Tariff Classification of wood flooring products (including cork)

Memorandum D10-14-55

Ottawa, February 7, 2022

This document is also available in PDF (356 KB) [help with PDF files]

In brief

The editing revisions made in this memorandum have been made to clarify current policies or procedures and reflect the guidance provided by existing World Customs Organization Compendium Classification Opinions and the Harmonized System Explanatory Notes.

An Appendix has been added with images of sample wood flooring panels.

This memorandum explains the Canada Border Services Agency’s interpretation regarding the tariff classification of certain flooring products under Chapters 44 and 45 of the Customs Tariff.

Legislation

Chapter 44 Wood and articles of wood; wood charcoal

| 44.07 | Wood sawn or chipped lengthwise, sliced or peeled, whether or not planed, sanded or end-jointed, of a thickness exceeding 6 mm. |

| 44.09 | Wood (including strips and friezes for parquet flooring, not assembled) continuously shaped (tongued, grooved, rebated, champhered, V-jointed, beaded, moulded, rounded or the like) along any of its edges, ends or faces, whether or not planed, sanded or end-jointed. |

| 44.12 | Plywood, veneered panels and similar laminated wood. |

| 44.18 | Builders’ joinery and carpentry of wood, including cellular wood panels, assembled flooring panels, shingles and shakes. |

Chapter 45 Cork and articles of cork

| 45.03 | Articles of natural cork. |

Guidelines and general information

1. This memorandum explains the CBSA’s interpretation regarding the tariff classification of boards, plank, panel and strip flooring, plywood flooring, veneer wood flooring and similar laminate wood flooring, cork flooring, assembled flooring panels, multilayer engineered wood flooring, and parquet flooring, taking into account the guidance provided on these goods by the World Customs Organization (WCO) Compendium Classification Opinions (CCO) and the Harmonized System (HS) Explanatory Notes.

Definitions

Wood boards, planks, panels and strips are defined as long, flat, usually rectangular pieces of wood material, of considerable length and breadth compared with the thickness, used for floors. They may be solid, multilayer engineered or multi-stripped wood.

Engineered wood flooring or engineered hardwood flooring products are simply marketing terms for multilayered flooring panels made of either plywood, veneered panels or similar laminated wood of heading 44.12, or of assembled flooring panels of heading 44.18.

Multi-stripped panels have been assembled with a top surface layer (with a parquet-like appearance) made up of multiple (two or more) pieces or strips glued or otherwise bonded edge to edge to make up a larger sheet.

Administrative policy

Solid sawn or chipped plank and wood strip flooring

2. Solid sawn or chipped wood boards, plank, etc., of heading 44.07 may be planed or sanded, but not continuously shaped (e.g., bevelled) on any of the edges or ends. The boards, planks, etc., must be of a thickness exceeding 6 mm.

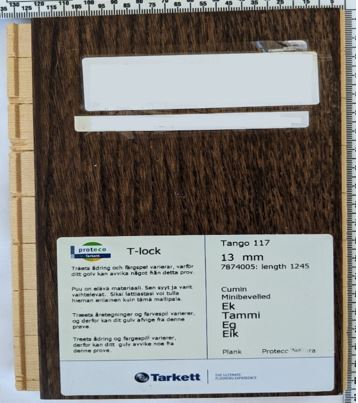

3. Wood strip flooring generally consists of one piece of solid boards, planks, etc., of wood flooring (including strips or friezes for parquet flooring, not assembled) which, after sawing or squaring, has been continuously shaped on any of the edges (e.g., bevelled or tongue-and-grooved). Such wood strip flooring is classified in heading 44.09. (See Appendix A – image 1.)

4. Wood strip flooring of coniferous wood (softwood), such as pine, that have been continuously worked or bevelled on any of the edges are classified under tariff item 4409.10.00.

5. Oak strip flooring that has been continuously worked or bevelled on any of the edges is classified under tariff item 4409.29.10.

6. Maple and other non-coniferous strip flooring of this type are classified under tariff item 4409.29.90.

Plywood flooring panels

7. Plywood flooring must consist of at least three sheet or panel layers of wood glued and pressed together with the grain of the successive layers generally at angles. (See Appendix A, image 2)

8. Plywood flooring panels are differentiated from assembled flooring panels of heading 44.18 by the top surface layer. The top surface layer of plywood of heading 44.12 should be a continuous sheet, whereas assembled floor panels of heading 44.18 generally have a top surface made up of pieces or strips glued or otherwise bonded edge to edge to make up a larger sheet.

9. For tariff classification purposes, bamboo wood is considered to be a non-coniferous wood (hardwood) unless specifically provided for otherwise, such as under subheading 4412.10.

10. Plywood floor panels consisting solely of sheets of wood (other than bamboo) of subheading 4412.3 will have plies that do not exceed 6 mm in thickness.

11. Plywood flooring with at least one outer ply of tropical wood, as defined in subheading note 1 to Chapter 44, is classified under subheading 4412.31.

12. The top layer of plywood may be coated with a very thin layer of clear colourless plastic. Some sub-flooring plywood products that are intended to be used next to concrete, such as in a basement, may also have a coating or outer layer of plastic. This type of product remains classified as plywood under heading 44.12.

Veneered flooring panels (and similar laminated wood flooring panels)

13. Veneered flooring panels and similar laminated wood flooring can be made by shearing or slicing a thin layer from a block of wood to make up one top sheet veneer with a base or core usually of softwood, fibreboard, particleboard, etc. The effect is a continuous veneer sheet used as the top layer of the flooring panel with an inferior wood base or core. This type of veneered flooring panel remains classified under heading 44.12.

14. Wood veneer flooring with a base or core of softwood, fibreboard or particleboard, and an outer ply of hardwood, such as maple or oak, or of tropical wood is classified under tariff item 4412.99.90. The base or core layer of the flooring panel can be of any thickness, and the top veneer layer may be coated with a very thin layer of clear, colourless plastic.

15. Similar laminated wood of Subheading 4412.94 includes blockboard, laminboard and battenboard, in which the core is thick and composed of blocks, laths or battens of wood glued together and surfaced with an outer ply. The panels may be faced with one solid wood, particle board or similar board, fibreboard, plywood or metal ply. Similar laminated wood also includes panels in which the core consists of a layer or layers of other materials such as particle board, fibreboard, wood waste glued together, asbestos or cork. (See Appendix A, image 3)

16. Similar laminate wood flooring panels of Subheading 4412.99 will have two or more sheets, with one continuous top face sheet. It may have at least one ply which exceeds 6 mm, and the grain of alternate layers may be parallel.

17. Veneered flooring made with a top layer of cork falls under Chapter 45 (Cork and Articles of Cork). This type of flooring is generally made with agglomerated cork fixed to a base of fibreboard and is classified under tariff item 4504.90.00. Cork flooring with a top layer of natural cork fixed to a base of fibreboard or particle board is classified under tariff item 4503.90.00.

Assembled flooring panels

18. Assembled flooring panels of heading 44.18 covers solid blocks, strips and friezes assembled into flooring panels, and “multilayer” parquet flooring panels consisting of blocks, strips and friezes assembled on a support of one or more layers of wood. In many cases, the panels will be tongue-and-grooved along the edges and the top layer varnished.

19. Assembled flooring panels are classified under tariff items 4418.73.00, 4418.74.00, 4418.75.00 and 4418.79.00, may be laminated and have been assembled with a top surface layer (with a parquet-like appearance) that is commonly made from multiple (two or more) pieces bonded side to side or at angles. In exceptional circumstances, assembled flooring panels may have a single strip or piece as the top layer, of a multilayer (two or more layer) parquet flooring panel.

20. Assembled multilayer bamboo flooring panels, consisting of bonded layers with a top layer of edge-glued, horizontally oriented bamboo strips, are classified under tariff item 4418.73.00. Generally, these panels are tongue-and-grooved along the edges to facilitate installation and may be surfaced with anti-abrasive coats or lacquers. (See Appendix A, image 4)

21. Typical parquet panels or tiles for mosaic floors consist of solid wooden strips arranged in chessboard or herringbone designs. The panels may be glued edge to edge and may also be provisionally glued to a backing, such as paper, to facilitate the laying of the flooring. These panels are classified under tariff item 4418.74.00. (See Appendix A, image 5)

22. “Multilayer” parquet flooring panels consist of panels or tiles of blocks, strips and friezes assembled on a support of one or more layers of wood. The core or middle layer and bottom layers can also be made up of strips and is placed at an angle to the grain of the top and bottom layers. These “multilayer” parquet flooring panels are classified under tariff item 4418.75.00. (See Appendix A, image 6)

23. Parquet flooring panels of Subheading 4418.79 consists of one single layer of solid pieces assembled together side by side. (See Appendix A, image 7)

Additional information

24. For certainty regarding the tariff classification of a product, importers may request an advance ruling. Details on how to make such a request are found in CBSA Memorandum D11-11-3, Advance Rulings for Tariff Classification.

25. For more information, call contact the CBSA Border Information Service (BIS):

Calls within Canada & the United States (toll free): 1-800-461-9999

Calls outside Canada & the United States (long distance charges apply):

1-204-983-3550 or 1-506-636-5064

TTY: 1-866-335-3237

Contact Us online (webform)

Contact Us at the CBSA website

Appendix A

Examples of various wood flooring products:

Image 1. Wood strip flooring of heading 44.09 – Photo of two samples of wood strip flooring panels, each composed of one strip facing up, and a second photo of the side view of the two wood strip panels’ tongue and groove edges.

Image 2. Plywood of Heading 44.12 – Photo of a plywood panel with one top ply sheet facing up, and a second photo of the multi-ply wood panel cross section.

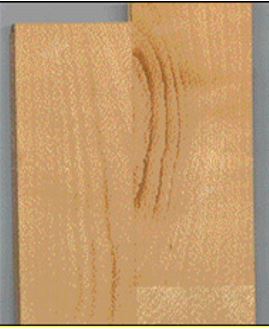

Image 3. Laminate Wood Panel (Battenboard) of Subheading 4412.94 – Photo of a laminate wood panel with one piece laminate sheet face up, battenboard core and laminate sheet back, and a second photo of the laminate wood panel cross section.

Image 4. Assembled multilayer bamboo flooring panel of Subheading 4418.73 – Photo of a multilayer bamboo panel of two or more strips on the top surface, and a second photo of a cross section of the multilayer panel composed of several assembled strips on each of the top, middle and back layers.

Image 5. Parquet panel for mosaic flooring of Subheading 4418.74 – Photo of four panels of multiple mosaic tiles, and a sketched picture of a panel composed of a chessboard of multi-directional tiles.

Image 6. Assembled Multilayer Flooring Panel (Parquet Surface) of Subheading 4418.75 – Photo of an assembled multilayer floor panel with multi-strip top surface layer, and a second photo of the assembled multilayer panel cross section.

Image 7. Parquet flooring panel of Subheading 4418.79 – Photo of a parquet floor panel cross section of two tongue and groove strips glued side edge to side edge, and a second photo of the top surface view of the parquet floor panel with two and a half strips glued edge to edge.

References

- Issuing office

- Trade and Anti-dumping Programs Directorate

- Headquarters file

- Legislative references

- Customs Tariff

- Other references

- D11-11-3

Compendium Classification Opinions 4418.73 - 1,

4418.74 - 1, 4418.75 - 1, 4418.75 - 2, 4418.75 - 3, 4418.79 - 1 - Superseded memorandum D

- D10-14-55 dated

- Date modified: