states that the resident owner will arrive at the port from within Canada to account for the boat.

Boat is classified at 8903.32.00.11, origin is Taiwan and the tariff treatment is MFN the customs duty rate is 9.5%. The value for duty is $5,000,000. The resident does not claim any personal exemption.

In order to establish the taxable amount:

| Item A is: Value for duty | $5,000,000 |

| For item B: Customs duties | $5,000,000 X 9.5% = $475,000 |

The taxable amount for this subject vessel is:

| A $5,000,000 + B $475,000 | = $5,475,000 |

As the taxable amount exceeds the price threshold of $250,000 for subject vessels, this vessel is subject to the luxury tax.

To determine the applicable luxury tax amount, calculate the luxury tax using Method A and B below:

| A $5,475,000 X B 10% | = $547,500 |

| (C $5,475,000—D $250,000) X E 20% | = $1,045,000 |

| C—D | = $5,225,000 |

The lesser amount of the two methods is method A at $547,000, this would be the amount of luxury tax to collect.

References

- Issuing office:

- Headquarters file:

- Legislative references:

-

- Customs Act

- Customs Tariff

- Select Luxury Items Tax Act

- Excise Tax Act

- Special Import Measures Act

- Value of Imported Goods (GST/HST) Regulations

- Vessel Duties Reduction or Removal Regulations

- Canadian Aviation Regulations

- Temporary Importation of Conveyances by Residents of Canada Regulations

- Motor Vehicle Safety Regulations

- Other references:

- Superseded Memorandum D:

- D18-4-1 dated

- Date modified: