Coding of Customs Accounting Documents

Memorandum D17-1-10

Note to reader

Canada Border Services Agency is currently reviewing this D-memo. It will be updated in the context of the CBSA Assessment Revenue Management (CARM) initiative and made available to stakeholders as soon as possible. Find out about CARM.

Ottawa, November 28, 2012

This document is also available in PDF (17.3 MB) [help with PDF files]

In Brief

1. Pending its full revision to ensure compliance with the standard on Web accessibility, this memorandum has been partially updated to introduce the temporary country code XK for imports from Kosovo. [Rev. June 5, 2015]

2. Imports from Kosovo should be coded with the Canadian temporary code "XK" in Field No. 12 – Country of Origin and Field No. 13 – Place of Export of the B3, Canada Customs Coding Form. The currency for completing Field No. 17 is "EUR" (Euro Dollar). [Rev. June 5, 2015]

This memorandum describes various forms of accounting documentation and gives instructions for their completion.

Table of Contents

- Guidelines and General Information

- Description of Forms

- Information Requirements

- Documentation Requirements

- Additional Information

- Appendix A - Form B3 Field Sizes

- Appendix B - Coding Instructions for Non-warehouse and Non-consolidated Form B3

- Appendix C - Form B3 (Bonded Warehouse) Coding Instructions

- Appendix D - Form B3B, Canada Customs Cargo Control Continuation Sheet

- Appendix E - Metric Conversion

- Appendix F - Check Digit Calculation for Transaction Numbers

- Appendix G - Detailed Coding Statements

- Appendix H - List of Codes

- Appendix I - Bar Code Specifications

- Appendix J - Form B3, Type F - Coding Instructions for Consolidated Accounting Documents

Guidelines and General Information

1. This memorandum is a guide for Canada Border Services Agency (CBSA) personnel, brokers, and importers/owners who are involved in preparing and processing various customs coding forms.

2. Accounting documents must be properly coded before they can be accepted for either manual or automated data processing. The information used to prepare these documents is obtained from invoices, cargo control data, and other sources, and is coded and placed in a designated area on the coding form referred to as a field.

Description of Forms

Form B3, Canada Customs Coding Form

3.This form is a customs document used to account for imported goods, regardless of value, destined for commercial use in Canada according to sections 6 and 7 of the Accounting for Imported Goods and Payment of Duties Regulations (SOR/86-1062).

4. The CBSA will reprint B3 forms on white paper in blue ink. However, companies may privately print B3 forms in blue or black ink according to Memorandum D17-1-11, Private Printing Policy and Procedures. Importers/brokers must apply coloured wrappers to B3 forms as follows:

| Type | Colour |

|---|---|

| AB and AD (LVS threshold or more) | green |

| AB and AD (less than LVS threshold that quote a remission order number in Field No. 26) | green |

| C, D, H, M, and V (account) (LVS threshold or more) | blue |

| C, D, H, M, and V (account) (less than LVS threshold that quote a remission order number in Field No. 26) | blue |

| C, D, H, M, and V (cash) (regardless of value) | yellow |

| C (one-time release prior to payment) | yellow |

| C, D, H, M, and V (account) (less than LVS threshold) | white |

| F (consolidated account) (less than LVS threshold) | salmon |

| AB and AD (less than LVS threshold | white (mark AB or AD on wrapper) |

| 10, 20, 21, 22, and 30, including CADEX bonded warehouse | grey |

| CADEX non-bonded warehouse | gold |

5. Refer to Appendices B, C, and J for instructions and format examples of Form B3, Form B3 (bonded warehouse), and Form B3 (consolidated) respectively.

Form B3B, Canada Customs Cargo Control Continuation Sheet

6. Form B3B is used together with Form B3 when there is more than one cargo control document to be acquitted by one B3 form. A copy of Form B3B can be found in Appendix D.Form B6D, Ships' Stores Delivery Declaration

7. Form B6D is used together with Form B3, type 22, Ships' Stores, Sales to the Governor General and Diplomats. It has the declaration of the vessel's master or agent, or the airline company's agent, certifying that the goods are for use as ships' stores. It also has the border service officer's certificate that the goods were accompanied on board and sealed on the vessel or aircraft. You can find more information on ships' stores in Memorandum D4-2-1, Ships' Stores Regulations.

Information Requirements

8. It is in the best interest of brokers, importers/owners, and CBSA personnel to present accurate documents to CBSA. This allows CBSA to carry out its processing and enforcement functions and expedites release of the shipment to the importer/owner or broker.

9. All information on the coding forms must be legible and all fields must be completed according to the instructions in the appendices.

10. The B3 form package must also include all certificates, licences, permits, or other documents that may be required by another government department or agency as they apply to their acts or regulations for imported goods. However, consolidated Form B3 accounting documents (Form B3, type F) used to account for goods released under the Courier/Low Value Shipment (LVS) Program are not to include supporting documentation when the accounting document is presented to customs. Any supporting documentation (i.e., invoices, Orders in Council) are to be held at the importer's and broker's premises to allow an officer in the future to perform an audit of the records and to obtain or verify the information on which the calculation of duties was based.

11. The border services officer will review Form B3 documentation to ensure compliance with the CBSA's requirements. They will return any B3 form that does not meet the requirements to the importer/owner or broker, and where applicable, withhold release of goods. In all such cases, the border services officer will inform the importer/owner or broker of the reasons for rejection.

Documentation Requirements

12. When Form B3 is presented at a terminal office and is paid either by cash or account, only one copy is required: the CBSA copy. The official receipt for monies tendered for payment of Form B3 at automated locations is a stamped duty-paid copy of a Detailed Coding Statement (DCS) for cash entries or a Form K84, Importer/Broker Account Statement, for account entries. Both these statements are generated by the customs automated system. For details, refer to Memorandum D17-1-5, Registration, Accounting and Payment for Commercial Goods.

13. When requesting release prior to payment under a Release on Minimum Documentation (RMD) (excluding CADEX), two copies of the release documentation must be presented. The original will be retained by the CBSA for control purposes when the shipment is released and the duplicate returned to the importer/owner or broker for use with the confirming Form B3. In the case of a one-time release prior to payment, three copies of the release documentation are required. The third copy will be attached to the request from the importer/owner or broker to transact bonded operations. For more details, refer to MemorandumD1-7-1, Posting Security for Transacting Bonded Operations, and Memorandum D17-1-5.

14. Under the Courier LVS Program, approved participants can consolidate a number of shipments on Form B3, type F. This consolidation may include a number of LVS, which were released from the CBSA. Goods that are prohibited, controlled, or regulated by an Act of Parliament or a regulation made under such an Act are excluded from this program. However, the program accepts goods for which a special authority (i.e., Order in Council) applies. Goods valued at greater than the Courier LVS threshold are also excluded from this program. Consolidation of this B3 form may be made by a CBSA office, a regional consolidation, a consolidation by carrier, a consolidation by importer, or a national consolidation. For more information regarding the Courier LVS Program, refer to Memorandum D17-4-0, Courier Low Value Shipment Program.

15. Because Form B3 (bonded warehouse) is a multi-use form, the number of copies required will depend on the type. The following chart outlines this information when Form B3 is presented at a terminal office.

| Form B3 Type and Wrapper Colour | Copies Required | Remarks |

|---|---|---|

| 10 (grey) Form B3 for Warehouse | 3 | 1 to CBSA |

| 1 to warehouse control | ||

| 1 to warehouse operator | ||

| 13 (grey) Form B3 for Re-warehouse | 3 | 1 to CBSA |

| 20 (grey) Ex warehouse Form B3 for Consumption | 1 to warehouse control | |

| 21 (grey) Form B3 Ex warehouse for Export | 1 to warehouse operator | |

| 30 (grey) Transfer of Goods | ||

| 22 (grey) Form B3 Ships' Stores, Sales to the Governor General and Diplomats | 5 | 1 to CBSA |

| 1 to warehouse control | ||

| 1 to warehouse operator | ||

| 2 to the vessel |

16. At non-terminal offices, an importer's/broker's copy of the documentation is required for return with a daily notice of transactions finalized that day. The CBSA copy will be date-stamped with the date of final accounting and forwarded to the appropriate automated office.

Additional Information

17. Any questions regarding Form B3 coding instructions or format examples in this memorandum should be directed to the nearest CBSA office.

APPENDIX A

FORM B3 FIELD SIZES

The following indicates the maximum field size for each field on FormB3 where:

- T = Alpha/Numeric

- A = Alpha

- N = Numeric

- (...X) = up to X characters, e.g., (...3) up to 3characters

- (x) = x mandatory characters, e.g., (3) 3 mandatory characters

- xr = x characters to the right of the decimal point. These characters are included in the maximum field size.

FIELD and SIZE

- 1. name = T (...30), for each of a maximum of 4 lines; number = T (...15)

- 2. N (14)

- 3. T (...2)

- 4. N (3)

- 5. N (...9)

- 6. A (...1)

- 7. N (1)

- 8. N (...3)

- 9. N (...12)

- 10. N (...3)

- 11. T (...28), for each of a maximum of 2 lines

- 12. A (...3)

- 13. T (...4)

- 14. N (...2)

- 15. N (4)

- 16. N (2)/N (...2)

- 17. A (3)

- 18. N (...2)/A (1)

- 19.* N (...5)

- 20. for departmental use only

- 21. N (...4)

- 22. T (...30), for each of a maximum of 2 lines

- 23.* N (...7)

- 24. N (14)

- 25. N (...4)

- 26. T (...16)

- 27. N (10)

- 28. N (...4)

- 29.* N (...11) 3r

- 30. A (3)

- 31. N (...3)

- 32. N (...2)

- 33. N (...7) 5r

- 34. N (...7) 5r

- 35. N (...4) 2r

- 36.* N (...14) 2r

- 37.* N (...11) 2r

- 38.* N (...10) 2r

- 39.* N (...11) 2r

- 40.* N (...10) 2r

- 41.* N (...12) 2r

- 42.* N (...11) 2r

- 43. N (...7) 2r

- 44. N (4)

- 45. T (...24)

- 46. T (...4)

- 47. N (...12) 2r

- 48. N (...10) 2r

- 49. N (...11) 2r

- 50. N (...12) 2r

- 51. N (...12) 2r

*If the amount to be inserted in this field exceeds the maximum field size, the total amount should be divided among as many detail lines as are necessary.

APPENDIX B

CODING INSTRUCTIONS FOR NON-WAREHOUSE AND NON-CONSOLIDATED FORM B3

The fields of Form B3 must be completed according to the following instructions.

Note: For instructions on completing Form B3, consolidated accounting document, type F, see Appendix J, and for warehouse types, see Appendix C.

Field No. 1 - Importer Name and Address

Must complete importer's name on all Form B3 types. If Form B3 has two or more pages, complete on the first page. (For Form B3, type F requirements, see Appendix J.)

Show the importer's address if it does not appear on the supporting invoice.

In the "No." section of this field, show the customs business account number. This number is a standard way of identifying importing and exporting businesses, and is used in the processing of customs accounting documents. If you have one or more customs accounts, indicate the six-digit account identifier (e.g., RM0001).

Field No. 2 - Transaction Number

Must complete on all types of Form B3 when release prior to payment security is being used.

This number is 14 digits in length and contains the following:

- (a) the first five digits represent the account security number of the importer/broker who will present the accounting document and/or pay the duties and taxes; and

- (b) the next eight digits represent a number assigned by the importer/broker; and

- (c) the last digit is a check digit calculated using a formula provided by the CBSA (refer to Appendix F).

Show the transaction number assigned at time of release, if applicable, on all copies of Form B3 and on the first page of the supporting documents. It must be in bar-coded format (see the following note on bar coding) on the first page of the CBSA copy of Form B3. Refer to Appendix I for bar code specifications. The typed or clearly annotated transaction number must appear on all the remaining pages of Form B3 and on the first page of the supporting documents. If the supporting document is multi-paged, the total number of attachments must also be shown on the first page. This eliminates the need to include the transaction number on each page of the supporting documents.

The transaction number must also be typed or clearly annotated on all applicable permits, certificates, and licences.

The transaction number must not be duplicated for 7 years and 3 months (6-year period plus 15 current months). Note that if a transaction is adjusted, the 7 year period plus 3 months will begin at the date of final decision.

Notes:

- 1. All importers/brokers who have an account security number with release prior to payment privileges must submit FormB3 documentation with a bar-coded transaction number.

- 2. Importers/brokers having only "uncertified cheque" security must assign a transaction number to their accounting documentation. However, it is not mandatory that the transaction number be bar-coded. For all unsecured transactions (i.e.,"cash" transactions), the CBSA will assign a bar-coded transaction number.

The transaction number field on unsecured Form B3s and Form B3s type M, must be left blank because Form B3 will be numbered by customs upon presentation. Transaction numbers applied by importers and brokers will not be valid for mail shipments. Customs will apply a cash transaction number from the local numbering series.

Field No. 3 - Type

Must complete on all B3 form types. If Form B3 has two or more pages, the B3 form type is to be shown on the first page.

Code B3 form types alphabetically as follows:

- AB - Confirming Form B3 (final accounting) for goods released on minimum documentation.

- AD - Confirming sight Form B3 (interim accounting) for goods released on minimum documentation but where imperfect documentation has been provided.

- C - Form B3 (final accounting) for:

- (a) release of goods prior to the payment of duties and taxes (account); or

- (b) release of goods after the payment of duties and taxes (cash).

- D - Sight Form B3 (interim accounting) for goods as in type C above but where imperfect documentation has been provided.

- F - Form B3 consolidated entry for goods released under the Courier/LVS Program. (See Appendix J for B3 form completion instructions.)

- H - Supplementary Form B3—to voluntarily declare goods reported, but not accounted for at the time of final accounting (for example, invoiced line inadvertently omitted on Form B3) or for overages.

- M - Confirming Form B3 (final accounting) for release of postal goods.

- V - Voluntary Form B3—used by an importer/owner to voluntarily declare goods that were delivered without official customs release.

The date of direct shipment (Field No. 16) equals the date of presentation for exchange purposes.

Applied duty rates are those in effect on the date of presentation of the V-type accounting document.

Field No. 4 - Office Number

Must complete for all Form B3 types.

If Form B3 has two or more pages, complete on the first page.

Show the CBSA office of release code number. (See Appendix H, List 1(a) or 1(b) for the code number of the CBSA office responsible for the release of the goods.)

For Forms B3 accounting for postal shipments, show the CBSA office code number where the goods are being accounted for.

Field No. 5 - GST Registration Number

If a Business Number (BN) is used in Field No. 1, this field may be left blank.

Field No. 6 - Payment Code

Show an "I" on the first page of Form B3 if an importer has posted security and the goods are released under a customs broker's account security number.

In such cases, the daily Form K84, Importer/Broker Account Statement, will be produced for the broker, separating transactions for the importers identified above.

Field No. 7 - Mode of Transport

Complete for all shipments valued at greater than CAN$2500 exported from the United States. Leave blank for types H, M, and V. (For Form B3, type F requirements, see Appendix J.)

Show the code for the mode of transport by which the goods arrived in Canada. Valid codes are as follows:

| Air | 1 |

|---|---|

| Highway | 2 |

| Rail | 6 |

| Pipeline | 7 |

| Commercial Hand Carried Goods | 8 |

| Marine | 9 |

Field No. 8 - Port of Unlading

Complete for all marine shipments valued at greater than CAN$2500 exported from the United States. (See Appendix H, List1(a) or 1(b) for the code number of the port of unlading.)

Leave blank for types F, H, M, and V.

Field No. 9 - Total Value for Duty

Must complete for all types of Form B3. (For Form B3, type F requirements, see Appendix J.)

Add each of the classification line (Field No. 37) value for duty amounts to obtain total value for duty of the shipment in Canadian dollars, and round the total to the nearest dollar. (Do not include a decimal point.)

If Form B3 has two or more pages, complete only on the first page.

Field No. 10 - Sub-header Number

Must complete on the first page of each sub-header for all types of Form B3.

Leave blank on any subsequent pages unless a change occurs to the content of the sub-header fields (i.e., vendor name, countries, tariff treatment, direct shipment date, currency code, time limit).

Sub-header numbers must be assigned in sequence from 1 to 999.

Note: When an additional sub-header must be prepared, all the sub-header fields must be completed and not just those fields which are different from the previous sub-header.

Field No. 11 - Vendor Name

Must complete on the first page of each sub-header for all types of Form B3. (For Form B3, type F requirements, see Appendix J.)

If the goods are invoiced from the United States, show the name, three-digit state code as listed in Appendix H, and the five-digit zip code of the vendor or consignor of the goods as they appear on the supporting invoice(s).

Each new vendor must be shown on a new sub-header.

Show the name of the vendor or the consignor of the goods as it appears on the supporting invoice(s). Do not abbreviate the name. Use the same name format consistently on all B3 forms.

Where the goods are shipped from one country and invoiced (i.e., sold or consigned) from another, show the vendor's name of the actual seller or consignor; for example, goods shipped from Nippon Textiles of Tokyo, Japan and invoiced from Textile Exporters Inc. of New York, US, show the vendor's name as Textile Exporters Inc.

If the goods are invoiced from a country other than the United States, but are exported from the United States, indicate the name of the foreign vendor followed by the state code and zip code of the US exporter.

Field No. 12 - Country of Origin

Must complete on the first page of each sub-header for all types of Form B3. (For Form B3, type F requirements, see Appendix J.)

Show the three-digit alphabetic state code if the country of origin is the United States. Show a two-digit alphabetic International Organization for Standardization (ISO) country code if the country of origin is other than the United States. Refer to the list of country/state codes in Appendix H.

In the case of identical goods from multiple countries of origin, each of which is entitled to the same tariff treatment, allocate an estimated quantity and value of the imported goods on a proportionate basis according to country of origin.

Each new country or state must be shown on a new sub-header.

Field No. 13 - Place of Export

Must complete on the first page of each sub-header for all types of Form B3. (For Form B3, type F requirements, see Appendix J.)

Show the three-digit alphabetic state code if the country of export is the United States. If the goods were exported from a US foreign trade zone, show the appropriate code for that zone. Show the two-digit alphabetic ISO country code if the country of export is other than the United States. Refer to the list of country/state/foreign trade zone codes in Appendix H. Each new foreign trade zone, state, or country must be shown on a new sub-header.

Field No. 14 - Tariff Treatment

Must complete on the first page of each sub-header for all types of Form B3. (For Form B3, type F requirements, see Appendix J.)

Use one of the following codes:

| Tariff Treatment | Code |

|---|---|

| Commonwealth Developing Countries Remission Orders | 1 |

| Most-Favoured-Nation Tariff | 2 |

| General Tariff | 3 |

| Australia Tariff | 4 |

| New Zealand Tariff | 5 |

| Commonwealth Caribbean Countries Tariff | 7 |

| Least Developed Country Tariff | 8 |

| General Preferential Tariff | 9 |

| United States Tariff | 10 |

| Mexico Tariff | 11 |

| Mexico-United States Tariff | 12 |

| Canada-Israel Agreement Tariff | 13 |

| Chile Tariff | 14 |

| Costa Rica Tariff | 21 |

| Iceland Tariff | 22 |

| Norway Tariff | 23 |

| Switzerland-Liechtenstein Tariff | 24 |

| Peru Tariff | 25 |

| Colombia Tariff | 26 |

The use of code 10 for the United States Tariff treatment, code 11 for the Mexico Tariff treatment, code 12 for the Mexico-United States Tariff treatment, code 14 for Chile Tariff treatment or code 21 for Costa Rica Tariff treatment is permissible only under two circumstances. The first most common situation is when the importer/owner or broker is making a declaration that the imported goods originate and that the importer/owner or broker is in possession of a valid NAFTA, CCFTA or CCRFTA Certificate of Origin, as the case may be, which covers the goods being imported. The second situation is when the importer/owner or broker is importing certain non-originating textile goods under a tariff preference level and has a statement certifying that the goods have met the conditions set out in the Textile and Apparel Extension of Benefit Order. Deliberate use of these codes when the goods are not entitled to such tariff treatments may result in enforcement action.

Each new tariff treatment must be shown on a new sub-header.

Refer to the Customs Tariff for information on the applicability of these tariff treatments.

Field No. 15 - U.S. Port of Exit

Complete on the first page of each sub-header on Form B3, types AB, AD, C, and D, for shipments valued at greater than CAN$2500 exported from the United States. (For Form B3, type F requirements, see Appendix J.)

US port of exit is defined as the "US Customs and Border Protection (CBP) port at which or nearest to which the land surface carrier transporting the merchandise crosses the border of the United States into Canada, or in the case of exportation by vessel or air, the US CBP port where the merchandise is loaded on the vessel or aircraft which is to carry the merchandise to Canada."

Show the four-digit port of exit code as indicated in Appendix H, List 6.

Field No. 16 - Direct Shipment Date

Must complete on the first page of each sub-header for all types of Form B3 if the currency code is other than Canadian dollars. May be left blank if currency code is Canadian dollars. (For Form B3, type F requirements, see Appendix J.)

This date is the date used to select the rate of exchange for converting the foreign currency into Canadian funds.

Show MM DD (Month, Day).

Each new date must be shown on a new sub-header.

Field No. 17 - Currency Code

Must complete on the first page of each sub-header for all types of Form B3. (For Form B3, type F requirements, see Appendix J.)

The ISO codes will be used (e.g., United States Dollar = USD). Refer to the list of currency codes in Appendix H.

Each new currency must be shown on a new sub-header.

Field No. 18 - Time Limit

Complete on the first page of types D and AD of Form B3.

Complete on the first page of each sub-header for types C and AB of Form B3, if a time control applies.

When a sight Form B3, type D or AD is prepared, 90 D must be shown as the time limit unless a time limit is required for any other purpose. In this latter case, the sight Form B3 time limit must not be shown.

When 1/60 and 1/120 Forms B3 are prepared, the time limit must be shown in months.

Each new time limit must be shown on a new sub-header.

Show the time limit according to the format in the examples below:

| Time Limit | Shown As |

|---|---|

| 1 week | 1 W |

| 30 days | 30 D |

| 1 month | 1 M |

| 60 days | 60 D |

| 2 months | 2 M |

| 90 days | 90 D |

| 3 months | 3 M |

| 1 year | 1 Y or 12 M |

| 2 years | 2 Y or 24 M |

| 15 years | 15 Y |

Field No. 19 - Freight

Must complete on the first sub-header for shipments valued at greater than CAN$2500 exported from the United States. It is acceptable to show valid amounts on each sub-header or to show a total amount on the first page. Do not leave the first sub-header blank. (For Form B3, type F requirements, see Appendix J.)

Leave blank for types H, M, and V.

Show the total freight charges, to the nearest Canadian dollar, to transport the imported goods from the place of direct shipment in the US to the consignee in Canada. A table may be used to assess freight charges. In cases where no freight was paid, such as when the owner uses his or her own transportation to pick up the goods, an estimated typical case should be shown.

Field No. 20 - Release Date

Leave blank. (Excluding type F, see Appendix J.)

Field No. 21 - Line

Must complete on all types of Form B3.

Enter the sequential value for the classification line each time a classification number is assigned. Each occurrence of a classification number must be assigned a unique line number regardless of the number of rates or detail lines required to display it.

Line numbers may not be skipped or duplicated within Form B3, regardless of the number of sub-headers.

Field No. 22 - Description

Show all references, such as D Memorandum numbers, value and classification ruling numbers, and import permit numbers. (For Form B3, type F requirements, see Appendix J.)

Must show the reason for the use of sight Form B3 documents in this field.

For goods subject to the Special Import Measures Act (SIMA), importers not enrolled in the Customs Self-Assessment (CSA) program must clearly show the description of the goods. The description must conform to the written notification provided by an officer of the CBSA.

For goods subject to the SIMA, importers enrolled in the CSA program must provide, upon request and within 21 days, documents which clearly show the description of the goods. The description must conform to the written notification provided by an officer of the CBSA.

Importers may be assessed an administrative monetary penalty if they fail to provide the required description as outlined in the written notification provided by an officer of the CBSA for any goods subject to SIMA.

Field No. 23 - Weight in Kilograms

Complete for all shipments valued at greater than CAN$2500 exported from the United States by air or marine modes of transport. Leave blank for types H, M, and V. (For Form B3, type F requirements, see Appendix J.)

Complete only on the first detail line of each transaction.

Show the gross weight, to the nearest whole kilogram, of the goods described in the transaction.

Field No. 24 - Previous Transaction Number

Leave blank on all types of Form B3, except type H.

Field No. 25 - Previous Transaction Line

Leave blank on all types of Form B3.

Field No. 26 - Special Authority

Complete on each classification line for all types of Form B3, if applicable. (For Form B3, type F requirements, see AppendixJ.)

Leave blank on each classification line where an Order in Council (OIC), other than a remission order, reduces or removes duties on specified goods.

When the owner is authorized by OIC to import goods under special conditions, show the OIC number in this field. Show the number in the formats indicated below:

- (a) Orders in Council submitted to the Governor in Council by Treasury Board, e.g., Order in Council P.C. 1973-1/82, January 9, 1973, must be shown as 73-1-82.

- (b) Orders in Council submitted to the Governor in Council by the department concerned, e.g., Order in Council P.C.1985-277, January 31, 1985, must be shown as 85-277.

- (c) Duty Deferral, e.g., 87-016W0001.

- (d) Exporter Distribution Centre (GST) special authority code "1999 - 0000" - relieves GST when authorized by the CBSA.

(For more information, refer to Memorandum D7-4-1, Duties Relief Program.)

If the OIC number contains an oblique stroke (/), this must be shown as a hyphen (-): e.g., Order in Council 67-23/261 must be shown as 67-23-261.

Where Form B3 for goods entered under an OIC contains two or more lines of calculations, such as a remission Form B3 for goods entered under several classification numbers, the OIC number must be shown again with each new classification line.

In any case where an OIC number is amended, the original number must be quoted in this field. That is, the number of the amending Order is to be ignored.

The benefits of the United States Tariff and the Mexico Tariff may, under the Textile and Apparel Extension of Benefit Order, be extended to certain textile and apparel goods which are cut and sewn or otherwise assembled (or woven or knit) in the United States or Mexico from fabric (or yarn or fibre) produced or obtained in a non NAFTA country. When accounting documents are presented for such goods, the appropriate special authority number must be shown. In the event an Order in Council applies to these goods, the number for that Order would take precedence over the special authority number used to identify the textile and apparel goods referenced above.

Field No. 27 - Classification Number

Must complete on all types of Form B3. (For Form B3, type F requirements, see Appendix J.)

Show the correct classification number as indicated in the Customs Tariff for each commodity included in the shipment covered by Form B3.

The first six digits represent the International Harmonized System Code, the seventh and eighth digits are subdivisions for customs purposes, and the remaining two digits represent a statistical suffix.

A decimal point must be placed after the fourth, sixth, and eighth digits (e.g., 1234.56.78.90).

Field No. 28 - Tariff Code

Complete on all types of Form B3 if the conditions specified in the Chapter 99 (special classification provisions) tariff item apply. Indicate only the first four digits of the tariff item (e.g., 9923). (For Form B3, type F requirements, see Appendix J.)

Field No. 29 - Quantity

Complete on each classification line for all types of Form B3, in the unit of measure required by the Customs Tariff. (For FormB3, type F requirements, see Appendix J.)

Leave blank if no unit of measure is applied from the Customs Tariff or to any excise tax rates.

If a quantity is required for excise tax in a unit of measure different from that specified in the Customs Tariff, the quantity required for excise tax should be indicated on the next Form B3 line. The line number must not be completed for this line.

If only one quantity applies to a classification line, it must be shown on the first detail line. However, this quantity may be repeated on subsequent detail lines.

Field No. 30 - Unit of Measure

Complete on each classification line for all types of Form B3 as specified in the Customs Tariff.

Leave blank if no unit of measure is applied from the Customs Tariff or to any excise tax rates.

As a result of Customs Tariff requirements, only metric alphabetic codes can be used. Consequently, imperial measures indicated on an invoice must be converted to metric prior to completion of Form B3. Refer to metric conversion tables in Appendix E.

If a unit of measure is required for excise tax and is different from that specified in the Customs Tariff, the unit of measure required for excise tax should be completed on the next Form B3 line. The line number must not be completed for this line.

If only one unit of measure applies to a classification line, it must be shown on the first detail line. However, this unit of measure may be repeated on subsequent detail lines.

Refer to the list of unit of measure codes in Appendix H.

Field No. 31 - Value for Duty Code

Complete on each classification line for all types of Form B3. (For Form B3, type F requirements, see Appendix J.)

Use a combination of one of the first-digit code numbers and one of the second-digit code numbers to indicate the basis on which the value for duty was determined.

The first-digit code number (relationship)

Explanation

- 1 The vendor and purchaser are not related firms as defined in section 45(3) of the Customs Act.

- 2 The vendor and purchaser are related firms as defined in section 45(3) of the Customs Act.

The second-digit code number (valuation method used)

Explanation

- 3 Price paid or payable without adjustments (section 48 of the Customs Act)

- 4 Price paid or payable with adjustments (section 48 of the Customs Act)

- 5 Transaction value of identical goods (section 49 of the Customs Act)

- 6 Transaction value of similar goods (section 50 of the Customs Act)

- 7 Deductive value of imported goods (section 51 of the Customs Act)

- 8 Computed value (section 52 of the Customs Act)

- 9 Residual method of valuation (section 53 of the Customs Act)

Example: If the vendor and purchaser are related firms and the value for duty is the transaction value of similar goods, code 26 is shown.

Field No. 32 - SIMA Code

Complete on all types of Form B3 for goods subject to an action under the Special Import Measures Act (SIMA) and/or a Surtax Order. (For Form B3, type F requirements, see Appendix J.)

Identify the type of SIMA disposition applicable to the goods being imported as well as the mode of payment in the following manner:

The first digit will be the SIMA assessment type:

- 1 - Goods are not subject to a finding by the Canadian International Trade Tribunal (CITT) and/or a surtax order under the Customs Tariff;

- 2 - Only applies to goods covered by a price undertaking offered by all or substantially all exporters of the subject goods and accepted by the Commissioner;

- 3 - Only applies to goods subject to a preliminary determination commencing on the day the determination was made and ending on the day the Commissioner causes the investigation to be terminated or the day the CITT makes an order or finding;

- 4 - Goods are subject to a CITT finding. There is no amount of anti-dumping duty and/or countervailing duty owing which results in a nil payment;

- 5 - Goods are subject to a CITT finding and/or a surtax order. Anti-dumping duty and/or countervailing duty, and/or a surtax, amount is payable.

Note: When goods are subject to a CITT finding and/or a surtax order and SIMA duty and/or a surtax amount are covered by a remission order, SIMA code 50 should be used.

The second digit will indicate a nil assessment or the payment mode:

- 0 - Nil payment;

- 1 - Cash;

- 2 - Bond (used only for provisional duty or during the time of an expedited review)

- Notes: The following SIMA Code combinations are the only ones that are valid:

- 10 Use to identify non-subject goods when splitting the line of a Form B3 to separate goods of the same classification from goods that are subject to a CITT finding

- 20 Use for goods covered by a price undertaking

- 30 Use for goods where the provisional duty assessment is nil

- 31 Use for goods where the provisional duty assessment is covered by cash

- 32 Use for goods where the provisional duty assessment is covered by a SIMA bond

- 40 Use for subject goods where the SIMA duty assessment is nil

- 51 Use for goods where the SIMA duty assessment and/or the surtax amount is covered by cash

- 52 Use for subject goods under an expedited review where the SIMA duty assessment is covered by a SIMA bond

- 50 Use for subject goods where the SIMA duty assessment is covered by a valid OIC number, which must be entered in Field No. 26

Importers may be assessed an administrative monetary penalty (AMP) if they fail to provide the required code for any goods subject to SIMA.

Field No. 33 - Rate of Customs Duty

Must complete on each classification line for all types of Form B3 if a rate of customs duty applies. (For Form B3, type F requirements, see Appendix J.)

Where the Chapter 99 (special classification provisions) classification number reduces the rate to 0, this field must be left blank.

Where percentage and specific duties apply, the percentage rate of duty is shown on the first detail line. The specific rate of duty is shown on the next detail line. The line number must not be completed for this line.

If an additional rate of duty equivalent to an excise duty applies, show this rate of duty on the next detail line in this field. The line number must not be completed for this line.

The format must be as shown in the following examples:

| Rate(s) | Shown As |

|---|---|

| Free | Free, any combination of zeros or blank. |

| 18.5% | 18.5 |

| 20% | 20 or 20.0 |

| $ .94/kg | .0094 |

| $1.41/kg | .0141 |

Field No. 34 - Excise Tax Rate

Must complete with either an excise tax rate or an exemption code on the first detail line of each classification line for all types of Form B3. (See Appendix H, List 7 for excise tax exemptions and Appendix J for Form B3, type F requirements.)

If excise tax does not apply, leave this field blank.

Commodities with different excise tax rates or exemption codes must be coded on separate classification lines.

Where excise tax is payable, show the rate in the same format as the examples of appendix B.

| Rate(s) | Shown As |

|---|---|

| $ .0205/L | .0205 |

| $23.148/kg | 23.148 |

| 10% of the duty-paid value | 10 or 10.0 |

| $100.00 per air conditioner, installed in a vehicle | 100.00 |

Note: Goods subject to excise tax may not be combined on the same detail line with goods not subject to excise tax.

Field No. 35 - Rate of Goods and Services Tax (GST)

Must complete with either a GST rate or a GST status code on the first detail line of each classification line for all types of Form B3. (For Form B3, type F requirements, see Appendix J.)

Where GST is payable, show the rate as 5 or 5.0.

Where a GST status code applies, complete this field using code numbers from List 4 of Appendix H.

Packing materials or packing containers are subject to GST at a rate of 5%, except where the packing materials or packing containers qualify for non-taxable importation under a section of Schedule VII to the Excise Tax Act.

Field No. 36 - Value for Currency Conversion

Complete on each classification line for all types of Form B3. (For Form B3, type F requirements, see Appendix J.)

Show this amount in the currency specified on the invoice to a maximum of two decimal points. For example, 55,000 yen is shown as 55000.00.

For assistance in determining the amount to be shown in this field, consult the Memoranda D13 series.

Field No. 37 - Value for Duty

Complete on each classification line for all types of Form B3 by multiplying the value for currency conversion by the exchange rate. (For Form B3, type F requirements, see Appendix J.)

Show the value for duty in Canadian dollars separated by a decimal point. For example, $96.00 is shown as 96.00.

Calculations must be made to the cent.

Field No. 38 - Customs Duties

Complete on all types of Form B3 if customs duty applies. (For Form B3, type F requirements, see Appendix J.)

Show the amount of customs duty which is payable (not including provisional, anti-dumping, or countervailing duty) in dollars and cents separated by a decimal point. For example, $105.00 is shown as 105.00 and $123.84 as 123.84.

When a percentage rate of customs duty applies, customs duty is obtained by multiplying the value for duty by the rate of customs duty. When a specific rate of customs duty applies, customs duty is obtained by multiplying the quantity by the rate.

Note: Special calculations may apply if a remission order applies. Refer to the format examples in this appendix.

Field No. 39 - SIMA Assessment

Complete on all types of Form B3 if an amount of surtax and/or provisional duty, anti-dumping duty or countervailing duty is payable. (For Form B3, type F requirements, see Appendix J.)

When goods are subject to a Surtax Order, refer to the Memoranda D16 series.

For provisional, anti-dumping and/or countervailing duty refer to the Memoranda D14 and D15 series.

Show the amount in dollars and cents separated by a decimal point.

Note: These amounts and/or duties form part of the value for the calculation of excise taxes, except if provisional duty is deferred by bond.

Field No. 40 - Excise Tax

Complete on each classification line for all types of Form B3 if an excise tax applies. (For Form B3, type F requirements, see Appendix J.)

When a percentage rate applies, calculate excise tax by multiplying the total of the value for duty, customs duties, and the SIMA assessment by the excise tax rate.

When a specific rate applies, calculate excise tax by multiplying the quantity by the excise tax rate.

Note: Special calculations may apply if a remission order is applicable. Refer to the format examples in this appendix.

Field No. 41 - Value for Tax

Complete on each classification line for all types of Form B3 if GST is payable. (For Form B3, type F requirements, see Appendix J.)

Add the value for duty, customs duties, any SIMA assessment, and any excise tax, and show the total amount in this field.

Show the amount in dollars and cents separated by a decimal point. For example, $1056.00 is shown as 1056.00.

Field No. 42 - GST

Complete on each classification line for all types of Form B3 if GST applies. (For Form B3, type F requirements, see Appendix J.)

Calculate GST to the cent by multiplying the value for tax by the rate of GST.

Show the amount of GST, if any, in dollars and cents separated by a decimal point.

Note: Special calculations may apply if a remission order is applicable. Refer to the format examples in this appendix.

Field No. 43 - Deposit

Complete on types D and AD of Form B3. (For Form B3, type F requirements, see Appendix J.)

Leave blank on all other types.

Calculate 10% of the value of the goods for which the importer/owner or broker cannot account to obtain the sight deposit applied.

The minimum deposit is $100 and the maximum deposit is $1,000.

The deposit must be included in the total customs duties (Field No. 47).

If Form B3 has two or more pages, complete only on the last page.

Field No. 44 - Warehouse Number

Leave blank on all types of Form B3.

Field No. 45 - Cargo Control Number

Complete on Form B3, types C, D, M, AB, and AD. Leave blank for types H and V. (For Form B3, type F requirements, see Appendix J.)

Show the cargo control number exactly as it appears on the cargo control document, including the carrier code.

Any hyphens shown in the carrier code (first four digits) must be indicated.

Only one cargo control number can be shown in Field No. 45. If there is more than one cargo control document to be acquitted by one Form B3, list all the cargo control numbers on Form B3B and show the Form B3B in this field.

If there are two or more pages on Form B3, complete only on the last page.

Leave this field blank if no cargo control document is required.

For more information concerning cargo control documents, refer to Memorandum D3-1-1, Policy Respecting the Importation and Transportation of Goods.

Field No. 46 - Carrier Code at Importation

Complete for shipment valued at greater than CAN$2500 exported from the United States by air or marine.

Leave blank on document types F, H, M, and V.

Show the four-character carrier code of the carrier on which the goods were laden at the time of their importation into Canada.

Where there are only three digits, as in an air carrier, show the three-character code plus a hyphen.

Field No. 47 - Customs Duties

Complete on all types of Form B3 if customs duties are payable. (For Form B3, type F requirements, see Appendix J.)

If there is no customs duty payable, leave blank or show any combination of zeros.

This field will include customs duty and deposit amounts only.

Add each of the detail line (Field No. 38) customs duty amounts and any deposit amount to obtain total customs duties.

Show the total in dollars and cents separated by a decimal point.

If Form B3 has two or more pages, complete this field only on the last page.

Field No. 48 - SIMA Assessment

Complete on all types of Form B3 if an amount of surtax and/or provisional duty, anti-dumping duty or countervailing duty is payable. (For Form B3, type F requirements, see Appendix J.)

Show the total of each of the classification lines (Field No. 39) provisional duty or SIMA duty amounts and/or the amounts of a surtax, unless deferred by bond as designated by SIMA Codes 32 or 52 or covered by a remission order as indicated by SIMA code 50.

Show the total in dollars and cents separated by a decimal point.

If Form B3 has two or more pages, complete only on the last page.

Field No. 49 - Excise Tax

Complete on all types of Form B3 if excise tax is payable. (For Form B3, type F requirements, see Appendix J.)

If there is no excise tax payable, leave blank or show any combination of zeros.

Add each of the detail line (Field No. 40) excise tax amounts to obtain total excise tax.

Show the total amount of all excise tax in dollars and cents separated by a decimal point.

If Form B3 has two or more pages, complete only on the last page.

Field No. 50 - GST

Complete on all types of Form B3 if GST is payable. (For Form B3, type F requirements, see Appendix J.)

If there is no GST payable, leave blank or show any combination of zeros.

Add each of the detail line (Field No. 42) GST amounts to obtain total GST.

Show the total amount of all GST in dollars and cents separated by a decimal point.

If Form B3 has two or more pages, complete only on the last page.

Field No. 51 - Total

Must complete on all types of Form B3. (For Form B3, type F requirements, see Appendix J.)

If there are no customs duties or taxes payable, show any combination of zeros. Do not leave blank.

If Form B3 has two or more pages, complete only on the last page.

Field - Importer/Agent Declaration

Complete on all types of Form B3.

Show the name and telephone number of the person making the declaration, and identify the company represented by the person making the declaration.

Date and sign the declaration on the original copy of Form B3. The importer/owner/agent declaration must be signed by the person whose name appears in the declaration.

If Form B3 has two or more pages, complete only on the last page.

The person making the declaration is indicating that the information on Form B3 is accurate and complete. The importer/owner/agent should keep in mind that the deliberate use of code 10 for the United States Tariff, code 11 for the Mexico Tariff, code 12 for the Mexico-United States Tariff, code 13 for the Israel Tariff, code 14 for the Chile Tariff, or code21 for the Costa Rica Tariff when such use is not appropriate may result in enforcement action.

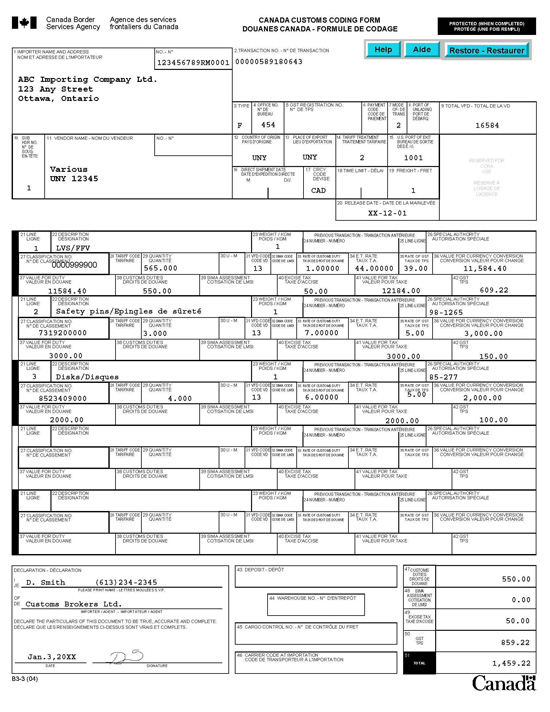

Form B3 - Format Examples and Explanations

The examples included in this section are designed to provide importers/brokers with essential information about the various Form B3 format requirements. These examples depict typical, not actual transactions.

Note: The rates of duty, GST, and excise taxes, as well as the rates of exchange used for calculation and testing purposes on the examples are not necessarily currently in effect. Therefore, while the actual coding on the examples is correct, information such as tariff rates and tax rates should be verified by checking the Customs Tariff, the Excise Tax Act, and other reference sources to ensure accuracy. Bar codes shown on Form B3 examples are for illustration purposes only.

The examples have been set forth in the following order:

| Example No. | Type Format |

|---|---|

| Simple Form B3 Type Formats | |

| 1 | AB - Confirming Form B3 |

| 2 | C - Perfect Form B3 |

| 3 | D - Sight Form B3 |

| 4 | AD - Confirming Sight Form B3 |

| 5 | V - Voluntary (bona fide) |

| 6 | V - Voluntary (investigation) |

| 7 | H - Supplementary B3 Form |

| Complex B3 Form Formats | |

| 8 | Multiple Sub-headers (diplomatic goods) |

| 9 | Chapter 99 special classification provisions |

| 10 | Packaged manufactured tobacco with package exceeding 200 grams |

| 11 | Packaged manufactured tobacco |

| 12 | Additional duty on cigar ($0.067 per cigar) |

| 13 | Additional duty on cigar (duty-paid value) |

| 14 | Cigarettes containing tobacco 1361 g per thousand |

| 15 | Excise taxes and special levies |

| 16 | SIMA assessment (payment) |

| 17 | SIMA assessment (deferred by bond) |

| 18 | Canadian goods repaired abroad without warranty in a country other than the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica |

| 19 | Importation of goods repaired free under warranty in a Country other than the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica |

| 20 | Importation of goods repaired without warranty in the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica |

| 21 | Importation of goods repaired free under warranty in the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica |

| 22 | Partial remission (flat rate per month) |

| 23 | Repayment of drawback, refund or remission |

| 24 | Duty deferral program |

| 25 | Imported Spirits for Blending Remission Order |

| 26 | Partial remission of GST (1/60) |

| 27 | Packing (duty and goods and services tax) |

| 28 | Canadian goods returned |

| 29 | Proportional duty (1/120) - Vessels |

| 30 | Computer Carrier Media Remission Order - Dutiable import |

| 31 | Forms B3 and E29B, for temporary importations |

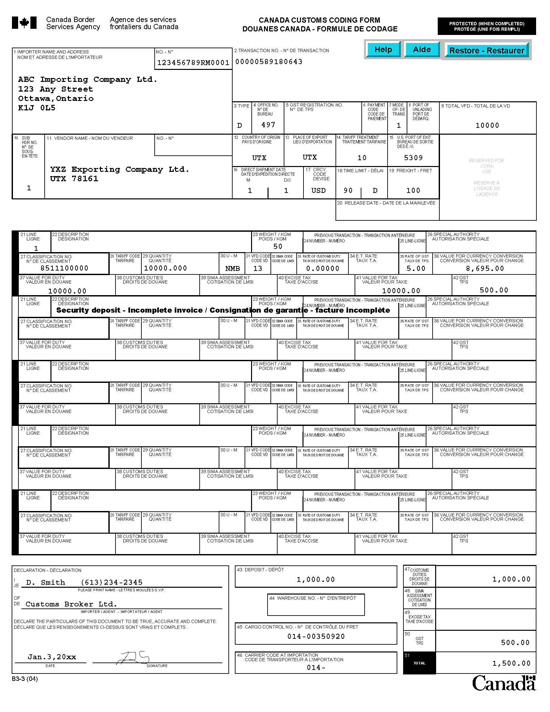

EXAMPLE 1

Type AB - Confirming Form B3

This example shows the format to be used to complete a simple Form B3, type AB when accounting for goods released on minimum documentation.

EXAMPLE 2

Type C - Perfect Form B3

This example shows the format to be used to complete a simple Form B3, type C.

EXAMPLE 3

Type D - Sight Form B3

This example shows the format to be used when an importer/owner prepares a sight Form B3 because fully satisfactory documentation cannot be submitted. The sight deposit amount must be shown in Field No. 43 and added into total duty (Field No. 47). The reason for the sight document is shown in Field No. 22 on the line following the last line accounting for the goods. The time limit must be shown in Field No. 18.

EXAMPLE 4

Type AD - Confirming sight Form B3

This example shows the format to be used when accounting for goods released on minimum documentation where a sight deposit applies. The sight deposit amount must be shown in Field No. 43 and added into the total duty (Field No. 47). The reason for the sight document is shown in Field No. 22 on the line following the last line accounting for the goods. The time limit must be shown in Field No. 18.

EXAMPLE 5

Type V - Voluntary (bona fide)

This example shows the format to be used by an importer/owner who has come forward and voluntarily declared goods that were delivered to him without the benefit of CBSA clearance. The importer/owner has also produced invoices for this shipment, and therefore, all the fields on Form B3 can be correctly completed. A brief statement of the circumstances is shown in the body of Form B3.

EXAMPLE 6

Type V - Voluntary (investigation)

This example shows the format to be used when a voluntary or assessment Form B3 is prepared as a result of a CBSA file or ruling: in this case, an Investigation Division file. Those fields for which the required information is not available or is not applicable must be left blank (e.g., Field No. 45, "Cargo Control Number"). The file relating to Form B3 is shown in the description field and a brief statement of the circumstances is shown in the body of Form B3.

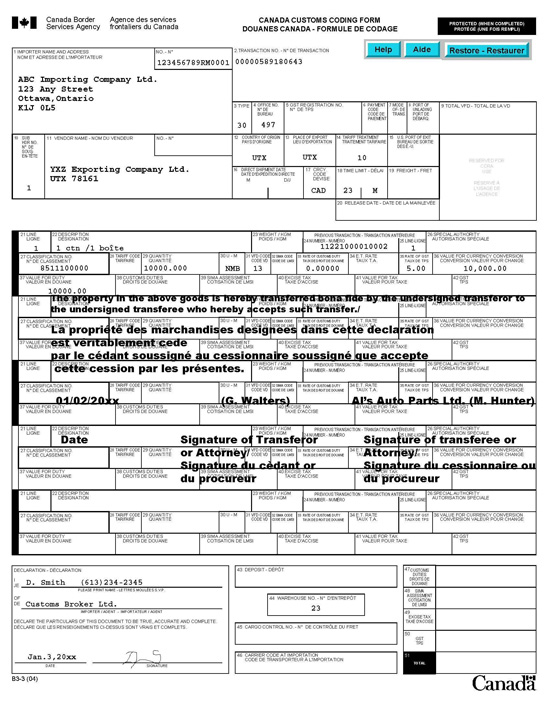

EXAMPLE 7

Type H - Supplementary Form B3

This example shows the format to be used to voluntarily account for goods previously reported but not accounted for at the time of final accounting: for example, to account for a line on an invoice that was inadvertently omitted on a previous Form B3. Field No. 24, "Previous Transaction Number" is to indicate the transaction number of the previous Form B3. No cargo control number is required in Field No. 45, "Cargo Control Number." The release date must be shown in the body of Form B3.

EXAMPLE 8

Multiple sub-headers (diplomatic goods)

This example shows the format to be used when a change occurs to the content of the sub-header (e.g., vendor name). All fields within the sub-header must be completed on each new page as well as the appropriate fields on the related classification line. Sub-header fields should never be completed on new pages if a new sub-header is not applicable. Note that in any situation where multiple pages apply, trailer information in Field Nos. 43 to 51 should only be completed on the final Form B3 page.

EXAMPLE 8 - cont

The certificate referred to in Field No. 22 is one attested to by a signing officer of the embassy or consulate, declaring the goods to be for official use and not for sale.

EXAMPLE 9

Chapter 99 - Special classification provisions

This example shows the format to be used when a special classification provision of Chapter 99 of the Customs Tariff is applicable. In Field No. 27 indicate the classification number for the goods from Chapters 1 97 of the Schedule to the Customs Tariff. Indicate only the first four digits of the Chapter 99 tariff item in Field No. 28 (i.e., tariff item 9967.00.00 is indicated as 9967). In this case the normal rate of duty equal to 6% is lowered to a free rate by the Chapter 99 tariff item. GST is still payable unless the goods qualify for the use of a GST status code.

EXAMPLE 10

Packaged manufactured tobacco with package exceeding 200 grams

For tobacco of Heading 24.03 imported in packages greater than 200 grams, the importer is required to manually calculate the excise duty rate and the amount. Therefore, if an importer brings in 20 packages weighing 454 grams each, the quantity of 20 would be entered in field 29; while the 44.00 would be coded into field 34. The importer must then calculate the total excise duties owed and enter that amount into field 40. The excise duty per package is calculated by multiplying $2.8925 (the rate for each 50 gram increment or fraction of 50 grams contained in a package) by the number of units of 50 grams, including fractions of 50 gram, in each package. In this case there are 10 units of 50 grams in each package. Thus the excise duty amount per package would be $28.925 ($2.8925 times 10) and the excise duty payable on the total shipment of 20 packages would be $578.50 ($28.925 times 20).

EXAMPLE 11

Packaged manufactured tobacco

As of July 30, 2008, only one rate of excise duty is to be applied on each entry line. Although this legislative change concerns an adjustment to the excise duty for "packaged" manufactured tobacco of Heading 24.03, for systems validation purposes the excise tax rate field 34 will be used to validate the excise duty amount owing. Therefore, for "packaged" manufactured tobacco of this Heading, the excise tax rate field must be completed with the applicable excise duty rates that apply to E codes E37-41 as follow:

| Package size | Rate |

|---|---|

Up to but not exceeding 50 grams |

$2.8925 |

Greater than 50 grams but not exceeding 100 grams |

$5.7850 |

Greater than 100 grams but not exceeding 150 grams |

$8.6775 |

Greater than 150 grams but not exceeding 200 grams |

$11.5700 |

EXAMPLE 12

Additional duty on cigar ($0.067 per cigar)

As of January 1, 2008 the excise duty rate on cigars is $18.50 per 1000 cigars (Section 4 of Schedule 1 to the Excise Act, 2001); and the additional duty rate is the greater of $0.067 per cigar or the 67% of the duty-paid value with the later meaning, in respect of imported cigars, the value of the cigars as it would be determined for the purpose of calculating an ad valorem duty on the cigars in accordance with the Customs Act, whether or not the cigars are subject to ad valorem duty, plus the amount of any duty imposed on the cigars under section 42 of the Excise Act, 2001 and section 20 of the Customs Tariff. In this example the rate of $0.067 per cigar is greater than the rate of 67% of the duty-paid value.

EXAMPLE 13

Additional duty on cigar (duty-paid value)

In this example, the additional excise duty on cigars applies and is calculated at the rate of 67% of the duty-paid value (see previous example for the definition of duty-paid value)

EXAMPLE 14

Cigarettes containing tobacco 1361 g per thousand

The excise duty rate is $0.425 for each five cigarettes of fraction of five cigarettes contained in any package as per section 1(b) of Schedule 1 to the Excise Act, 2001. For standard package sizes (i.e. packages of 20 or 25 cigarettes), this amounts to $85.00 per 1000 cigarettes.

If a cigarette exceeds 102mm in length, each portion of 76 mm or less is considered to be a separate cigarette (Section 2 of the Excise Act, 2001); therefore, the quantity reported should reflect the each portion of 76 mm or less.

For classification line 1, nine cigarettes not exceeding 102mm in length are being imported. Therefore, a quantity of nine is reported and the rate of $85.00 per 1000 applies.

For classification line 2, nine cigarettes exceeding 102mm in length (i.e. 110 mm) are being imported. In this case, each cigarette contains 2 portions of 76mm or less. Therefore, the quantity is multiplied by 2 as shown in the example on classification line 2, for the calculation of the excise duty.

EXAMPLE 15

Excise taxes and special levies

This example shows the format to be used when accounting for automobiles with various excise tax rates. When different excise tax rates apply, a new classification line must be completed for each line. In this example the special levy does not apply on line 1, only the $100 for the air conditioner. A listing of vehicles, associated fuel-efficiency ratings and the formula for the calculation of the weighted fuel consumption (in a case where a specific brand is not listed) can be found either at the CRA or NRCan Web site at http://www.cra-arc.gc.ca/E/pub/et/etsl64/README.html or http://oee.nrcan.gc.ca/transportation/tools/fuelratings/fuel-consumption.cfm; automobiles that have a weighted average fuel consumption rating of 13 or more litres per 100 kilometres will be subject to the excise tax at the following rates:

- at least 13 but less than 14 litres per 100 kilometres, $1000;

- at least 14 but less than 15 litres per 100 kilometres, $2000;

- at least 15 but less than 16 litres per 100 kilometres, $3000; and

- 16 or more litres per 100 kilometres, $4000.

EXAMPLE 16

SIMA assessment (payment)

This example shows the format to be used when the goods are subject to SIMA assessment, and payment of SIMA duty is made. The SIMA code in Field No. 32 shows 31; the first digit indicates that provisional duty is being assessed and the second digit indicates that the amount is being paid in cash. The export price has been determined to be the selling price on the invoice and is 5¢ each or $50 for the shipment. The normal value has been determined to be 10¢ each or $100 for the shipment. The provisional anti dumping duty is the amount by which the export price is lower than the normal value, in this case 5¢ per unit times the number of units released during the provisional period (1000 × 5¢ = $50). Value for tax in Field No. 41 must include the SIMA assessment amount completed in Field No. 39. Total SIMA assessment must be included in Field No. 48.

EXAMPLE 17

SIMA assessment (deferred by bond)

This example shows the format to be used when the goods are subject to SIMA assessment, and a bond has been posted for deferral of payment of the SIMA assessment. The SIMA code in Field No. 32 shows 32; the first digit indicates that provisional duty is being assessed and the second digit indicates the payment is deferred by a SIMA bond (See Memorandum D14 1 5 for details respecting use of the SIMA bond). Provisional anti dumping duty is the difference between normal value and export price (see previous example for details). Value for tax in Field No. 41 does not include the SIMA assessment amount which is shown in Field No. 39. The total SIMA assessment amount in Field No. 48 is nil.

Note that the bond number is shown in Field No. 22.

EXAMPLE 18

Canadian goods repaired abroad without warranty in a country other than the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica

This example shows the format to be used when Canadian goods are returned after being repaired without warranty in a country other than the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica. The first classification line shows the value of the goods at the time of import less the value of the repairs. Duty and GST are relieved under the Canadian Goods Abroad Program. Indicate 98-01-0101 in Field No. 26, "Special Authority." The second classification line shows the value of the repairs. Duty and taxes must be calculated for this line in the normal manner. Total value for duty in Field No. 9 includes the value of the goods at the time of export as well as the value of the repairs.

EXAMPLE 19

Importation of goods repaired free under warranty in a country other than the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica

This example shows the format to be used when goods are returned after being repaired under warranty in a country other than the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica.

- (a) The first classification line is the good's Canadian value at time of export meaning the import value less the value of the repairs, additions, or work abroad. Duties including GST are relieved on this amount; and

- (b) The second classification line, with the same classification number, is the value of the repairs, equipment additions, or work done abroad. Duties including GST are payable on this amount. However, in this example, the goods are repaired under warranty and are not subject to GST. Indicate GST status code 66 in Field No. 35.

Total value for duty in Field No. 9 includes the value of the goods at the time of export, as well as the value of the repairs. The value for duty code in Field No. 31 will be "19" or "29," as appropriate, for the residual method of valuation.

EXAMPLE 20

Importation of goods repaired without warranty in the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica

This example shows the format to be used when Canadian goods are returned after being repaired in the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica where the goods are not under warranty. Indicate the classification number of the goods in Chapters 1 97 of the Customs Tariff in Field No. 27. Indicate "9992" in Field No. 28. The goods and repairs are duty free because they qualify under a Chapter 99 special classification provision (tariff item 9992.00.00), but the goods are subject to GST on the value of the repair that appears in Field 37 of the classification line. The value for duty code in Field No. 31 will be "19" or "29," as appropriate, for the residual method of valuation.

EXAMPLE 21

Importation of goods repaired free under warranty in the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica

This example shows the format to be used when Canadian goods are returned after being repaired free under warranty in the United States, Mexico, Chile, Israel or another CIFTA beneficiary, or Costa Rica. The goods and the repairs are duty free because they qualify under a Chapter 99 special classification provision (tariff item 9992.00.00) and are not subject to GST because they qualify under GST status code 66. Indicate the classification number of the goods in Chapters 1 97 of the Customs Tariff in Field No. 27. Indicate "9992" in Field No. 28. The value for duty code in Field No. 31 will be "19" or "29," as appropriate, for the residual method of valuation.

EXAMPLE 22

Partial remission (flat rate per month)

This example shows the format to be used when an importer/owner is entitled to partial remission of GST based on a flat rate per month as specified in the remission order. The duty and taxes payable are not related to the value for duty or to the rate of duty payable under the particular classification number. Indicate "9993" in Field No. 28.

EXAMPLE 23

Repayment of drawback, refund, or remission

This example shows the format to be used when documenting the importation of goods once exported from Canada and are re imported (heading No. 9813, 9814, or 9992) and on which the customs duties, refunds or drawbacks allowed at the time of exportation, must be repaid. In Field No. 26, insert special authority number 50 0000. In Field No. 38, "Customs Duties" or Field No. 42, "GST," insert the amount being repaid. The statement shown on the body of the example is required.

EXAMPLE 24

Duty Deferral Program

This example shows the format to be used when goods are imported under the Duty Deferral Program. In this case, 60% of the imported goods are subject to remission of customs duty only. The remaining 40% of the goods have to be shown on the first classification line on which regular customs duty and GST must be paid. The second line accounts for 60% of the goods which are entitled to remission of 100% of the customs duty. The GST is not remitted under this program. Depending on the authorization granted to the importer of the goods, the amount of relief may vary. The relief amount will be indicated on the authorization. For further information, refer to Memorandum D7 4 1, Duties Relief Program.

EXAMPLE 25

Imported Spirits for Blending Remission Order

This example shows the format to be used when remitting partial duty under the Imported Spirits for Blending Remission Order. This Order remits customs duty payable equivalent to excise duty on spirits, wine, or flavouring materials having a spirit content, imported into Canada for the purpose of being blended in a distillery with spirits in bond. Indicate the OIC number "83-2525" in Field No. 26. For more information, see Memorandum D8-2-18, Imported Spirits for Blending Remission Order.

EXAMPLE 26

Partial remission of GST (1/60)

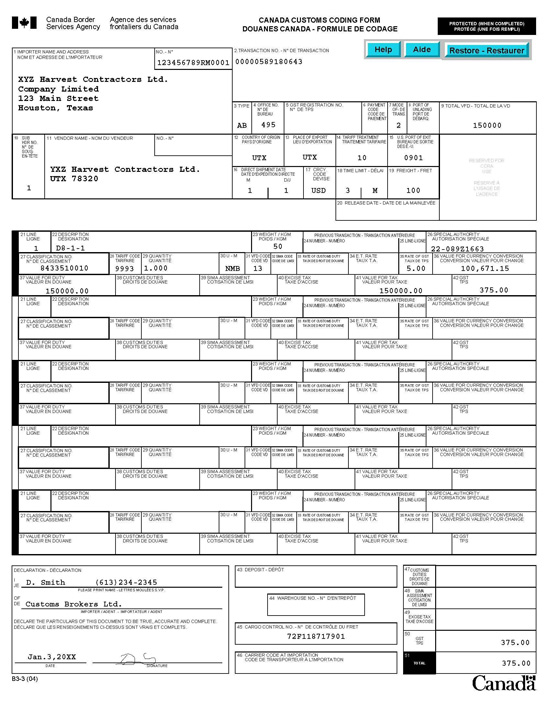

This example shows the format to be used when goods are duty free, but are subject to relief of GST on a proportional (1/60) basis only. Note that only one classification line is required. The value for currency conversion must be completed in Field No. 36. If the goods are subject to GST, it is calculated on the value for tax divided by 60 multiplied by the time limit (in this example, $150,000 ÷ 60 × 3(months) × 5% = $375.00). For more information, refer to Memorandum D8 1 1, Temporary Importation (Tariff Item No. 9993.00.00) Regulations.

EXAMPLE 27

Packing (duty and goods and services tax)

This example shows the format to be used when duty and GST are collected for packing on a separate classification line. Note that the line accounting for packing follows the line accounting for the goods to which it relates.

EXAMPLE 28

Canadian goods returned

This example shows the format to be used when Canadian goods are re imported into Canada. The shipper should be shown in Field No. 11 for vendor. Field No. 16, "Direct Shipment Date," is not required. Field No. 17, "Currency Code," must show the code for Canadian currency. The value for duty code in Field 31 will be "19" or "29," as appropriate, for the residual method of valuation.

Note: GST may apply to goods classified under tariff No. 9813.00.00. Use code 66 only if no GST is payable. Refer to example 21 for more information.

EXAMPLE 29

Proportional duty (1/120) - Vessels

This example shows the format to be used when goods are subject to a remission on a proportional 1/120 basis. Order in Council 88 0357 must be quoted in Field No. 26, "Special Authority." The Headquarters' authorization number (e.g., CCV 88/999) must be quoted in Field No. 22, "Description." Form B3 must be accompanied by a copy of the Headquarters' authorization. The entire amount may be accounted for on Form B3, but if payments are made on a monthly basis, they should be accounted for on Form B2 with reference to the original Form B3.

EXAMPLE 30

Computer Carrier Media Remission Order - Dutiable import

This example shows the format to be used when dutiable software is imported. The value of the carrier medium and the reproduction service is accounted for on line 1. The value of the data or instructions contained on the carrier medium is accounted for on line 2. The Computer Carrier Media Remission Order relieves the duty but GST applies. See Memorandum D8-3-15, Computer Carrier Media Remission Order, for further information.

EXAMPLE 31

Forms B3 and E29B, for temporary importations

This example shows the format to be used when goods are temporarily imported and are subject to full relief of duty but only partial (1/60) relief of GST. GST is calculated on 1/60th of the value for duty multiplied by the number of months the goods will remain in Canada (i.e., $1000 ÷ 60 × 3(months) = $50). They must be documented on Forms E29B and B3 and the forms are cross referenced.

APPENDIX C

FORM B3 (BONDED WAREHOUSE) CODING INSTRUCTIONS

The fields of Form B3 (bonded warehouse) must be completed according to the following instructions.

Field No.1 - Importer Name and Address

Must complete importer's name on all Form B3 types. If Form B3 has two or more pages, complete on the first page. (For Form B3, type F requirements, see Appendix J)

Show the importer's address if it does not appear on the supporting invoice.

In the "No." section of this field, show the Business Number and the CBSA account number. This number is a standard way of identifying importing and exporting businesses, and is used in the processing of CBSA accounting documents. If you have one or more CBSA accounts, indicate the six-digit account identifier (e.g., RM0001).

Field No.2 - Transaction Number

Must complete on all types of Form B3 when release prior to payment security is being used.

This number is 14 digits in length and includes the following:

- (a) the first five digits represent the account security number of the importer/broker who will present the accounting document and/or pay the duties and taxes; and

- (b) the next eight digits represent a number assigned by the importer/broker; and

- (c) the last digit is a check digit calculated using a formula provided by customs (refer to Appendix F).

Show the transaction number assigned at time of release, if it applies, on all copies of Form B3 and on the first page of the supporting documents. It must be in bar-coded format (see the following note on bar coding) on the first page of the CBSA copy of Form B3. Refer to Appendix I for bar code specification. The typed or clearly written transaction number must appear on all the remaining pages of Form B3 and on the first page of the supporting documents. If the supporting document is multi-paged, the total number of attachments must also be shown on the first page. This eliminates the need to include the transaction number on each page of the supporting documents.

The transaction number must also be typed or clearly written on all applicable permits, certificates, and licences.

The transaction number must not be duplicated for 7 years and 3 months (a 6-year period plus 15 current months). Note that if a transaction is adjusted, the 7-year period plus 3 months will begin at the date of final decision.

Notes:

- 1. All importers/brokers who have an account security number with release prior to payment privileges must submit Form B3 documentation with a bar-coded transaction number.

- 2. Importers/brokers having only "uncertified cheque" security must assign a transaction number to their accounting documentation. However, it is not mandatory that the transaction number be bar-coded. For all unsecured transactions (i.e., "cash" transactions), customs will assign a bar-coded transaction number.

Field No.3 - Type

Must complete on all Form B3 types. If Form B3 has two or more pages, Form B3 type is to be shown on the first page.

Code Form B3 types numerically as follows:

- 10 - Form B3 for all goods in warehouse - used when goods are to be entered into a CBSA customs bonded warehouse.

- 13 - Form B3 for re-warehouse - used when goods are re-warehoused after being transferred (except to a duty-free shop) or removed on type 30, e.g., after removal from another bonded warehouse either at the same CBSA office or at a different CBSA office. Refer to Memorandum D4-3-7, Duty Free Shop - Contraventions and Penalties, for the completion instructions for Form B116, Canada Customs Duty Free Shop Accounting Document, that is presented when goods are entered into a duty-free shop.

- 20 - Form B3 for ex-warehouse for consumption - used to account for duty and taxes on goods taken out of the warehouse for use in Canada that were warehoused on Form B3, types 10 and 13.

- 21 - Form B3 for ex-warehouse for export or approved deficiencies - used when goods that were warehoused on Form B3, types 10 and 13 are taken out of the warehouse and exported for damaged goods and shortages, proof is required. Damaged goods should be documented on Form K11, Certificate of Damaged Goods.

- 22 - Form B3 for ex-warehouse for ships' stores, sales to the Governor General and diplomats - used to account for goods that were warehoused on Form B3, types 10 and 13, and taken out of the warehouse for use as ships' stores.

- 30 - Form B3 for transfer of goods - used for the transfer of goods from one bonded warehouse to another or transfer of ownership or title. Refer to Memorandum D7-4-4, Customs Bonded Warehouses, for information on the transfer of goods between warehouses, and Memorandum D4-3-7 for information concerning goods that are transferred between a CBSA customs warehouse and duty-free shop.

Field No.4 - Office Number

Must complete on all Form B3 types.

If Form B3 has two or more pages, complete on the first page.

Show the CBSA accounting office code number. (See Appendix H, List 1(a) or 1(b) for the code number of the CBSA office responsible for the accounting of the goods.)

Field No.5 - GST Registration Number

If a Business Number (BN) number is used in Field No. 1, this field may be left blank.

Field No.6 - Payment Code

Show an "I" on the first page of Form B3 if an importer has posted security and the goods are released under a customs broker's account security number.

In such cases, the daily Form K84, Importer/Broker Account Statement, will be produced for the broker, separating transactions for the importers identified above.

Field No.7 - Mode of Transport

Complete on Form B3, type 10 for all shipments valued at greater than CAN$2500.

Show the code for the mode of transport by which the goods arrived in Canada. Valid codes are as follows:

| Air | 1 |

|---|---|

| Highway | 2 |

| Rail | 6 |

| Pipeline | 7 |

| Commercial Hand Carried Goods | 8 |

| Marine | 9 |

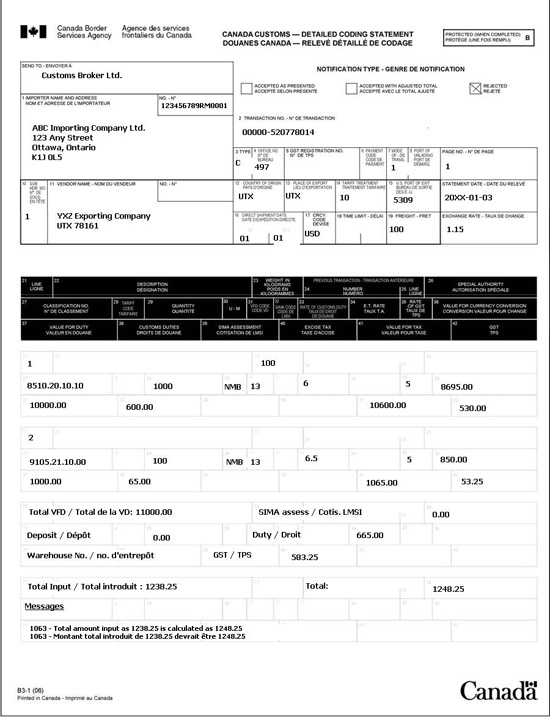

Field No.8 - Port of Unlading