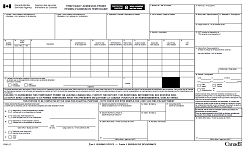

E29B – Temporary Admission Permit

A link to the Portable Document Format (PDF) of this form is provided. The content of the form is duplicated in HTML below.

Form content

PROTECTED B when completed

- 1. Importer — name, address, and telephone no.

- 2. Agent — name, address, and telephone no.

- 3. Destination in Canada

- 4. Broker's ref.

- 5. Use in Canada

- 6. Authority

- 7a. Quantity

- 7b. Weight

- Gross

- Net

- 8. Description

- 9. Classification no.

- 10. Value for duty

- 11. Tariff treatment

- 12. Rate of duty

- 13. Customs duties

- 14. Excise tax

- 15. Value for tax

- 16. GST

- 17. Total

- 18. I declare the information contained to be true and complete.

- Importer/Agent

- Signature

- 19. Permit no.

- 20. Expiry date (YYYY-MM-DD)

- 21. Extended to (YYYY-MM-DD)

- 22. Cargo control no.

- 23. GST collected on transaction no.

- 24. Make refund cheque payable to:

- Name and address

- Postal code

- US$ x (exchange rate) = CAN$

- Cash/Cheque/Bond No.

- Where American funds have been tendered, the deposit will be adjusted according to the U.S. exchange rate at the time of banking, and therefore the actual Canadian dollar equivalent of the deposit may differ from the amount indicated.

- All refunds will be made in Canadian currency by means of a Government of Canada cheque.

- The goods described herein are subject to CBSA control while in Canada and must be re-exported under CBSA supervision on or before the expiry date of the permit. On re-exportation both goods and permit must be presented for identification and comparison.

FAILURE TO SURRENDER THIS TEMPORARY PERMIT ON LEAVING CANADA WILL FORFEIT THE DEPOSIT. FOR ADDITIONAL INFORMATION, SEE REVERSE SIDE. - 26. CBSA office stamp

- 27. CBSA officer

- This portion to be completed by the CBSA for acquittal purposes

- I hearby declare that the goods described herein were:

- 28. Examined by me and re-exported from Canada

- 29. Duties paid under transaction no.

- 30. Examined by me and shipped in bond to:

- CBSA office

Under - Cargo control no.

- CBSA office

- 31. Destroyed under supervision

- 32. Other

- 33. Deposit accounted for on transaction no.

- 34. Dated

- 35. Deposit returned by cheque no.

- 36. Dated

- 37. Accounting centre

- 38. CBSA office stamp

- 39. CBSA officer

- 40. Remarks

Important

This form is a temporary admission permit which enables you to retain the goods described on this form in Canada under certain conditions:

- The permit is for a specified time. Remember the expiry date.

- Failure to comply with the terms and conditions of this permit may constitute an offence under customs law and thereby render the goods liable to seizure and forfeiture.

- The goods imported must be presented to the Canada Border Services Agency (CBSA) for identification at the time of re-exportation, and the permit copies must be presented for acquittal. Failure to comply with these terms and conditions may result in the forfeiture of the deposit.

- If you are unable to export the goods within the specified time period, or have any questions regarding this importation contact the nearest CBSA office before the expiry date indicated on this permit.

Distribution of copies

- Issuing CBSA office

- Accounting Control Copy (to be discarded where no security is posted)

- Importer Copy (to be returned to the CBSA at time of acquittal)

- Importer Receipt Copy (to be certified by the CBSA at time of acquittal and returned as a receipt)

- Customs Broker's Copy (to be certified by the CBSA at time of acquittal and returned as a receipt)

- Date modified: