Reassessment Policy

Memorandum D11-6-10

This D-memo will come into effect with the scheduled external implementation of CARM in October 2024. It is available now in PDF format only for your reference. The D-memo currently in effect is available on this page.

ISSN 2369-2391

Ottawa,

This document is also available in PDF (488 KB) [help with PDF files]

In Brief

This memorandum has been amended to provide instructions and annex E explaining how to submit by e-mail a request for extension to the 90-day period to submit corrections.

This memorandum outlines and explains the Canada Border Services Agency's (CBSA) reassessment policy with respect to the following situations:

- (a) Importers who have been the subject of a CBSA trade compliance verification and who have been directed to self-adjust incorrect declarations of origin, tariff classification, and value for duty; and

- (b) Importers who have not been the subject of a CBSA trade compliance verification and who have identified incorrect declarations of origin, tariff classification, and value for duty for which they are submitting self-adjustments.

Legislation

Sections 32, 58, 59 and 74 of the Customs Act

Guidelines and General Information

1. The subject of this memorandum is the reassessment period for which importers must correct their declarations of origin, tariff classification, and value for duty after identifying or receiving specific information that gives them reason to believe that their previous declarations are incorrect.

2. This memorandum does not address applications for a refund of duties under section 74 of the Customs Act (the Act). For more information on refund of duties, refer to Memorandum D6-2-3, Refund of Duties.

3. In accordance with section 32.2 of the Act, an importer, an owner of goods, or an authorized person (hereafter referred to as "the importer") is required to correct a declaration of origin, tariff classification, or value for duty within 90 days after having reason to believe that the declaration is incorrect. This obligation applies to a correction that would result in either money payable to the CBSA or is revenue neutral.

4. "Reason to believe" occurs when specific information was considered to be available to the importer to indicate that an origin, tariff classification, or value for duty declaration was incorrect. For more information on "reason to believe", refer to Memorandum D11-6-6, "Reason to Believe" and Self-adjustments to Declarations of Origin, Tariff Classification, and Value for Duty.

5. Subsection 32.2(4) of the Act specifies that an importer's obligation to make a correction in respect of imported goods ends four years after the goods have been accounted for under subsection 32(1), (3), or (5).

6. Corrections to declarations under section 32.2 of the Act must be presented on a properly completed Form B2, Canada Customs - Adjustment Request. For more information on how to submit adjustment requests, refer to Memorandum D17-2-1, Coding of Adjustment Request Forms.

7. Pursuant to section 59 of the Act, an officer may re-determine or further re-determine the origin, tariff classification, and/or value for duty of imported goods at any time within four years after the date of the determination, or within such further time as may be prescribed.

Time Limit Under Section 32.2 of the Customs Act

8. The 90-day time period to make a correction to a declaration of origin, tariff classification, or value for duty under section 32.2 of the Act begins on the date the importer has, or was considered to have had, reason to believe that a declaration is incorrect.

9. Where the importer did not have specific information at the time of accounting to indicate that a declaration was incorrect, "reason to believe" will occur on the date that the importer obtains specific information or is informed in writing of the necessary requirements to correctly account for the goods. The 90-day time period to make a correction to a declaration begins on the date the specific information is received by the importer.

- For example, a trade compliance verification final report issued on November 20, 2015, identifies all errors found during the verification. If, before the verification, there was no specific information available to give the importer reason to believe that a declaration was incorrect, the date of the report will constitute the date of "reason to believe". The importer would have 90 days from the date of the report to amend all incorrect declarations for the reassessment period identified in the report.

10. Where there is uncertainty on how to correctly account for the origin, tariff classification, or value for duty of the goods, importers are strongly encouraged to request a ruling from the CBSA. The procedures for obtaining a ruling are outlined in Memorandum D11-4-16, Advance Rulings Under Free Trade Agreements, Memorandum D11-11-1, National Customs Rulings (NCR), and Memorandum D11-11-3, Advance Rulings for Tariff Classification.

11. From the date that an NCR or an advance ruling is issued, the importer will be required to declare all future importations in accordance with that ruling as it becomes the importer's specific information providing "reason to believe".

- Note: If it is determined that specific information was available to the importer prior to receiving the ruling, the earlier specific information will be considered by the CBSA to be the reason to believe that a declaration was incorrect.

Correction to a Declaration for a Period Before the Date of Specific Information

12. When dealing with goods covered by a free trade agreement, an importer may be required to make a correction to a declaration for the period before the date that they have specific information because of obligations regarding importations under that free trade agreement.

13. Subsection 32.2(1) of the Act requires an importer to make a correction to a declaration if the importer has specific information that the proof of origin on which a declaration was based contains incorrect information. Therefore, when an importer becomes aware that a proof of origin is no longer valid for imported goods, it is required to make corrections to all affected declarations for the period covered by that proof of origin in accordance with the self-adjustment provisions of the Act.

- For example, on August 25, 2015, an importer receives a notification from an exporter that a certificate of origin covering goods imported in 2014 is no longer valid. The importer is obligated to correct all declarations within 90 days from August 25, 2015, for the goods imported in 2014, for the period covered by the erroneous certificate of origin.

14. For imported goods that are subject to retroactive amendments to the price paid or payable, an importer may be required to make corrections to declarations made before the date of the specific information. In situations where an agreement in writing was in effect at time of importation to later reduce the price paid or payable of imported goods and the price reduction subsequently occurs, a correction made under the authority of section 32.2 of the Act is necessary if the importer is provided with specific information giving reason to believe that a declaration of value for duty is incorrect, and the correction would be revenue neutral. An importer may elect to pursue a refund of duties under the authority of paragraph 74(1)(e) of the Act if the price reduction would result in a decrease of value for duty.

Reassessment Period for Importers who are not the Subject of a Trade Compliance Verification

15. For a pictorial representation of the following information, refer to Appendix A of this memorandum.

Specific Information Not Available

16. An importer who conducts an internal audit or review, or engages a third party to do so, may become aware of incorrect declarations. In this case, the audit or review report may be considered to be the specific information that gives the importer "reason to believe", provided that:

- (a) there was no previous information available that would be considered reason to believe that a declaration was incorrect;

- (b) the CBSA had not already initiated a trade compliance verification; and

- (c) the report identifies only revenue neutral corrections or ones in which duty is payable to the CBSA.

17. For an internal report to be considered to be specific information that gives "reason to believe", the report must be based on an audit or review of the importer's activities to ensure that the goods have been correctly accounted for. The written report must provide a detailed account of the issue that was examined, the scope of the review, and a clear description of the errors found in the customs accounting documents. In addition, all conclusions and required corrections must be clearly explained and supported by the specific legislative provisions.

18. Where all previous conditions are met, importers will not be required to make a correction to a declaration before the date of the internal report. Importers will only be required to account for the goods according to the recommendations of the internal report on a going forward basis.

19. Importers who disagree with the conclusion of their own audit or review are advised to request a ruling from the CBSA in accordance with paragraph 10 of this memorandum.

Specific Information Available

20. When an importer, who is not currently the subject of a CBSA trade compliance verification, becomes aware that specific information was previously available but was not considered and consequently declarations of origin, tariff classification, and/or value for duty are incorrect, the CBSA requires the importer to self-correct all incorrect declarations dating back to the date of the specific information, to a maximum of four years as provided for under subsection 32.2(4) of the Act.

21. Where the only type of specific information previously available is a legislative provision that is prima facie, evident, and transparent, as identified, as in subparagraph 1(a) of Memorandum D11-6-6, the CBSA may not require an importer to amend incorrect declarations for a maximum of four years. If the corrections would result in no customs duties payable or only Goods and Services Tax (GST) payable, and the importer is a GST registrant eligible to receive input tax credits, the importer will only be required to amend incorrect declarations back to the beginning of their last completed fiscal period.

Voluntary Disclosures Program

22. The Voluntary Disclosures Program promotes compliance with the accounting and payment provisions of the Customs Act, Customs Tariff and Excise Tax Act by encouraging clients to come forward and correct deficiencies in order to comply with their legal obligations.

23. Where the legislated 90-day time limit under section 32.2 of the Act has expired, importers who have not made the required corrections to their declarations of origin, tariff classification, and/or value for duty may request corrective measures under the Voluntary Disclosures Program. For more information, refer to Memorandum D11-6-4, Relief of Interest and/or Penalties Including Voluntary Disclosure.

Reassessment Period for Importers After a CBSA Trade Compliance Verification

24. For the purpose of this memorandum, the term "verification period" means the time frame within which the goods under review were accounted for. The verification period will be clearly identified in the notification letter issued by the CBSA officer that is conducting the verification.

25. Under section 59 of the Act, an officer may re-determine the origin, tariff classification, and/or value for duty of imported goods at any time within four years after the date of accounting. When goods are re-determined as a result of a trade compliance verification, an importer must amend all incorrect declarations pursuant to section 32.2 of the Act for the reassessment period. The reassessment period will be determined on the basis of whether or not specific information giving "reason to believe" was available to the importer.

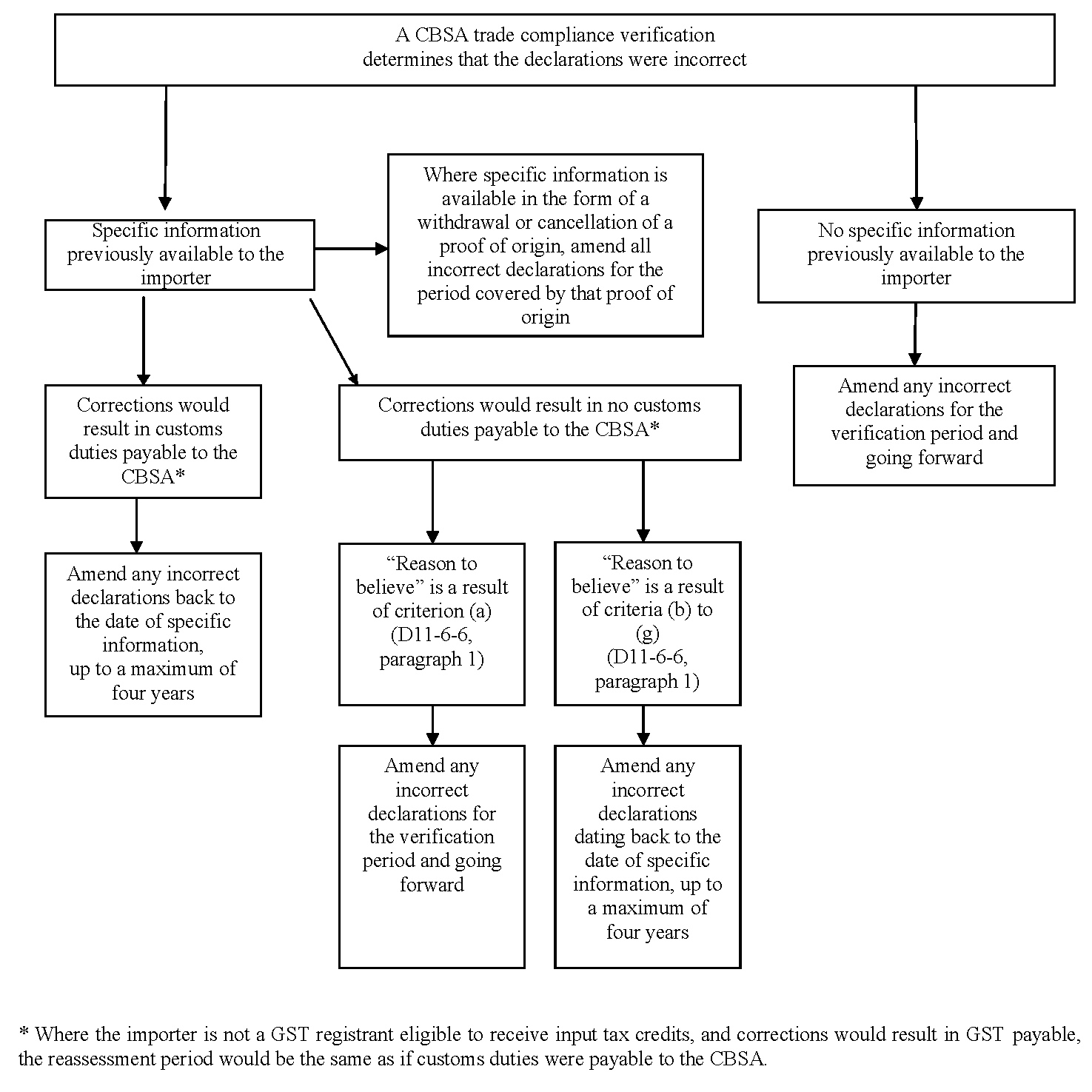

26. For a pictorial representation of the following information, refer to Appendix B of this memorandum.

The CBSA Determines That Specific Information was not Available

27. In the case of a trade compliance verification where the CBSA determines that specific information was not available, the importer will not be considered to have had "reason to believe". The importer will be required to amend all incorrect declarations only for the verification period, as identified in the CBSA's initial notification letter and going forward.

- For example, a letter from the CBSA dated March 23, 2015 notifies the importer of an upcoming trade compliance verification of goods imported during their January 2014 to December 2014 fiscal year. In its trade compliance verification final report dated September 8, 2015, the CBSA identifies errors but determines that the importer did not have reason to believe that the declarations were incorrect. In this case, the importer must amend all incorrect declarations accounted for during the verification period (i.e., January 1, 2014 to December 31, 2014), and going forward.

The CBSA Determines That Specific Information was Available

28. In the case of a trade compliance verification where the CBSA determines that specific information was available, the importer will be considered to have had "reason to believe". The importer will be required to amend all incorrect declarations dating back to the date of the specific information, to a maximum of four years, as provided for in the Act.

29. Where the only specific information previously available was a legislative provision that was prima facie, evident, and transparent as identified in subparagraph 1(a) of Memorandum D11-6-6, the CBSA may not require the importer to amend incorrect declarations to a maximum of four years. Where the corrections would result in no customs duties payable or only GST payable, and the importer is a GST registrant eligible to receive input tax credits, the CBSA may determine that the reassessment period for which the importer will be required to amend incorrect declarations will be the verification period, as identified in the notification letter, up to the date of the final verification report and all future importations going forward.

- For example, on July 13, 2015, an importer receives a trade compliance verification final report from the CBSA concluding that a prima facie, evident, and transparent tariff classification provision was not followed. Where the corrections would result in no additional customs duties payable, the CBSA may only require the importer to amend all incorrect declarations dating back to the starting date of the verification period. In this example, if the importer's fiscal year was the calendar year, the importer might only be required to amend all incorrect declarations from January 1, 2014 and going forward. If the corrections would result in customs duties payable, the importer would be required to self-correct back to the date of specific information up to a maximum of four years.

30. Where the type of specific information identified in subparagraphs 1(b) through (g) of Memorandum D11-6-6 was previously available to the importer, the reassessment period for which the importer will be required to amend incorrect declarations will be the period dating back to the date of that specific information, up to a maximum of four years, whether or not the corrections result in any customs duties payable to the CBSA.

- For example, if a ruling issued prior to the trade compliance verification was not followed, the CBSA will require the importer to amend all incorrect declarations dating back to the date of the ruling, up to a maximum of four years, whether or not the corrections generate customs duties payable to the CBSA.

Importer's Report Used as Specific Information

31. For a pictorial representation of the following information, refer to Appendix C of this memorandum

32. During a trade compliance verification, an importer may notify the CBSA that they have accounted for goods in accordance with the results of a self-initiated review. In the event that the CBSA determines that the findings and results of the review are incorrect, the importer may be required to correct only for the verification period and going forward if the verification determines that the report was prepared in accordance with the conditions set out in paragraphs 16 and 17 of this memorandum.

33. If the CBSA determines that the self-initiated review was not based on the conditions set out in paragraphs 16 and 17, the report will not be considered to be specific information. The CBSA will provide the importer with a detailed explanation as to why the report cannot be considered as specific information, giving "reason to believe". That said, other "reason to believe" criteria may still apply.

34. Should the CBSA determine that specific information regarding the correct accounting of the goods was available to the importer prior to the completion of the importer-initiated review, the CBSA may require the importer to amend all incorrect declarations back to the date of specific information, to a maximum of four years from the date of accounting.

35. It may be determined that the results of the review are correct. If the importer did not account for the goods in accordance with the results, and the goods were incorrectly declared, the importer must amend all incorrect declarations dating back to the date of the report, to a maximum of four years and correctly account for all future importations, provided that all conditions in paragraphs 16 and 17 are met. Where the importer's internal report is dated after the beginning of the verification period, the importer will be required to amend all incorrect declarations for the verification period, as identified in the CBSA initial notification letter, and going forward.

Exporter Origin Verifications

36. In the case of an exporter origin verification, the verification period will be the period covered by the proof of origin. Where a good is found to be non-originating, an importer's reassessment period will be the period set out in the proof of origin.

- For example, during an exporter origin verification, the CBSA determines that a good does not originate and at the conclusion of the verification, informs the importer in writing that the goods do not qualify for the benefits of the preferential tariff treatment claimed at the time of accounting. The reassessment period for which the importer will be required to correct declarations will be the period covered by the related certificate of origin.

37. Refer to Appendix D for more examples on how the reassessment policy applies to an exporter origin verification.

38. Where the CBSA discovers an incorrect tariff classification of a good during an exporter origin verification, one of the following processes will apply, provided that there was no previous specific information available:

- (a) If the good is found to be originating but the tariff classification is incorrect, the importer will be informed of the correct tariff classification at the conclusion of the exporter origin verification, and must correctly account for the good for any future importations from the date of the notice and going forward.

- (b) If the good is found to be non-originating and the tariff classification is incorrect, the importer will be informed at the conclusion of the exporter origin verification that the good does not originate and will also receive a determination on the correct tariff classification of the goods. The importer will be required to amend all incorrect declarations of origin for the verification period, as well as make corrections to the tariff classification for the period covered by the proof of origin.

90-day Filing Period

39. Following a CBSA trade compliance verification where errors are found, the importer must submit corrections to declarations relating to same and similar goods and/or the same issues within 90 days from the date of the trade compliance verification final report.

40. For the purposes of this memorandum, the term ¨same and similar goods¨ means: Identical and other models/styles of goods that have the same function as the goods being verified, that differ in a manner (e.g., size, colour, capacity) that does not alter the tariff classification of the goods at the tariff item level.

41. For the purposes of this memorandum, the term ¨same issues¨ means: Identical program requirements or considerations relating to the legislative provisions that apply to imported goods.

Requesting an Extension to the 90-day Period to Submit Corrections

42. An importer may submit a written request to the CBSA seeking an extension to the 90-day filing period. Such a request must be sent either by e-mail to the CBSA at cbsa.extension_corrections_prorogation.asfc@cbsa-asfc.gc.ca, as per the procedures outlined in Appendix E of this memorandum, or by mail at:

Trade Policy Division, Commercial and Trade Branch

Canada Border Services Agency

L’Esplanade Laurier (LEL), 21st floor

300 Laurier Avenue W.

Ottawa, ON, K1A 1E4

43. The importer's request must be made no later than 45 days from the date of the final report. Requests received after 45 days will not be considered and will be immediately denied.

44. At the time of any request for an extension, an importer must be able to demonstrate that it has begun the process of making corrections. Such requests for extensions must also be accompanied by a fulsome explanation of why the 90-day period cannot be met.

45. Factors that the CBSA may take into account when considering a request for an extension include, but are not limited to:

- (a) Natural disasters (i.e., fires, floods, ice storms) when the event destroyed books and records, or made them inaccessible, or for other related reasons why filing the adjustments was delayed or prevented.

- (b) Local, regional, or national emergencies in the community where the client or representative resides or carries on business.

- (c) Civil disturbances or disruptions in services, such as prolonged postal strikes, strikes within the government, lockouts, and demonstrations, where no alternative services or arrangements are reasonable or possible.

- (d) Death or serious illness pertaining to key persons involved in filing the adjustments.

- (e) Instances where the volume of corrections to be made exceeds the importer's capacity to process them within the required time limit.

- Note: This list is not exhaustive, but rather illustrates the types of circumstances the CBSA may take into account when considering any request for an extension to the 90-day period to file adjustments.

46. Following receipt and review of an application for an extension, the CBSA will notify the importer of its decision in writing, and provide a schedule for filing the remaining self-corrections. If the extension is granted, the period for making corrections will be extended to a maximum of 30 days.

47. Even if an extension is granted, the importer will be required to submit corrections for the first year of the reassessment period by the 90th day of the filing period.

48. If an extension is granted and corrections for the first year of the reassessment period are not received by the 90th day, the extension will be revoked and the importer will be subject to penalties.

Penalty Information

49. Importers who have "reason to believe" and who do not file corrections within the 90-day period as required under section 32.2 of the Act will be liable to penalties under the Administrative Monetary Penalty System (AMPS).

50. More information on penalties is available in Memorandum D22-1-1, Administrative Monetary Penalty System.

Challenging a CBSA Decision

51. When a notice of a decision has been given under subsection 59(2) of the Act, an importer who disagrees with the CBSA's decision may file a request for a further re-determination, under the authority of subsection 60(1), within 90 days of the CBSA decision. For further information on the dispute resolution process, refer to Memorandum D11-6-7, Importer's Dispute Resolution Process for Origin, Tariff Classification, and Value for Duty of Imported Goods.

Additional Information

52. For more information, call contact the CBSA Border Information Service (BIS):

Calls within Canada & the United States (toll free): 1-800-461-9999

Calls outside Canada & the United States (long distance charges apply):

1-204-983-3550 or 1-506-636-5064

TTY: 1-866-335-3237

Contact Us online (webform)

Contact Us at the CBSA website

Appendix A

Corrections as a Result of an Importer Initiated Audit or review

* Where the importer is not a GST registrant eligible to receive input tax credits, and corrections would result in GST payable, the reassessment period would be the same as if customs duties were payable to the CBSA.

Appendix B

Reassessment Period for Importers After a CBSA Trade Compliance Verification

Appendix C

Reassessment Period for a CBSA Trade Compliance Verification When a Previous Importer-initiated Audit or Review Meets the Conditions in Paragraphs 16 and 17

Appendix D

Examples of Reassessment Periods After an Exporter Origin Verification

Scenario 1 – First verification

- Exporter issues blanket certificates of origin for four consecutive years (2012, 2013, 2014 and 2015 calendar years) to a variety of importers.

- The importers use the certificates of origin to claim preferential tariff treatment for all four years.

- The CBSA initiates a verification of origin for the goods certified for the 2014 calendar year and notifies all of the importers of these goods.

- The CBSA determines that one of the goods on the certificate of origin is non-originating.

- The CBSA provides the exporter with an interim and a final verification report, indicating that all importers to whom the certificate of origin was issued for the verified period must be advised of the results and provided with an amended certificate.

- The importers are also notified at the same time that the good has been determined to be non-originating for the verified period. The importer now has specific information giving "reason to believe" and is required to make corrections pursuant to section 32.2 of the Act.

Outcome: If the importer does not make corrections for the verification period, the CBSA may reassess all incorrect declarations of origin made during the verified period (2014).

Scenario 2 – Exporter's review following a verification

- Following a verification, an exporter conducts a review of the origin of their goods for previous and subsequent years in order to determine if the goods certified in those years qualified as originating.

- The exporter determines that the goods they previously certified as originating did not qualify and should not have been certified as originating.

- The exporter notifies all importers to whom those certificates were issued and advises that the certificates are no longer valid.

- Upon receipt of the exporter notification and the withdrawal of the certificates of origin, the importer has reason to believe that the goods do not originate and must make corrections, under section 32.2 of the Act, to all entries for which a preferential tariff treatment was claimed for the periods covered by the certificates that are no longer valid.

Outcome: If the importer does not make corrections, and is subsequently selected for a verification by the CBSA, it will be liable for duties and taxes payable plus penalties under the Administrative Monetary Penalty System (AMPS).

Scenario 3 – "Pattern of conduct"

- Following an initial verification, the CBSA conducts a second verification of the same exporter for the same good for a different period.

- In both verifications, the CBSA determines that the good is non-originating.

- As such, the CBSA will have established a "pattern of conduct" with respect to that exporter and all certificates of origin issued after the period covered by the second verification of that good will be deemed to be invalid until the exporter is able to prove, to the satisfaction of the CBSA, that the good now originates.

- The CBSA will notify both the exporter and importer when a "pattern of conduct" has been established.

Outcome: The importer is required to amend all incorrect declarations of origin for the entire verified period, as well as for the period following the second verification up to the effective date of the "pattern of conduct". The importer must not claim preferential tariff treatment for those goods going forward from the date of the notification. If the importer does not make corrections, the CBSA may reassess all incorrect declarations of origin for the importations made during the verified period.

Scenario 4 – Cancellation of "pattern of conduct"

- Subsequent to the establishment of a "pattern of conduct" (Scenario 3), an exporter may submit information to the CBSA to demonstrate that the subject goods now qualify as originating goods. This information may be submitted by the exporter in the form of a request for an advance ruling.

- The information presented by the exporter must be sufficiently detailed and specific to allow the CBSA to confirm that the goods now qualify as originating goods.

- It is important to note that all future importations will remain subject to a full verification of origin by the CBSA at any time within four years from the date of accounting.

Outcome: Pursuant to section 74 of the Act, the importer may file a refund request on all entries made following the CBSA's cancellation of the "pattern of conduct", up to the maximum period allowed for in legislation.

Appendix E

Submitting requests by e-mail for an extension to the 90-day period to submit certain corrections under section 32.2 of the Customs Act following a CBSA trade compliance verification where errors are found

1. Following a CBSA trade compliance verification where errors are found, importers may submit a request for an extension to the 90-day period to submit corrections by encrypted or non-encrypted e-mail. If an importer chooses to submit such a request by e-mail, they must indicate their choice between encrypted or non-encrypted e-mail in the request and meet the required conditions set by the CBSA. These conditions are described below.

2. An importer who chooses to submit their request for an extension of the 90-day period to submit corrections by e-mail but does not clearly indicate in their request their choice between encrypted or non-encrypted e-mail, or their request does not meet the required conditions, will have their request processed according to the procedures above.

3. The importer must complete and provide the consent statement below. An authorized person may submit the request for an extension to the 90-day period to submit corrections by e-mail on behalf of their client. The importer also has the responsibility to inform the CBSA of any contact information changes (phone number, e-mail address, etc.)

4. The CBSA will seek to obtain an electronic delivery and read receipt from the importer for each e-mail exchanged during the processing of the request for an extension to the 90-day period to submit corrections. If it is not possible to obtain an electronic delivery and read receipt, other forms of acknowledgements will be accepted (e-mail, phone call, etc.)

5. The reception date of the documents is deemed to be the date when the e-mail is sent by the CBSA or the applicant.

6. The importer who elects to use encrypted e-mail for processing their request for an extension of the 90-day period to submit corrections is responsible for ensuring that compatible software (Winzip and others) is used.

7. When the request meets the required conditions, the CBSA will send all documents related to the request for an extension to the 90-day period to submit corrections to the importer by encrypted or non-encrypted e-mail, depending on the choice indicated.

8. The CBSA does not guarantee the security of electronic communications. By consenting to communicate by e-mail with the CBSA, the importer accepts all inherent risks with this mode of communication and thus relieves the CBSA from all responsibility, present and future, related to the protection of the information while it is being exchanged by e-mail.

Consent statement

“I choose to communicate by {Non-Encrypted / Encrypted} **Please indicate your choice** e-mail with the CBSA during the processing of the request for an extension to the 90-day period to submit corrections, following a CBSA trade compliance final verification report where errors are found. This includes the sending and the reception of documents, as well as any other correspondence required during the processing of the extension request. I authorize the communication by e-mail for all exchanges and I accept all inherent risks. I hereby relieve the CBSA from any responsibility, present and future, in relation to the protection of the information exchanged by e-mail. I have read and I accept the conditions.”

Signature:

Date:

Case number:

Name of the importer / authorized person:

Business Name:

Occupation/Title:

Telephone number:

E-mail address:

References

- Issuing office:

- Trade and Anti-dumping Programs Directorate

- Headquarters file:

- Legislative references:

- Customs Act

Customs Tariff

Excise Tax Act - Other references:

- D6-2-3, D11-4-16, D11-6-4, D11-6-6, D11-6-7, D11-11-1, D11-11-3, D17-2-1, D22-1-1

- Superseded memorandum D:

- D11-6-10 dated

- Date modified: