Preparation and Presentation of Blanket B2 Adjustment Requests

Memorandum D17-2-4

Note to reader

Canada Border Services Agency is currently reviewing this D-memo. It will be updated in the context of the CBSA Assessment Revenue Management (CARM) initiative and made available to stakeholders as soon as possible. Find out about CARM.

Ottawa, January 26, 2017

ISSN 2369-2391

This document is also available in PDF (769 Kb) [help with PDF files]

In Brief

This memorandum contains the procedures and instructions surrounding the preparation and presentation of Blanket B2 Adjustment Requests.

Corrections were made to the definitions of Blanket B2 Adjustment, Issue, and Reason. Paragraph 4 was also amended for clarification purposes.

Disclaimer: The company names and addresses are purely fictional for the purposes of outlining exactly how the information should be presented and formatted in Form B2. Any similarities presented in all examples in D17-2-4, to current or past importer or brokers are by coincidence only.

Table of contents

- Legislation

- Definitions

- Guidelines and General Information

- Special Import Measures Act

- Blanket B2 Authorization Application

- Blanket B2 Adjustment Request Submission

- Blanket Adjustments Submitted as a Result of a CBSA Trade Verification

- Interest

- Additional Information

- Appendix A - Blanket B2 Authorization Application

- Appendix B – Sample Form B2

- Appendix C - Blanket B2 Worksheet Template

- Appendix D - Establishing the Interest Median Date

- Appendix E - Addresses of CBSA Regional Trade Offices That Accept Blanket B2 Authorization Applications

- References

Legislation

Customs Act

Special Import Measures Act

Definitions

For the purpose of this memorandum, the following definitions apply:

- "Act"

- Means the Customs Act.

- Form B3, Canada Customs Coding Form

- Referred to as B3-3 (the electronic fillable version of the form) in many of the Canada Border Services Agency’s (CBSA) electronic documents. It is the customs document used to account for imported commercial goods. It is still called B3, as it will be referred to throughout this memorandum.

- Form B2, Canada Customs – Adjustment Request

- Referred to as Form B2. It is the CBSA's document used to request an adjustment to a commercial accounting declaration.

- Blanket B2 adjustment

- Is an adjustment that corrects accounting information pertaining to one issue and up to three reasons, each having 25 or more B3 transactions.

- Blanket B2 Authorization Application

- Is an application package submitted to the CBSA by an importer/agent, requesting authorization to submit a Blanket B2 Adjustment Request. It consists of an application form, workbook(s) containing data on all transactions for which adjustments are being requested, and an Agency Agreement if applicable.

- Blanket B2 Adjustment Request

- Is comprised of a Form B2 and the workbook(s) containing data on all of the transactions for which adjustments are being requested. It is submitted by an importer/agent after receiving a letter of authorization from the CBSA.

- Diversion

- Occurs when the conditions for which an imported good was granted relief of duty are no longer met (see Memorandum D11-8-5, Conditional Relief Tariff Item).

- F Type Transaction

- Is a consolidated transaction used to account for goods released under the Courier Low Value Shipment (LVS) Program.

- Issue

- Is the legislative authority associated with the adjustment request (e.g., 74(1) (c.1) or 32.2(2) of the Act).

- Reason

- Is the description of the circumstances for which a correction is being requested (e.g., correction of origin, tariff classification, value for duty).

- Workbook

- Is an electronic file containing multiple worksheet pages within a spreadsheet application.

- Worksheet

- Is a page or sheet within a workbook.

Guidelines and General Information

1. This memorandum is intended for the use of importers/agents who prepare and submit blanket B2 adjustments to the CBSA.

2. Blanket B2 adjustments are used to correct the same issue for up to three reasons affecting multiple B3 transactions with a single request rather than submitting individual B2 claims for each transaction. They are designed to reduce the administrative burden for importers/agents and the CBSA.

3. A submission is considered a blanket B2 adjustment when there are a total of 25 or more transactions, in a 12 month period, that require correction for the same reason. Adjustment requests containing 24 or fewer transactions will not be considered a blanket adjustment and should be submitted as single B2 adjustment requests. Refer to Memorandum D17-2-1, The Coding, Submission and Processing of Form B2 Canada Customs Adjustment Request for further information on single B2 adjustments.

4. A Blanket B2 Authorization Application may be submitted to correct one issue containing up to three reasons; however, the CBSA reserves the right to accept or reject any or all of the reasons for which a correction is being requested. Each reason for which a blanket B2 adjustment is being requested must be presented as an individual workbook in the application package.

5. This memorandum provides the standardized format for preparing Blanket B2 Adjustment Requests. Individual trade programs may, however, have additional requirements that must be included in the Blanket B2 Adjustment Request (e.g., Special Import Measures Act (SIMA) Compliance, Compliance Verification, Origin or Valuation).

6. The submission of a blanket B2 adjustment does not remove an importer's obligation under section 32.2 of the Act to voluntarily amend their original declarations within 90 days of having "reason to believe" that their declaration of tariff classification, origin or value for duty of the goods was incorrect. For more information regarding "reason to believe" and the obligation to self-adjust please refer to Memorandum D11-6-6, "Reason to Believe" and Self-adjustments to Declarations of Origin, Tariff Classification, and Value for Duty.

7. Instances where a blanket B2 adjustment request cannot be used include:

- (a) classifications subject to Tariff Rate Quotas;

- (b) cases where licenses are applicable;

- (c) overages (should be reported on a voluntary entry);

- (d) Courier Low Value Shipment consolidated transaction (F-type entries);

- (e) requests for further re-determination (sections 60 or 61 of the Act);

- (f) appeals (sections 67 and 68 of the Act); or,

- (g) requests relating to accounting documents for which the time limit for appeal, refund or diversion has expired.

8. "F" type transactions must be submitted separately on single B2 adjustment requests under the guidelines related to the Courier Low Value Shipment (LVS) transaction process. Please refer to Memorandum D17-4-0, Courier Low Value Shipment Program.

Special Import Measures Act

9. Adjustment requests related to issues under SIMA cannot be combined with other legislative issues on a Blanket B2 Adjustment Request. Furthermore, Blanket B2 Adjustment Requests related to SIMA require that written pre-approval be obtained from the SIMA Compliance Unit Manager. All requests related to SIMA are to be sent directly to:

Canada Border Services Agency

Trade and Anti-dumping Programs Directorate

222 Queen Street, 9th floor

Ottawa, Ontario, K1A 0L8

Attention: Manager, SIMA Compliance Unit

10. Additional information regarding requests under SIMA legislation is contained in Memorandum D14-1-3, Re-determinations and Appeals Under the Special Import Measures Act.

Blanket B2 Authorization Application

11. Importers/agents must obtain authorization from the CBSA regional trade office, closest to where their books and records are maintained, before submitting a Blanket B2 Adjustment Request (refer to Appendix E for a list of CBSA offices that accept Blanket B2 Authorization Applications). To obtain authorization, a hard copy of the Blanket Authorization Application (see Appendix A) must be submitted along with:

- (a) an Agency Agreement where applicable; and,

- (b) an electronic workbook(s) (CD-R media) containing data on all of the transactions for which adjustments are being requested, in chronological order by accounting date (see example of required format in Appendix C).

12. The completed workbook(s) must be saved to a CD-R disk media only. The CD-R media must be clearly labelled as a Blanket B2 Authorization Application and include the importer's name, business number, and adjustment period (ex: Blanket B2 Authorization Application - ABC Company, 123456789RM0001, January 2011 – January 2015). Submission of Blanket B2 Authorization Applications will not be accepted via electronic mail (e-mail) or any other electronic media.

13. The workbook must be saved under the importer's name or business number and include the adjustment period (Example: ABC Company, 2011-2015 or 123456789RM0001, 2011-2015).

14. Supporting documentation is not required when submitting the Blanket B2 Authorization Application; however, the adjustment reason(s) for the blanket request must be clearly explained.

15. Blanket B2 Authorization Applications must be approved by the CBSA before Form B2s can be submitted. Therefore, Form B2s submitted along with the Blanket B2 Authorization Application will not be accepted.

16. The filing of a Blanket B2 Authorization Application does not constitute filing an adjustment request pursuant to section 32.2 or 74 of the Act. It in no way removes or extends the time limits to file a required adjustment pursuant to section 32.2 of the Act nor does it extend the one year (under 74 (1)) C.1)) or the four year time limits to file a refund request pursuant to section 74 of the Act. Importers/agents should submit individual B2 adjustment requests for transactions that are approaching their legislative time limits.

17. The CBSA will conduct a review of the Blanket B2 Authorization Application and will notify the importer/agent in writing of its status. Supporting documentation will be requested, when necessary.

18. Where supporting documentation is requested, the importer/agent will receive specific written instructions from the CBSA on the documentation required. Not adhering to these instructions may result in the request being rejected.

19. The CBSA will issue a blanket B2 adjustment authorization letter, for applications that have been reviewed and accepted.

Blanket B2 Adjustment Request Submission

20. Once an importer/agent receives an authorization letter, they may submit a Blanket B2 Adjustment Request. When submitting a Blanket B2 Adjustment Request, the following documentation should be included:

- (a) two copies of the completed Form B2 (see Appendix B for example); one for the CBSA and one for the importer/agent receipt copy;

- (b) electronic workbook(s) saved on CD-R disk media and in the format specified in paragraphs 22-25 of this memorandum; and,

- (c) a hard copy of the electronic workbook(s).

21. The following fields of the Form B2 must be completed:

- (a) the Header (Fields 1, 2, 4, 10 and11);

- (b) Fields 5, 6 and 7 should indicate "VAR" (various);

- (c) Explanation;

- (d) Declaration;

- (e) Justification for Request; and,

- (f) the Trailer (Fields 38-45);

22. If the Blanket B2 Adjustment Request contains transactions with accounting dates that cover more than one calendar year, then separate Form B2s and their associated workbooks will be required for each calendar year. Each workbook must include worksheets that separate the B2 adjustments by calendar quarter.

23. The worksheet for each quarter must contain the accounting data originally submitted on the B3, and the requested changes (i.e., B2 data). Each worksheet must be prepared in chronological order according to the accounting date.

24. The completed workbooks should be saved to CD-R disk media only. The CD-R disk media must be clearly labelled as a Blanket B2 Adjustment Request and include the importer's name, business number, adjustment period, and authorization number provided on the CBSA's letter of authorization (Example: Blanket Request - ABC Company, 123456789RM0001, January 2011 – January 2015, Authorization # XXXXX).

25. Each workbook must be saved under the importer's name or business number and include the year (Example: ABC Company, 2011 or 123456789RM0001, 2011). Each worksheet, within the workbook, must be named under the importer's name or business number and include the quarter period (Example: ABC Company Q1-2011, ABC Company Q2-2011 etc. or 123456789RM0001 Q1-2011, 123456789RM0001 Q2-2011). Either format is acceptable but must be consistent for all files.

26. When submitting blanket B2 adjustments that contain split line changes, the split line methodology, as per D17-2-1, must be used. Responsibility rests with the importer/agent to correctly number the new line resulting from the split or the sub header, when a new sub header is required.

27. When the Blanket B2 Adjustment Request results in monies owing to the CBSA (i.e., accounts receivable), payment may be submitted with the request. All requests submitted with payments should be sent to the closest CBSA Cash Office along with an envelope, addressed to the authorizing office or the CBSA officer who conducted the verification, if the request is a result of a verification. Non-revenue and/or accounts payable Blanket B2 Adjustment Requests should be submitted to the CBSA regional trade office that authorized the blanket request or to the CBSA officer that conducted the verification (see Appendix E for a list of CBSA offices). Importers/agents may also submit non-revenue and/or accounts payable Blanket B2 Adjustment Requests to their closest CBSA office, for forwarding to the appropriate CBSA regional trade services office.

Blanket Adjustment Submitted as a Result of a CBSA Trade Verification

28. Pursuant to a CBSA trade compliance verification, an importer may be required to submit corrections within 90 days from the date of the final verification report. These corrections may be submitted as a Blanket B2 Adjustment Request.

29. A Blanket B2 Authorization Application is not required for Blanket B2 Adjustment Requests submitted as a result of a CBSA trade compliance verification, provided that all the adjustment requests fall within the scope of the verification and the reassessment period. Adjustment requests outside of the verification scope or period must be submitted as single B2 adjustment requests or as a standard Blanket B2 Adjustment Request, requiring a Blanket B2 Authorization Application.

30. B2 Blanket Adjustment Requests must be directed to the officer who conducted the verification and should include:

- (a) an Agency Agreement where applicable;

- (b) Form B2 referencing the verification case number and completed as per paragraph 21 of this memorandum;

- (c) electronic workbook(s) saved on CD-R disk media in the format specified in paragraphs 22-25 of this memorandum (Note: the verification case number should be referenced instead of an authorization number); and,

- (d) a hard copy of the electronic workbook(s).

Interest

31. When calculating interest, the median date will be considered as the date the interest begins. The median date equals the date between the first and last transaction within the respective quarter (see Appendix D for example). When the number of days in a period is an even number, the date immediately after the median date will be used. For blanket B2 adjustments that are submitted without payment, interest will continue to accumulate until the Detailed Adjustment Statement (DAS) decision date.

32. As indicated in paragraph 27, importers/agents may choose to submit the payment with their Blanket B2 Adjustment Request, if applicable. Should they choose to do so; the importer/agent is responsible for calculating interest. The interest start date should be calculated as per the calendar quarter median method described above in paragraph 31 and the end date should be the date payment is presented.

33. For further information on the application of interest, refer to Memorandum D11-6-5, Interest and Penalty Provisions: Determinations/Re-determinations, Appraisals/Re-appraisals, and Duty Relief.

Additional Information

34. For more information, from within Canada, you may call the Border Information Service at 1-800-461-9999. From outside Canada you may call 204-983-3500 or 506-636-5064. Long distance charges will apply. Agents are available Monday to Friday (08:00 – 16:00 local time / except holidays). TTY is also available within Canada: 1-866-335-3237.

Appendix A – Blanket B2 Authorization Application

Part 1 – Applicant Identification

Note that the filing of a Blanket B2 Authorization Application does not constitute filing an adjustment request pursuant to section 32.2 or 74 of the Act. It in no way removes or extends the time limits to file a required adjustment pursuant to section 32.2 of the Act, nor does it extend the one year (section 74(1)(c.1) of the Act) or the four year time limits to file a refund request pursuant to section 74 of the Act.

Part 2 – Workbook and Supporting Documentation

Provide a workbook of all the transactions related to the adjustment request in electronic and hard copy format. Additional supporting documentation may be required, depending on the nature of the claim.

In the case of an application being filed by an agent on behalf of an importer, also include the Agency Agreement / power of attorney

Documents in support of the adjustment(s) may include, but are not limited to:

- ruling(s) or other CBSA direction;

- descriptive literature;

- example(s) of typical entries with supporting documentation;

- Certificate(s) of Origin;

- proof of diversion to qualified end-use or end-user; and,

- financial records.

Appendix B – Sample Form B2

Appendix B – Sample Form B2

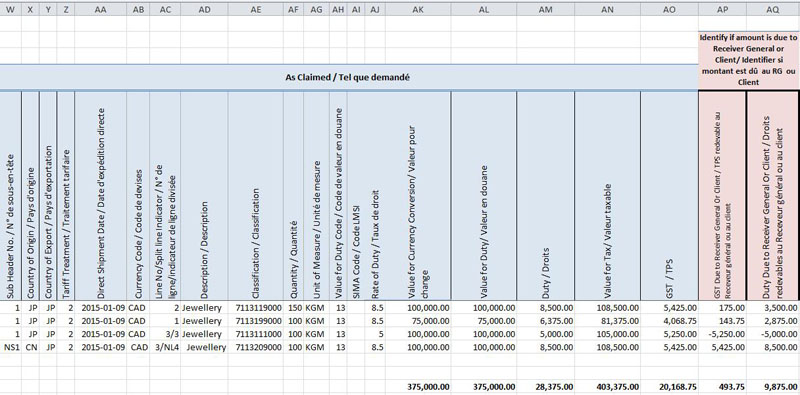

Appendix C - Blanket B2 Worksheet Template

This worksheet template must be used when preparing and submitting a Blanket B2 Authorization Application and a Blanket B2 Adjustment Request.

Appendix C – Blanket B2 Worksheet Template

Appendix D - Establishing the Interest Median Date

Establishing the Interest Median Date

Using the sample calendar quarter above, the following table demonstrates how to establish the median date within a calendar quarter for the interest start date.

| First Transaction Date | Last Transaction Date | Median Date |

|---|---|---|

| January 1, 2015 | March 31, 2015 | February 15, 2015 |

| January 22, 2015 | March 31, 2015 | February 25, 2015 |

| January 12, 2015 | February 17, 2015 | January 30, 2015 |

Regardless of the number of transactions in the calendar quarter, or if the majority of transactions occur in a particular month of the calendar quarter, the date range is based on the median date between the first and last transaction dates.

The following formulas are to be used:

- For a period containing an even number of days: (n ÷ 2) + 1

- For a period conaining an odd numbers of days: (n + 1) ÷ 2

Where "n" represents the total number of days between the first and the last transaction within the respective quarter.

Appendix E - Addresses of CBSA Regional Trade Offices That Accept Blanket B2 Authorization Applications

Please take note of a change to the Calgary trade office address, in effect since March 1, 2021.

Quebec / Atlantic Region

Canada Border Services Agency

Trade Operations Division

c/o B2 Processing Centre

400 Youville Square, 5th floor

Montreal, QC H2Y 2C2

Canada

Greater Toronto Area / Northern Ontario Region

Canada Border Services Agency

Trade Operations Division

c/o B2 Processing Centre

1980 Matheson Blvd. E., Suite 144

Mississauga, ON L4W 5R7

Canada

Prairie Region

Canada Border Services Agency

Trade Operations Division

Victory Building

269 Main Street

Winnipeg, MB R3C 1B3

Canada

Canada Border Services Agency

Trade Operations Division

220 - 4 Ave S.E.

Suite 171

Calgary, AB T2G 4X3

Canada

Pacific Region

Canada Border Services Agency

Trade Compliance Division

412 - 4th Floor 1611 Main Street

Vancouver, BC V6A 2W5

Canada

References

- Issuing office:

- Trade and Anti-dumping Programs Directorate

- Headquarters file:

- Legislative references:

- Customs Act

Special Import Measures Act - Other references:

- Form B2, Form B3, D11-6-5, D11-6-6, D11-8-5, D14-1-3, D17-2-1, D17-4-0

- Superseded memorandum D:

- D17-2-4 dated January 17, 2017

- Date modified: